Trying to choose between LifeLock and Experian IdentityWorks? You're not alone. With both offering credit monitoring, dark web surveillance, and generous identity theft insurance, the decision isn’t as simple as it seems.

We’ve tested both services hands-on — digging into their features, pricing, customer support, and even those little extras you might not notice at first. Whether you're here for the credit protection or curious about who does a better job keeping your digital life secure, we’ve got you covered with insights from real-world use and expert reviews.

But which one truly delivers the most peace of mind? Let’s dive into the core features and see which service stands out!

| LifeLock | Experian IdentityWorks | |

| Website | LifeLock.Norton.com | Experian.com |

| Pricing | $7.50 – $33.39/month | $24.99 – $34.99/month |

| Money-back guarantee | 60 days | 7 days |

| 3-bureau credit monitoring | Yes (with premium plans) | Yes (with paid plans) |

| 24/7 customer support | Yes | No |

| Identity theft insurance | Up to $3 million | Up to $1 million |

| Best deal | 52% Off Coupon > | N/A |

Highlights from our LifeLock and Experian IdentityWorks comparison

- LifeLock packs a punch with up to $3 million in identity theft insurance, plus perks like home title monitoring and 24/7 live support — perfect if you want full-on protection, even if it costs a bit more.

- IdentityWorks keeps it budget-friendly with a free tier for basics and paid plans that include FICO score tracking and credit monitoring from all three major bureaus.

- If you love extra tech goodies, LifeLock’s got you covered with a VPN, antivirus, and a handy password manager to boost your digital security game.

- Curious which option gives you the most bang for your buck? Don’t miss LifeLock’s 42% off coupon — jump to our pricing showdown and find your perfect match!

Choosing the best identity theft protection: LifeLock or Experian IdentityWorks?

Before diving into the specifics, let's take a moment to outline the key criteria for selecting the ideal identity theft protection service:

- Monitoring: LifeLock and IdentityWorks excel at keeping an eye on your personal information. They monitor everything from public records to credit files and even the dark web to spot potential threats. This proactive approach helps you catch any issues early on.

- Protection: Beyond just monitoring, LifeLock and IdentityWorks provide robust privacy tools to keep your personal information safe. Both services help remove your data from risky online sites. LifeLock partners with Norton antivirus for enhanced security, while IdentityWorks offers comprehensive family plans and FICO score tracking.

Notifications: Quick alerts are essential for stopping identity fraud. LifeLock and IdentityWorks both notify you of suspicious activity right away, helping you take swift action to mitigate potential damage.

- Resolution: If identity theft occurs, both LifeLock and IdentityWorks offer dedicated support to help you through the resolution process. IdentityWorks offers up to $1 million in identity theft insurance, while LifeLock provides up to $3 million in insurance to cover eligible expenses and losses, ensuring you have the financial support needed to recover.

Let’s swiftly break down the differences between LifeLock and IdentityWorks to see which one fits your identity theft protection needs best.

LifeLock vs Experian IdentityWorks: Side-by-side comparison

A side-by-side comparison brings several features and benefits of LifeLock and IdentityWorks into clear view:

| LifeLock | Experian IdentityWorks | |

| Pricing | $7.50 – $33.39/month | $24.99 – $34.99/month |

| Family-focused plans and features | ✅ | ✅ |

| 3-bureau credit monitoring and reports | ✅, 1-bureau (Equifax) or 3-bureau (Experian, TransUnion, and Equifax) | ✅ (Experian, TransUnion, and Equifax) except with the free plan (Experian only) |

| Dark web monitoring and alerts | ✅ | ✅ |

| Identity theft insurance | Up to $3 million | Up to $1 million |

| Social media account alerts | ✅ | ✅ |

| Credit lock | ✅ | ✅ |

| Lost wallet remediation | ✅ | ✅ |

| Antivirus and VPN | ✅ (for an extra fee) | ❌ |

| Password manager | ✅ | ❌ |

| 24/7 customer support | ✅ | ❌ |

| Best deal | 52% Off Coupon > | N/A |

LifeLock vs Experian IdentityWorks: Which identity protection service is more trustworthy?

When judging the trustworthiness of identity theft protection services, it's good to check out their history, user reviews, and adherence to industry standards.

Now, let's dive into the details of our two contenders.

LifeLock overview

| Starting price | $7.50/month |

| Supported platforms | Windows, macOS, Android, and iOS |

| Three-bureau credit monitoring | Yes (top-tier plans) |

| Identity theft insurance | Up to $3 million |

| Best deal | 52% Off Coupon > |

Backed by Gen Digital (formerly NortonLifeLock), LifeLock has been on identity theft watch duty since 2005, and it’s still one of our top picks. It monitors your credit, scans the dark web, and sends timely alerts when anything sketchy pops up. While no service catches everything, LifeLock’s solid recovery support helps us breathe easier when things go sideways.

