Aura combines robust identity theft protection with everyday digital security tools in a single, all-in-one package that outshines most standalone services.

You receive three-bureau credit monitoring, AI-driven dark web scans, real-time fraud alerts, up to $1 million in insurance per adult, a no-logs VPN, antivirus protection, password manager, and even parental controls on family plans. And it is all supported by 24/7 experts and a 60-day money-back guarantee. This comprehensive setup safeguards your identity, finances, and devices without forcing you to piece together multiple subscriptions.

With data breaches on the rise, scam texts hitting your phone daily, and shady public Wi-Fi lurking everywhere, identity theft is no longer a “what if” — it’s a “when.” Aura steps in with 24/7 protection that includes real-time alerts, dark web scans powered by AI, a built-in VPN, antivirus, and robust credit monitoring.

But let’s be honest: any service can look good on paper. So we rolled up our sleeves and tested Aura on desktop and mobile—exploring its dashboard, triggering alerts, and even jumping onto some questionable networks to see how it performed. The results? Some standout features really surprised us (especially these ones).

If you’re wondering whether Aura is worth your time (and your money), this review cuts through the noise with real test results and hands-on insights. Let’s get into it.

| Website | Aura.com |

| Pricing | $12 – $32/month ($9 with coupon) |

| Supported platforms | Windows, macOS, Android, and iOS |

| 3-bureau credit monitoring | Yes (across all plans) |

| Insurance | $1M – $5M ($1M per adult) |

| Security extras | VPN, antivirus, password manager, and parental controls |

| Best deal | 68% Off Coupon > |

Highlights from testing Aura

- Aura packs a serious punch when it comes to identity theft and fraud protection. It covers everything from personal and financial data monitoring to built-in antivirus, a secure VPN, password manager, parental controls, and even up to $1 million in insurance.

- The setup? Super simple. The dashboard? Easy to navigate. And if you ever need help, you’ve got 24/7 customer support and US-based fraud specialists ready to jump in—whether you're on desktop or mobile. You can see what the experience is like here.

- Aura also keeps things wallet-friendly, with competitive pricing and a generous 60-day money-back guarantee on annual plans. It’s a feature-rich, cost-effective alternative to other big names like NordProtect and Identity Guard — and after testing it ourselves, we can confidently say it holds its own.

Exclusive Aura Coupon:

Get 68% Off Aura subscription plans with the coupon below:

(Coupon is applied automatically; 60 day money-back guarantee.)

Aura pros and cons

Let’s take a look at the pros and cons of choosing Aura Identity Theft Protection to safeguard your online privacy.

+ Pros

- Antivirus software across all plans

- Comprehensive identity theft protection and credit monitoring services

- Dark web monitoring

- Fraud call protection

- Up to $1 million in insurance coverage

- Plans for individuals, couples, and families

- Useful parental control app

- Password manager and VPN included

- 24/7 customer support and fraud resolution

- Transparent pricing

- 3-bureau credit monitoring included in all plans

– Cons

More expensive than some competitors

See the latest Aura prices and deals.

Aura identity theft protection features overview

Before we roll up our sleeves and get into the details, here’s the highlight reel of what Aura offers:

Robust identity monitoring toolkit – Aura keeps a close eye on your personal and financial info to catch suspicious activity before it turns into full-blown identity theft.

- Credit monitoring with yearly credit reports – Get alerts for changes to your credit files across all three major bureaus, plus a credit report every year to stay in the know.

- Fraud calls protection – Tired of spam calls? Aura helps block the shady stuff, giving you back some peace and quiet.

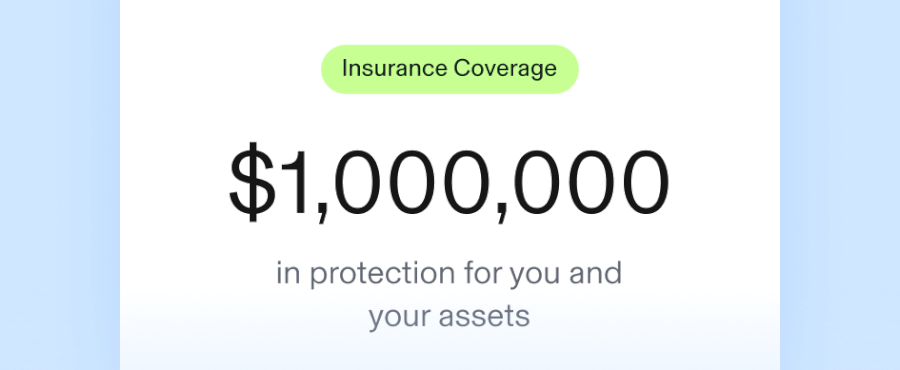

- Up to $1M in identity theft insurance – Coverage for eligible losses and expenses if identity theft ever strikes. Basically, a financial safety net.

- 24/7 customer support – Got questions or a fraud emergency at 2 AM? Aura’s support team is always just a call or message away.

- Built-in VPN service – A secure VPN to keep your browsing private, even when you're on sketchy public Wi-Fi. Works across multiple devices too.

- Password manager – Store all your passwords in one safe place and get alerts if any of them are weak or have been compromised.

