LifeLock delivers powerhouse identity theft protection backed by Norton, with up to $1 million in insurance coverage and layered monitoring that watches your credit, dark web exposures, financial accounts, and even social media profiles.

You gain real-time alerts for suspicious activity, dedicated US-based restoration specialists to handle recovery if fraud strikes, lost wallet assistance, and optional integration with Norton 360 antivirus and VPN for broader device security. Multiple plan tiers let you choose from essential one-bureau monitoring to full three-bureau coverage on premium options, all supported by 24/7 support and a 60-day money-back guarantee to start protecting your identity confidently.

In this no-fluff, straight-talking review, we dig into everything: LifeLock’s pricing plans, what it’s like to use day-to-day, and how well it stands up to modern cyber threats. Spoiler: it's not all perfect, but it might just be what you’re looking for.

If you’re curious about what LifeLock actually offers — and what it’ll cost you — you can jump straight to our breakdown of features and pricing.

| Website | LifeLock.Norton.com |

| Pricing | $7.50 – $79.99/month |

| Money-back guarantee | 60 days |

| 3-bureau credit monitoring | 1-bureau (Equifax) or 3-bureau (Experian, TransUnion, and Equifax) with premium plans |

| 24/7 customer support | Yes |

| Identity theft insurance | Up to $3 million |

| Best deal | 52% Off Coupon > |

Highlights from our hands-on LifeLock review

- LifeLock brings some heavy-duty protection to the table — think three-bureau credit monitoring, dark web and social media scanning, and up to $1 million in insurance for identity theft losses. Not bad, right?

It also keeps an eye on your personal info, flags shady financial activity, and offers 24/7 support—all through a dashboard that’s surprisingly easy to navigate. And if you're wondering what else it can do behind the scenes, we’ve rounded up LifeLock’s extra tools and add-ons here.

Still, it’s not a magic shield. LifeLock can’t catch every threat, and it won’t cover every kind of transaction, so good digital hygiene is still a must. Thinking of signing up? Don’t miss current deals and discounts to make sure you get the best bang for your buck.

LifeLock pros and cons

Now, let's examine the advantages and disadvantages of selecting LifeLock for safeguarding your online privacy.

+ Pros

30-day free trial period (recently added)

A VPN with family plans

Comprehensive identity theft protection service

- Can be combined with Norton 360 antivirus software

Up to $1 million insurance for certain costs incurred from identity theft

User-friendly interface and easy setup

Stolen wallet protection

Simple-to-use mobile apps

– Cons

- 3-bureau monitoring is available in higher-tier plans only

- Confusing paid plan structure

- Higher cost compared to some competitors

LifeLock features overview

Before we delve into specifics, let's take a quick overview of what LifeLock offers:

Monitoring personal information – Tracks your Social Security number (SSN), credit card details, and other sensitive data to detect unauthorized use.

- Dark web surveillance – Scans dark web databases for any trace of your data, alerting you to potential exposure.

- Financial transaction monitoring – Keeps an eye on your financial transactions and alerts you to any suspicious activities, allowing for swift action to minimize damage.

- Credit monitoring – Monitors your credit activity, alerting you to changes that could indicate fraud.

- Lost wallet protection – Assists in quickly canceling and replacing important cards and documents if your wallet is lost or stolen.

- Insurance and stolen funds reimbursement – LifeLock offers up to $1 million in insurance to cover losses due to identity theft across all plans, and in its premier tier, it provides the same amount for reimbursement of stolen funds, ensuring solid financial protection.

- 24/7 customer support – Round-the-clock customer service is available to assist with any issues or concerns.

- 30-day free trial – Recently introduced a 30-day free trial period, allowing new users to experience the service before committing.

Two-factor authentication – Offers two-factor authentication to secure your account, adding an extra layer of security against unauthorized access.

See all LifeLock features here >

LifeLock's features suggest a focus on user safety, offering a comprehensive and proactive approach to identity theft protection.

What LifeLock is and how does it work?

