Identity theft drains billions from victims each year through fraudulent accounts, loans, and charges that wreck credit scores and peace of mind. Identity Guard and Aura rank among the top services for spotting threats early with dark web scans, credit monitoring, and up to $1 million in insurance coverage, but they structure their protection very differently.

Aura delivers an all-in-one suite that includes antivirus, VPN, password manager, and parental controls alongside three-bureau monitoring on every plan, while Identity Guard focuses on tiered identity alerts with AI-driven insights, social media monitoring, and more affordable entry-level pricing. This 2026 comparison cuts through the details on features, costs, and real-world value so you pick the right shield for your risks. You can also jump straight to the features comparison if you want to see how they stack up side by side.

Identity Guard has strong monitoring and social media protection. But Aura packs in even more, like antivirus, VPN, and parental controls, making it a better all-in-one pick for most people.

We’ve tested both, read the fine print, and checked what real users are saying — so by the end, you’ll know exactly which one’s right for you.

| Aura | Identity Guard | |

| Website | Aura.com | IdentityGuard.com |

| Pricing | $12 – $50/month ($9 with a coupon) | $6.67 – $39.9/month |

| Money-back guarantee | 60 days | 60 days |

| 3-bureau credit monitoring | Yes (Experian, TransUnion, and Equifax) with all plans | 1-bureau or 3-bureau (Experian, TransUnion, and Equifax) with top-tier plans |

| 24/7 customer support | Yes | Yes (for identity theft emergencies) |

| Identity theft insurance | Up to $1 million (up to $5 million with the family plan) | Up to $1 million |

| Best deal | 68% Off Coupon > | 25% Off Coupon > |

Highlights from our Aura and Identity Guard comparison

Aura packs a punch with all-in-one protection on every plan — think identity monitoring, antivirus, VPN, and even parental controls. Identity Guard takes a more classic route with tiered plans focused on strong identity monitoring and AI-driven risk analysis.

When it comes to coverage, both offer up to $1 million in insurance per adult, but Aura ups the game for families with up to $5 million and 24/7 support (yep, even at 2 AM). Identity Guard, meanwhile, sticks to business hours.

If you're after fast alerts and extra layers of digital defense, Aura’s got your back, especially for families. Identity Guard shines in social media monitoring and identity threat detection.

Want to see which gives you more bang for your buck? Jump to our pricing comparison to see how Aura stacks up with a 68% off deal.

Picking the right identity theft protection: Aura vs Identity Guard

Before diving into our detailed comparison of Aura and Identity Guard, let's quickly go over how to pick the right identity theft protection service:

Monitoring — Services like Aura and Identity Guard keep a close watch on different data points to detect identity theft. They monitor public records, credit files, and even the dark web to see if your personal information is at risk. This thorough monitoring acts as an early warning system to catch threats before they become big problems.

Protection — Besides monitoring, these services help safeguard your info with tools like antivirus software, secure browsing, and spam call blocking. They can also help remove your personal information from data brokers and other risky places online, lowering the chance of identity theft.

Notifications — Getting timely alerts is key to stopping identity fraud in its tracks. Aura and Identity Guard send out fraud alerts to let you know about any suspicious activity so you can act fast.

Resolution — If identity theft happens, both Aura and Identity Guard have dedicated support to help you through the process. They also offer insurance to cover eligible expenses and losses, giving you the financial support you need to recover.

Now, let’s compare Aura and Identity Guard to see which one is the best fit for your identity theft protection needs.

Aura vs Identity Guard: Side-by-side comparison

Let's compare Aura and Identity Guard side-by-side to help you find the perfect fit for your identity protection needs. Here's a quick overview of their key features:

| Aura | Identity Guard | |

| Pricing | $9 – $25/month (with coupon) | $6.67 – $39.9/month |

| Family-focused plans and features | ✅ | ✅ (but no parental controls) |

| 3-bureau credit monitoring and reports | ✅ (Experian, TransUnion, and Equifax) with all plans | ✅ (Experian, TransUnion, and Equifax) with top-tier plans |

| Dark web monitoring and alerts | ✅ | ✅ |

| Identity theft insurance | Up to $1 million (up to $5 million with the family plan) | Up to $1 million |

| Social media account alerts | ❌ | ✅ |

| Credit lock | ✅ | ✅ |

| Lost wallet remediation | ✅ | ✅ |

| Antivirus and VPN | ✅ | ❌ |

| Password manager | ✅ | ✅ |

| 24/7 customer support | ✅ | ✅ (for identity theft emergencies) |

| Best deal | 68% Off Coupon > | 25% Off Coupon > |

Aura vs Identity Guard: Which identity protection service can you really trust?