Now, it hasn’t always been smooth sailing. In 2010, LifeLock paid a $12 million fine to the FTC over some overly bold advertising claims. But to their credit, they’ve taken steps to rebuild trust, improving both their services and their commitment to transparency.

These days, they’ve earned a glowing Trustpilot score of 4.8 out of 5, based on over 7,900 reviews. That’s a solid endorsement from real users, though a small slice (about 9%) still report frustrations with alert settings, tech hiccups, or customer service delays.

There was also a scare in late 2022 when a credential-stuffing attack hit over 6,000 accounts. LifeLock acted fast, notified affected users by January 2023, and tightened their defenses — a good reminder that even security companies are in the trenches fighting cyber threats.

Still, LifeLock has kept pace with growing digital risks by bundling powerful Norton extras like VPN, antivirus, and a password manager — dive in to check their extra digital security features!

All in all, LifeLock continues to offer a strong defense, with constant improvements and a hefty set of tools that make it more than just an ID theft monitoring service.

LifeLock pros and cons

Now, let’s delve into the advantages and disadvantages of choosing LifeLock for safeguarding your digital identity:

+ Pros

30-day free trial period (recently added)

A VPN with family plans

Comprehensive identity theft protection service

Can be combined with Norton 360 antivirus software

Up to $1 million insurance for certain costs incurred from identity theft

User-friendly interface and easy setup

Stolen wallet protection

Simple-to-use mobile apps

– Cons

3-bureau monitoring is available in higher-tier plans only

Confusing paid plan structure

Higher cost compared to some competitors

Let's now turn our attention to IdentityWorks.

Experian IdentityWorks overview

| Starting price | $24.99/month |

| Supported platforms | Android, and iOS |

| Three-bureau credit monitoring | Yes (top-tier plans) |

| Identity theft insurance | $1M |

| Best deal | N/A |

Experian IdentityWorks brings some serious credit cred to the world of identity protection. With decades of experience and a name you probably recognize from your credit report, Experian offers daily alerts for suspicious activity and credit changes — perfect for keeping a sharp eye on your Experian file.

Founded in 1996 and based in Dublin, Experian is one of the “Big Three” credit-reporting giants, right up there with Equifax and TransUnion. With data on over a billion people and businesses around the world, they’re kind of a big deal when it comes to credit.

And their identity protection service holds its own. IdentityWorks includes three-bureau credit monitoring, dark web scans, identity restoration, and flexible pricing (including a free basic plan). Whether you’re just dipping your toes into ID protection or looking for full coverage, there's a plan that fits.

Of course, even big players have their bumps in the road. Experian has dealt with some major data breaches over the years:

2015 breach: Up to 15 million people affected, mostly T-Mobile customers.

2020 breach: Info on 24 million South Africans and 800,000 businesses exposed.

2021 breach: Data from 220 million Brazilian citizens leaked.

Not ideal—but since then, Experian has tightened its security measures and taken steps to better protect user data. If you’re wondering how their security stacks up now, jump to our security and privacy section!

As of now, Experian holds a Trustpilot score of 4.1 out of 5, with over 84,000 reviews — not bad for a company that's been in the spotlight for so long.

Bottom line? IdentityWorks pairs Experian’s credit smarts with simple tools that make it easy to stay protected, without emptying your wallet.

Experian IdentityWorks pros and cons

Let’s delve into the pros and cons of choosing IdentityWorks:

+ Pros

Credit file and personal info web scanning

Instant misuse alerts on all plans

Identity theft recovery aid including lost wages

Credit monitoring with one or three bureaus

SSN tracking for unauthorized use

Dark web checks for personal data leaks

Financial account vigilance

Licensed private investigators for theft restoration

– Cons

Confusing and cumbersome setup

Basic plans cover only TransUnion

No discounts for yearly plans

Bare-bones password manager

Availability and insurance coverage: Does LifeLock or Experian IdentityWorks offer more comprehensive protection?

| LifeLock | Experian IdentityWorks | |

| Identity theft insurance amount | From $1M up to $3M depending on the plan | From $500,000 up to $1M |

| Stolen funds reimbursement | From $25,000 up to $1M depending on the plan | Up to $1M |

LifeLock provides comprehensive insurance coverage across its plans, ensuring you're covered for up to $1 million in legal and expert expenses. Depending on your plan, there's additional coverage for stolen funds and personal expenses. This service is accessible across Windows, macOS, Android, and iOS, and includes the Norton Safe Web browser extension for Chrome, Firefox, and Edge, making it easy to stay protected on any device.

IdentityWorks also offers robust insurance coverage, with options ranging up to $1 million on its highest plan and up to $500,000 on lower-priced plans. It operates as a convenient cloud-based service accessible through web browsers and mobile apps for Android and iOS, ensuring you can monitor your identity on the go.