Founded in 2005 and in collaboration with Norton 360, LifeLock delivers a suite of identity theft protection services. It keeps a vigilant eye on your credit reports and scours the dark web for any signs of your personal data. If something seems amiss, LifeLock is quick to send you an alert. Though no service can guarantee absolute protection or track every transaction, LifeLock offers a safety net with its recovery assistance.

LifeLock works with Norton 360 to add antivirus protection to its services, and it throws in Norton Secure VPN with family-focused plans. This expands the scope of protection beyond just monitoring credit and personal information. LifeLock has several plans that offer varying levels of coverage, some including legal assistance and compensation for losses after identity theft.

Company background: Can we trust LifeLock?

Norton LifeLock, previously known as LifeLock Inc., was established in 2005 and became notable for its identity theft prevention software. After being acquired by Symantec in 2017, it underwent rebranding to Norton LifeLock in 2019 and to Gen Digital Inc. in 2022. The company's history includes the integration of LifeLock with Norton 360 services and a controversial past with legal challenges, such as the FTC's $12 million fine in 2010 for deceptive advertising claims.

Despite past issues, including the resignation of co-founder Robert J. Maynard, Jr. in 2007 amid personal controversies, Norton LifeLock has improved its services and security measures. It actively counters fraudulent use of its name and steers clear of shady practices, demonstrating its dedication to consumer trust.

LifeLock boasts a strong 4.8 Trustpilot score, which definitely says something. That said, not everyone’s thrilled — about 6% gave it 1 star, mostly over clunky alerts, tech bugs, or customer support that missed the mark. So while many folks are fans, it’s not totally drama-free.

The 2022 breach: What happened?

In December 2022, LifeLock was hit by a credential stuffing attack — basically, hackers tried a bunch of stolen logins to see what stuck. Unfortunately, it worked on over 6,000 accounts. The company caught the spike in logins on December 16th and notified affected users the following month.

They’ve since tightened security, but yep — some personal info was exposed. It’s a solid reminder that even security companies can get caught in the crossfire, and staying safe online is never a one-and-done deal.

Core features: What do you get with LifeLock?

LifeLock packs in a bunch of tools designed to keep identity thieves off your back. Let’s take a look at the standout features that make it tick.

Security monitoring and alerts

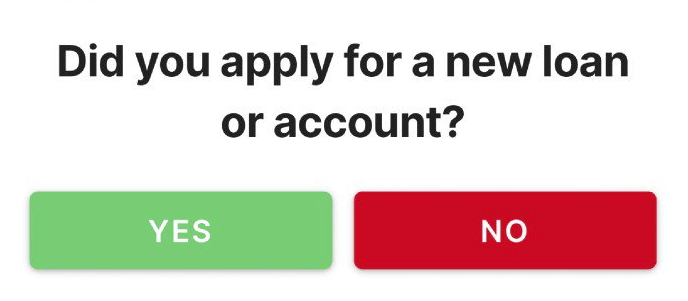

LifeLock’s vigilant security monitoring and alert system, which includes watchful tracking of potential identity misuse, is engineered to detect signs of identity theft early. By keeping an eye on your personal data, such as your SSN, credit card information, and even your investment accounts, LifeLock stands guard, ready to notify you of any unusual activity.

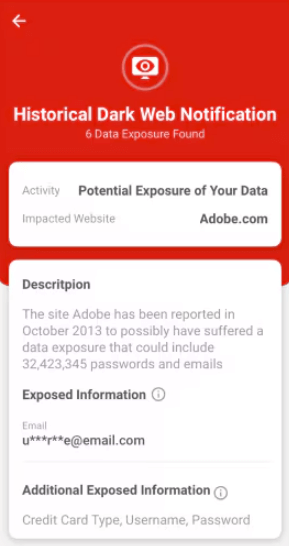

Dark web monitoring

One standout feature of LifeLock is its dedicated surveillance of the dark web – an infamous region of the internet often linked with unlawful activities. LifeLock diligently searches this hidden underbelly for any signs of your personal details. Should it discover your information being misused, you’ll receive an alert promptly, empowering you to take swift action to protect your accounts.

