Identity Guard and LifeLock deliver proven identity theft protection with strong core features, yet our side-by-side comparison reveals clear trade-offs in monitoring technology, insurance coverage, digital extras, and pricing that determine which one fits you best.

You need dependable safeguards like three-bureau credit monitoring, dark web surveillance, real-time fraud alerts, million-dollar insurance, and helpful tools such as AI risk analysis or built-in antivirus and VPN. We examine every plan tier, feature set, and current cost in detail so you can decide on the service that provides the right balance of protection for your identity, finances, and online security.

We tested both services hands-on — logging into their dashboards, setting up alerts, and even contacting support — to see how they perform in real life.

By the end of this guide, you’ll know exactly which one gives you more peace of mind (and better bang for your buck).

| Identity Guard | LifeLock | |

| Website | IdentityGuard.com | LifeLock.Norton.com |

| Pricing | $6.67 – $22.09/month | $7.50 – $79.99/month |

| Money-back guarantee | 60 days | 60 days |

| 3-bureau credit monitoring | 1-bureau or 3-bureau (Experian, TransUnion, and Equifax) with top-tier plans | 1-bureau (Equifax) or 3-bureau (Experian, TransUnion, and Equifax) with premium plans |

| 24/7 customer support | Yes (for identity theft emergencies) | Yes |

| Identity theft insurance | Up to $1 million | Up to $3 million |

| Best deal | 25% Off Coupon > | 52% Off Coupon > |

Highlights from our Identity Guard and LifeLock comparison

Identity Guard uses IBM’s Watson AI to deliver smart, real-time monitoring, while LifeLock leans on Norton 360’s antivirus to boost your protection.

For families, Identity Guard stands out with affordable, all-in-one plans that don’t jump in price. LifeLock offers more insurance coverage, but expect a price hike after the first year.

Both services offer solid alerts and monitoring, but Identity Guard’s AI and consistent pricing give it the edge in value and simplicity.

- They also come with a few digital security extras — like VPNs, antivirus, and password managers — that are worth a closer look. You can see how these bonus tools compare here.

- And if you're ready to save, be sure to check out the latest Identity Guard deals and LifeLock discounts.

Find the right identity protection for you: LifeLock vs Identity Guard

To help you make an informed decision, let’s quickly outline the essential factors to consider before comparing Identity Guard and LifeLock:

Monitoring: Both Identity Guard and LifeLock keep an eye on key data points to detect any signs of identity theft. They monitor public records, credit files, and even the dark web to spot any compromise of your personal information. This thorough surveillance acts as an early warning system, helping you catch threats before they become bigger problems.

Protection: These services offer more than just monitoring. They include essential privacy tools like antivirus software, secure browsing via VPNs, and spam call blocking. They also help remove your personal info from data brokers and other risky online spots, lowering the chances of identity theft.

Notifications: Timely alerts are key to minimizing the damage from identity fraud. Both Identity Guard and LifeLock send out fraud alerts to notify you of any suspicious activity, so you can act quickly to protect yourself.

Resolution: If identity theft does happen, both services provide dedicated support to guide you through the resolution process. They offer insurance to cover eligible expenses and losses, ensuring you have the financial backup to recover from the incident.

We’re breaking down how Identity Guard and LifeLock compare to help you choose the best identity theft protection service.

Identity Guard vs LifeLock: Side-by-side comparison

Let's take a look at how Identity Guard and LifeLock compare to help you decide which service best meets your identity protection needs. Here's an overview of their key features:

| Identity Guard | LifeLock | |

| Pricing | $6.67 – $39.9/month | $7.50 – $79.99/month |

| Family-focused plans and features | ✅ (without parental controls) | ✅ |

| 3-bureau credit monitoring and reports | ✅ (Experian, TransUnion, and Equifax) with top-tier plans | ✅ (Experian, TransUnion, and Equifax) with premium plans |

| Dark web monitoring and alerts | ✅ | ✅ |

| Identity theft insurance | Up to $1 million | Up to $3 million |

| Social media account alerts | ✅ | ✅ |

| Credit lock | ✅ | ✅ |

| Lost wallet remediation | ✅ | ✅ |

| Antivirus and VPN | ❌ | ✅ (as an add-on for an extra fee) |

| Password manager | ✅ | ✅ |

| 24/7 customer support | ✅ (for identity theft emergencies) | ✅ |

| Best deal | 25% Off Coupon > | 52% Off Coupon > |

LifeLock or Identity Guard: Who can you trust with your personal data?

Selecting the right identity theft protection service starts with understanding the company behind it. That includes its reputation, customer trust, and adherence to industry standards.

Let’s break down how Identity Guard and LifeLock compare in these key areas.

Identity Guard overview

| Starting price | $6.67/month |

| Supported platforms | Windows, macOS, Android, and iOS |

| Three-bureau credit monitoring | Yes (top-tier plans) |

| Identity theft insurance | Up to $1 million |

| Best deal | 25% Off Coupon > |

Identity Guard has been in the identity protection game since 1996, and with nearly three decades under its belt, it’s safe to say it knows a thing or two about digital security. Now operating as part of the Aura family, Identity Guard blends years of experience with cutting-edge tools like IBM Watson’s AI, giving it a powerful edge in spotting threats before they cause damage.