When evaluating the trustworthiness of identity theft protection services, it's essential to consider their reputation, user base, and adherence to industry best practices.

Now, let’s take a closer look at both of our contenders.

Aura overview

| Starting price | $12/month ($9 with a coupon) |

| Supported platforms | Windows, macOS, Android, and iOS |

| Three-bureau credit monitoring | Yes (across all plans) |

| Identity theft insurance | $1M – $5M ($1M per adult) |

| Best deal | 68% off coupon > |

Launched in 2014 by Hari Ravichandran after his own credit info was stolen, Aura was built to make the internet safer for everyone. Fast forward to today, and it’s protecting over a million members worldwide with its all-in-one approach to digital security.

Aura’s focus on user-friendly design hasn’t gone unnoticed — it’s racked up praise from the Mom’s Choice Awards, Inc. Magazine, and Forbes. With a solid 4.3 TrustScore on Trustpilot (based on 780+ reviews), it’s clear customers appreciate the service.

After scooping up Identity Guard, Aura leveled up with flexible plans for individuals, couples, and families. But it’s not just about identity theft protection — you also get a full digital security toolkit. We’re talking antivirus, a slick password manager, and a built-in VPN with military-grade encryption and 100+ virtual locations. So whether you're shopping from the couch or streaming from abroad, you’re covered. Go to Aura’s extra tools and digital defenses to find out more!

One exciting new addition is the Family Protection Online Balance feature (available on iOS for Family & Kids plans). It helps parents track trends in their kids’ online activities, spotting shifts that might affect their well-being. Plus, it offers helpful recommendations and conversation starters, making those tricky talks a little easier.

Aura pros and cons

Let's delve into the pros and cons of choosing Aura for your digital identity protection.

+ Pros

- Antivirus software across all plans

- Comprehensive identity theft protection and credit monitoring services

- Dark web monitoring

- Fraud call protection

- Up to $1 million in insurance coverage

- Plans for individuals, couples, and families

- Useful parental control app

- Password manager and VPN included

- 24/7 customer support and fraud resolution

- Transparent pricing

- 3-bureau credit monitoring included in all plans

– Cons

More expensive than some competitors

Identity Guard overview

| Starting price | $6.67/month |

| Supported platforms | Windows, macOS, Android, and iOS |

| Three-bureau credit monitoring | Yes (top-tier plans) |

| Identity theft insurance | Up to $1 million |

| Best deal | 25% Off Coupon > |

Identity Guard has been in the identity protection game since 1996, and that legacy shows. Now part of the Aura family, it's built a solid reputation for digital safety in a world that’s only gotten riskier.

With a 3.6 TrustScore on Trustpilot (from over 4,470 reviews), many users praise its powerful monitoring tools and social media oversight. But it’s not all five stars — about 1 in 10 reviewers have voiced frustrations around login hiccups, surprise auto-renewals, or tricky cancellations. If you're wondering how helpful the team is when things go sideways, you can skip to our section on customer support to see how they handle it.

What makes Identity Guard stand out is how it blends experience with smart tech, including AI-powered alerts powered by IBM Watson. On top-tier plans, you’ll also get extras like home title monitoring, USPS address change alerts, safe browsing tools, and even an Experian credit lock. It’s a nice boost for anyone looking for more than just basic monitoring.

See all Identity Guard features here >

Identity Guard pros and cons

Identity Guard, like any service, has its downsides. Among its array of features, you'll find:

+ Pros

$1 million in identity theft insurance on all plans

AI-powered identity monitoring

Extra alerts are helpful

Simple-to-understand, upfront pricing

US-based customer support

Comprehensive individual or family coverage

Password managers included in all plans

Family plan protects an unlimited number of children

Budget-friendly basic plan

Predictive risk management score

– Cons

Pricey high-tier plan

Monthly credit score or credit card monitoring requires a more expensive plan

- No parental control tools

Limited cybersecurity tools

When it comes to trust, Aura shines bright with its all-in, no-nonsense approach to digital security and a clean history free of any major mishaps. Identity Guard holds its own but has had some bumps with customer support and cancelation hassles along the way.

Availability and insurance coverage: Does Aura or Identity Guard offer more comprehensive protection?