This proactive measure adds an extra layer of defense, ensuring that your sensitive information is safeguarded – even in the more obscure and potentially dangerous areas of the web.

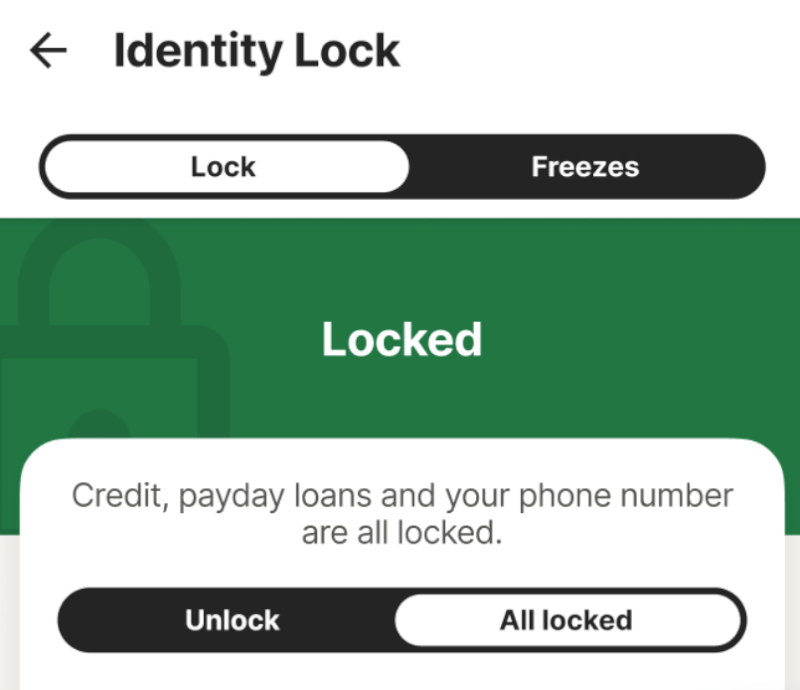

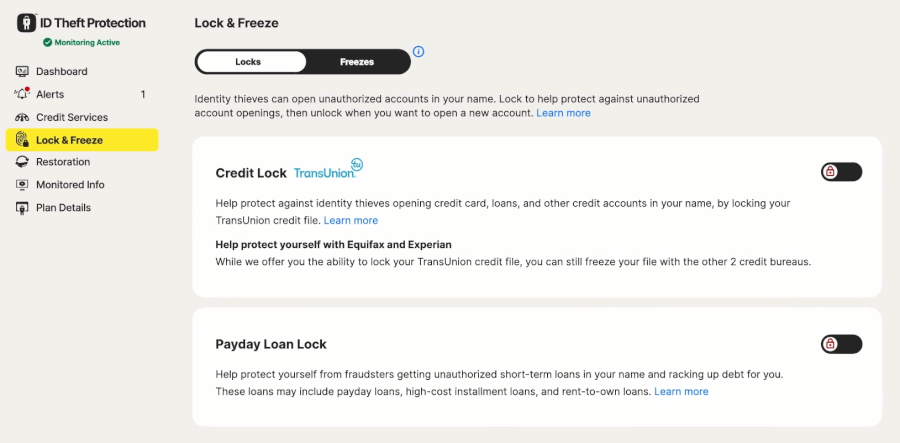

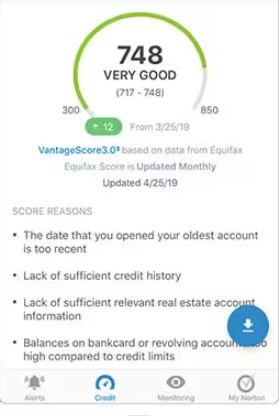

Comprehensive three-bureau credit monitoring with credit reports

LifeLock subscribers get monthly credit reports and daily credit-score updates from all three major credit bureaus. Plus, with the top-tier plan, you can lock your TransUnion credit file. This helps keep your credit safe from unauthorized access.

You can easily lock or unlock your file whenever you want, controlling who can check your credit when you apply for new credit or loans.

