Can Identity Guard stand up to today’s digital threats, or is it just another promise-heavy platform? With cyber threats lurking around every corner, protecting your identity isn’t just smart—it’s essential. But not all protection services are created equal.

We rolled up our sleeves and took Identity Guard for a spin to find out if it lives up to the hype. From real-time alerts to financial account monitoring, we looked at how it stacks up in the real world, not just in marketing copy.

In a rush? Jump straight to the breakdown of Identity Guard’s features and pricing to see if it’s worth it.

But here’s the real question: Can Identity Guard keep you safe, or is it time to keep looking? Stick around — we’ve got the answers.

| Website | IdentityGuard.com |

| Pricing | $6.67 – $23.99/month |

| Money-back guarantee | 60 days |

| 3-bureau credit monitoring | 1-bureau or 3-bureau (Experian, TransUnion, and Equifax) with top-tier plans |

| 24/7 customer support | Yes (for identity theft emergencies) |

| Identity theft insurance | Up to $1 million |

| Best deal | 63% Off Coupon > |

Highlights from our hands-on Identity Guard review

- Identity Guard makes a bold entrance into the identity protection space with smart tech like IBM Watson AI, a sleek dashboard, and up to $1 million in identity theft insurance. From monitoring your financial accounts to scanning the dark web for stolen info, it covers a lot of ground—and does it with style.

- But it doesn’t stop at the basics. Take a closer look at the security extras that come with Identity Guard, from safe browsing to password management.

- While its plans scale nicely for different budgets and needs, there are a few trade-offs, like the lack of a VPN and a mobile app that could use a little polish. Still, Identity Guard offers a solid package for anyone serious about digital protection.,

- Looking to protect your digital identity without breaking the bank? Check out Identity Guard's best deals here for top-notch security at the most competitive rates.

First, let's examine the strengths and weaknesses of using Identity Guard.

Identity Guard pros and cons

When it comes to Identity Guard, you'll find it offers a mix of positives and a few things to consider, similar to what you'd see with Aura or LifeLock:

+ Pros

$1 million in identity theft insurance on all plans

AI-powered identity monitoring

Extra alerts are helpful

Simple-to-understand, upfront pricing

US-based customer support

Comprehensive individual or family coverage

Password managers included in all plans

Family plan protects an unlimited number of children

Budget-friendly basic plan

Predictive risk management score

– Cons

Pricey high-tier plan

Monthly credit score or credit card monitoring requires a more expensive plan

Limited cybersecurity tools

Identity Guard: A Look at its protection features

Unveiling its arsenal, Identity Guard offers a panoply of features designed to shield against the specter of identity theft. Let’s take a closer look at the impressive suite of features that Identity Guard offers:

Credit monitoring – Vigilant monitoring of credit reports from Experian, Equifax, and TransUnion to identify suspicious changes that could signal fraud.

Dark web surveillance – Searches through the hidden corners of the internet to detect if your personal information is being traded or misused.

High-risk transaction alerts – Acts as an early warning system, notifying you of suspicious financial activities.

Insurance and resolution services – Provides a bulwark, ensuring financial recuperation and expert guidance in the event of identity theft.

Password manager – Fortifies your online vaults by managing and securing your passwords, included with all plans.

Social media account monitoring – Guards your digital reputation by keeping an eagle eye on your social channels for any unusual activities.

Safe browsing feature – Steers you clear of phishing nets and treacherous websites, ensuring your online journey is secure.

Two-factor authentication (2FA) login – Adds an extra layer of defense, requiring a second form of verification to access your accounts.

Family plan protection – Covers an unlimited number of children, ensuring comprehensive protection for your entire family.

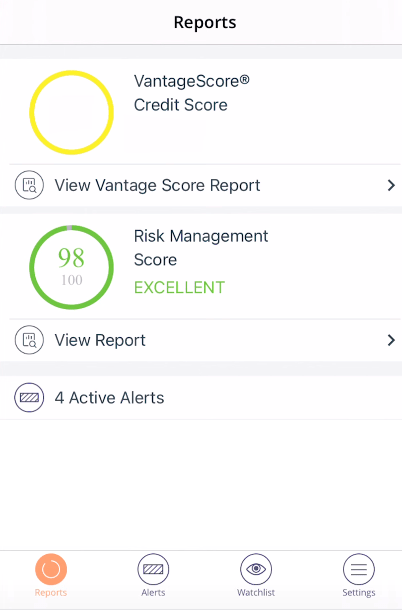

Predictive risk management score – Offers insights into your risk level, helping you take proactive measures to secure your identity.