Over the years, it has earned a reputation for providing dependable identity monitoring, dark web surveillance, and even family protection plans that make it easy to cover your loved ones under one roof. Plans also include $1 million in identity theft insurance and US-based fraud resolution experts, which strengthens its appeal.

That said, like many services in this space, Identity Guard has its share of hiccups. On Trustpilot, it currently holds a 3.6-star rating based on over 4,470 reviews. Around 10% of users have reported issues such as confusing cancellation processes and unexpected auto-renewals, which are fairly common complaints in the industry.

But how does that reputation stack up against LifeLock’s? Let’s take a closer look at the full security and privacy comparison.

Identity Guard pros and cons

Just like Aura and IdentityIQ, Identity Guard has its share of strengths and weaknesses. Here's a breakdown of the key pros and cons to help you decide if it’s the right fit.

+ Pros

$1 million in identity theft insurance on all plans

AI-powered identity monitoring

Extra alerts are helpful

Simple-to-understand, upfront pricing

US-based customer support

Comprehensive individual or family coverage

Password managers included in all plans

Family plan protects an unlimited number of children

Budget-friendly basic plan

Predictive risk management score

Cons

Pricey high-tier plan

Monthly credit score or credit card monitoring requires a more expensive plan

Limited cybersecurity tools

Now, let’s shift our focus to LifeLock.

LifeLock overview

| Starting price | $7.50/month |

| Supported platforms | Windows, macOS, Android, and iOS |

| Three-bureau credit monitoring | Yes (top-tier plans) |

| Identity theft insurance | Up to $3 million |

| Best deal | 52% Off Coupon > |

Born in the desert heat of Tempe, Arizona, LifeLock has been guarding digital identities since 2005. Now backed by Norton, it’s grown into one of the most recognized names in identity theft protection. From scanning the dark web for your leaked information to monitoring your credit reports and sending real-time alerts, LifeLock works like a digital watchdog for your personal data.

As of now, LifeLock holds a strong 4.8 TrustScore on Trustpilot, based on over 7,920 reviews — a clear sign that many users trust the service. Still, about 9% of reviewers have left the lowest rating, mentioning false alerts, occasional glitches, and frustrating support experiences. If you're wondering how LifeLock handles customer care, jump to our support deep dive.

Even with a few complaints, LifeLock stands tall in the identity protection space, especially with Norton’s cybersecurity muscle behind it. From fraud alerts and lost wallet protection to reimbursement coverage and VPN access, it’s packed with features designed to help keep your digital life secure.

LifeLock pros and cons

As with our Aura vs LifeLock showdown, let’s take a closer look at what makes LifeLock a strong choice (or not) for safeguarding your digital privacy.

+ Pros

30-day free trial period (recently added)

A VPN with family plans

Comprehensive identity theft protection service

- Can be combined with Norton 360 antivirus software

Up to $1 million insurance for certain costs incurred from identity theft

User-friendly interface and easy setup

Stolen wallet protection

Simple-to-use mobile apps

– Cons

- 3-bureau monitoring is available in higher-tier plans only

- Confusing paid plan structure

- Higher cost compared to some competitors

Availability and insurance coverage: Which offers better insurance and platform coverage?

| Identity Guard | LifeLock | |

| Identity theft insurance amount | $1M for each adult member | $1M with all plans, but only for lawyers and experts. Stolen funds and personal expenses vary from $25,000 to $1M, depending on the plan |

| Stolen funds reimbursement | Up to $1M | From $25,000 to $1M, depending on the plan |

When it comes to availability and insurance coverage, both Identity Guard and LifeLock offer robust protection against identity theft. Identity Guard’s “Total” and “Ultra” plans thoroughly monitor credit scores and reports from all three major credit bureaus.

On the other hand, LifeLock stands out with insurance coverage that can reach up to $3 million for its highest-tier plan. However, the $1 million coverage mainly covers costs for lawyers and experts, while reimbursement for stolen funds and personal expenses starts at $25,000, depending on the plan. This tiered approach offers flexibility but requires careful consideration to choose the right plan for your needs.

| Identity Guard | LifeLock | |

| Windows? | ✅ | ✅ |

| macOS? | ✅ | ✅ |

| Android? | ✅ | ✅ |

| iOS? | ✅ | ✅ |

| Browser extensions? | ✅ | ✅ |

LifeLock’s system supports both Windows and macOS, and its Norton Safe Web browser extension works with Google Chrome, Mozilla Firefox, and Microsoft Edge. Both services offer mobile apps for Android and iOS, making it easy to manage your protection on the go.

Meanwhile, Identity Guard lets you stay in the loop whether you're on your phone or laptop — it works smoothly on Chrome, Firefox, and Safari. Quick check-ins and real-time alerts are a breeze, but if you're diving into the details, the desktop version is where the magic happens.

Core identity protection capabilities: Who wins Identity Guard and LifeLock face-off?

When it comes to protecting your identity, both Identity Guard and LifeLock have their strengths. Each service covers features like credit monitoring, dark web surveillance, and bank account security.

Let's dive into their credit monitoring services first.