Not sure which platforms each one supports? Here's a quick breakdown:

| LifeLock | Experian IdentityWorks | |

| Windows? | ✅ | ❌ |

| macOS? | ✅ | ❌ |

| Android? | ✅ | ✅ |

| iOS? | ✅ | ✅ |

| Browser extensions? | ✅ | ❌ |

Core identity protection: LifeLock vs Experian IdentityWorks – Which one wins?

Both services deliver strong identity protection, but their strengths vary. Take a look at how they stack up — or head straight to our winner revealed if you're just here for the TL;DR.

Credit monitoring across the bureaus

Credit monitoring is a crucial feature for any identity theft protection service, and we found both LifeLock and Experian IdentityWorks to be quite robust in this area.

With Experian IdentityWorks, you get the option for both single-bureau and triple-bureau credit monitoring. They keep an eye on Experian, TransUnion, and Equifax, ensuring any unusual activity is quickly detected and addressed. We appreciated the daily credit reports and FICO scores, which kept us regularly updated on our credit status.

LifeLock offers similar flexibility with options for one-bureau or three-bureau credit monitoring, depending on your plan. Their “Ultimate Plus” plan stands out, providing monthly credit reports and daily credit-score updates from all three major bureaus.

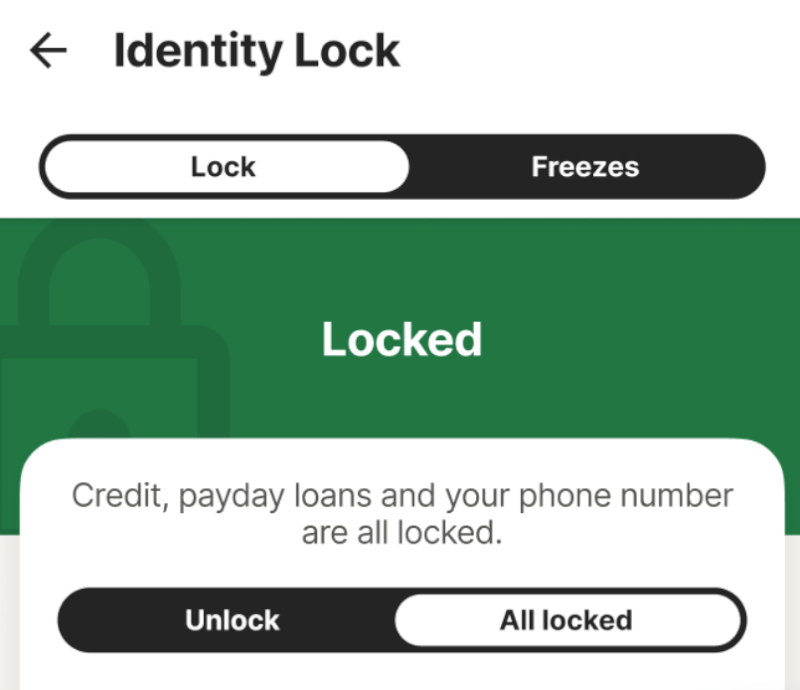

One feature we found particularly handy was the ability to lock and unlock your TransUnion credit file with just a click, as you can see below:

This made it easy to control who could check our credit when applying for new credit or loans. However, it’s worth noting that the lower-tier plans are more basic, monitoring only one bureau and not including free credit reports. So, you’d need to lock your Experian and Equifax files separately.

Dark web surveillance

Through our testing, IdentityWorks appeared great at keeping an eye on your personal information. It sends alerts quickly if there's anything suspicious, which helps when it comes to protecting against identity theft. Plus, it dives deep into the dark web to ensure your details, like Social Security numbers (SSNs), email addresses, and credit card info, aren't being misused.

LifeLock also stands out with its dark web surveillance. It constantly searches those hidden corners of the internet where illegal activities happen. We felt a lot more secure knowing LifeLock was watching out for any signs of our personal information being misused. The alerts come quickly if anything is found, so you can act fast to secure your accounts. LifeLock also scans trillions of data points every day and offers privacy monitoring features that look for your info being sold on the dark web.

So, both services offer this extra layer of defense, ensuring that your sensitive information is protected even in the more obscure and risky parts of the web.

Identity theft insurance

Dealing with identity theft can be tough, and from what we’ve seen, IdentityWorks offers solid fraud protection. However, LifeLock takes it a step further with more extensive insurance. Their top-tier plan includes $3 million in coverage, while IdentityWorks caps out at $1 million.

One thing we noticed with IdentityWorks is that the insurance coverage stays at $1 million, no matter if you're an individual or a couple. This might not be flexible enough if you have a larger family.

See detailed IdentityWorks coverage info here >

LifeLock, on the other hand, adjusts the coverage based on the number of adults and children in the plan. For instance, LifeLock’s “Ultimate Plus” plan provides up to $3 million in identity theft insurance, covering stolen funds, legal fees, and personal expenses. This tiered approach is especially beneficial for families, ensuring everyone gets the protection they need.

