You face identity theft risks every time you shop online, apply for credit, or share personal details. The best identity theft protection services monitor your information across all three credit bureaus, scan the dark web for leaks, and provide up to $5 million in insurance, plus expert recovery help if trouble hits.

LifeLock built its reputation over decades, yet newer competitors have arrived, bundling VPNs, antivirus, and faster alerts at lower prices. After hands-on testing of monitoring depth, response times, and overall value, one provider delivered the most complete package for 2026 — and it outperformed expectations.

In this in-depth guide, we’re breaking down the best identity theft protection services available today — what they offer, how much they cost, and how they perform when things go wrong. We’ve tested them all, from high-tech monitoring tools to user experience and real-world support. One service rose above the rest in speed, coverage, and value, but it wasn’t the one we expected — dive in to the surprise leader.

Let’s dive in — you’ll want to see how your current protection stacks up.

Best identity theft protection services: Our top picks for 2026

After thorough research and rigorous testing, we present the top six identity theft protection services for 2026, emphasizing their security, performance, and unique features:

- Aura – Top-notch identity protection with quick threat alerts and up to $5M insurance for families. Aura is also unmatched in terms of value, especially with this 68% off coupon.

- NordProtect – Built by the minds behind NordVPN, this service fuses identity protection with top-tier cybersecurity, offering VPN security, real-time alerts, and an easy setup.

- Identity Guard – Alongside core features, this service offers security extras including a password manager, a safe browsing tool, and unlimited children with family plans.

- LifeLock – A rock-solid choice, enhanced by Norton 360 antivirus software to ensure thorough protection.

- IdentityIQ – With Bitdefender on board, this jack-of-all-trades ramps up its security suite with antivirus and VPN services.

- IDShield – An all-encompassing service that excels in the market with its licensed private investigators and insurance coverage of up to $3M.

In the next sections, we’ll dive deeper into our top picks for identity theft protection available today. We’ll share what makes each service stand out, their best features, and how well they guard against identity theft.

How we chose the best identity theft protection services (so you don’t have to)

Choosing the right identity theft protection can feel like navigating a digital minefield — but don’t worry, we’ve done the heavy lifting for you. Our hands-on testing helped us find the best mix of serious security and smart value. Here’s a peek at how we ranked the top services based on our experience:

- Cost and value: We crunched the numbers to see which plans deliver the most bang for your buck. After all, you shouldn’t have to empty your wallet just to keep your identity safe.

- Discounts and guarantees: Who doesn’t love a good deal? We hunted down the best annual discounts, special pricing offers, and made sure the services back up their promises with solid money-back guarantees.

- Comprehensive protection: We didn’t just stop at basic coverage. We dug into the details, checking whether plans included must-haves like antivirus software, VPNs, password managers, and parental controls. Full device protection = full peace of mind.

- Credit monitoring: Catching identity theft early often comes down to good credit monitoring — and the best services keep tabs on all three credit bureaus. We made sure to spotlight the ones that do.

- Dark web monitoring: Your personal info doesn’t belong on the dark web, period. We looked for services that patrol the shady corners of the internet and alert you the moment your data pops up where it shouldn’t.

- Identity theft insurance: Bad things can happen even with the best protection. That's why we checked to see how much insurance coverage each service offers — because having a financial safety net is a must.

We looked at everything — features, pricing, real-world experiences — to find the real standouts. Our goal? To help you land the best identity theft protection without breaking the bank.

1. Aura — Best all-around identity protection

| Starting price | $12/month ($9 with coupon) |

| Supported platforms | Windows, macOS, Android, and iOS |

| Three-bureau credit monitoring | Yes (Experian, TransUnion, and Equifax) |

| Identity theft insurance | $1M – $5M ($1M per adult) |

| Best deal | 68% off coupon > |

Aura provides exceptional all-round protection with its comprehensive identity monitoring toolkit. We've found that Aura goes beyond just monitoring credit files from the major bureaus — it actively detects potential threats and alerts you promptly. What's really impressive is its spam call protection, ensuring a secure user experience. Aura also offers up to $1M in identity theft insurance per member (up to $5 with family-focused packages) and round-the-clock customer support, which has been helpful in urgent situations.

The built-in VPN service ensures anonymity across multiple devices, while the password manager keeps accounts secure by flagging compromised or weak passwords. We've found the antivirus software effective against malware and other cyber threats, providing peace of mind.

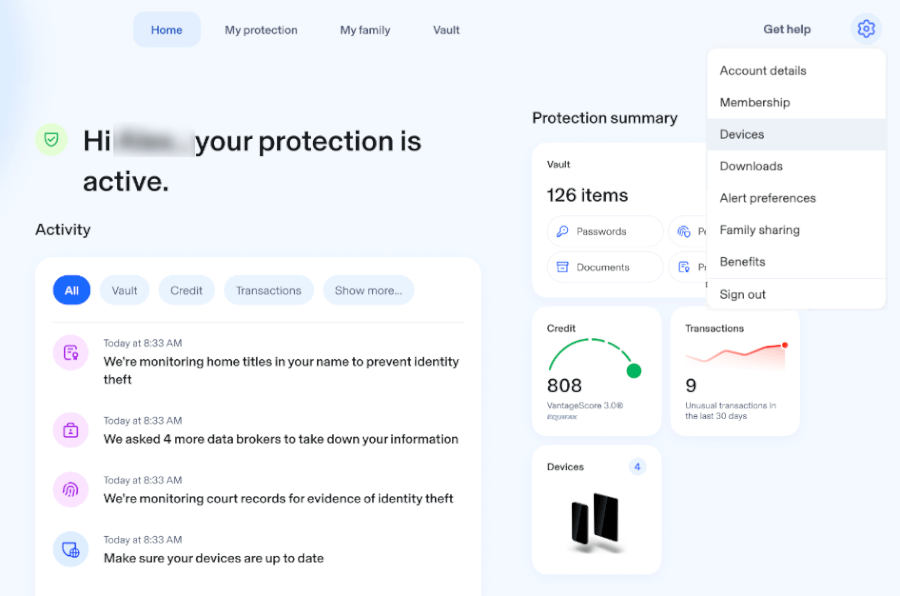

Aura's dashboard is intuitive and user-friendly, allowing easy access to features like credit monitoring, dark web scans, and real-time alerts. Check the screenshot below for an example of its streamlined design:

Aura's dark web monitoring is thorough, constantly scanning for leaks of personal information and notifying users of any breaches. Additionally, its financial transaction monitoring keeps a watchful eye on credit, banking, and investment accounts for any signs of fraudulent activity.

One unique feature, CreditLock, allows users to lock their Experian credit report to prevent unauthorized access, a handy tool for added security. In case of a lost wallet, Aura assists promptly with card cancellation and develops a recovery plan to safeguard your identity. Plus, their 60-day money-back guarantee on annual subscriptions adds confidence to your investment.

To sum up, Aura’s extensive array of tools — from vigilant dark web monitoring and real-time financial alerts to a secure VPN — alongside stellar customer support and up to $1 million in identity theft insurance, positions it as the ultimate solution for complete identity protection.

| Aura plans | Individual | Couple | Family |

|---|---|---|---|

| 1-month | $12.00/month | $20.00/month | $30.00/month |

| 1-year | $9.00/month | $17.00/month | $25.00/month |

Deal: Get 68% discount on Aura's yearly plans >

Aura pros and cons

Let’s take a look at the strengths and weaknesses of opting for Aura to protect your digital identity:

+ Pros

- Antivirus software across all plans

- Comprehensive identity theft protection and credit monitoring services

- Dark web monitoring

- Fraud call protection

- Up to $1 million in insurance coverage

- Plans for individuals, couples, and families

- Useful parental control app

- Password manager and VPN included

- 24/7 customer support and fraud resolution

- Transparent pricing

- 3-bureau credit monitoring included in all plans

– Cons

More expensive than some competitors

Exclusive Aura Coupon:

Get 68% Off Aura subscription plans with the coupon below:

(Coupon is applied automatically; 60 day money-back guarantee.)

2. NordProtect — Trusted identity protection from the makers of NordVPN

| Starting price | $4.49/month |

| Supported platforms | Windows, macOS, Android, and iOS |

| Three-bureau credit monitoring | No (TransUnion only) |

| Identity theft insurance | $1M |

| Best deal | 71% Off Coupon > |

If you’ve ever tried NordVPN, you already know Nord Security takes online safety seriously. Now, with NordProtect, they’re bringing that same level of dedication to identity protection — and then some. It’s a full-on security suite that blends identity monitoring, credit alerts, and powerful cybersecurity tools into one slick, easy-to-use package. Think of it as your personal bouncer in the wild world of the internet.

One of NordProtect’s standout features is its identity theft insurance, which covers up to $1 million per adult for stolen funds, legal fees, lost wages, and even mental health support. They’ve even thrown in cyber extortion protection, which means if someone tries to hold your data for ransom, NordProtect has your back.

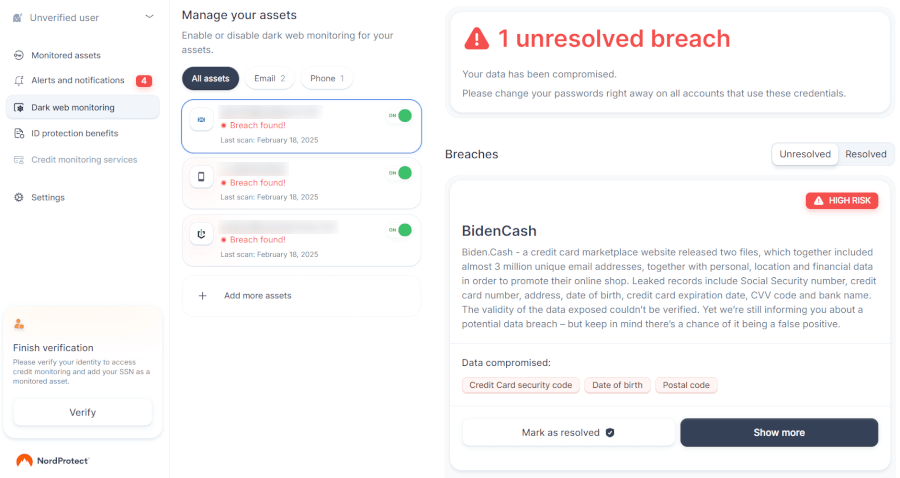

Setup is smooth sailing, just what we’ve come to expect from Nord. It’s quick, painless, and the dashboard is a breeze to use. Don’t just take our word for it — check out the clean layout below:

No need to bundle up — NordProtect stands on its own. Check out the table below to see how much it’ll run you:

| NordProtect plans | Silver | Gold | Platinum |

|---|---|---|---|

| 1-month | $15.49/month | $21.49/month | $28.49/month |

| 1-year | $6.49/month | $8.49/month | $11.99/month |

| 2-year | $4.49/month | $6.49/month | $9.99/month |

Deal: Get 71% off NordProtect plans here >

Either way, you’re getting solid identity protection, and if you go for the full package, you’ll also be securing your browsing and password management in one tidy deal.