Antivirus – Say goodbye to malware and cyber threats with Aura’s built-in antivirus that runs quietly in the background.

- Dark web monitoring – If your personal info pops up in dark corners of the internet, Aura will let you know fast.

- Financial transaction monitoring – Keep tabs on your credit cards, bank accounts, and investments with alerts for suspicious transactions.

- Experian CreditLock – Lock down your Experian credit report with a tap, stopping sneaky attempts to open accounts in your name (exclusive to Experian).

- Lost wallet remediation – Misplaced your wallet? Aura helps you cancel cards quickly and create a plan to secure your identity again.

- 60-day money-back guarantee – Try Aura risk-free with a full refund if you change your mind within 60 days (annual plans only).

How Aura Identity Theft Protection works: Everything you need to know

Aura's platform is super user-friendly, and behind the scenes, it's scanning everything from the dark web to your bank transactions and even your social media activity to catch anything sketchy before it becomes a real problem.

But Aura doesn’t stop at just monitoring. You also get a built-in VPN to keep your browsing private and secure, plus antivirus software that quietly fights off malware and other cyber nasties while you go about your day.

Getting started with Aura was refreshingly easy. The setup took just a few minutes, and from there, everything could be managed via their slick mobile app — available for both iPhone and Android. Once you’re in, you’ll start getting mobile alerts for anything suspicious, like your info popping up where it shouldn’t (looking at you, dark web).

During setup, Aura will ask for a bunch of personal details. It might seem like a lot at first, but it’s essential — this is how Aura tailors its monitoring to you and gives you real-time alerts when something’s off. And if the worst happens? You’ve got up to $1 million in identity theft insurance to help cover the costs of getting your life back on track.

Company background: Can we trust Aura?

Aura’s story kicked off in 2014 when founder Hari Ravichandran set out to build the kind of digital security he wished he'd had — after personally going through the nightmare of credit info theft. What started as a personal mission quickly turned into a full-on movement to simplify and strengthen online safety for everyone. Fast forward to today, Aura is protecting over a million users around the globe and still charging ahead with one big goal: making the internet a safer, less stressful place for all of us.

Hari Ravichandran, the Founder and CEO of Aura, emphasizes the company’s guiding principle:

“We aim to provide an all-in-one intelligent safety solution that’s both simple to grasp and effortless to use.”

Aura’s top-notch identity protection hasn’t gone unnoticed — it’s earned plenty of recognition along the way. It has received awards from Mom’s Choice Awards, Inc., Inc. Magazine, and Forbes. It also has a high TrustScore of 4.3 out of 5 on TrustPilot from 800 reviews, showing it’s all about happy customers and top-notch service.

Thanks to its smart move in acquiring Identity Guard, Aura now rolls out three tailor-made plans — for individuals, couples, and families alike.

Core features: What do you get with Aura?

Aura’s identity theft protection service is engineered to counteract the myriad of digital threats online. With prompt fraud alerts from credit and identity monitoring, Aura outpaces competitors, enabling swift action against identity theft. Its comprehensive dark web monitoring scours the internet's hidden areas for any signs of your personal information.

Aura vigilantly monitors your credit across all major bureaus and keeps an eye on your bank and investment accounts for signs of fraudulent activity. It even extends protection to your home and personal property titles. Two-factor authentication and enhanced malware defense are among the additional measures that fortify your digital security cocoon.

Let's explore how each of these features contributes to your digital safety net.

Credit monitoring with a safety net

Aura’s three-bureau credit monitoring is akin to having a personal bodyguard for your financial health. Here's what you can expect from this vigilant feature:

Continuous watch over your credit reports: Aura keeps an eagle eye on your credit reports from all three major credit bureaus – Equifax, Experian, and TransUnion – ensuring nothing slips by unnoticed.

- Comprehensive coverage for peace of mind: With Aura's extensive credit monitoring, you're covered from all angles. Any changes or inquiries made to your credit files are detected swiftly, so you're always in the know.

- Near real-time monitoring for immediate action: The moment something fishy pops up on your credit report, Aura sends you an alert. This prompt notification system empowers you to act quickly to prevent potential fraud.

Aura packs a solid lineup of tools to help you stay in control of your financial health. You’ll get monthly credit score updates and a yearly credit report — great for keeping tabs on your credit habits. That said, the credit coverage isn’t all-access. Reports come just once a year, and you won’t find any credit simulators or budgeting calculators in the mix. Still, it’s a strong start for anyone wanting to keep their credit in check without too much fuss.

Aura’s dashboard makes it super easy to:

- Easily check your credit info anytime, so you’re always in the know about your financial standing.

- Stay on top of your credit with constant monitoring and a clear picture of your credit health.

- Flip on Experian CreditLock to block shady credit checks before they even happen.

- Get instant alerts for any sketchy financial activity, so you can jump into action fast.

In short, Aura keeps you one step ahead, giving you the tools and info to take charge of your financial life.