Credit monitoring across the bureaus

| Identity Guard | LifeLock | |

| What does credit monitoring include? | – Three-bureau credit monitoring – Monthly credit reports and daily updates – Credit lock – Credit freezes for full protection | – Three-bureau credit monitoring – Monthly Equifax credit score updates – Experian credit lock |

| See coverage details > | See coverage details > |

Regarding credit monitoring, we've found that both LifeLock and Identity Guard have unique strengths. LifeLock’s “Advantage” plan lets you lock your TransUnion credit file, which is a great way to keep unauthorized people out. But if you want to watch all three credit bureaus, Identity Guard’s “Total” plan is the way to go. It gives you a full view of your credit status.

For the most detailed monitoring, Identity Guard’s “Ultra” and LifeLock’s “Ultimate” Plus plans are the best bets. These plans offer annual reports from all three major bureaus, so nothing slips through the cracks. We also like that Identity Guard's “Ultra” plan gives you monthly credit score updates from Equifax and an Experian credit lock for added security. And the alerts for suspicious activity are super handy, coming through email, text, or phone, so you can act quickly.

If you’re on a budget, it’s good to know that Identity Guard's “Value” plan doesn’t include credit monitoring. In contrast, even LifeLock’s lower-tier plans offer some level of monitoring, though it's limited to one bureau.

With LifeLock, you get monthly credit reports and daily score updates from all three major bureaus if you go for the top-tier plan. Plus, you can lock your TransUnion file whenever you want, which is pretty convenient for controlling who gets to see your credit info.

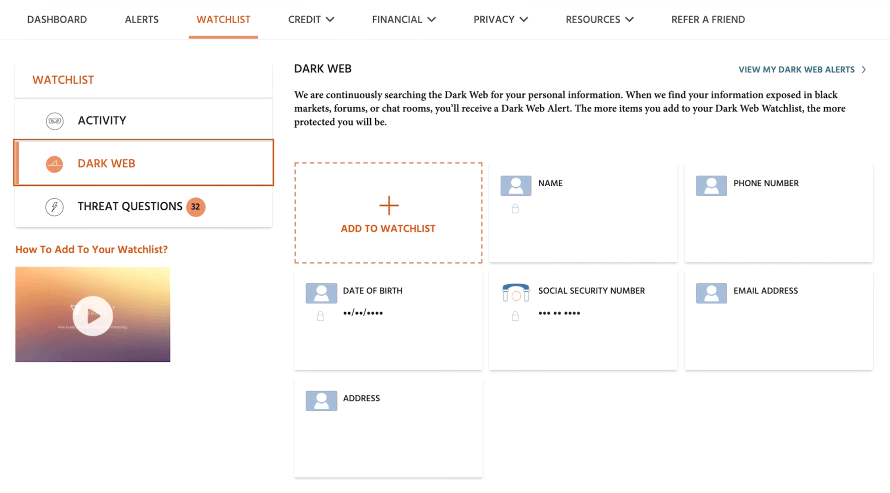

Dark web surveillance

Exploring the dark web might sound like something out of a spy movie, but when it comes to identity protection, it’s a real battleground. Both Identity Guard and LifeLock do a fantastic job of keeping an eye on this shadowy part of the internet for us.

Identity Guard uses AI to search the dark web for any trace of our sensitive info. It's always on alert for our SSNs, credit card details, or health insurance IDs. If anything suspicious pops up, we get immediate alerts and practical advice on what to do next. This feature is included in all their plans, and it’s powered by IBM Watson, ensuring thorough and reliable monitoring.

LifeLock also dives into the dark web, looking for signs that our data might be compromised. One of the standout features we love is how quickly LifeLock sends alerts if our information is found. This extra layer of security is very reassuring, especially since the dark web is such a risky place.

Financial and investment account safeguards

Protecting our financial and investment accounts from identity thieves is crucial, and both LifeLock and Identity Guard offer strong defenses.

When it comes to LifeLock, here’s what stands out:

Sends alerts for unauthorized utility accounts and phone takeover attempts.

Offers up to $3 million in total insurance coverage, including stolen funds reimbursement.

Monitors transactions in credit, checking, and savings accounts, plus 401(K) investments.

The “Ultimate Plus” plan covers up to $1 million in identity theft losses, including personal expenses and legal costs.

Lower-tier plans provide $25,000 to $100,000 coverage for stolen funds and personal expenses.

Identity Guard brings its own set of valuable protections:

The “Ultra” plan alerts us to suspicious transactions across various accounts.

Provides a $1 million insurance policy focused on restoration services.

All plans offer up to $1 million in identity theft insurance for legal fees, lost wages, and other expenses.

The “Ultra” plan includes white glove fraud resolution services, where a specialist handles most recovery work.

For consistent coverage across all plan levels, Aura is another option worth considering, as they offer $1 million for stolen funds and legal expenses in every plan.

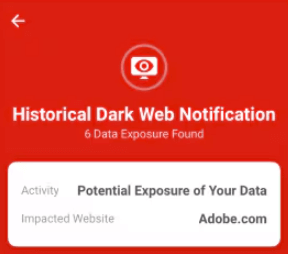

Real-time activity alerts

Being alerted to unusual account activity is crucial in the battle against identity theft. Both Identity Guard and LifeLock excel in this area, promptly notifying you of any suspicious movements on your bank and investment accounts, changes to your Social Security number (SSN), address updates, and unexpected liens on your home title.

LifeLock’s vigilant security monitoring system is designed to detect potential identity misuse early on. It keeps a close watch over your data, including your SSN and credit card information, as well as monitoring your investment accounts. LifeLock's alerts are swift and can make a significant difference in mitigating potential damage from identity theft.