NordProtect stays on high alert, scanning the dark web 24/7 to catch any signs of your info being leaked. If something sketchy turns up, you’ll be the first to know. The credit monitoring is solid, too, although it’s currently limited to TransUnion, so you won’t get updates from Experian or Equifax just yet (3-credit monitoring is announced as coming soon). Still, those real-time alerts help you catch fraud early, and if you need to freeze your credit, NordProtect walks you through it step by step.

One of the serious standouts? Cyber extortion coverage. If a shady hacker tries to hold your data for ransom, NordProtect jumps in with expert support. It even helps cover the costs — a rare safety net most identity protection services skip entirely. And if identity theft strikes, you won’t be left scrambling — Nord’s recovery specialists will walk you through every step.

So, is NordProtect worth it? If you’re after rock-solid identity protection with a dash of cybersecurity muscle, it’s a fantastic pick — especially if you’re already rolling with NordVPN. You can bundle it or go solo, depending on what fits your needs (and budget) best.

Of course, no service is perfect. NordProtect’s top-tier plans can get a bit pricey, and while support is generally solid, the lack of live chat feels like a missed opportunity from such a tech-savvy brand. We’d also love to see coverage from all three credit bureaus instead of just TransUnion. Still, if you're after an easy, all-in-one security suite from a name you already trust, NordProtect delivers.

NordProtect pros and cons

NordProtect brings a lot to the table, but is it the right fit for you? Let’s take a closer look at the highs and lows:

+ Pros

$1M identity theft recovery

Cyber extortion coverage

24/7 dark web monitoring

Effortless to set up and use

Criminal record and malware breach alerts

3-Bureau credit monitoring

Higher tiers come with a VPN and a password manager

Accepts a range of payment methods

- Frequent deep discounts on long-term plans

30-day money-back guarantee

– Cons

Pricey premium plans

No live chat support

SSN required for credit monitoring (but that’s typical)

3. Identity Guard — Full-spectrum identity theft protection with AI alerts

| Starting price | $7.50/month |

| Supported platforms | Windows, macOS, iOS, and Android |

| Three-bureau credit monitoring | Yes (Experian, TransUnion, and Equifax) |

| Identity theft insurance | $1M |

| Best deal | 63% Off Coupon > |

Identity Guard taps into the brainpower of IBM Watson AI — yep, that Watson — to deliver smart, lightning-fast identity theft protection. Thanks to this AI-driven setup, you’ll get alerts about data breaches, shady transactions, and dark web sightings faster and more accurately than with many other services. It’s like having a supercomputer on your side, scanning the digital world 24/7 to catch threats before they spiral out of control.

You’ve got options when it comes to plans. The “Ultra” plan is loaded with three-bureau credit monitoring (Experian, Equifax, and TransUnion), monthly credit score updates, an Experian credit lock, and yearly full credit reports. It also keeps you in the loop via email, text, or phone alerts — so you’re never caught off guard.

The “Total” and “Value” plans scale things down. The “Value” plan skips credit monitoring entirely, which feels like a letdown compared to what you get even in some entry-level LifeLock plans. The “Total” plan gives you daily credit score updates but no full credit reports. Still, all plans come with up to $1 million in identity theft insurance, which ups the peace-of-mind factor.

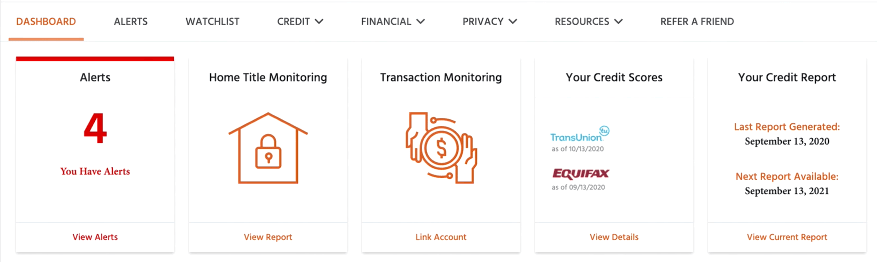

Identity Guard’s dashboard is smooth and easy to navigate, whether you’re on desktop or the mobile app. We found the desktop version especially handy for getting the big picture at a glance — take a peek at the screenshot below to see it in action.

Now, it’s not perfect. Identity Guard doesn’t include a VPN or bonus cybersecurity tools, and the premium plans aren’t exactly cheap. But thanks to its powerful AI engine, robust monitoring, and clear pricing, it’s still one of the top picks for serious identity protection.

Identity Guard pros and cons

Thinking of going with Identity Guard? Let’s look at the ups and downs first:

+ Pros

$1 million in identity theft insurance on all plans

AI-powered identity monitoring

Extra alerts are helpful

Simple-to-understand, upfront pricing

US-based customer support

Comprehensive individual or family coverage

Password managers included in all plans

Family plan protects an unlimited number of children

Budget-friendly basic plan

Predictive risk management score

Cons

Pricey high-tier plan

Monthly credit score or credit card monitoring requires a more expensive plan

Limited cybersecurity tools

4. LifeLock — Shielding your identity with Norton’s full support

| Starting price | $7.50/month |

| Supported platforms | Windows, macOS, iOS, and Android |

| Three-bureau credit monitoring | Yes (Experian, TransUnion, and Equifax) |

| Identity theft insurance | $1M – $3M |

| Best deal | 37% off coupon > |

LifeLock teams up with Norton 360 to bring you a one-two punch of identity theft protection and cybersecurity. It keeps tabs on your credit, scans the dark web for your personal info, and alerts you the moment something shady pops up. While no service can catch everything, LifeLock offers solid peace of mind — and a recovery crew ready to help if things go south.