See detailed LifeLock coverage info here >

Restoration services rundown

When it comes to restoring your identity after a theft, both LifeLock and IdentityWorks offer crucial assistance. We've found that LifeLock provides a standout service with its 24/7 live customer support, ensuring you can get help whenever you need it, day or night. This has been incredibly reassuring in stressful situations, knowing that immediate assistance is just a call away.

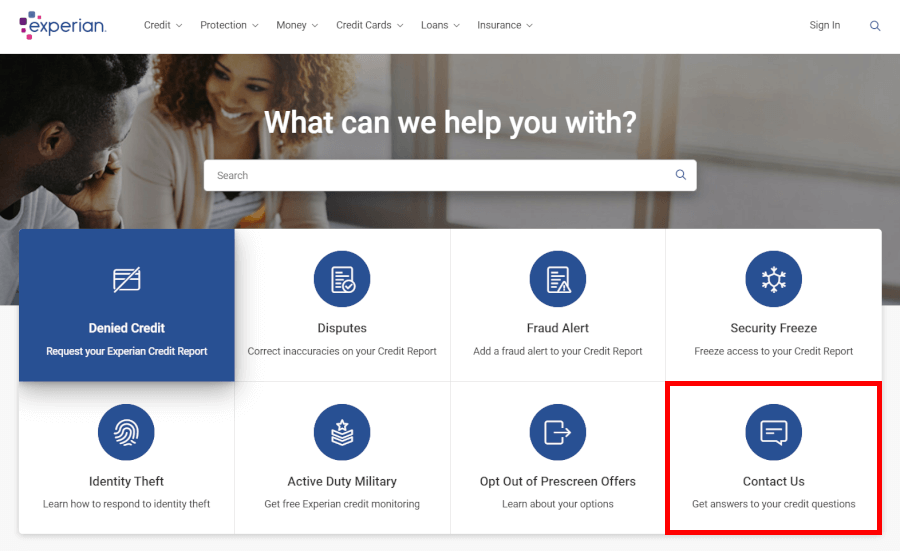

On the other hand, IdentityWorks offers support primarily through email or live chat, which can be less convenient for urgent matters. Finding their customer service phone number can sometimes be a bit of a hunt, which might not be ideal in a pinch.

Both services provide useful online resources for answering common questions about identity restoration, which has been handy for getting quick answers during our experience. Additionally, LifeLock's lost wallet service, which tracks all your identifying cards, adds a layer of convenience and security that we've found invaluable.

Additional digital defenses: Who offers better extras?

LifeLock strengthens its identity theft protection with a range of digital security tools, while Experian IdentityWorks prioritizes its core strengths in credit and identity monitoring.

As we delve into their additional security features, you'll see how LifeLock's comprehensive strategy adds multiple layers of protection.

Secure VPN service

LifeLock includes a VPN service as part of its higher-tier plans, which is powered by Norton, its parent company. This VPN service is great because it doesn't track or save your browsing activities due to its strict no-log policy. It also uses bank-grade encryption to keep your private information safe when you're online, automatically kicks in when you connect to public networks, and has a handy kill switch feature that disconnects your device from the internet if the VPN connection drops. These features really give you peace of mind and add an extra layer of security for all your online activities.

On the other hand, IdentityWorks doesn't provide a VPN service with its identity protection plans. This could be a downside if you're looking for a comprehensive security solution that includes secure internet browsing. So, if having a secure VPN is important to you, LifeLock's offerings are definitely more aligned with what you need.

Antivirus software

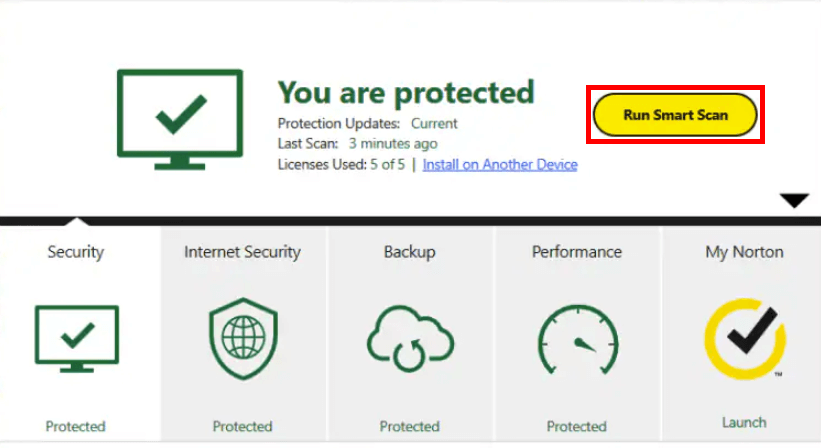

We've found that LifeLock really shines with its antivirus software, thanks to its integration with Norton’s security products.