Meanwhile, Identity Guard’s high-risk transaction monitoring acts like having a dedicated lookout for your finances. It alerts you to any unauthorized activities and allows you to customize how you receive alerts, whether through real-time text messages or emails. This flexibility ensures you stay informed and can take immediate action, no matter where you are.

Digital security extras compared: Identity Guard vs LifeLock

In the world of digital security, Identity Guard and LifeLock arm their users with a robust array of extra defenses. Identity Guard employs advanced AI to enhance surveillance, while LifeLock benefits from Norton’s expertise in device security. These services go beyond simple identity monitoring, providing comprehensive protective suites to ensure your digital safety is always covered.

Address change and public record alerts

Keeping a close watch on your public records and address changes is crucial in the battle against identity theft. Identity Guard and LifeLock are diligent in monitoring public records for any suspicious alterations, such as changes to your home address, which can be a red flag for potential fraudsters attempting to redirect your mail.

LifeLock's “Ultimate Plus” plan goes the extra mile with home title monitoring and sex offender registry reports, adding layers of protection. Similarly, Identity Guard's Ultra plan includes USPS address change monitoring to enhance its surveillance efforts.

Social media monitoring

When it comes to social media monitoring, Identity Guard and LifeLock have got your back. They both keep a close watch over your social accounts to catch any signs of trouble that could threaten your identity. Identity Guard is especially handy with its focus on spotting cyberbullying and impersonation attempts. It’s been pretty reassuring to have their alerts popping up whenever something fishy happens on my social feeds. They cover platforms like Facebook, Instagram, X, YouTube, and TikTok which is super helpful in keeping tabs on all angles of my online presence.

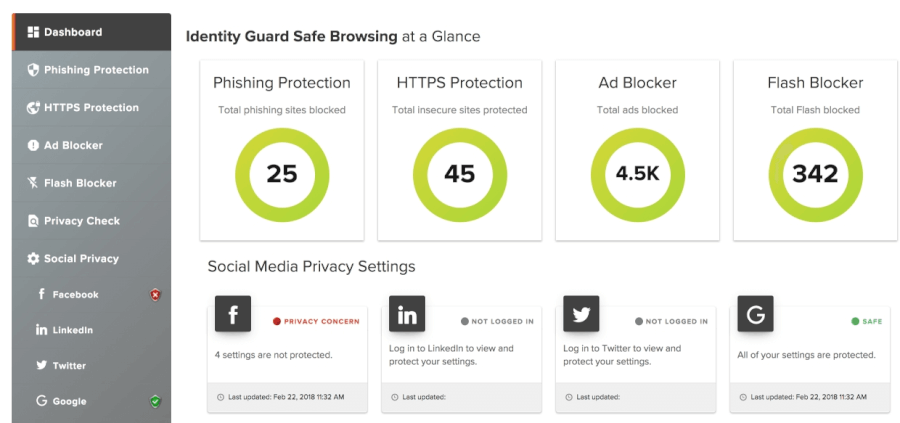

Browser security extensions compared

Identity Guard's Safe Browsing extension is a powerful tool for enhancing online security. After a simple installation and login process, it immediately fortifies our browsing experience. The extension excels in blocking phishing attempts and automatically upgrades connections to HTTPS for encrypted data transmission. It's also effective at blocking ads and malvertisements, boosting browsing speed, and minimizing exposure to harmful content.

Moreover, the extension proactively blocks Flash content, known for its vulnerability to malware. It enhances privacy by eliminating trackers that monitor online activities, safeguarding personal data from unauthorized collection. Identity Guard goes further by offering a social privacy manager to secure social media accounts and a privacy checker to remove personal information from online databases, reducing the risk of identity exploitation.

Secure VPN service and antivirus software (as part of Norton security suite)

In the world of digital security, having a secure VPN and strong antivirus software is like having an impenetrable shield and a sharp sword.

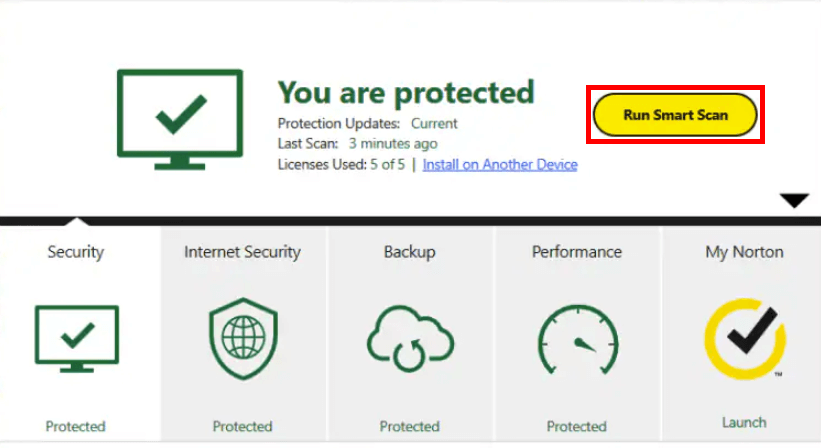

We've been using LifeLock, which is powered by Norton, and it offers a secure VPN and antivirus software that really puts our minds at ease. This combo keeps our data encrypted and our devices safe from threats. The VPN masks our IP address and protects our online activities, while Norton’s antivirus scans for and eliminates malware, giving us solid protection.