Navigating LifeLock is a breeze. The dashboard is clean, simple, making it easy to find what you need — whether checking alerts, reviewing credit activity, or scanning for dark web breaches.

And here’s where the combo with Norton shines: family-focused LifeLock plans come bundled with Norton Secure VPN and antivirus tools. It’s a major security upgrade — though heads up, you’ll need the higher-tier plans to unlock the good stuff. The basic plan? It sticks to single-bureau credit monitoring and doesn’t include free credit reports.

Want full credit protection? You’ll have to manually freeze or lock your files with Experian and Equifax, since LifeLock only auto-locks TransUnion. That said, it does a great job managing your TransUnion credit and adds an extra layer of control.

It monitors key info like your Social Security number, credit card details, and bank activity. If your data leaks onto the dark web or a sketchy transaction pops up, LifeLock fires off an alert so you can jump on it fast. It also keeps an eye on your financial accounts to catch potential fraud early.

Lose your wallet? LifeLock’s got your back with fast support to cancel and replace your cards and IDs. You also get up to $1 million in insurance for identity theft losses on every plan — and if you’re on the top-tier option, you get the same coverage for stolen funds too.

Need help? LifeLock offers 24/7 customer support, and there’s a 30-day free trial so you can take it for a spin before making a commitment.

Quick tip: Compare LifeLock plans and see current discounts on their official page.

LifeLock pros and cons

Time to weigh the good and the not-so-good of LifeLock’s protection:

+ Pros

30-day free trial period (recently added)

A VPN with family plans

Comprehensive identity theft protection service

Can be combined with Norton 360 antivirus software

Up to $1 million insurance for certain costs incurred from identity theft

User-friendly interface and easy setup

Stolen wallet protection

Simple-to-use mobile apps

– Cons

Confusing paid plan structure

Higher cost compared to some competitors

5. IdentityIQ — Scalable coverage for comprehensive identity security

| Starting price | $8.49/month |

| Supported platforms | Windows, macOS, iOS, and Android |

| Three-bureau credit monitoring | Yes (Experian, TransUnion, and Equifax) |

| Identity theft insurance | $1M |

| Best deal | 15% off coupon > |

IdentityIQ offers different levels of protection, so you can choose the plan that fits your needs best. If you want the most coverage, the “Secure Max” plan has it all — $1 million in identity theft insurance, monitoring for child identity theft, alerts for new applications in your name, and even credit-building tools like utility payment reporting. You’ll also get monthly credit reports and strong support if fraud happens.

What sets IdentityIQ apart? Its partnership with Bitdefender. That means you get antivirus and VPN protection baked into your plan — a sweet bonus if you want an all-in-one security setup. That said, heads up: the fine print does mention possible data sharing with third parties or government entities, so it's something to keep in mind.

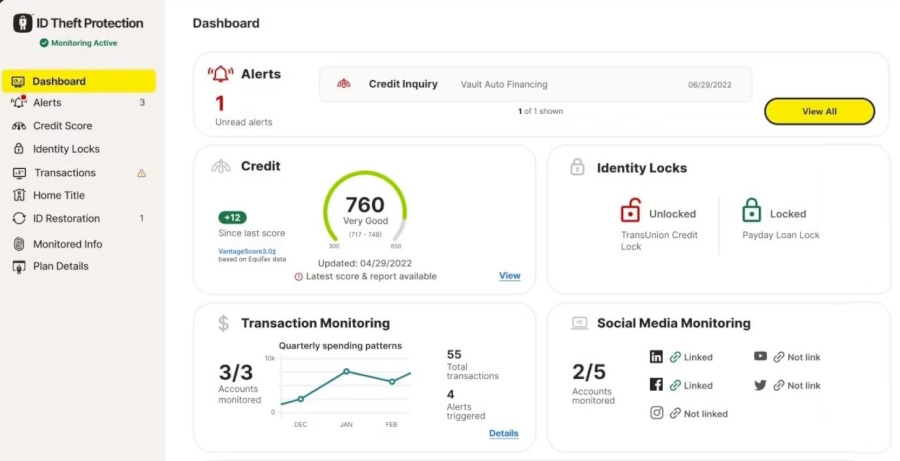

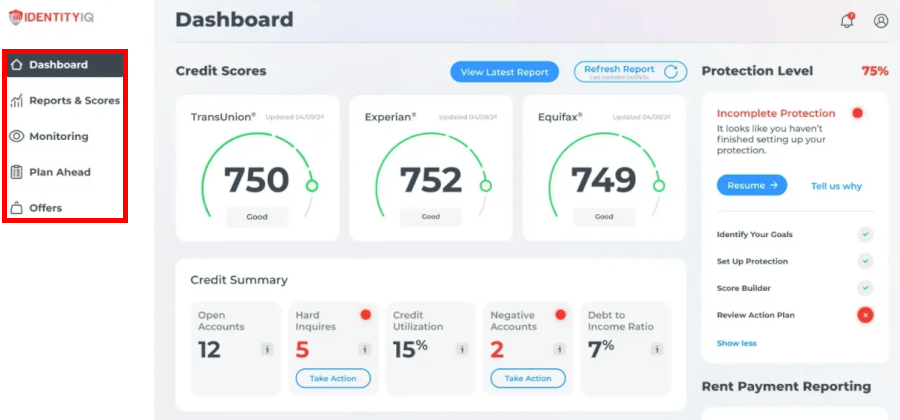

Their mobile app keeps you in the know with real-time alerts the moment something suspicious pops up. The new dashboard has a more modern look and feels easy to navigate, making it simple to check your status at a glance — see the screenshot below.