But if you go for the lower-tier plans, you'll get more basic credit monitoring. They might only watch one credit bureau and might not include free credit reports. If you choose these plans, know their limits. To fully protect your credit, you'll have to freeze or lock your credit files with Experian and Equifax separately since LifeLock only does this for TransUnion. Still, LifeLock makes protecting your TransUnion credit file simple, adding a security layer that's both effective and easy to use.

Note: Credit lock and credit freeze serve similar purposes, yet they differ in operation. A credit freeze stops the opening of new accounts, while a credit lock, offered by credit bureaus, allows for quicker locking and unlocking of your credit.

Financial monitoring and stolen funds reimbursement

LifeLock's financial monitoring feature keeps you informed about important transactions in your financial accounts, like credit, checking, and savings. It also watches for any suspicious changes to your accounts or new ones being opened – red flags for potential identity theft. Even your 401(K) investments get a watchful eye.

With the “Ultimate Plus” plan, you're covered for up to $1 million in losses related to identity theft. This includes compensating for personal expenses and covering legal costs.

While the “Ultimate Plus” plan offers robust coverage, lower-tier plans start with a $25,000 limit for stolen funds and personal expenses, which increases to $100,000 for mid-tier plans. If you're after consistent coverage across all plan levels, check out alternatives like Aura. They offer $1 million for stolen funds and legal expenses in all their plans, just like LifeLock's $1 million legal fee coverage.

Stolen wallet protection

Losing your wallet can be a major headache, but LifeLock’s Stolen Wallet Protection is designed to make things a lot easier. It helps you:

- Cancel and replace important items like credit cards and your driver’s license

Reduce the stress and impact of the loss

Speed up the recovery process so you can get back on track

If you’ve entered your driver’s license, debit, and credit card numbers into LifeLock’s secure dashboard, their support team can walk you through the steps to cancel and replace them.

This protection comes standard with every LifeLock plan, so no matter which tier you’re on, you’ll have access to this essential support.

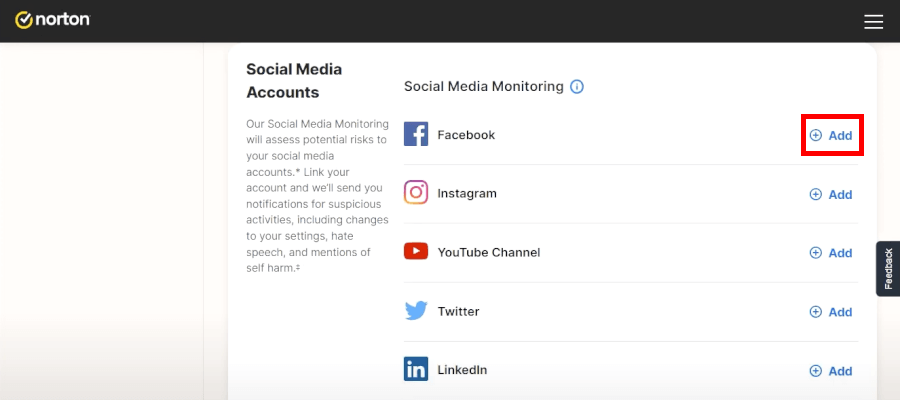

Social media monitoring

LifeLock’s social media monitoring helps protect your online identity across all major platforms — including Facebook, LinkedIn, X (formerly Twitter), YouTube, Instagram, TikTok, and Snapchat. It’s a smart way to stay ahead of threats in today’s always-connected world.

The service scans for signs of cyberbullying, hate speech, and unauthorized changes to your account settings – key indicators of potential hacking or misuse. Getting alerts for suspicious activities, like unexpected profile changes or the sharing of risky links, can be a lifesaver in preventing a breach.

The service scans for signs of cyberbullying, hate speech, and unauthorized changes to your account settings – key indicators of potential hacking or misuse. Getting alerts for suspicious activities, like unexpected profile changes or the sharing of risky links, can be a lifesaver in preventing a breach.