See all Identity Guard features here >

These features, collectively, form a robust phalanx against the advancing threats in the digital arena. We felt well-protected and informed about our digital security with Identity Guard.

What is Identity Guard and how does it work?

Identity Guard isn’t just another identity protection service— it’s powered by the brainy force of IBM Watson AI, scanning the web 24/7 for threats to your personal info, bank accounts, investments, and even social media. Think of it as a digital watchdog that never sleeps, ready to alert you at the first whiff of suspicious activity.

And here’s some peace of mind: every Identity Guard plan includes up to $1 million in identity theft insurance, covering certain financial losses if fraud strikes.

Is Identity Guard trustworthy? A quick look behind the scenes

Since its inception in 1996, Identity Guard has stood as a bastion in the identity theft protection services landscape, now under the aegis of Aura. With a pedigree that spans decades, it’s earned its stripes and the trust of its clientele through an unwavering commitment to safeguarding digital identities.

The question isn’t just “Can we trust Identity Guard?” – it’s whether we can afford not to have such a seasoned veteran guarding our personal information in today’s digitally fraught environment.

Core features: What does Identity Guard really offer you?

Peering into the heart of Identity Guard, we discern the core features that form the bedrock of its identity protection service. From credit monitoring and reporting that vigilantly tracks changes in your financial activities, to dark web surveillance that searches the internet for traces of your personal data.

These core offerings are the pillars that uphold your digital security.

Credit monitoring and reporting

Monitoring your credit reports and your score is crucial for identity protection. Two out of three Identity Guard plans include monitoring for all three credit bureaus, alerting you to early signs of fraud.

The “Ultra” plan notifies you of suspicious activities via email, text, or phone, allowing quick action to protect your financial information. Meanwhile, the cheapest plan, “Value” doesn’t offer it at all, while the “Total plan” offers daily monitoring and credit score updates but no credit reports.

The “Ultra” plan includes:

Monitoring of credit bureaus (Experian, Equifax and TransUnion) to track changes to your credit reports

Monthly credit score updates based on our Equifax credit file

Experian credit lock

Three-bureau annual credit report

Compared to other services, we noticed that Identity Guard’s Value plan lacks credit monitoring, which even some basic plans from competitors like LifeLock offer. This might make Identity Guard less appealing if you want credit protection on a budget.

Dark web surveillance

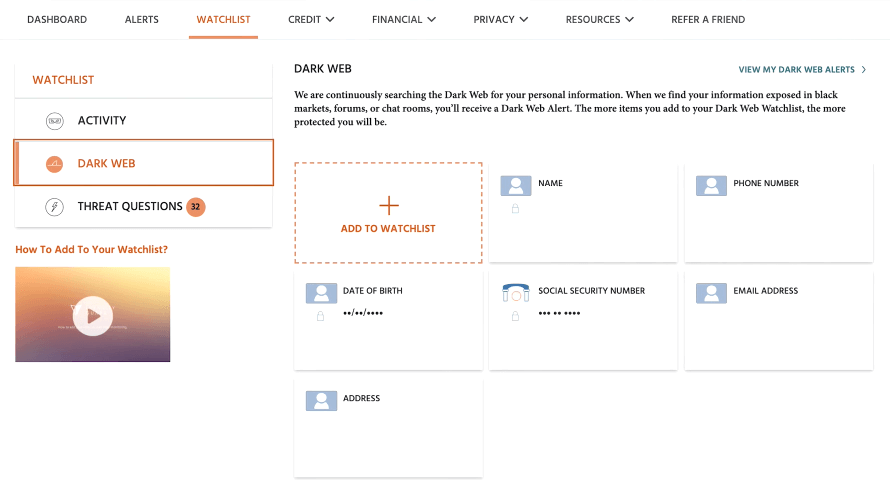

Identity Guard's dark web surveillance is like a periscope into the digital underworld, alerting you to leaks of your personal information. This feature helps keep your digital identity safe from the dark web's threats.