Lose your wallet? IdentityIQ’s got your back. Their lost wallet service helps cancel and replace everything important, fast. And if identity theft ever strikes, their US-based restoration pros are ready to step in and help you recover quickly.

All in all, IdentityIQ packs a solid punch with 3-bureau credit monitoring, dark web surveillance, real-time alerts, and recovery support. It’s a versatile option with plenty of coverage for different needs and budgets. Sure, the privacy policies could be more reassuring, but the features and support are impressive for the price.

IdentityIQ pros and cons

Let’s weigh the pros and cons of choosing IdentityIQ for your digital identity protection:

+ Pros

$1 million stolen funds reimbursement with all plans

AI-driven approvals and recommendations

Affordable integration with antivirus and VPN

Easy setup with out-of-the-box connectors

Monthly credit scores and reports

User-friendly system and organized interface

Family protection included

Three-bureau credit monitoring available

– Cons

Data sharing with third parties

Higher costs with extra charges for add-ons

No free trial or version is available

- Limited customer support options

6. IDShield — Family-focused identity protection at a low cost

| Starting price | $14.95/month |

| Supported platforms | Android and iOS |

| Three-bureau credit monitoring | Yes (Experian, TransUnion, and Equifax) |

| Identity theft insurance | $1M – $3M |

| Best deal | N/A |

IDShield keeps things simple and wallet-friendly, with family plans starting at just $29.95/month that cover up to 11 people. That’s right, nearly a dozen family members under one plan, making it a great pick for larger households looking to stay protected without overspending.

At the core, you get credit monitoring from TransUnion, with the option to add Experian and Equifax for full 3-bureau coverage. You’ll be alerted to any new credit inquiries or accounts that pop up in your name. Dark web monitoring watches for your sensitive info — like Social Security numbers and medical IDs — floating around online, and SSN tracking keeps a close eye on any suspicious use of your identity.

One standout feature? IDShield includes up to $3 million to cover legal fees and expenses if your identity is stolen. Plus, their team of licensed private investigators is ready to jump in and help restore your identity when you need it most.

On top of that, IDShield comes loaded with handy tools like VPN protection via Proxy One for safer browsing, malware defense to keep your devices squeaky clean, a password manager to lock down your logins, and parental controls to help keep the kids safe while they’re online.

There’s more under the hood, too — social media scans flag privacy risks, court record monitoring catches address or legal changes, and medical claim reports help spot health data misuse. You also get tools for managing your online rep, and if your wallet vanishes, IDShield helps you replace your cards in no time.

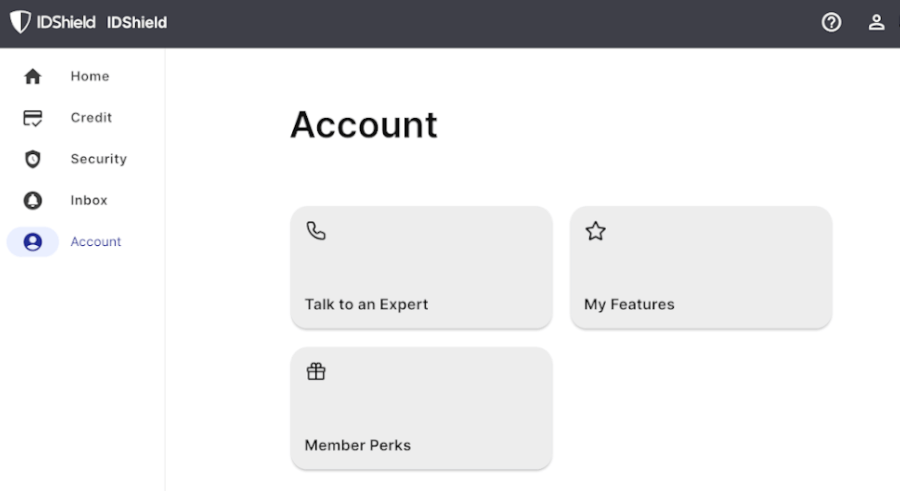

The initial setup might require creating several login profiles on third-party sites, but once that's done, the interface is user-friendly and easy to navigate. Overall, IDShield provides a comprehensive and affordable solution for families wanting to protect their identities without breaking the bank.

IDShield pros and cons

Let’s break down what IDShield gets right — and where it could use a little backup:

+ Pros

Credit file and personal info web scanning

- Instant misuse alerts on all plans

- Identity theft recovery aid including lost wages

- Credit monitoring with one or three bureaus

- SSN tracking for unauthorized use

- Dark web checks for personal data leaks

- Financial account vigilance

- Complimentary Trend Micro security suite (VPN, antivirus, and password manager)

- Licensed private investigators for theft restoration

– Cons

- Confusing and cumbersome setup

- Basic plans cover only TransUnion

- No discounts for yearly plans

- Bare-bones password manager

Identity theft statistics and trends in 2026

Identity theft hits harder every year, with criminals using smarter tools to target your personal data. The numbers below show why you can't afford to skip proactive monitoring and recovery support when picking a protection service.

- Reports hit record highs: The FTC received over 1.1 million identity theft complaints in the first nine months of 2025 alone, which is more than the full-year total for 2024.

- Billions in losses: Fraud losses topped $12.5 billion in 2024, with 2025 data showing sharp increases driven by scams and identity crimes.

- Credit card fraud dominates: It remains the most common type, accounting for a large share of cases, often tied to data breaches and stolen credentials.