Dark web monitoring

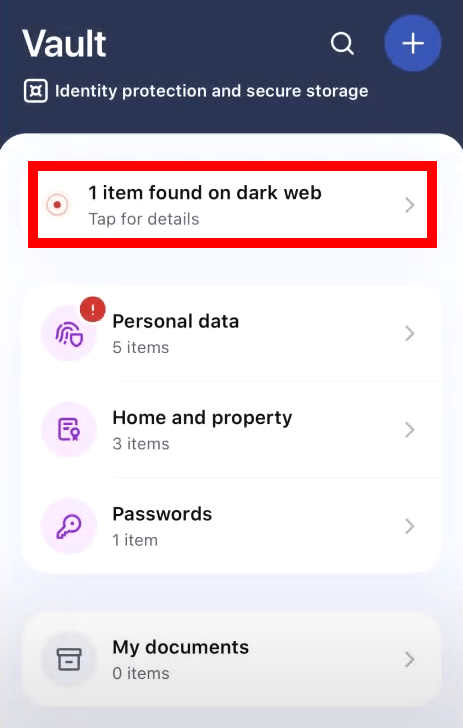

The dark web, a shadowy corner of the internet notorious for the unauthorized trading of personal data, is under constant surveillance by Aura's dark web monitoring. This smart threat detection is key to Aura’s protection — giving you a heads-up fast so you can tackle data breaches head-on.

Accessing the dark web monitoring panel is equally easy. It's all right in the user settings dashboard, as you can see below:

Aura’s dark web monitoring acts like your undercover digital detective — constantly scanning shady forums and sketchy marketplaces for any trace of your personal info. If your data pops up, you’ll get an instant alert so you can lock things down fast.

Here’s what you get:

- Smart threat detection that spots leaks early.

- Daily dark web scans — because once isn’t enough.

- Instant alerts so you can change compromised passwords ASAP.

- Tax fraud monitoring to catch identity theft red flags.

- Privacy tools to keep your browsing low-key post-breach.

- Automated data broker removals to wipe your info from sketchy sites.

Aura's Dark Web monitoring is your digital guardian angel, tirelessly protecting your privacy from the shadows of the internet.

Bank and investment account monitoring

As financial fraud and identity thefts climb, the need for robust credit monitoring is critical. Aura meets this challenge by offering strict monitoring of financial activities across the three major credit bureaus – Equifax, Experian, and TransUnion. It vigilantly checks for new loans or credit cards potentially opened under your or your child's names and keeps an eye on existing accounts for unauthorized transactions.

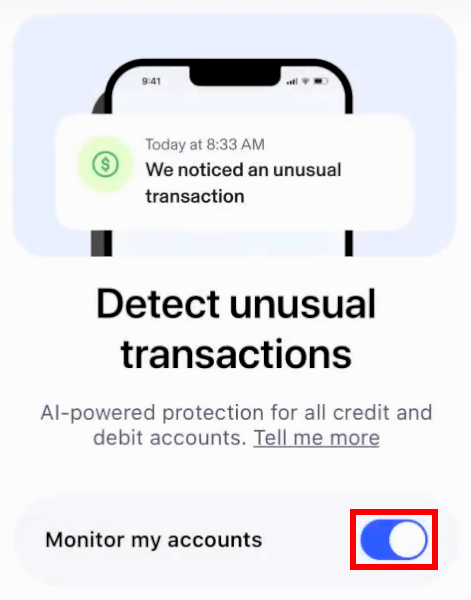

Aura’s got your back when it comes to financial protection — covering everything from your checking and savings to retirement and credit card accounts. With smart transaction monitoring and customizable limits, it’s like having a watchdog for your money 24/7.

Securely link your accounts with Plaid, and manage everything with ease right from the Aura app. From setting up alerts to securing your Wi-Fi, Aura keeps you protected from all angles.

If something shady pops up, Aura’s credit monitoring tools let you act fast, like locking your accounts before hackers can make a move. And with regular credit score updates and yearly reports, it’s easy to stay on top of your finances and ahead of any risks.

Insurance and resolution services

If identity theft ever strikes, Aura’s got your back with a generous $1,000,000 insurance policy per adult. It’s designed to help you bounce back financially, covering everything from stolen funds to legal help and even travel costs. Now that’s what we call serious peace of mind.

Now, let’s take a look at the insurance coverage Aura’s plans provide:

| Plan | Individual | Couple | Family |

| Identity theft protection insurance | Up to $1M | Up to $1M | Up to $5M |

| Insurance per person | $1M | $1M | $1M |

Just a heads-up: the $1M insurance doesn’t cover anyone under 18. And to get reimbursed, adult members need to show proof of their losses and exp.enses, Aura’s team will then review everything to see what qualifies under the policy.

But Aura doesn’t stop at cutting a check. Their white-glove support is where things really shine. If identity theft strikes, you’ll get:

One-on-one help from expert resolution agents who handle the messy stuff so you don’t have to.

A personalized recovery plan designed just for your situation — think of it as your step-by-step guide to getting things back on track.

Hands-on support every step of the way, including help dealing with credit bureaus, government agencies, and even legal authorities.

All in all, Aura doesn’t just offer coverage — they show up with a full game plan, ready to help you bounce back fast and with less stress.

Device and network security

Aura knows that keeping your devices and networks safe is key to protecting your identity, so every plan includes antivirus software to fend off malware. In addition to this, Aura offers a VPN service, which they state is a no-logs VPN service (no data collected). That said, it would bolster confidence if the service were audited, as we've seen with ExpressVPN and NordVPN.