On the other hand, Identity Guard might not have direct cybersecurity tools like LifeLock, but it excels in predictive risk management and real-time alerts. For those looking to boost their digital defenses even further, pairing LifeLock with Norton 360 can provide proactive protection against various threats, including malware that can steal your identity. However, it's important to note that Norton 360 comes with additional costs.

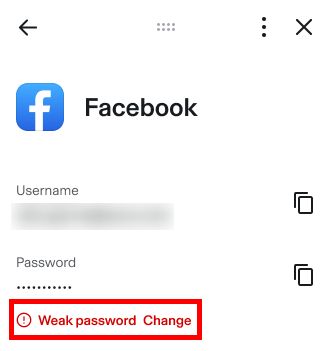

Secure password management solutions

Both Identity Guard and LifeLock understand the importance of managing passwords, offering password managers with their services. LifeLock, integrated with Norton, provides a secure vault for storing passwords. It automatically generates strong passwords and includes autofill, making it easy to maintain unique passwords for all your accounts.

Identity Guard’s password manager is straightforward and user-friendly. It securely stores and manages passwords, protecting your credentials from unauthorized access. This tool is included in all plans, adding significant value for anyone needing an easy way to handle password management.

Two-factor authentication

Two-factor authentication (2FA) is essential for preventing identity theft. Both Identity Guard and LifeLock offer 2FA to enhance security. LifeLock, integrated with Norton, adds an extra verification step, like a code sent to your mobile device, to reduce the risk of unauthorized access.

Identity Guard also employs 2FA, requiring an additional step to keep your account secure even if your password is compromised. This extra layer of protection shows Identity Guard’s dedication to safeguarding your digital identity.

Ease of use and support: How user-friendly are Identity Guard and LifeLock?

Navigating identity protection can be tricky, but we’ve tested Identity Guard and LifeLock to see which one makes it easier to stay safe.

Let’s dive in and see what sets them apart.

Signing up and setting up your protection

Getting started with LifeLock is straightforward. You enter personal information like your name, SSN, birthdate, address, phone number, and email, then provide your credit card details and agree to the terms. Next, you add the accounts you want LifeLock to monitor, from social media to bank accounts. The setup time varies based on how many accounts you want to protect.

After setting a secure password and entering your billing details, you access the LifeLock dashboard to manage settings and view alerts. The user-friendly dashboard and guided setup process make it easy to get started and stay protected.

Setting up Identity Guard is also a breeze. The intuitive interface guides you through the process. After selecting your plan, you create a password and provide essential details like your email, name, address, phone number, date of birth, and SSN. Helpful popups explain why each piece of information is needed, making it straightforward.

You’ll enter a payment method during signup. Once done, your account is set up in under a minute. Log in with your email and password, and you’ll see a quick overview of the service. Since Identity Guard is cloud-based, no downloads are necessary; everything runs smoothly in your browser.

Navigating your dashboard and apps

Once you're set up, the dashboard becomes your control center for monitoring and managing your protection.

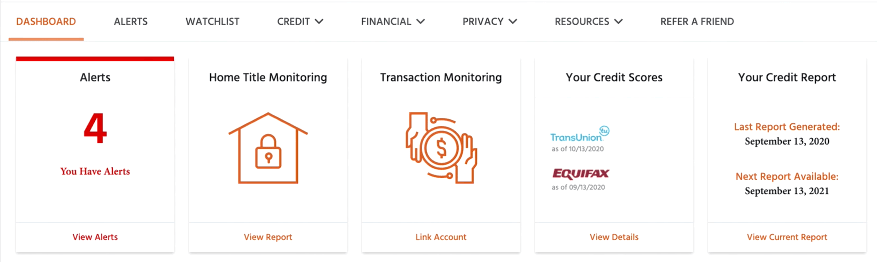

We've found Identity Guard's dashboard to be incredibly user-friendly, with clickable icons and drop-down menus that make navigation a breeze. The top menu includes sections like “Dashboard,” “Alerts,” “Watchlist,” “Credit,” “Financial,” “Privacy,” and “Resources.” We especially like the quick access to tools like alerts, credit scores, reports, home title monitoring, and security freeze. The desktop version gives a comprehensive view, while the mobile app is perfect for quick checks and alerts on the go.

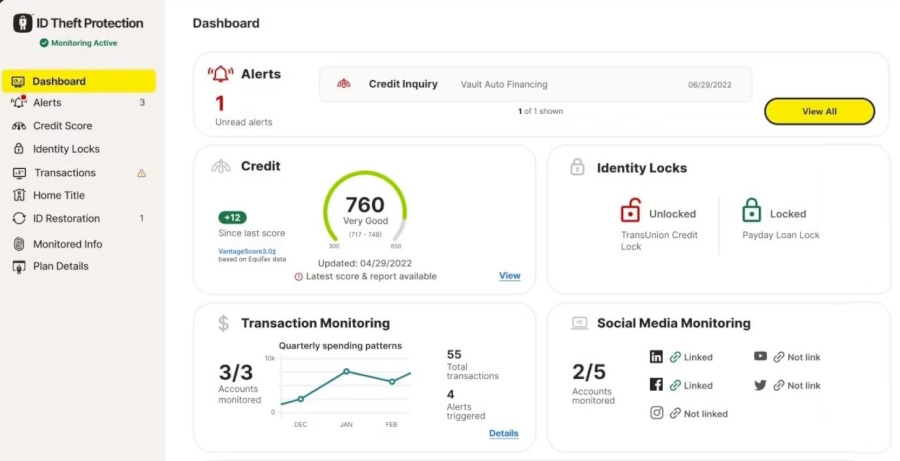

LifeLock's interface is also impressive, with an elegant and intuitive dashboard that presents crucial information at a glance. You can easily check your credit score, monitor alerts, and see your identity lock status. The top tabs provide quick access to important sections like alerts, credit scores, identity lock, transactions, ID restoration, and monitored info. We’ve found LifeLock’s mobile apps for Android and iOS to be super helpful, making it easy to manage your account and get instant alerts wherever you are.