Learn more about LifeLock's plans here >

LifeLock’s security extras

On top of its core features, LifeLock provides a variety of security extras that boost its protection capabilities even more.

It's part of Norton security suite

Although LifeLock doesn't come with Norton antivirus software or VPN, you can pair it with Norton 360 for a stronger online defense. Combining LifeLock with Norton 360 offers proactive protection against various online threats, like malware aiming to steal your digital identity.

Norton's anti-malware tools serve as a vigilant digital shield, providing real-time protection against viruses, worms, trojans, and ransomware. It's a reliable defender, proactively keeping your devices secure from cyber threats.

Moreover, integrating Norton Secure VPN with your security setup encrypts your online connections, providing a more private browsing experience and an extra layer of privacy.

2FA login

LifeLock’s 2FA feature fortifies your account's defenses, insisting on a second proof of identity beyond just the password. This could be a code received through a text, an email, or generated by an authentication app. In some cases, it could even involve biometric verification like a fingerprint or facial recognition.

By requiring this additional verification step, LifeLock ensures that even if your password falls into the wrong hands, your account remains protected.

Sex offender registry reports

With LifeLock’s “Ultimate Plus” plan, you’ll get alerts if your name or personal information appears in a sex offender registry — a rare but serious sign that your identity could be misused in a sensitive and alarming way. It’s an added layer of protection you won’t find in most plans.

File-sharing network searches

LifeLock’s file-sharing network search keeps an eye on peer-to-peer (P2P) networks — the kind often used for sharing files — to make sure your personal information isn’t showing up where it shouldn’t. If your data is found, you’ll get an alert right away so you can take quick action to protect your identity.

Ease of use: What’s it like using LifeLock day to day?

In our testing, we found that setting up LifeLock is a breeze, thanks to its straightforward process and user-friendly interface. Whether you're a tech guru or just getting started, the intuitive design makes it easy to navigate.

What's impressive is LifeLock Select's seamless integration with Norton device security, ensuring compatibility across various platforms like Windows, Mac OS, Android, and iOS. This wide compatibility means users can install LifeLock on their devices and enjoy its features, as long as they have an active internet connection for setup and security updates.

Getting started with LifeLock

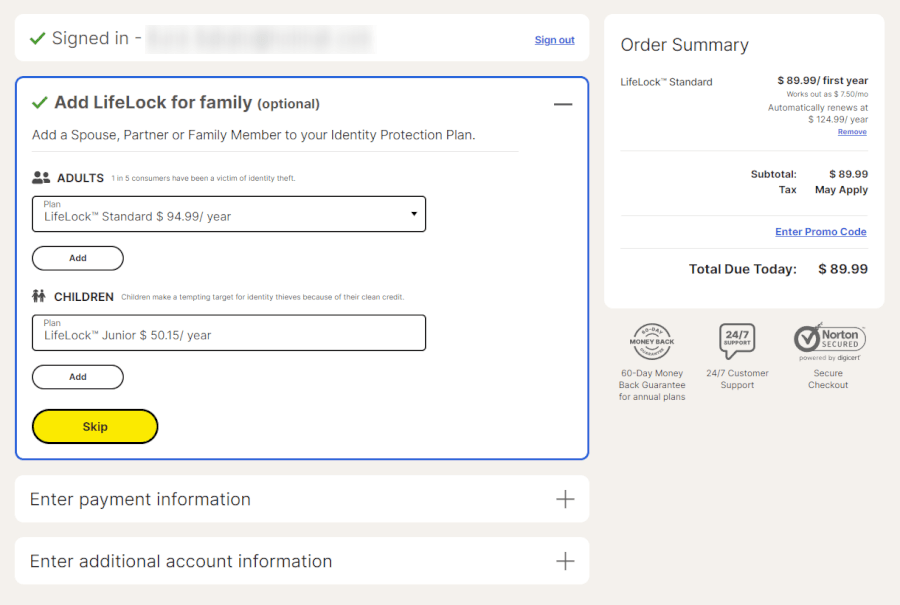

Getting started with LifeLock is straightforward. You'll need to enter essential personal information, including your name, SSN, birthdate, address, phone number, and email address. The next step is to provide your credit card details and agree to the subscription terms.