If you opt for one of their comprehensive plans, you can even upgrade to Norton 360, which includes antivirus software covering multiple devices. This setup not only keeps your identity safe but also shields your devices from malware, viruses, ransomware, phishing attacks, and identity theft. It's an extra layer of security that we really appreciate.

On the other hand, IdentityWorks doesn't include antivirus software in its identity protection plans. This can be a bit of a letdown if you're looking for an all-in-one solution for your digital security.

Password manager

LifeLock includes a password manager as part of Norton’s security tools. This handy feature stores your passwords in an encrypted, cloud-based vault, automatically creates complex and unique passwords for added security, and lets you sync passwords across multiple devices. From our experience, this makes managing and securing your passwords a breeze, ensuring your login credentials are safe and accessible wherever you go.

On the other hand, IdentityWorks doesn't offer a password manager with its identity theft protection plans. So, you'd need to look for third-party solutions for password management, which might not integrate as smoothly as LifeLock’s option.

Parental controls and child safety

LifeLock includes parental control features in its higher-tier family plans, giving us tools to monitor our kids' online activities and keep them safe. These plans can cover up to five children, offering comprehensive protection for the whole family. From our experience, the parental controls are great for monitoring online activities and setting limits on internet usage, which can be crucial for protecting children from online threats.

On the flip side, IdentityWorks doesn’t offer specific parental controls or child safety tools in any of its plans. However, their family plan covers up to 10 children and an additional adult, providing extensive identity theft insurance and three-bureau credit monitoring for children. While Experian’s family plan offers significant coverage for kids, the lack of specific parental controls might be a bit of a drawback for some of us.

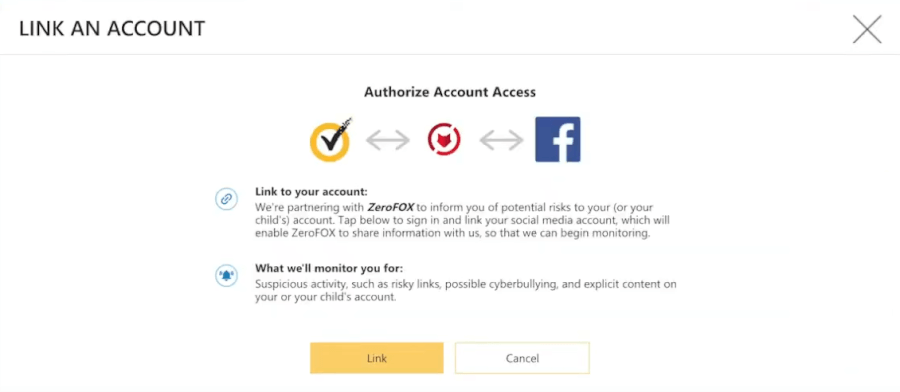

Social media monitoring

LifeLock includes social media monitoring features in its “Ultimate Plus” plan. It alerts you to potential compromises on your social media accounts, helps you stay ahead of threats like account takeovers, and ensures your online presence is secure.

IdentityWorks offers social media monitoring in its “Premium” plan, scanning for potential risks and breaches. It sends you alerts about suspicious activities related to your profiles.

Both services provide solid social media monitoring, but in our experience, LifeLock’s integration with its broader suite of security tools makes it a bit more seamless.

Additional monitoring features

IdentityWorks includes additional monitoring options such as home and auto title monitoring in its top-tier services, providing users with comprehensive protection against various types of identity theft.

LifeLock’s upper-tier plans also offer alerts for Buy Now, Pay Later (BNPL) plans and phone takeover monitoring, ensuring that users are protected against emerging threats.

Ease of use and support: Is LifeLock or Experian IdentityWorks more user-friendly?

Ease of use and support hold key importance when selecting an identity theft protection service. LifeLock and IdentityWorks each offer distinct experiences, with differences in setup processes, app interfaces, and customer support options.

Let’s dive into what each service offers and see which one might be the best fit for you.