Identity Guard’s monitoring scans these hidden corners 24/7, protecting your personal information – like social security numbers (SSNs), credit card details, and health insurance IDs. If your data is detected on the dark web, you receive detailed alerts and advice on actions like changing passwords or securing accounts.

All Identity Guard plans include dark web monitoring, data breach notifications, and high-risk transaction alerts. Powered by IBM Watson, their AI scans black market websites, secret chat rooms, and underground forums to protect your sensitive information. This vigilance provides peace of mind, knowing your digital identity is constantly monitored.

By leveraging advanced AI and maintaining constant surveillance, Identity Guard fortifies your defenses against identity theft, ensuring your personal information remains protected from cybercriminals.

Insurance and resolution services

If identity theft strikes, Identity Guard’s insurance and resolution services are there to help you recover without financial loss. All plans offer up to $1 million in identity theft insurance, covering legal fees, lost wages, and other expenses related to reclaiming your identity.

Now, they don't just hand you a $1 million check. You need to show proof of your expenses and the identity theft. Reimbursement is based on actual losses, so you’ll need to provide documentation like legal bills, receipts for childcare, or proof of lost wages.

The insurance policy covers a lot – legal costs, missed work, childcare, and direct financial losses from identity theft, all within the $1 million limit. Unlike some services that offer an additional $1 million for direct financial losses, Identity Guard’s coverage includes all related expenses within the total $1 million cap.

For added convenience, the “Ultra” plan features white glove fraud resolution services. If your identity is stolen, an account specialist handles most of the recovery work, providing significant relief during a stressful time.

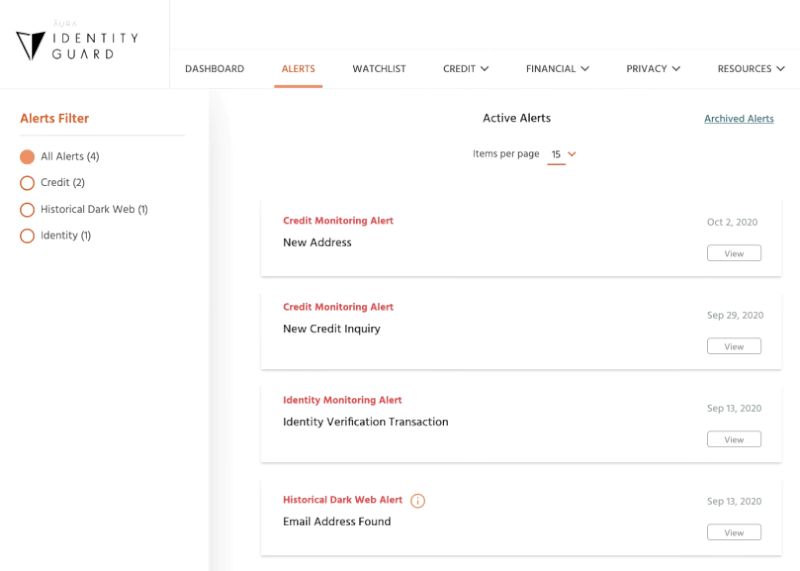

Alert system for high-risk transactions

Identity Guard’s high-risk transaction monitoring is like having a vigilant lookout for your finances, alerting you to any unauthorized activity. You can tailor the types of alerts you receive and choose how you’re notified – whether by real-time text alerts or email. This flexibility keeps you informed no matter where you are.

The desktop app and browser extension also add peace of mind, knowing our digital activities are protected.

Beyond the basics: Identity Guard’s added protection

Identity Guard doesn’t stop at the basics — it includes added layers of protection to cover more ground.

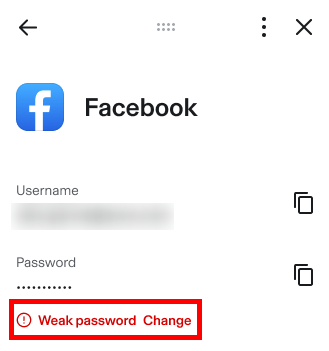

Password manager (included with all plans)

Let’s face it — keeping track of dozens of passwords is a nightmare. That’s where Identity Guard’s built-in password manager comes in, giving you a secure, easy way to manage all your logins without the sticky notes or browser guesswork.