You then add accounts for LifeLock to monitor, which could range from social media to bank accounts. The time this takes will vary based on how many accounts you want to protect.

After setting a secure password and entering your billing details, you complete the purchase and gain access to the LifeLock dashboard. This is where you'll manage settings and view alerts, keeping you informed about the security of your personal information.

Navigating LifeLock's interface

We were pretty impressed with LifeLock’s interface – it’s elegantly designed, with an intuitive dashboard that presents crucial information in a format that's easy to digest. With a glance, you can check your credit score, monitor alerts, and see your identity lock status. Plus, clickable icons throughout the dashboard provide extra insights to help you understand the services better.

The top tabs on the dashboard give quick access to vital sections like alerts for notifications of suspicious activities, credit for credit scores and bureau reports, identity lock for controlling your credit file security, transactions for monitoring financial activities, ID restoration for resources on identity recovery, and monitored info for the data LifeLock is safeguarding for you.

All in all, LifeLock's user-friendly interface ensures smooth navigation and management of your identity protection tools, making it accessible for users of all levels.

LifeLock's mobile apps

We found LifeLock's mobile apps for Android and iOS to be a real asset, making the transition from desktop to mobile a breeze. They let you manage your account smoothly and get instant alerts wherever you are. The interface is easy to use and you won't have any trouble.

However, we noticed something that might confuse users – there are two apps to choose from, LifeLock for Norton360 and LifeLock ID Theft Protection, which could lead to uncertainty about which app to download and use. But once you're logged in, both apps are user-friendly and easy to navigate, so you'll get the hang of it quickly.

LifeLock support: Is help there when you need it?

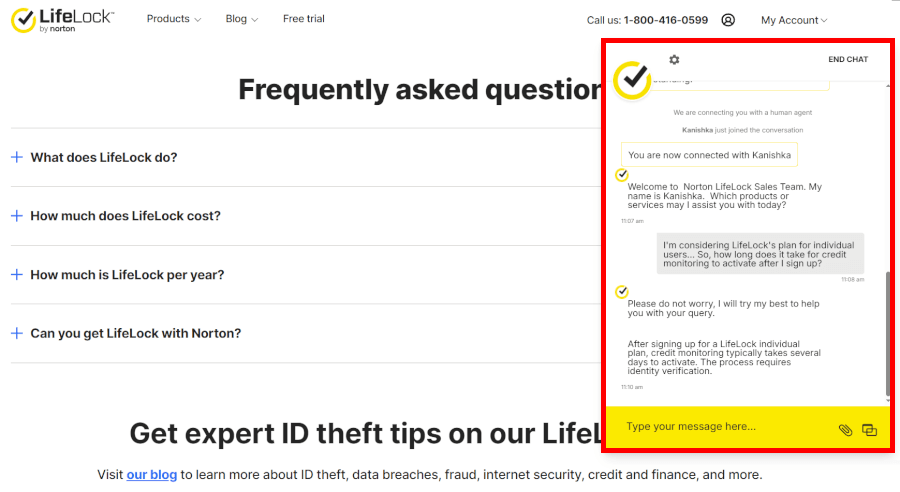

LifeLock keeps things reassuringly accessible with 24/7 customer support available by phone and live chat — and we have to say, we were pleasantly surprised. When we tested the live chat, an agent jumped in almost instantly. Friendly, fast, and well-informed, they made the whole experience feel refreshingly easy.

No matter which LifeLock plan you choose, round-the-clock help is included, so whether it’s a midnight panic or a weekend question, someone’s there to assist. Prefer to troubleshoot on your own? LifeLock’s blog and FAQs are pretty robust, offering self-service tips and helpful how-tos.,

That said, we did notice one quirk: some support agents seem more familiar with Norton’s antivirus products than LifeLock’s identity features. This doesn’t affect basic issues much, but for trickier identity-related questions, the experience can be a bit hit or miss.