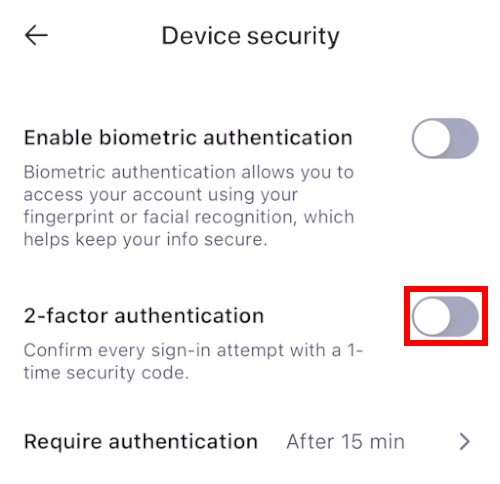

Enabling 2-factor authentication is as easy as a click of a button, as you can see below.

To amp up your security, Aura offers:

- Password manager – Not only does it securely store your passwords, but it also gives you a heads-up when accounts are compromised or passwords are weak, keeping your accounts locked down tight.

Two-factor authentication – This double-check security step asks for a second form of verification, making unauthorized access a whole lot trickier.

Advice on authenticator apps – Aura even guides you on using authenticator apps for a super-secure two-step verification, especially handy after a data breach.

Aura's security extras

With Aura Identity Theft Protection, you're armed with a powerful shield that fends off the constant barrage of identity theft and cybercrime threats.

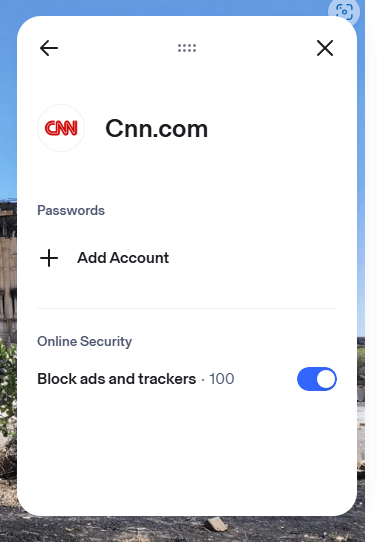

Advanced ad and tracker blocking

Aura elevates your web experience by eliminating distractions and preserving privacy with its advanced ad and tracker-blocking technology. Install the Aura browser extension to block digital tracking. It's compatible with Chrome, Firefox, and Edge, ensuring protection across devices.

You can purchase a separate subscription to Aura Ad Blocker if you wish. Note that the ad-blocking component does not work on Firefox. Simply click the link below to get our discount pricing on Aura Ad Blocker.

Exclusive Aura Ad-Blocker Coupon:

Get 50% Off Aura's ad-blocking solution with the coupon below:

(Coupon is applied automatically; 60 day money-back guarantee.)

One drawback with this type of ad-blocking is that it relies on an extension within the browser. If you use a VPN ad-blocker, however, it will seamlessly protect all browsers and apps from ads and tracking.

The ad-blocker extension also safeguards against online scams and phishing and blocks malicious websites from harming your device with malware.

One caveat of the Aura extension is the occasional verification prompts. We noticed this with activities like Google searches, which may slow down online research and be slightly annoying.

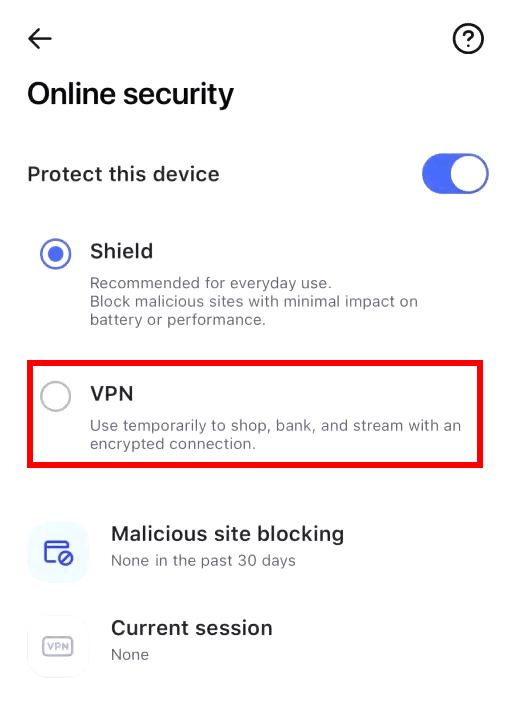

Secure VPN service

Aura’s VPN is the backbone of its digital security, wrapping your internet connection in AES-256 encryption, the gold standard of privacy protection, ensuring your safety, especially on public Wi-Fi.