This handy tool stores your credentials in an encrypted vault, autofills them when needed, and even helps you create strong, unique passwords for every account. It’s like having a personal bouncer for your digital life, only way more organized.

Best of all? It’s included in every Identity Guard plan, which means you’re getting a feature many companies charge extra for, without paying a cent more.

Social media account monitoring

We’ve found Identity Guard’s social media monitoring pretty useful. Identity Guard monitors several of your social media accounts for unusual activity. When you provide access, it watches for hacks, scams, and inappropriate posts attributed to you. This proactive monitoring alerts you if you share personal and financial information with potentially fraudulent users, helping to prevent identity theft.

You can monitor up to five different social media accounts, including Facebook, Instagram, YouTube, Twitter, and LinkedIn. By giving Identity Guard access to these accounts, any suspicious activity will be promptly flagged, allowing you to take immediate action to protect your digital identity.

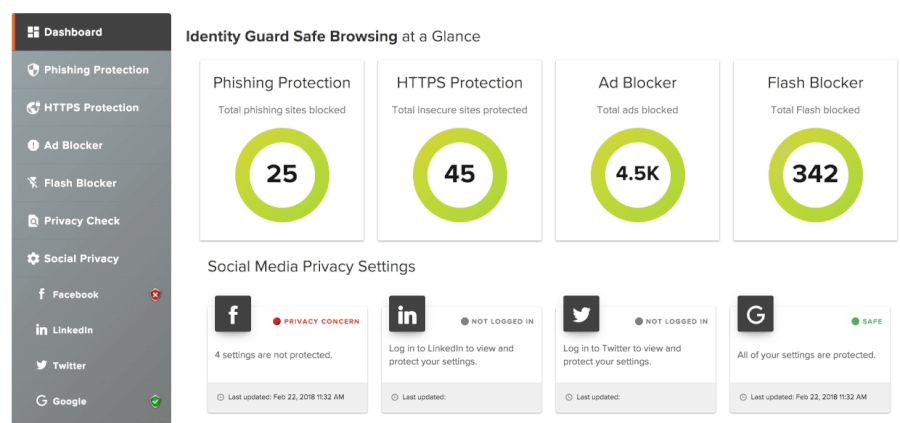

Safe Browsing extension

As subscribers, we activated the Safe Browsing extension by installing it, clicking the shield icon, and logging in with our Identity Guard credentials. It offers solid protection by guarding against phishing attacks, upgrading insecure connections to HTTPS, and blocking ads and malvertisements for a faster, cleaner browsing experience. It also blocks Flash content to prevent malware and deletes trackers that monitor your online behavior.

Plus, the social privacy manager helps secure your social media accounts, while the privacy checker lets you remove personal information from people search sites.

2FA login

With Identity Guard, a two-factor authentication (2FA) login is like having a friendly bouncer at the door of your digital accounts. With Identity Guard, logging in requires both your password and a second layer of verification, making it much harder for cyber crooks to sneak in.

It’s a simple step that adds serious peace of mind, helping to keep your sensitive info locked down, even if your password slips into the wrong hands.

That said, while 2FA is a strong security move, Identity Guard doesn’t go all out with extra protections like a VPN or advanced device-level safeguards. Competitors like Aura, for example, bundle in a secure VPN, antivirus, and even a password manager for a more well-rounded digital defense.

See all Identity Guard features here >

Ease of use: Can anyone use Identity Guard without a headache?

Identity Guard is easy to use with a simple and intuitive interface. From setup to daily use, the dashboard makes protecting your information straightforward.