However, choosing between the LifeLock for Norton360 and LifeLock ID Theft Protection apps can be a bit confusing. Once logged in, though, both apps are straightforward and easy to navigate.

Customer support and self-help resources

When you find yourself needing help, having reliable customer support can make a huge difference. LifeLock offers around-the-clock support, ready to assist whenever you need it. Meanwhile, Identity Guard's US-based case managers are experts in tackling fraud issues.

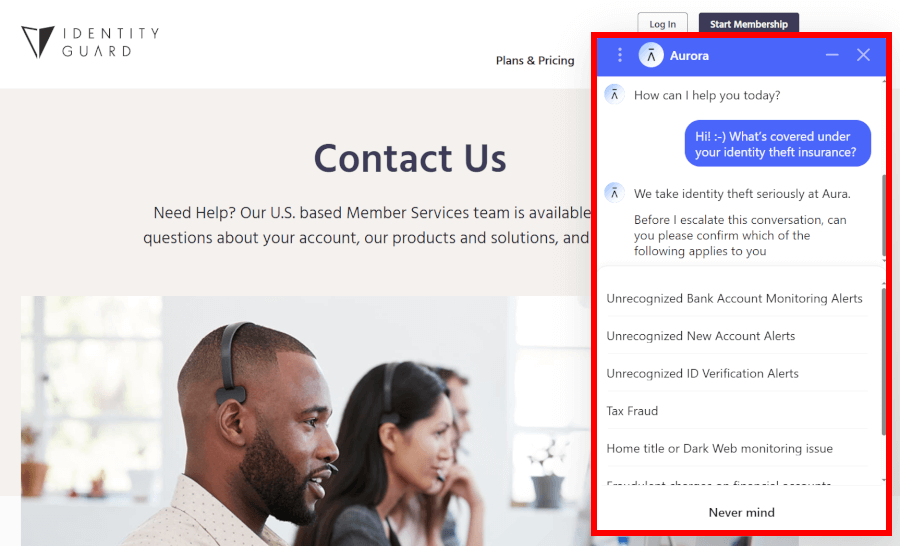

We’ve had a pretty smooth ride with Identity Guard’s support. For quick fixes, their built-in AI assistant is surprisingly helpful. Need a real human? Just call 1-833-692-2187 or email customercare@identityguard.com.

During our tests, the support team was friendly, easy to reach, and knew their stuff. They’re available during business hours and weekday evenings, and if you hit an identity theft emergency, they’ve got your back 24/7. There’s no live chat (yet), but between the AI and responsive email and phone support, you’re never left hanging.

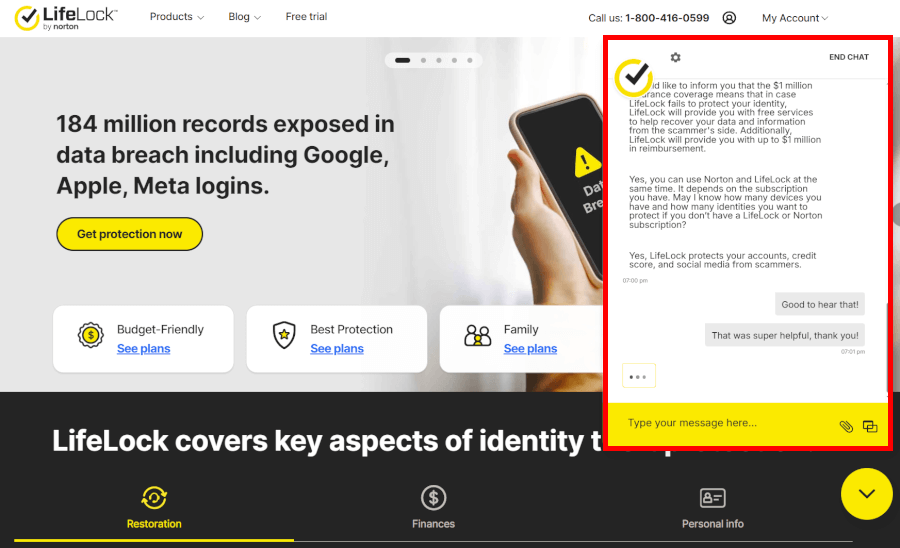

LifeLock’s 24/7 support is just a click away, and honestly, we were pleasantly surprised. When we tested the live chat, an agent popped in almost instantly. They were friendly, fast, and knew their stuff, making the whole experience feel refreshingly easy.