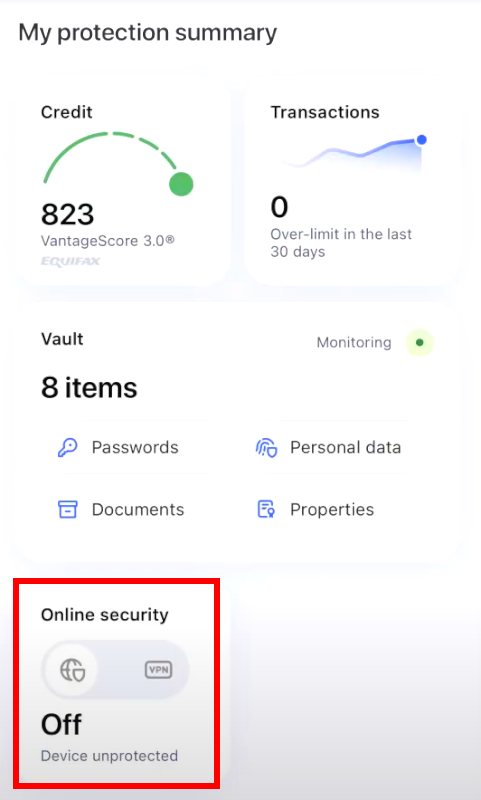

You can enable Aura's VPN by logging into the app, scrolling down to “Online security”, checking both “Shield” and “VPN”, and toggling the switch next to “Protect this device”. You can see this in the screenshot below.

Gone are the days of Aura’s VPN being stuck in the US. Now you can browse like a local in Europe, Asia, or pretty much anywhere, thanks to 100+ virtual locations. Just make sure your plan includes it — otherwise, you might still feel grounded. For serious globetrotters, Surfshark and NordVPN offer even more options.

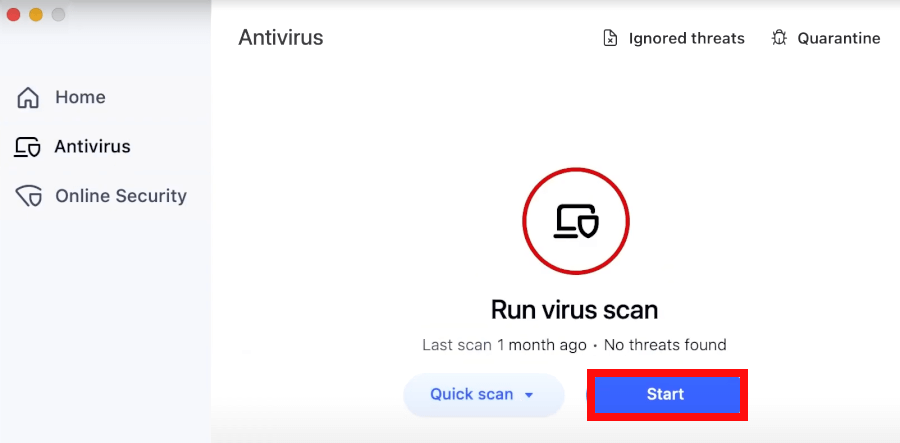

Next-gen antivirus with built-In AI

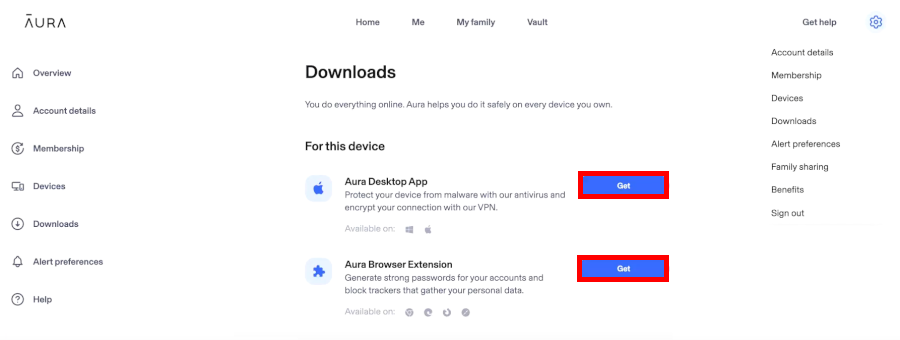

Aura's antivirus, enhanced with AI, ensures safe browsing on Windows PC, macOS, and Android. The antivirus, a separate download, is easy to install and operates in the background, scanning and removing malicious software like viruses, ransomware, spyware, and trojans.

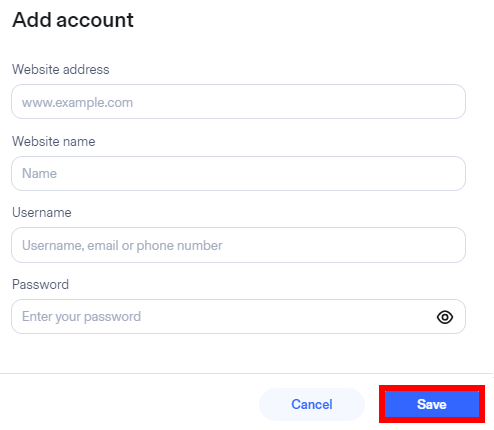

Password-protected vault for private data

Aura equips each adult member with 1 GB of secure cloud storage in the Vault, a virtual safe space for your crucial documents and passwords. This vault isn't just for grown-ups – it also lets you set up profiles for your kids, fostering a secure online playground for them.

Meanwhile, Aura's password manager acts like a trusty sidekick, taking the burden of remembering an endless list of login details off your shoulders. As you surf the web, it seamlessly stores your credentials, and retrieving them is just a tap away on the mobile app or a click on the Aura Chrome extension.