Setting up your protection

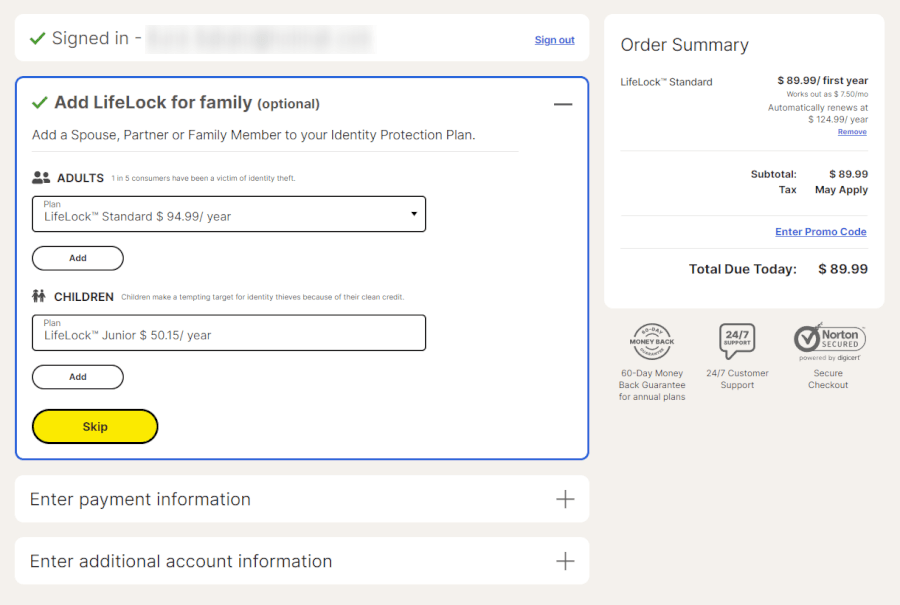

Setting up protection with LifeLock is pretty straightforward. You start by entering your basic details like name, SSN, birthdate, address, phone number, and email. Then, you add your credit card info and agree to the subscription terms. If you want extra security, you can opt to include Norton antivirus and VPN during setup, which is a nice bonus. Plus, LifeLock offers a 60-day money-back guarantee for annual plans, which gives you some time to test everything out and make sure you're happy with it.

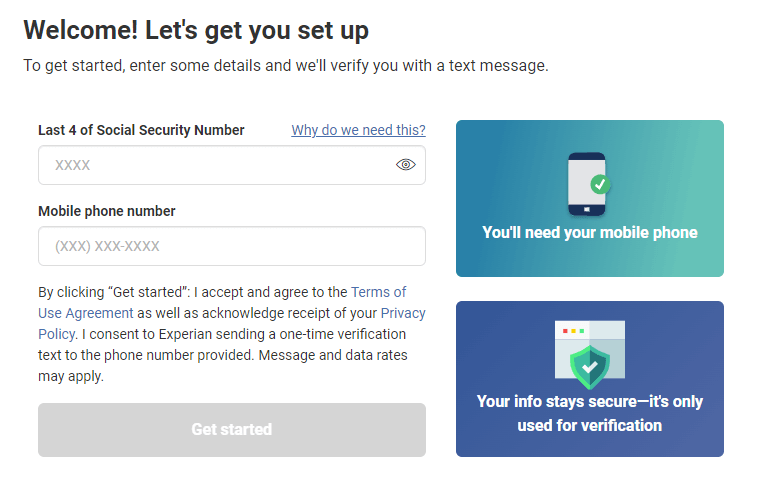

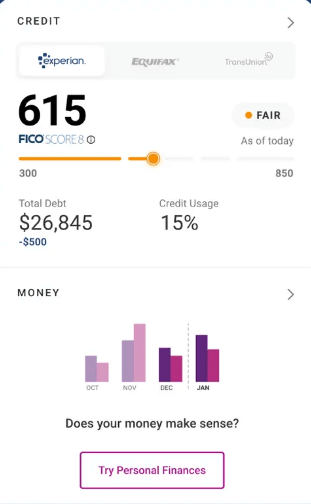

Now, setting up with IdentityWorks was also user-friendly. Once I created my account, I could immediately see key details like my FICO score, credit usage percentage, and total debt. They offer different plans ranging from a free option with basic monitoring to a “Premium” plan that includes three-bureau credit monitoring, identity theft insurance, and a FICO score tracker – all designed to provide comprehensive protection.

Using IdentityWorks, I found their dashboard really intuitive. It made it easy to lock my credit file, check alerts, and even run a free child ID scan. Additionally, IdentityWorks offers a 7-day free trial for its premium services, allowing you to test the service without any initial financial commitment.

Navigating your apps

Navigating LifeLock’s mobile apps for Android and iOS has been straightforward for us. They make it simple to manage your account on the go and stay updated with instant alerts wherever you are. The interface is very user-friendly, so you can easily explore features like identity monitoring and credit score updates.

Initially, we noticed there are two apps to choose from – LifeLock for Norton360 and LifeLock ID Theft Protection. This might be confusing at first, but once you’re logged in, both apps are easy to use. They also integrate smoothly with other Norton security tools, providing added digital protection.

On the other hand, the Experian mobile app has also impressed us, although it can take some time to get used to. It allows you to access your account, check detailed credit reports, monitor your FICO scores, and receive instant alerts about any suspicious activity.

Still, we’ve found it useful and enjoyable to use, despite some initial navigation challenges.