User interface and initial setup

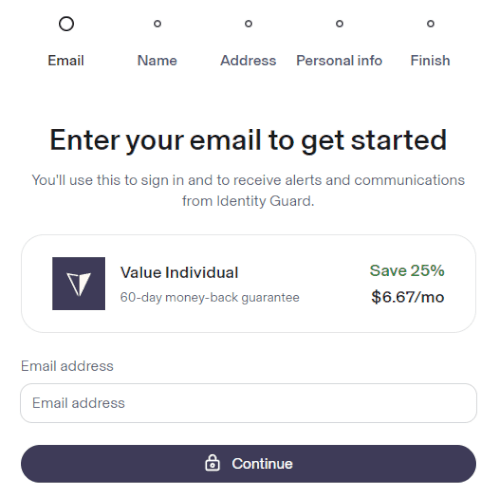

Starting with Identity Guard is super easy. The user interface is friendly and guides you through the setup smoothly. After picking your plan, you create a password and enter your email, name, address, phone number, date of birth, and SSN. We appreciated the helpful popups explaining why certain information is needed, which is great if you’re new to this.

You’ll need to provide a payment method during signup, and once you do, your account is set up in under a minute. You then log in with your email and password to start using the service. The first-time login offers a quick overview of how everything works, which you can skip if you’re already familiar with ID theft protection services. No downloads are necessary since Identity Guard runs in your browser as cloud-based software.

We found the dashboard very user-friendly. It gives a clear overview of your digital security status and makes it easy to navigate through various features.

Desktop and mobile apps

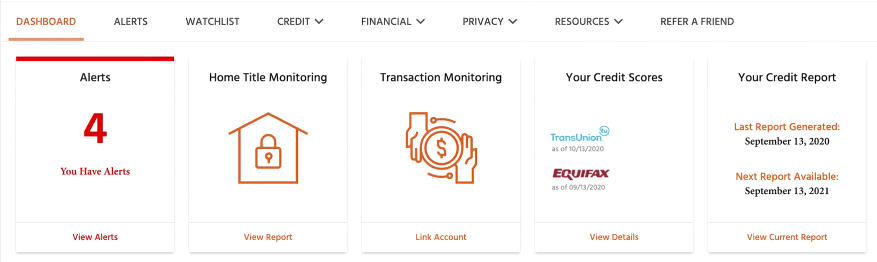

Whether on your desktop or using the mobile app, Identity Guard keeps your digital security in check. We’ve found the desktop version especially helpful for getting a comprehensive view of our security landscape, making it easy to manage and monitor our identity protection.

It’s user-friendly, with clickable icons and drop-down menus that make it easy to find what you need. The top menu includes sections like “Dashboard”, “Alerts”, “Watchlist”, “Credit”, “Financial”, “Privacy”, and “Resources”. You can also easily access account settings, get help, and sign out.

The dashboard itself offers quick access to popular tools like alerts, monthly credit score, credit reports and scores, home title monitoring, transaction monitoring, security freeze, and so on. Everything is laid out clearly, so it’s easy to find and use the tools you need.

For mobile use, Identity Guard offers apps for both Android and iOS. These are great for quick checks and receiving alerts. While the mobile app is handy for on-the-go monitoring, we find the desktop version essential for in-depth management.

Cancellation process: What you need to know

Thinking of calling it quits with Identity Guard? Thankfully, canceling your plan is pretty painless — at least, it was for us.

Here’s how to cancel online:

- Head to the “My Account” section in the top right of your dashboard.

- Click on “Billing & Subscription” in the left-hand menu

Hit the “Cancel Plan” button and follow the prompts

Prefer the personal touch? You can also cancel by calling customer service at 1-877-751-5899.

Heads-up: Your subscription will stay active until the end of your current billing cycle, and Identity Guard doesn’t offer refunds for unused time. We had no issues, but some users have reported being charged after cancellation, so it’s worth double-checking your account afterward.

Customer support: What sort of help do you get with Identity Guard?

Getting in touch with Identity Guard’s support team is easy and hassle-free. You can reach them by phone at 1-833-692-2187 or by email at customercare@identityguard.com. When we tested their support, we connected quickly with a friendly, helpful rep—no long holds or endless menus.

The support number is easy to spot, appearing throughout the dashboard. Phone support is available Monday through Saturday, including weekday evenings, though they are closed on Sundays.