- Synthetic identities on the rise: Fraudsters blend real and fake details to create “new” identities. This trend is accelerating with AI and expected to surge further in 2026.

- AI-powered threats emerging: Deepfakes, voice cloning, and automated scams are gaining traction, making fast alerts and expert restoration even more critical.

These trends make one thing clear: strong three-bureau monitoring, dark web scans, and million-dollar insurance aren't extras you can afford to ignore. They're essentials for staying ahead.

Understanding identity theft protection services

In today’s digital jungle, protecting your personal info is a must! Let’s break down how identity theft protection services work and what to keep an eye out for to stay one step ahead of the hackers.

What are identity theft protection services?

Identity theft protection services are like a digital watchdog for your personal information. Offered by specialized companies, these services work around the clock to guard your identity and help you bounce back if something goes wrong. Here’s what they typically bring to the table:

Detecting misuse of your personal info: From shady loan applications to surprise credit accounts, these services scan for signs your data’s being used without your permission.

Monitoring your accounts: They keep an eye on your bank, credit, and even social media accounts, looking for anything out of the ordinary.

Sending real-time alerts: If something sketchy shows up, you’ll be the first to know, so you can take action fast.

Helping you recover: If identity theft does strike, you’ll have pros on your side to help sort it out, from paperwork to contacting banks and agencies.

Cleaning up the mess: Need to dispute fraudulent charges or clear your name? These services are built for that too.

- Covering the costs: Most come with identity theft insurance to help cover any financial losses or legal bills, so you’re not left picking up the pieces alone.

Identity theft can hit harder than you'd think, messing with your finances and personal life in a big way. Some of the most common types include:

Credit card fraud: When someone goes on a shopping spree with your card info — without asking, of course.

Loan fraud: Scammers take out loans or credit lines in your name, leaving you with the bill.

Medical identity theft: Using your personal details to get medical care or prescriptions, which can wreck your records and cost you money.

Financial identity theft: Sneaky access to your bank accounts or financial assets — and they’re not just browsing.

Dark web monitoring: Keeps tabs on shady corners of the internet to see if your info’s up for grabs.

SSN trace alerts: Flags anything odd going on with your Social Security number.

Privacy scans: Clears your personal info from public sites to shrink your digital footprint.

Just a heads-up: most of these services don’t reimburse you for money lost to fraud. But they do a solid job of lowering your risk — and if something does go wrong, they’re there to help you bounce back faster.

How do identity theft protection services work?

These services constantly scan for shady activity — whether it’s someone trying to open a loan in your name or your Social Security number popping up on the dark web.

Once they spot something suspicious, you’ll get a heads-up via text, email, or app alert so you can jump in and shut it down fast. They monitor your credit files, run privacy scans to wipe your info off sketchy public sites, and even flag weird activity tied to your SSN.

The smart ones use AI and slick algorithms to sift through tons of data and spot red flags before they turn into real problems. They also keep tabs on your credit across all three major bureaus — Experian, Equifax, and TransUnion — and can even track your credit score month-to-month.

Bonus perks? Some services throw in cybersecurity tools like VPNs, antivirus, and password managers. If your wallet ever goes missing, they’ll help you cancel and replace your cards. And if the worst happens, you’ll have expert support to guide you through the recovery process, step by step.

How to choose the right identity theft protection service for you?

Finding the right identity theft protection doesn’t have to feel like a chore. Just assess your risks, compare features, and check out the customer service and reputation to pick the best fit for you.

Figure out your identity theft risk

Before diving into identity theft protection services, it helps to know what kind of risk you're actually dealing with. That means thinking about what personal data you want to keep safe — and how likely it is someone might try to steal it.

Do you bank online, shop from your phone, or overshare on social media? Then you're at a higher risk, and a more robust service like LifeLock or IDShield might be the way to go. These offer solid protection with features like dark web scans, instant alerts, and data encryption.

But if you’re more old-school — rarely online and handling things in person — a simpler, more affordable plan might be all you need.

See what’s being watched (in a good way)

Not all identity theft protection services keep an eye on the same stuff, so it pays to know exactly what’s being monitored. The best ones (like Aura and McAfee) cast a wide net, covering everything from your Social Security number to your bank accounts, credit cards, and even your social media profiles.

Want extra peace of mind? Go for a service that also checks public records like tax filings, property records, or even sex offender registries.

The more ground they cover, the faster they can spot trouble and help you deal with it.

Triple-check your credit coverage

When it comes to credit monitoring, one bureau just won’t cut it. For real peace of mind, pick a service that watches all three major credit bureaus — Experian, Equifax, and TransUnion. That way, no matter where shady activity shows up, you’ll catch it.

Some services (like Aura) include all three in every plan, so you’re not stuck with partial protection. All your bases? Covered.

Peek into the fine print on identity theft insurance

If identity theft strikes, you don’t want to be stuck footing the bill. That’s where identity theft insurance comes in — covering things like legal fees, lost wages, and other recovery costs. Basically, it's your financial safety net while you get your life back on track.

Some services offer up to $1 million in coverage, but don’t just look at the number — check what’s actually included. Not all policies are created equal!

Don’t get left hanging — check out their recovery support

If your identity does get swiped, you’ll want more than just a good luck email. Look for a service that steps in with real help — we’re talking dedicated fraud specialists who stick with you through the entire mess.

From filing police reports to calling banks and fighting off bogus charges, solid recovery support can turn a nightmare into a manageable to-do list. When things go sideways, it’s good to know you’ve got a pro in your corner.

Look for a service that’s easy to use (a smooth app is a big bonus)

Let’s be real — if a protection service feels like rocket science, you probably won’t use it. That’s why a clean, user-friendly design (especially on mobile) makes a big difference. The best services let you check alerts, track your data, and manage everything from your phone — no tech degree required.