Customer support and resources

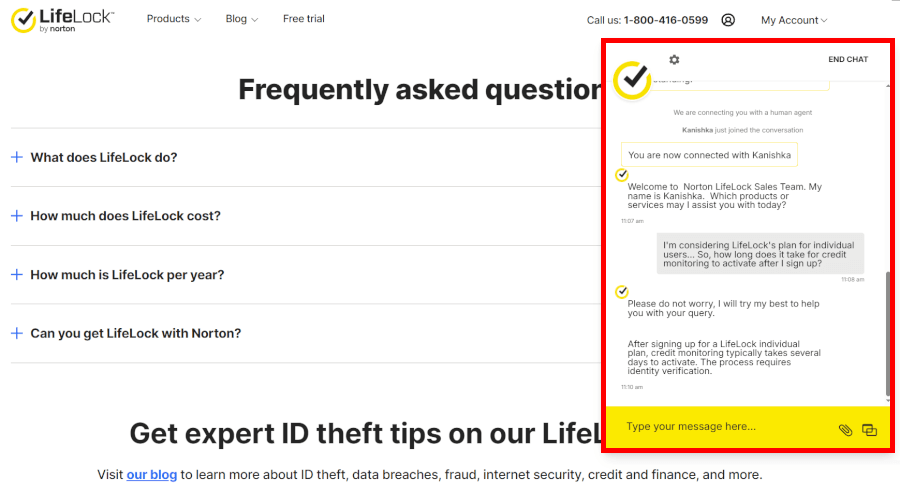

When it comes to handling identity theft issues, having strong customer support is crucial. LifeLock shines here with 24/7 support and US-based identity restoration experts who are always ready to help.

However, sometimes the support staff seem more versed in Norton’s antivirus products than in LifeLock’s identity services.

IdentityWorks offers support through live chat and email, but it’s not available 24/7, which can be frustrating in urgent situations.

They also have a toll-free number and provide helpful info on credit scores and reports through their dashboard. However, our experience with their support has been a bit hit-or-miss in terms of response times and helpfulness.

LifeLock’s support team is generally reliable and knowledgeable. They’re available 24/7 for all plans. While they don’t have direct chat or email options, their blog and FAQs are quite helpful for finding answers on your own.

Financial health: Who offers more helpful credit reports and scores?

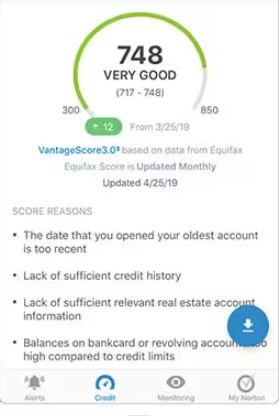

LifeLock and IdentityWorks both provide useful tools for tracking credit reports and scores. IdentityWorks uses FICO scores, which are widely recognized for assessing creditworthiness, making it a great choice for users who prioritize FICO score tracking.

LifeLock, on the other hand, uses VantageScore and offers three-bureau credit monitoring and reports with its “Ultimate Plus” plan, providing comprehensive coverage. Experian IdentityWorks provides quarterly credit reports, with daily updates available in the “Family” plan, making it ideal for those who need frequent insights into their credit history.

LifeLock’s premium plan includes monthly credit reports and daily score updates from all three major bureaus, plus the ability to lock or unlock your TransUnion credit file. However, their lower-tier plans only offer basic monitoring with one bureau and might not include free credit reports.

Experian IdentityWorks also offers a free plan with FICO score tracking, making it accessible for budget-conscious users.

Security and privacy: Is LifeLock or Experian IdentityWorks a safer choice?

| Security features | LifeLock | Experian IdentityWorks |

| Bank-level AES-256 encryption | ✅ | ✅ |

| Real-time threat and fraud alerts | ✅ | ✅ |

| Two-factor authentication | ✅ | ✅ |

| Dedicated privacy tools (VPN, ad block) | ❌ (separate Norton bundle) | ❌ |

Security and privacy are paramount when selecting an identity theft protection service. LifeLock offers two-factor authentication (2FA), while IdentityWorks provides multi-factor authentication (MFA), enhancing account security and providing us with peace of mind. IdentityWorks also includes monthly privacy scans and assistance with removing personal data from people finder sites, bolstering privacy safeguards.

In terms of tools, LifeLock impressed us with its comprehensive approach, integrating a secure VPN, antivirus software, password manager, and parental controls into their top-tier plans. These features seamlessly supported our daily digital activities, simplifying security management across multiple devices. On the other hand, IdentityWorks focuses on critical tools like dark web surveillance, identity restoration services, and three-bureau credit monitoring, crucial for preempting potential threats.

Pricing showdown: LifeLock or Experian IdentityWorks for your wallet?

When comparing LifeLock and IdentityWorks plans and pricing, it's essential to consider the value each offers relative to cost.

| LifeLock plans | Price for individuals | Price for families (two adults) | Price for families (two adults and five kids) |

| Standard | $7.50/month | $12.49/month | $18.49/month |

| Advantage | $14.50/month | $22.09/month | $29.99/month |

| Ultimate Plus | $19.50/month | $33.39/month | $38.99/month |

LifeLock provides nine tiers for individuals, couples, and families, offering varying levels of protection and increasing prices after the first year. Here’s a simplified breakdown:

Standard: $7.50/month for the first year (then $12.49/month). Includes up to $25,000 in stolen funds reimbursement, $1 million for legal costs, and US-based identity restoration.