Aura’s password manager keeps an eye on your credentials, flagging weak or leaked passwords and walking you through quick fixes — kind of like NordPass, built right into your protection suite.

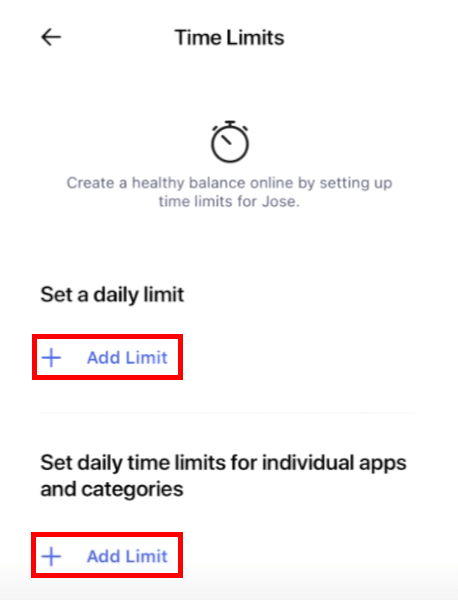

Child protection solution for peace of mind

With the Aura Family plan, you’re arming your household with a powerful digital sidekick! Aura’s child protection tools give parents full control over their kids’ online world, making sure they stay safe while navigating the digital space.

By installing the Aura app on all your family’s devices, you create a solid shield against harmful content and online dangers. As shown below, you can easily set screen time limits, pause internet access during family moments, and keep tabs on your kids' online activity to protect them from cyberbullying and online threats.

These are real concerns in our ever-connected world, and Aura’s proactive measures give you the peace of mind and control you need to ensure your kids' online experiences are both safe and positive.

Ease of use: Are Aura's apps easy to use?

After testing Aura for a few weeks, we found that both the desktop and mobile interfaces are super intuitive, making it easy to manage all your security features with just a few clicks.

User interface and initial setup

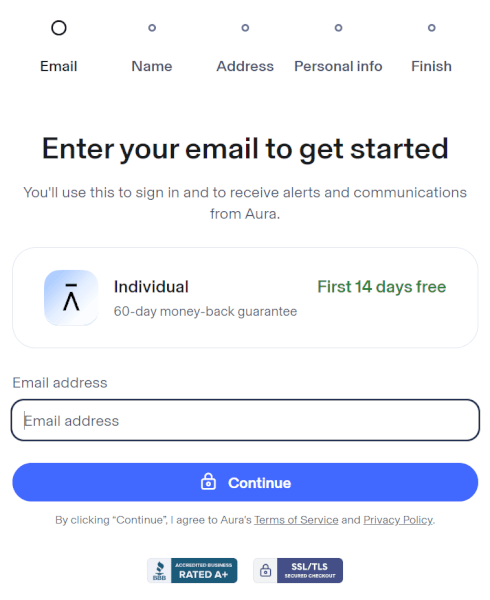

To sign up for Aura Identity Theft Protection, navigate to Aura's official website and select a subscription. Here, you'll be prompted to provide your name, email, phone number, and create a strong password.

After filling in these details, click the “Sign Up” button to complete the process, and voilà – you've just created your new Aura account.

Setting up Aura’s service is easy. The user interface is straightforward, offering quick access to features like VPN and antivirus. Separate downloads for features like Safe Gaming keep setup uncomplicated. Aura’s browser extensions enhance security with tools like password management and ad blocking.

In our experience with Aura Identity Theft Protection, the interface is incredibly user-friendly, making the signup process a breeze. We found it to be quick and straightforward, with just a few simple steps to start enjoying all of Aura's services.

Testing out Aura's desktop app

From our time using it, we found the Aura desktop app pulls everything together into one clean, easy-to-use interface. It gives you quick access to your credit score, recent transactions, and alerts about your personal information—all in one place.

We really liked how customizable the dashboard is. You can focus on what matters most to you, whether that's keeping tabs on your financial accounts, monitoring social media activity, or staying alert to issues with sensitive info like your Social Security number or credit cards. It makes managing your digital security feel a lot more approachable and less like a chore.

Aura mobile app

For those always on the move, Aura’s mobile app makes staying secure a breeze. Available for both iOS and Android, it’s perfect for keeping your digital life protected, no matter where you are.

Its sleek interface simplifies protection management, facilitating smooth account access and financial account linking for vigilant monitoring. The app enables effective Aura account management and personal information protection directly from your smartphone.

With instant mobile notifications, Aura keeps you in the loop on any security issues, making sure you stay protected no matter where life takes you.

In our testing, we found that while Aura’s multiple apps each bring their own security perks, it can feel a little more complicated compared to services like LifeLock, which bundles everything into one handy app.

Aura customer support: Fast, friendly, or frustrating?

Aura's customer support shines brightly, offering 24/7 US-based help every single day of the year — because identity theft doesn’t take holidays. Their team isn’t just friendly; they’re seasoned pros with an average of seven years of experience, so you know you’re in good hands. And if the worst happens and you fall victim to identity theft, Aura’s dedicated fraud resolution specialists are ready to jump in with clear guidance and steady support to help you get back on track.