Every LifeLock plan includes round-the-clock help, so whether it’s a midnight question or a weekend emergency, someone’s there. Prefer to dig in yourself? Their blog and FAQs are packed with helpful info. Just a heads-up: some agents are more Norton-focused, but overall, getting support was smooth sailing.

Financial health: Who offers more helpful credit reports and scores?

LifeLock's top-tier plan shines with its robust credit monitoring. It provides monthly credit reports and daily updates from all three major credit bureaus, which has been invaluable for keeping a close watch on our financial status.

On the other hand, Identity Guard's “Ultra” plan offers a thorough annual credit report from all three bureaus, offering a comprehensive snapshot of our credit health. Choosing between them boils down to whether you prefer frequent updates or a detailed annual review to safeguard your financial well-being.

Security and privacy: Is Identity Guard or LifeLock a safer choice?

When it comes to keeping our online lives private and secure, both Identity Guard and LifeLock offer impressive defenses against digital threats.

| Security features | Identity Guard | LifeLock |

| Bank-level AES-256 encryption | ✅ | ✅ |

| Real-time threat and fraud alerts | ✅ | ✅ |

| Two-factor authentication | ✅ | ✅ |

| Dedicated privacy tools (VPN, ad blocker) | ✅ (browser extension, ad/tracker blocking but no VPN) | ❌ (separate Norton bundle) |

Identity Guard uses IBM Watson’s AI for predictive insights and features like a safe browsing extension and password manager to protect against phishing and malware. Their commitment to strong encryption, regular security checks, and multi-factor authentication gives us peace of mind about our digital identities.

LifeLock provides additional security with Norton Secure VPN and comprehensive device protection across different platforms. They’ve significantly improved their security practices, including robust multi-factor authentication and regular audits. It’s worth noting that both services may share some personal data as required by law, but they prioritize protecting data through advanced encryption and strict security protocols.

In the end, the choice between Identity Guard and LifeLock depends on whether you prefer AI-driven insights and extensive online protection or VPN-powered privacy and broad device security.

Plans and pricing: Does Identity Guard or LifeLock offer greater value for money?

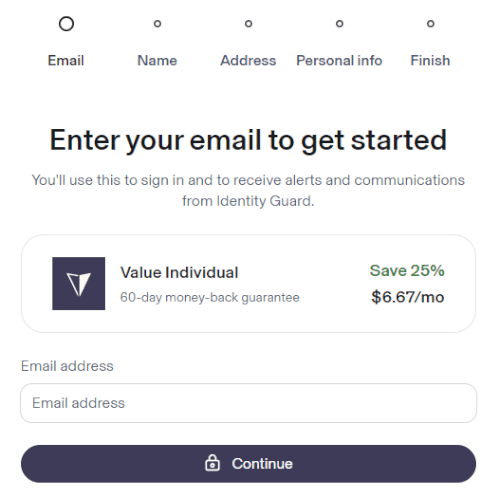

When it comes to choosing the right plan, Identity Guard offers a variety of options to fit different needs and budgets.

| Identity Guard plans | Price for individuals | Price for families |

| $6.67/month | $10.00/month | |

| $11.99/month | $17.99/month | |

| $17.99/month | $22.09/month |

Here’s a quick look at their individual plans:

Value: $6.67 per month. This plan provides basic identity theft protection, including dark web surveillance and high-risk transaction alerts. It's a great starter option for those new to identity protection.

Total: $16.67 per month. This plan offers more comprehensive protection, including credit monitoring, dark web surveillance, high-risk transaction alerts, and social media account monitoring. It's ideal for those looking for more robust coverage.

Ultra: $25.00 per month. This top-tier plan includes everything from the “Total” plan plus enhanced fraud resolution services and regular credit score updates. Perfect for those who want the highest level of protection and peace of mind.

For families, Identity Guard offers plans ranging from $10 to $22.09 per month, covering up to five adults and any number of children. These family plans ensure everyone in your household is protected, making them a great choice for families wanting to keep their identities safe.

Their 60-day money-back guarantee for annual plans purchased through their website gives you peace of mind to try the service risk-free.

See all Identity Guard prices and deals here >

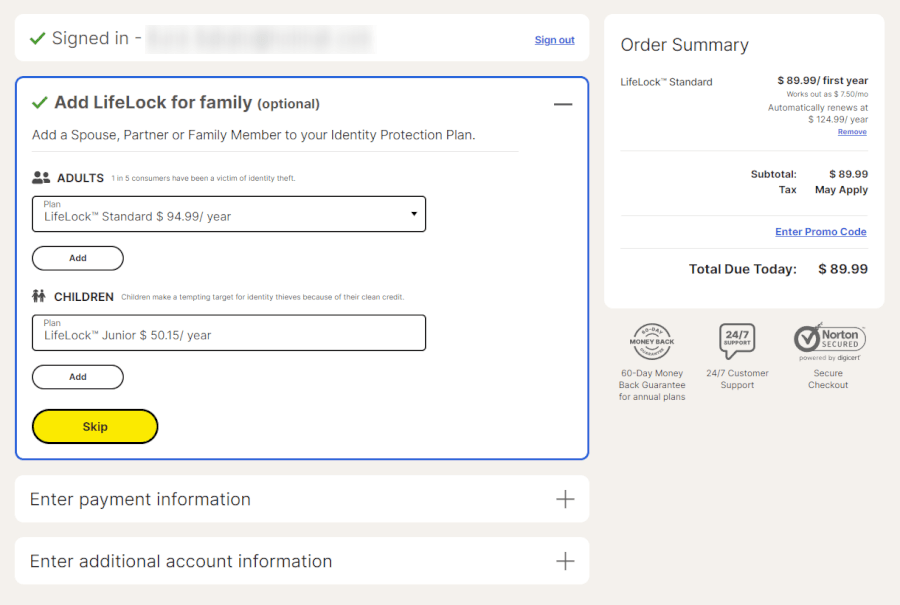

As you can see below, LifeLock’s plans also cater to a variety of needs and budgets.