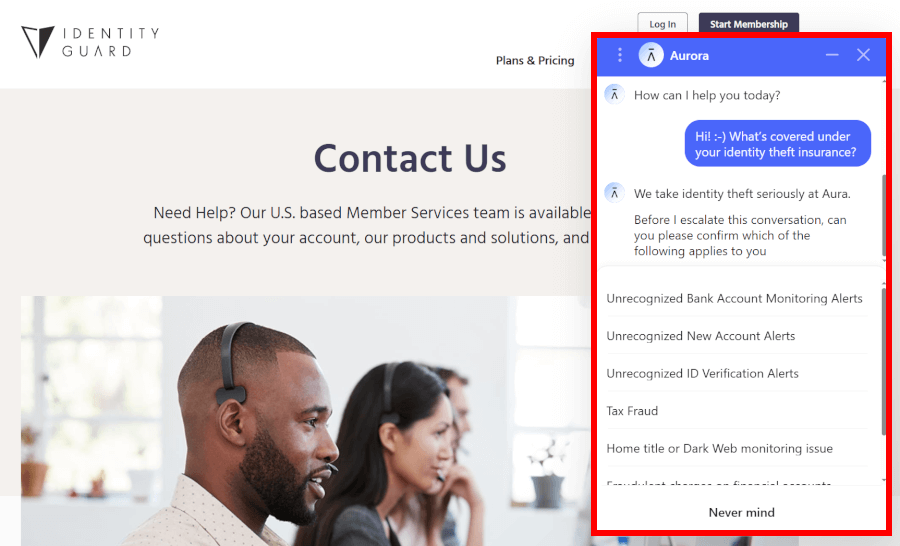

But here’s a bonus: Identity Guard now offers a helpful AI chatbot, available directly on their site. It’s quick to respond and great for common questions or account issues—perfect if you want answers without picking up the phone.

And if you're dealing with an identity theft emergency, there's 24/7 access to live support, so you're never left stranded when it matters most.

Plans and pricing: Is Identity Guard worth your money?

Anchoring down on the specifics, Identity Guard’s plans are a flotilla of options, each tailored to navigate different extents of the identity protection sea.

The service offers several individual plans, including:

- Value: This plan includes basic identity theft protection, including dark web surveillance and high-risk transaction alerts.

- Total: This plan offers comprehensive protection, including credit monitoring, dark web surveillance, high-risk transaction alerts, and social media account monitoring.

- Ultra: This top-tier plan provides the most extensive coverage. It includes all features from the “Total” plan plus enhanced fraud resolution services and regular credit score updates.

If you're looking for family-focused protection, Identity Guard offers plans covering up to five adults and an unlimited number of children. Check out Identity Guard's family plans here to ensure comprehensive coverage for your entire household.

| Identity Guard plans | Value | Total | Ultra |

|---|---|---|---|

| Individual | $6.67/month | $11.99/month | $17.99/month |

| Family | $10.00/month | $17.99/month | $23.99/month |

Deal: Get 63% discount on Identity Guard's plans >

Identity Guard offers a variety of pricing tiers, making it easier to find something that fits your budget. We found their lowest-priced tier to be one of the most affordable among ID theft protection services, which is great for anyone looking to save some money.

We also appreciated their 60-day money-back guarantee for annual plans purchased through their website. It gave us peace of mind, knowing we could try the service risk-free and make sure it was the right fit for our digital security needs.

How secure is your data with Identity Guard?

Privacy is super important in identity theft protection, so we wanted to make sure Identity Guard was up to the task. We checked out their privacy policy and data security features when we signed up and shared our sensitive info, expecting it to be well-protected.

| Security features | Identity Guard |

| Bank-level AES-256 encryption | ✅ |

| Real-time threat and fraud alerts | ✅ |

| Two-factor authentication | ✅ |

| Dedicated privacy tools (VPN, ad blocker) | ✅ (browser extension, ad/tracker blocking but no VPN) |

Identity Guard uses strong security measures, like “military-grade encryption” – probably 256-bit AES, which is top-notch. They’re clear about not sharing your details with third parties unless necessary, like reporting scam calls to the FCC.

They do share some basic info, like your email and IP address, with partners and service providers, but that’s pretty standard for most websites. Identity Guard also uses advanced security protocols, regular audits, and multi-factor authentication (MFA) to keep everything extra secure. These features make us feel confident in their ability to protect our digital identity.

How to get started with Identity Guard: A quick guide

Here’s a quick guide to get started with Identity Guard:

- Visit the Identity Guard's website here and choose a plan.