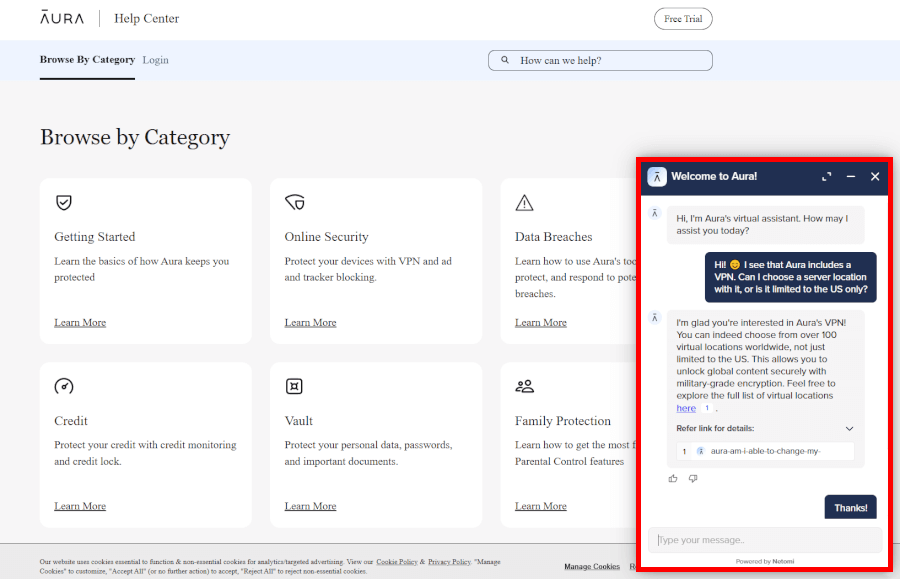

Whether you prefer picking up the phone (+1 833-552-2123), shooting over an email (support@aura.com), or chatting live during business hours, Aura makes it easy to get in touch your way. We also gave their AI assistant a spin and were pleasantly surprised — it delivered all the info we needed without missing a beat. See it in action below:

For the self-sufficient user, a rich repository of self-help documents and articles is at your disposal, allowing you to resolve simpler issues on your own or to learn more about the service at your leisure.

Plans and pricing: Is Aura worth your money?

Aura keeps things simple with three well-organized identity protection plans, each tailored to fit different lifestyles and needs.

- Individual Plan: This plan is perfect for single users. It encompasses $1 million in identity theft insurance, 1GB of secure cloud storage in the Vault, and comprehensive security for up to 10 devices.

- Couple Plan: Ideal for two users. It includes the same $1 million insurance coverage for identity theft, doubles the cloud storage to 2GB, and extends device security coverage to 20 devices.

- Family Plan: Designed with families in mind. It significantly increases the insurance coverage to $1 million per adult, provides a generous 5GB of cloud storage space, and secures up to 50 devices.

| Aura plans | Individual | Couple | Family |

|---|---|---|---|

| 1-month | $12.00/month | $20.00/month | $30.00/month |

| 1-year | $9.00/month | $17.00/month | $25.00/month |

Deal: Get 68% discount on Aura's yearly plans >

If safeguarding your children is your main concern, Aura's “Kids” plan is tailored for you. This unique plan offers parental controls powered by Circle, ensuring safe browsing and time management across all devices for an unlimited number of children. However, it's important to note that unlike other plans, the “Kids” plan does not include standard identity theft protection.

Each Aura identity theft protection plan includes $1 million in identity theft insurance per person and 24/7 US-based customer support. There's also a 60-day money-back guarantee for annual subscriptions, ensuring satisfaction and peace of mind.

Aura's pricing, while higher than some competitors, encompasses a comprehensive suite of security products within a single subscription. You can follow our dedicated Aura coupon page for the latest deals.

How to get started with Aura: A quick guide

Ready to take your digital security up a notch with Aura? Here’s a super simple guide to help you get set up:

- Pick your plan: Head over to Aura’s website and pick the plan that best suits your security needs.

- Register with your email: Pop in your email address to kickstart the process.

- Fill in your info: Enter your name and address to set up your account.

- Complete your profile: Add the final touches, your payment details and SSN, to complete your profile.

Verify and sign up: Double-check that everything looks good, then hit that sign-up button to get started.

Install the app: Download the Aura app on your device (phone, tablet, or desktop) and start setting up your security features.

By following these steps, you'll be well on your way to securing your online presence with Aura.

Aura alternatives: How does Aura compare to competitors?

Let’s take a quick tour to see how Aura stacks up against competitors like NordProtect and Identity Guard. Each has its own charm, but Aura stands out in some key areas.

| Aura | NordProtect | Identity Guard | |

| Pricing | $9 – $25/month | $5.49 – $14.99/month | $6.67 – $22.09/month |

| 3-bureau credit monitoring | ✅ (with all plans) | ✅ (TransUnion only) | ✅ (with top-tier plans) |

| Dark web monitoring | ✅ | ✅ | ✅ |

| Identity theft insurance | Up to $5 million (family) | Up to $1 million | Up to $1 million |

| Credit lock | ✅ | ✅ | ✅ |

| Family-focused plans and features | ✅ | ❌ | ✅ |

| VPN, antivirus, password manager | ✅ (all included) | ✅ (top-tier plans) | ❌ (password manager only) |

| Best deal | 68% Off Coupon | 63% Off Coupon > | 63% Off Coupon |

If you’re all about cybersecurity, NordProtect, powered by NordVPN, brings top-notch VPN protection and anti-malware tools to the table. But, if you want a more well-rounded package, Aura’s got you covered with credit monitoring, dark web protection, and even a VPN — no extra cost. It’s like getting a full security suite without breaking the bank!