Still, LifeLock makes it easy to get help when you need it. Every plan comes with a toll-free number, and “Ultimate Plus” subscribers get priority support. While there’s no dedicated support portal or email option, the overall experience was smooth sailing, especially for everyday questions.

Plans and pricing: Is LifeLock worth the cost?

LifeLock's pricing plans are designed to cater to a variety of needs and budgets, offering different levels of protection for individuals and families. Here is a breakdown of their plans:

| LifeLock plans | Subscription length | Standard | Advantage | Ultimate Plus |

|---|---|---|---|---|

| Individual | 1-month | $11.99/month | $23.39/month | $34.99/month |

| 1-year | $7.50/month | $14.99/month | $19.99/month | |

| Family (two adults) | 1-month | $22.09/month | $45.99/month | $69.99/month |

| 1-year | $12.49/month | $22.09/month | $33.39/month | |

| Family with kids (two adults and up to five kids) | 1-month | $35.99/month | $57.99/month | $79.99/month |

| 1-year | $18.49/month | $29.99/month | $38.99/month |

Deal: Get 52% discount on LifeLock's yearly plans >

Individual Packages (covers one adult only):

- Standard: This plan includes up to $25,000 in stolen funds reimbursement, the same amount for personal expense compensation, and up to $1 million coverage for lawyers and experts, supported by US-based identity restoration specialists.

- Advantage: It raises the stakes with up to $100,000 in stolen funds reimbursement and personal expense compensation, alongside the $1 million coverage for legal professionals and experts, plus dedicated US-based identity restoration assistance.

- Ultimate Plus: This premium plan maximizes protection with up to $1 million in stolen funds reimbursement, $1 million for personal expenses, and the same high coverage for legal costs, all backed by expert identity restoration specialists in the US.

Unfortunately, it's clear that after the initial discounted year, LifeLock's prices see a notable increase. This hike might give pause to some users when it comes time to renew their subscriptions.

Family Plans (two adults):

- Standard (for family): This plan includes credit monitoring, suspicious activity alerts, and up to $25,000 in stolen funds reimbursement.

- Advantage (for family): The Advantage plan offers up to $100,000 in stolen funds reimbursement and a wider range of monitoring services.

- Ultimate Plus (for family): Provides the highest level of protection with up to $1 million in stolen funds reimbursement, $1 million for personal expenses, and legal coverage, along with US-based identity restoration support and three-bureau credit monitoring.

Family Plans (two adults and up to five children):

- Standard (for family with kids): This plan offers credit monitoring, alerts, and up to $25,000 in stolen funds reimbursement.

- Advantage (for family with kids): This plan adds up to $100,000 in stolen funds reimbursement and expanded monitoring services.

- Ultimate Plus (for family with kids): The top-tier plan offers up to $1 million in stolen funds reimbursement, comprehensive credit monitoring, and identity restoration support.

LifeLock Coupon:

Get 52% Off LifeLock subscription plans with the coupon below:

(Coupon is applied automatically; 60 day money-back guarantee.)

It's also worth noting that LifeLock does not offer a free trial but provides a 60-day money-back guarantee on annual plans.

How to get started with LifeLock: A quick guide

Getting started with LifeLock is simple – just follow this step-by-step guide:

Initiate your LifeLock journey – Begin by visiting the LifeLock website to create your account.

Provide your details – Enter essential personal details such as your full name, date of birth, and SSN to set the foundation for your identity protection.

Choose your protection plan – Evaluate LifeLock's array of plans and select the one that aligns with your security needs and budget constraints.

Access your dashboard – Once registered, gain access to your LifeLock dashboard, your command center for monitoring and managing your identity protection services.

Download the mobile app – Take LifeLock's protection wherever you go with the mobile app for Android and iOS. It reflects the desktop dashboard's ease of use in a mobile-friendly format, giving you streamlined access to account management and real-time alerts.

By following these steps, you'll be equipped with LifeLock's comprehensive identity theft protection and ready to secure your personal information.

Considering alternatives? How does LifeLock stack up against competitors?