Sign up using your email to create an account.

Enter your payment information for continuous protection with auto-renewal.

Fill in your personal details and set a strong password.

Install the Identity Guard apps on your devices (Android and iOS) following the provided instructions.

Start monitoring by adding personal information like your name, SSN, and financial details.

Now, relax as Identity Guard begins monitoring, scanning for threats, and alerting you to any suspicious activity to keep your digital identity secure.

Alternatives: How does Identity Guard stack up against competitors?

In the vast sea of identity theft protection services, Identity Guard sails alongside competitors like Aura and LifeLock. Each offers unique features and pricing structures.

| Identity Guard | Aura | LifeLock | |

| Pricing | $6.67 – $23.99/month | $9 – $25/month | $7.50 – $79.99/month |

| Family-focused plans and features | ✅ | ✅ | ✅ |

| 3-bureau credit monitoring and reports | ✅ (with top-tier plans) | ✅ (with all plans) | ✅ (with expensive plans) |

| Dark web monitoring and alerts | ✅ | ✅ | ✅ |

| Identity theft insurance | Up to $1 million | Up to $1 million (up to $5 million with the family plan) | Up to $3 million |

| Credit lock | ✅ | ✅ | ✅ |

| Antivirus, VPN, and password manager | ❌(password manager only) | ✅ | ❌ (as an add-on for an extra fee) |

| Lost wallet remediation | ✅ | ✅ | ✅ |

| Best deal | 63% Off Coupon | 68% Off Coupon | 52% Off Coupon |

Identity Guard stands out with its smart AI insights and a dashboard that’s easy to navigate, while Aura goes the extra mile with built-in device protection for a more all-in-one security package. Meanwhile, LifeLock adds unique extras like a VPN and sex offender registry alerts, offering added peace of mind.

Bottom line? Each service has its own strengths, so the best pick really depends on what kind of protection matters most to you.

Is Identity Guard worth the money? Our final verdict

If you’re looking for solid identity theft protection that’s smart, easy to use, and doesn’t cost a fortune, Identity Guard is a strong contender. With AI-powered monitoring (thanks to IBM Watson), clear pricing, and a clean, intuitive dashboard, it definitely checks a lot of boxes.

We especially liked how Identity Guard keeps things simple — from setup to navigation — and how it backs every plan with generous insurance coverage. It feels like having a digital bodyguard that doesn’t overcomplicate things.

But it’s not all smooth sailing. There’s no built-in VPN or antivirus, which some competitors offer, and you’ll need to upgrade to a higher-tier plan if you want monthly credit score updates. So while the essentials are covered well, some of the extra bells and whistles are missing.

If you’re leaning toward a more all-in-one solution, Aura might be the better fit. It includes extras like device protection, a VPN, and even parental controls — all wrapped into a competitive package that’s great for families or power users.

Other identity theft protection reviews on CyberInsider:

- Aura Review

- Experian IdentityWorks Review

- IDShield Review

- LifeLock Review

- McAfee Review

- IdentityIQ Review

- NordProtect Review

Identity Guard FAQ

What kind of monitoring does Identity Guard offer?

Identity Guard offers a comprehensive suite of monitoring services, including credit monitoring, dark web surveillance, high-risk transaction alerts, and social media account monitoring. Their AI-powered system, utilizing IBM Watson, scans for suspicious activity and provides detailed alerts to keep your personal information secure.

Can I cancel my Identity Guard subscription if I'm not satisfied?

Yes, you can cancel your Identity Guard subscription if you're not satisfied. The cancellation process is straightforward and can be done online through the “My Account” section or by contacting customer service at 1-877-751-5899.

Note that your subscription stays active until the end of the current period, and you won't get a refund for any unused time.

Which is better, Identity Guard or Aura?

While both Identity Guard and Aura offer robust identity theft protection services, Aura stands out as the superior choice for comprehensive digital protection. Aura includes device security and a VPN service, providing an all-encompassing shield for your online activities. Its competitive pricing and wide range of features make it a more attractive option for those looking to maximize their security.

On the other hand, Identity Guard's AI-driven insights and user-friendly dashboard are commendable, but Aura's additional features give it the edge for those prioritizing complete digital safety.

Leave a Reply