| LifeLock plans | Price for individuals | Price for families (two adults) | Price for families (two adults and five kids) |

| Standard | $7.50/month | $12.49/month | $18.49/month |

| Advantage | $14.50/month | $22.09/month | $29.99/month |

| Ultimate Plus | $19.50/month | $33.39/month | $38.99/month |

Here’s a simple breakdown:

Standard: $7.50/month for the first year (then $12.49/month). Includes up to $25,000 in stolen funds reimbursement, $1 million for legal costs, and US-based identity restoration. Great for essential identity protection.

Advantage: $14.99/month for the first year (then $20.83/month). Offers up to $100,000 in stolen funds reimbursement and personal expense compensation, plus $1 million for legal costs. Ideal for those seeking more comprehensive coverage.

- Ultimate Plus: $19.99/month for the first year (then $29.15/month). Provides up to $1 million in stolen funds reimbursement and personal expenses, with three-bureau credit monitoring. Best for those wanting maximum protection.

While LifeLock doesn’t offer a free trial, they do have a 60-day money-back guarantee on annual plans, so you can try it without a long-term commitment.

See all LifeLock pricing and deals here >

Wrap-up: Who claims victory, Identity Guard or LifeLock?

After diving into Identity Guard and LifeLock, here’s our take on how they stack up:

Trustworthiness: Tie

Availability and insurance: Tie

Core identity protection capabilities: Tie

Additional digital defenses: LifeLock

Ease of use and support: Tie

Financial health reports: Tie

Security and privacy: Tie

Plans and pricing: Identity Guard

Both Identity Guard and LifeLock offer top-notch identity protection, each with its unique strengths. Identity Guard shines with its AI-driven monitoring and budget-friendly plans, perfect for families or those who want solid coverage without fuss. Meanwhile, LifeLock, with its Norton 360 integration, provides customizable plans and strong additional digital defenses, great for users wanting tailored protection.

Identity Guard’s straightforward pricing is a plus, but LifeLock’s extensive insurance and extra digital tools are hard to beat. In the end, both services are reliable and effective – your choice depends on what you prioritize in identity protection.

And if you’re looking for a blend of both, Aura is worth considering. It offers a comprehensive suite of identity protection and cybersecurity features, making it a strong contender in the market.

Get Identity Guard safeguarding you from day one

If you’ve picked Identity Guard as your winner, this is how you activate its smartest tools to start proactive defense right away:

- Trigger the AI-powered initial scans for dark web exposures, identity risks, and predictive threats using IBM Watson insights.

- Customize real-time alert preferences so you only get notifications for high-priority changes like credit inquiries or SSN activity.

- Deploy the browser extension across your devices for instant phishing protection and tracker blocking.

- Load your passwords into the built-in manager and enable secure auto fill for everyday logins.

- For family plans, double-check unlimited child monitoring is enabled to cover everyone automatically.

These quick moves deliver personalized, high-tech protection from the moment you finish setup.

Identity theft protection comparison guides on CyberInsider:

- Aura vs LifeLock

- Aura vs Experian IdentityWorks

- IDShield vs Aura

- Aura vs McAfee

- Aura vs NordProtect

- LifeLock vs IDShield

- Aura vs Incogni

- Aura vs IdentityIQ

- Aura vs IDShield

- Identity Guard vs Aura

- Identity Guard vs NordProtect

- LifeLock vs Experian Identity Works

Identity Guard vs LifeLock FAQ

What's the main difference between LifeLock and Identity Guard?

The main difference lies in their approach to identity protection. LifeLock leverages Norton 360 antivirus for enhanced device security, while Identity Guard uses IBM’s Watson AI for advanced identity monitoring. LifeLock offers more extensive insurance coverage, whereas Identity Guard provides budget-friendly family plans and consistent pricing.

Do Identity Guard and LifeLock provide three-bureau credit monitoring?

Yes, both Identity Guard and LifeLock offer three-bureau credit monitoring, but it depends on the plan you choose. Identity Guard’s “Total” and “Ultra” plans include this feature, while LifeLock provides it with their “Ultimate Plus” plan.

Which service has better mobile app functionality for on-the-go monitoring?

Both Identity Guard and LifeLock offer robust mobile apps for on-the-go monitoring. LifeLock’s app is integrated with Norton’s security suite, providing a comprehensive security experience. Identity Guard’s app is user-friendly and provides quick access to alerts and monitoring tools, making it equally effective for mobile use.

Is Identity Guard trustworthy?

Yes, we consider Identity Guard trustworthy. Since its inception in 1996, Identity Guard has built a solid reputation in the identity theft protection industry. It operates under the umbrella of Aura and uses advanced AI technology to provide reliable identity monitoring and protection services.

Leave a Reply