Top picks like Aura and Incogni offer slick, intuitive apps that make it easy to stay one step ahead of identity thieves. Whether it’s scanning the dark web or tracking your credit, everything’s just a tap away. Even LifeLock’s app, bundled with Norton 360, adds extra tools like VPN and antivirus without overwhelming you. Easy wins, all around.

Check for smart security extras like a VPN, antivirus, and password manager

Identity theft protection is great — but it’s even better with some extra muscle. The best services throw in powerful tools like a VPN to keep your browsing private, antivirus software to fend off malware, and a password manager to help you ditch weak logins (we see you, “123456”). Some even add ad blockers for good measure.

Take Aura, for example — it bundles in a built-in VPN for safe surfing, an intuitive password manager that spots vulnerable passwords, and strong antivirus protection to keep your devices squeaky clean. It’s like getting a full cyber-safety toolkit in one sleek package.

Don’t forget customer support and reputation

When your identity’s on the line, you want a service that’s got your back — day or night. That’s why solid customer support matters just as much as fancy features. Look for services with 24/7 support and a strong reputation backed by real user reviews.

If something sketchy pops up at 2 AM, you don’t want to wait until business hours. Great support can make all the difference when things get stressful fast.

Snag a deal before you commit

Before locking yourself into a subscription, take a moment to explore any discounts, free trials, or money-back guarantees. Many services offer these perks, giving you the chance to test things out before making a long-term commitment.

Take Aura, for example — they offer a 60-day money-back guarantee on annual plans, so you can explore all the features with zero pressure. Plus, with a 68% discount coupon in the mix, getting top-tier identity theft protection doesn’t have to break the bank.

How to choose the right plan for you?

Picking the perfect identity theft protection plan really comes down to your personal needs. Are you flying solo or looking out for the whole family? Do you want something affordable that covers the basics, or are you all-in for a premium plan packed with every feature under the sun? There’s a plan out there that fits — it’s just about finding the one that matches your lifestyle and comfort level.

Individual vs family-focused plans

Flying solo? A simple individual plan might be all you need — it’ll keep an eye on your personal data and alert you to trouble, all without draining your wallet. But if you’re protecting a household, a family plan is the way to go. These usually cover multiple people and add extra features like parental controls, sex offender registry checks, and even cyberbullying alerts for your kids.

Take Aura, for example — they’ve got solid options for both setups. Their plans come packed with essentials like three-bureau credit monitoring, dark web scans, and up to $1 million in identity theft insurance. Their family plans? Even better — you get up to $5 million in coverage (up to $1 million per person), so everyone in your household gets the full protection treatment.

Budget-friendly vs premium plans

Looking for strong protection without the hefty price tag? Budget-friendly plans like Aura’s start at just $9–$25/month (with a coupon) and pack in a ton of value. You’ll get essentials like three-bureau credit monitoring, dark web scans, and up to $1 million in identity theft insurance — all wrapped up in a user-friendly package that won’t wreck your wallet.

Prefer the VIP treatment? McAfee’s plans range from $$119.99 to $424.99 per year and bring some serious muscle. Along with identity monitoring, you’ll also get premium extras like antivirus software and a secure VPN. It’s a bit of a splurge, but if you want top-shelf cybersecurity across the board, McAfee’s robust suite delivers big on peace of mind.

What to do if your identity is stolen: Step-by-step guide

Knowing the right steps to take when your identity is stolen can be a game-changer in bouncing back quickly and minimizing the chaos. A mix of swift actions and smart recovery strategies will help you tackle this stressful situation head-on and get back on track!

Take immediate action

As soon as you realize your identity has been stolen, act fast with these crucial steps:

Contact the companies involved: Reach out to the businesses where fraud occurred and inform them immediately. Stopping the fraudulent activity as soon as possible can prevent more damage.

Report to the Federal Trade Commission (FTC): Head to the FTC’s website to file a report. This creates an official record and helps authorities stay on top of identity theft trends.

File a police report: Visit your local police station and file a report. Having a police report, along with an Identity Theft Report, adds weight to your case and strengthens your claims.

Don't forget to place a fraud alert on your credit reports! It makes it much harder for thieves to open new accounts in your name, giving you an added layer of protection.

Plan for long-term recovery

Bouncing back from identity theft is a marathon, not a sprint. Stay on top of things with these steps for long-term recovery:

- Regularly check your credit reports: Especially within the first year after the theft, keep a close eye on your credit reports to ensure everything is in order. Identity theft protection services, with their fraud specialists and case managers, can offer valuable guidance throughout the process.

- Request confirmation letters: Once you've resolved the theft issues, ask the companies involved for letters confirming that any fraudulent accounts have been closed and debts cleared. This paperwork is key to keeping your credit report accurate.

- Set reminders and stay organized: Mark your calendar to check your credit reports regularly. Keep all related documents in a dedicated folder—it’ll save you time and stress as you stay on top of new activities.

Remember, recovery takes time. By staying vigilant, using available resources, and staying organized, you’ll regain control of your financial health and reduce the chances of future theft.

Top strategies to safeguard yourself from identity theft

To truly protect your identity, you've got to be proactive! That means locking down your personal info, using rock-solid passwords, and staying alert online.

But wait, there's more! Here are some extra smart strategies to help keep your identity safe and sound.

Protect your private info like a pro

Keep your personal info under lock and key — it’s one of the best ways to stop identity thieves in their tracks. Here are a few fun (but effective) ways to do just that:

Always double-check websites before entering sensitive info — it’s like making sure you’re not crashing the wrong party.