- Advantage: $14.99/month for the first year (then $20.83/month). Offers up to $100,000 in stolen funds reimbursement and personal expense compensation, plus $1 million for legal costs.

- Ultimate Plus: $19.99/month for the first year (then $29.15/month). Provides up to $1 million in stolen funds reimbursement and personal expenses, with three-bureau credit monitoring.

Although the numerous plans might seem daunting, they provide thorough identity theft protection for families. Additionally, LifeLock does not offer a free trial but makes up for it with a 60-day money-back guarantee on annual plans.

See LifeLock’s latest prices and deals here >

Now that we’ve explored what LifeLock brings to the table, it’s time to see how IdentityWorks stacks up:

| IdentityWorks plans | Monthly price | Annual price | Who’s covered |

| Basic | $0 | N/A | 1 adult (free basic monitoring) |

| Premium | $24.99 | $299.88 | 1 adult (full identity protection) |

| Family | $34.99 | $419.88 | 2 adults + up to 10 children (full identity protection) |

IdentityWorks offers a 7-day trial period for all its paid plans, allowing users to test the service before committing.

See IdentityWorks’s latest prices and deals here >

Both LifeLock and IdentityWorks offer robust identity theft protection with plans suited to various needs and budgets. LifeLock initially offered lower prices with significant first-year discounts compared to Experian. However, LifeLock's prices increase notably after the first year, leading to higher long-term costs.

In contrast, IdentityWorks starts with slightly higher prices for its top-level plan but maintains stable pricing over time, offering a more predictable option for ongoing identity protection.

On the other side, LifeLock's inclusion of a secure VPN, antivirus software, password manager, and parental controls adds significant value. These features provide extra layers of digital security beyond basic identity protection.

Making your choice: LifeLock or Experian IdentityWorks?

When comparing LifeLock and IdentityWorks for identity protection, several crucial factors stand out. Here’s a brief overview of how each service fares across key areas:

Trustworthiness: LifeLock

Availability and insurance: LifeLock

Core identity protection capabilities: LifeLock

Additional digital defenses: LifeLock

Ease of use and support: LifeLock

Financial health reports: Tie

Security and privacy: LifeLock

Plans and pricing: Tie

Both LifeLock and IdentityWorks offer strong and reliable services, each with its own advantages. However, LifeLock stands out for several reasons. Its comprehensive features, including strong insurance coverage and advanced digital defenses, make it an excellent choice. We especially liked the added security features like VPN and antivirus software, which gave us extra peace of mind.

LifeLock Coupon:

Get 52% Off LifeLock subscription plans with the coupon below:

(Coupon is applied automatically; 60 day money-back guarantee.)

On the other hand, IdentityWorks impressed us with its straightforward approach and budget-friendly pricing. It’s perfect for users looking for reliable identity protection without the worry of sudden price hikes upon renewal.

Identity theft protection comparisons on CyberInsider:

- Aura vs LifeLock

- Aura vs Experian IdentityWorks

- IDShield vs Aura

- Aura vs McAfee

- Aura vs NordProtect

- LifeLock vs IDShield

- Aura vs Incogni

- Aura vs IdentityIQ

- Aura vs IDShield

- Identity Guard vs Aura

- Identity Guard vs NordProtect

- Identity Guard vs LifeLock

LifeLock vs Experian IdentityWorks FAQ

What is the main difference between LifeLock and Experian IdentityWorks?

The main difference lies in their additional features and pricing structure. LifeLock offers a more comprehensive suite of digital security tools, including a VPN, antivirus software, and a password manager, integrated into their higher-tier plans. IdentityWorks, on the other hand, focuses more on core identity and credit monitoring services, providing a straightforward approach with family-friendly plans and stable pricing.

Is LifeLock better than Experian IdentityWorks?

LifeLock is generally a better choice for most users due to its extensive range of features and higher insurance coverage. It includes strong digital defenses like a VPN, antivirus software, and a password manager, offering comprehensive protection beyond just identity monitoring.

Additionally, LifeLock's flexible plans cater to various needs, making it suitable for those who want tailored security measures. On the other hand, IdentityWorks is ideal for users who prioritize budget-friendly options and essential identity protection without worrying about price hikes.

Do LifeLock and Experian IdentityWorks help if my identity is stolen?

Yes, both services provide dedicated support to help you recover from identity theft. LifeLock offers 24/7 live customer support and US-based identity restoration experts, while IdentityWorks provides identity restoration services and support through live chat and email. Both ensure you have the assistance needed to navigate the recovery process.

It says this article was updated July 14, 2025. Today is June 14, 2025. LOl.

Hi Debbie, yes the article was updated today (June 14th) so I fixed that July typo, thanks.