Identity Guard is great for extra tools like a password manager and safe browsing, but Aura takes it up a notch by bundling everything together: credit monitoring, dark web alerts, and more — all in one neat, affordable package. So, if you’re looking for all-around protection without the extra clutter, Aura’s the way to go.

Other identity theft protection reviews on CyberInsider:

- Experian IdentityWorks Review

- IDShield Review

- LifeLock Review

- McAfee Review

- IdentityIQ Review

- Identity Guard Review

- NordProtect Review

Should you buy Aura? Here’s what we think

After digging into everything Aura has to offer — like real-time identity theft alerts, up to $5 million in insurance, a built-in VPN and antivirus, and even a smart little AI assistant — we’re impressed. It bundles essential digital security tools into one user-friendly app, making it a solid choice for anyone serious about protecting their identity online.

Whether you're monitoring your credit, securing your passwords, or keeping an eye on your kids’ online safety, Aura makes it easy to stay in control. Plus, with 24/7 customer support and customizable dashboards, it doesn’t just protect — you actually enjoy using it.

Bottom line? If you're looking for a feature-rich, all-in-one identity theft protection service in 2026, Aura is absolutely worth a closer look.

Launch Aura protection effectively from day one

Since you’ve chosen Aura as your all-in-one safeguard, now you should complete these targeted setup actions to activate its strongest defenses immediately.

Finish the guided onboarding scans for credit, identity, and dark web to establish your baseline risk profile.

Prioritize your alert settings in the dashboard so only critical threats trigger notifications.

Deploy the mobile app and browser extensions across phones, tablets, and computers for seamless VPN and antivirus coverage.

Migrate existing passwords into Aura’s secure manager and turn on autofill for daily use.

On Couple or Family plans, add household members promptly to enable shared monitoring, parental controls, and shared insurance.

These straightforward moves put every layer of Aura’s protection to work right away, giving you comprehensive security without delay.

Aura FAQ

Is it safe to use Aura?

Yes, Aura is the real deal when it comes to digital protection. It uses top-notch encryption and a full suite of security tools — like VPN, antivirus, and real-time alerts — to help keep your personal info locked down tight.

Is it safe to give my SSN to Aura?

It might feel a little scary at first, but yes, it’s safe. Aura treats your Social Security Number (SSN) with the highest level of care. It’s only used to monitor for fraud, like suspicious credit activity or dark web leaks, so you can catch threats early.

How much does Aura identity theft protection cost?

With our exclusive coupon, Aura’s plans start at $9/month for the Individual plan (billed annually), which covers one adult and up to 10 devices. On the higher end, the Family plan costs $25/month, and it packs in protection for up to 5 adults, unlimited kids, and unlimited devices — perfect for larger households.

No matter which plan you choose, you get the same powerful features like credit monitoring, dark web scans, and real-time fraud alerts. And don’t forget to check our Aura coupon page for any sweet deals!

Can I protect my whole family with Aura?

Yes, you can! Aura’s Family Plan is a great option — it covers up to five adults and unlimited kids. You’ll get things like child SSN monitoring, parental controls, and safe browsing tools. So yes, even your little digital explorers can stay safe online.

How do I cancel my Aura subscription if I change my mind?

No stress, canceling is easy. If Aura’s not your vibe, just reach out to their 24/7 customer support team by phone, email, or live chat. They’ll take care of it quickly and without the runaround.

What an insightful ad. I recently scanned my email with Aura to see what info was available online, nothing recent was noted. In the past week I’ve had scam calls and scam emails by the dozen… I wonder if this has to do with not subscribing.

The issue I have with internet security and ID theft protection companies is the ongoing base price increases and constant push toward added features. In the past 10 years, Norton LifeLock has increased cost for basic protection while dropping base features in favor of new improved pricy add-ons. Costs have greatly outstripped inflation, even in the years of 2021-2024 when BLS real inflation in the US was 20.4%. This internet safety insurance is becoming increasingly burdensome in a world where life is untenable without the internet. The old marketing adage “get them with the right hook and they will be reeled in for life” is just as powerful today as it was 40 years ago and measurably more insidious. The Aura hook of 68% off in year 1 is a precursor of very high cost in years 2 through whenever.

How come you didn’t mention that Aura owned Pango Group, a company that owned quite a few VPNs and apparently now owns Bitdefender, Kaspersky, TOTALSecurity, Zander Insurance, and AOL.

some sources:

1.

https://vpnpro.com/blog/hidden-vpn-owners-unveiled-97-vpns-23-companies/

2.

https://windscribe.com/blog/the-vpn-relationship-map/

3.

https://www.pango.co/about-us