Avoid turning social media into your personal diary — posting vacation pics in real-time is basically sending thieves a “nobody’s home!” alert.

Skim through privacy policies to make sure sites are actually protecting your data — yep, it’s not thrilling, but it’s worth it.

And for an extra layer of defense, consider using an identity theft protection service that includes privacy scans. These tools help wipe your info from sketchy data broker sites and minimize your online footprint.

Level up your login game with strong passwords and 2FA

Think of your password as the front door to your digital life, and you don’t want it swinging open for just anyone. The key? A strong and unique password for every account.

Create passwords with at least eight characters.

Include a mix of letters, numbers, and symbols.

Avoid using easily accessible information like birthdays or common words.

- Bonus points if it looks like your cat walked across the keyboard.

Now, take your defenses up a notch with two-factor authentication (2FA). It’s like adding a security guard after the lock — even if someone figures out your password, they’ll hit a dead end without that second code sent to your phone. Trust us, your future self will thank you.

Stay smart, stay safe

Being safe online is a lot like exploring a big city — stay aware, don’t flash your valuables, and don’t hand out your info to shady strangers. That random email asking for your account number? Yeah, that’s probably a scam.

Here’s how to keep your digital self out of trouble:

Stick to trusted sources when downloading software, kind of like only eating sushi from a place with good reviews.

Check for “https” and that little padlock before entering any personal info — it’s your green light that the site’s secure.

Update your software regularly — those updates aren’t just annoying pop-ups, they’re patching security holes and keeping things smooth.

Use tools like antivirus and VPNs — your personal cybersecurity squad guarding your data around the clock.

Stay alert, surf smart, and you’ll dodge most of the digital danger out there.

Wrap it up: Lock down your future with the right ID protection

In the age of digital everything, keeping your identity safe is more important than ever. The top services come loaded with tools like credit monitoring, dark web scans, identity theft insurance, and even cybersecurity extras to help you sleep a little easier at night.

Whether you're flying solo, covering the whole crew, hunting for a bargain, or going all-in on premium perks, there’s a plan out there that fits just right.

One standout for 2026? Aura. It’s got the whole package — three-bureau credit monitoring, dark web scans, AI-powered alerts, and top-tier customer support. It’s your always-awake, never-blinking online protector.

Exclusive Aura Coupon:

Get 68% Off Aura subscription plans with the coupon below:

(Coupon is applied automatically; 60 day money-back guarantee.)

With up to $1 million in coverage and a strong focus on user experience, Aura goes the extra mile to keep your identity safe.

Identity theft protection reviews on CyberInsider

Not sure where to start? Our expert-backed identity theft protection reviews on CyberInsider cover everything from budget-friendly picks to feature-packed powerhouses.

Identity theft protection comparison guides on CyberInsider

After testing a wide range of identity theft protection services, we’ve rounded up our findings into handy comparison guides. Click through our reviews below to see which one stands out for you.

- Aura vs LifeLock

- Aura vs Experian IdentityWorks

- Aura vs NordProtect

- IDShield vs Aura

- Aura vs McAfee

- LifeLock vs IDShield

- Aura vs Incogni

- Aura vs IdentityIQ

- Aura vs IDShield

- Identity Guard vs Aura

- Identity Guard vs LifeLock

- Identity Guard vs NordProtect

- LifeLock vs Experian Identity Works

- LifeLock vs NordProtect

Best identity theft protection services FAQ

Who offers the best identity theft protection service in 2026?

Aura leads the pack in 2026, combining strong protection, smart features, and excellent support. With three-bureau credit monitoring, AI-powered fraud alerts, a user-friendly dashboard, and generous insurance coverage, it hits that sweet spot between price, performance, and peace of mind.

Which identity theft protection app is the most effective?

Aura takes the crown here too, with an intuitive app that blends powerful features and real-time alerts into a simple, easy-to-use experience. Whether you’re checking dark web results, managing alerts, or locking your credit file, Aura’s app makes it effortless to stay on top of everything — even on the go.

How much does identity theft protection cost?

Depending on the provider and plan, expect to pay anywhere from $9 to $25/month with discounts — or $90 to over $400/year. Budget-friendly options like Aura offer generous protection at lower prices when using coupons, while premium services like McAfee can cost more but often include added cybersecurity tools like antivirus software and VPNs.

What’s the best identity theft protection for families?

Aura is our top pick for families thanks to its all-in-one protection, generous insurance coverage, and child-focused tools. With Aura’s family plans, you get up to $5 million in identity theft insurance ($1 million per adult or child), along with features like parental controls, cyberbullying alerts, and sex offender registry monitoring. It’s designed to protect everyone in your household — not just the grown-ups.

What happens if my identity is stolen while I’m subscribed to a protection service?

If your identity is stolen, your protection service will help you respond fast, recover losses, and restore your identity. Services like Aura and LifeLock offer 24/7 US-based support, dedicated fraud resolution experts, and reimbursement through identity theft insurance. They’ll guide you through freezing your credit, closing fraudulent accounts, and filing necessary reports — so you’re not alone when it matters most.

Is identity theft insurance included, and what does it cover?

Yes, most top services include identity theft insurance, typically up to $1 million per person. This coverage usually helps reimburse costs like legal fees, stolen funds, lost wages, and even expenses related to recovering your identity. Aura goes a step further by offering up to $5 million per family on its family plans.

Hi there,

Great article, I learnt a lot as I am not familiar with this tool. One remark, I am based in Europe and I think it would be nice to mention which ones are available for us. It seems that many are mainly US focused.