While LifeLock offers solid identity theft protection, it’s smart to explore other options to find the best fit for your needs and budget. To help you compare, we’ve put together a quick overview of how LifeLock stacks up against some top competitors like Aura and IDShield:

| LifeLock | Aura | IDShield | |

| Three-bureau credit monitoring | ✅ (with premium plans) | ✅ (with all plans) | ✅ (with premium plans) |

| Dark web surveillance | ✅ | ✅ | ✅ |

| Identity theft insurance | Up to $3M | Up to $1M (up to $5M with the family plan) | Up to $3M |

| Private Investigator Support | ❌ | ❌ | ✅ |

| 24/7 customer support | ✅ | ✅ | ✅ (for urgent issues) |

| Best deal | 52% Off Coupon > | 60% Off Coupon > | N/A |

Both LifeLock and Aura offer credit monitoring and dark web surveillance, but Aura pulls ahead by providing $1 million coverage for stolen funds and legal expenses on every plan — a benefit LifeLock reserves for its higher tiers. Plus, Aura’s single-family plan could be a more wallet-friendly option if you have multiple users under one roof.

On the other hand, IDShield’s plans come with consultations from private investigators, which means you get expert, personalized help if your identity is stolen. They also offer social media monitoring and online reputation management, key in today’s digital world. While LifeLock covers a wider range of features and offers higher insurance amounts, IDShield’s investigative approach gives you a more hands-on defense.

Other identity theft protection reviews on CyberInsider:

- Aura Review

- NordProtect Review

- Experian IdentityWorks Review

- IDShield Review

- McAfee Review

- IdentityIQ Review

- Identity Guard Review

LifeLock review video

Final verdict: Is LifeLock the right identity protection for you?

LifeLock offers solid identity theft protection with a range of features built to keep your personal information safe. With 24/7 customer support and a user-friendly interface, it’s designed to be both accessible and reliable. Standout perks include strong credit monitoring, dark web surveillance, and identity theft alerts that help you stay one step ahead.

That said, there are a couple of trade-offs. Prices jump after the first year, and three-bureau credit monitoring is only available on higher-tier plans, which might not suit every budget.

Bottom line? Despite the higher cost and tiered structure, LifeLock delivers powerful protection, making it a strong choice if you’re serious about defending your digital identity.

Maximize LifeLock safeguards from day one

Since you are reading this, I assume you have selected LifeLock for identity protection. Now complete these targeted steps to activate its strongest monitoring and response features immediately.

Enter your full personal and financial details so LifeLock can track credit activity, dark web mentions, and account changes accurately.

Choose your preferred alert delivery (phone, text, email, or app) to stay informed the moment suspicious activity appears.

On Advantage or Ultimate Plus plans, enable advanced monitoring like three-bureau credit locks and investment account alerts.

Download the LifeLock app for real-time notifications, quick wallet replacement requests, and direct access to restoration specialists.

If adding Norton 360, install it right away to layer on device antivirus and VPN protection.

These fast actions turn your new plan into active, round-the-clock defense and help you get the most from LifeLock’s comprehensive coverage.

LifeLock FAQ

What services does LifeLock provide?

LifeLock diligently monitors a range of personal data points, from your Social Security number to your credit details, and sends you timely alerts if it detects anything that smells fishy. But LifeLock isn't just about monitoring; it's got your back with recovery services ready to spring into action if your identity does take a hit.

What level of protection does LifeLock offer against identity theft?

While LifeLock delivers an impressive array of tools to detect and alert you to various identity theft threats, it's worth noting that no service can offer complete protection against every possible scenario. LifeLock shines with its monitoring capabilities and prompt alerts, but complementing its features with your own diligent cybersecurity habits is also crucial.

Has LifeLock faced any controversy?

Yes, LifeLock has faced its share of controversies. The most significant was in 2010 when the FTC imposed a hefty $12 million fine on the company for making deceptive advertising claims about the extent of its protection services.

This event was a wake-up call for LifeLock, prompting a comprehensive overhaul of its practices. Since that time, LifeLock has bolstered its security protocols and services, showing a clear dedication to consumer protection and trust.

Leave a Reply