When it comes to protecting your identity, both Aura and Identity Guard have your back with up to $1 million in identity theft insurance for individual plans. However, Aura steps it up for families, offering coverage up to $5 million, while Identity Guard sticks with $1 million.

| Aura | Identity Guard | |

| Identity theft insurance amount | $1M for each adult member, up to $2M on the “Couple” plan, and up to $5M on the “Family” plan | $1M for each adult member |

| Stolen funds reimbursement | Up to $1M | Up to $1M |

All of Aura’s plans include up to $1 million in coverage for each adult, $2 million for couples, and $5 million for families. This includes a solid reimbursement for stolen funds, helping you bounce back if identity theft happens. Identity Guard also provides $1 million in coverage for legal fees, lost wages, and other expenses, but you’ll need to show proof of your losses.

| Aura | Identity Guard | |

| Windows? | ✅ | ✅ |

| macOS? | ✅ | ✅ |

| Android? | ✅ | ✅ |

| iOS? | ✅ | ✅ |

| Browser extensions? | ✅ | ✅ |

Aura works on multiple platforms, making it easy to protect your digital life no matter where you are. You can use Aura on macOS, Windows, iOS, and Android devices. Plus, their mobile apps for iOS and Android let you manage your identity protection on the go. For safer browsing, Aura also offers browser extensions compatible with popular web browsers, ensuring a smooth and secure online experience.

Identity Guard is a cloud-based service that you can access through your browser, with mobile apps for both Android and iOS. The mobile apps are great for quick checks and alerts, but for more detailed management, the desktop version is the way to go.

Core identity protection capabilities: Who wins Aura and Identity Guard face-off?

Aura and Identity Guard are both top-tier when it comes to identity monitoring — but they take slightly different routes to get there. They’ll both watch your credit like a hawk, dig through the dark web for signs of your info, and keep tabs on your bank accounts. The trick is figuring out which one packs the extra punch you need.

Credit monitoring across the bureaus

| Aura | Identity Guard | |

| What does credit monitoring include? | – Three-bureau credit monitoring – Checking, savings, and investment account monitoring – Payday loan monitoring – Credit lock | – Three-bureau credit monitoring – Monthly Equifax credit score updates – Experian credit lock |

| See coverage details > | See coverage details > |

Aura keeps a close watch on your credit reports from Equifax, Experian, and TransUnion, so nothing slips by unnoticed. Any changes or inquiries made to your credit files are detected swiftly, and Aura sends you an alert right away, empowering you to act quickly to prevent potential fraud. You also get regular monthly credit scores and an annual credit report. However, credit reports are available just once a year, and no credit simulators or financial planning tools exist.

Meanwhile, we found that only two out of three Identity Guard plans include monitoring for all three credit bureaus, alerting you to early signs of fraud. The “Ultra” plan notifies you of suspicious activities via email, text, or phone, allowing quick action to protect your financial information. The “Total” plan offers daily monitoring and credit score updates but no credit reports. The “Value” plan doesn’t offer credit monitoring at all.

Compared to other services, Identity Guard’s “Value” plan lacks credit monitoring, which even some basic plans from competitors offer. However, the higher-tier plans provide robust monitoring and alerts that can help safeguard your financial health.

Dark web surveillance

Regarding the dark web, both Aura and Identity Guard are like digital detectives, tirelessly searching for traces of your personal information among cybercriminals. With Aura, you get dark web alerts in all plans. Their advanced tools scan thousands of sites daily, and if anything suspicious pops up, Aura quickly alerts you so you can secure your accounts.

Identity Guard also keeps a close eye on the dark web, even with its “Value” plan. They monitor 24/7 for any suspicious activity involving your SSNs, credit card details, and health insurance IDs. With IBM Watson’s help, Identity Guard scans black market websites, chat rooms, and underground forums. If your data is detected, they send you detailed alerts and helpful advice on how to protect your accounts.

Both services provide strong defenses and timely alerts, giving us peace of mind knowing our personal information is being vigilantly monitored.

Financial and investment account safeguards

When it comes to keeping our financial accounts secure, both Aura and Identity Guard really step up. Aura’s real-time alerts quickly flag any suspicious activities in our financial accounts. The best part is that this comprehensive protection extends across all of Aura’s plans. They monitor unusual spending and even transactions that might not show up on a credit report, like payday loans. Plus, Aura’s remediation services and lost wallet protection are lifesavers if you ever lose your wallet or get robbed.

On the other hand, Identity Guard also provides excellent monitoring for unauthorized transactions and offers actionable advice to help strengthen our financial defenses. The only hiccup is that their remediation services aren’t included in all plans, which can be a bit of a drawback when dealing with the hassle of restoring our identity. While their insurance coverage is solid, having someone to guide us through the remediation process is incredibly valuable.

Both services offer annual credit reports from the top three credit bureaus and include features that protect our investment accounts and credit cards. They also provide dark web monitoring and check any other data connected to our SSN and personal information. Overall, we’ve found that both Aura and Identity Guard are dedicated to protecting our financial health. Still, Aura wins this round for offering consistent credit monitoring across all plans.

Additional digital defenses: Aura vs Identity Guard’s digital add-ons

Beyond the core capabilities of identity protection, Aura and Identity Guard offer additional digital defenses to enhance their services.

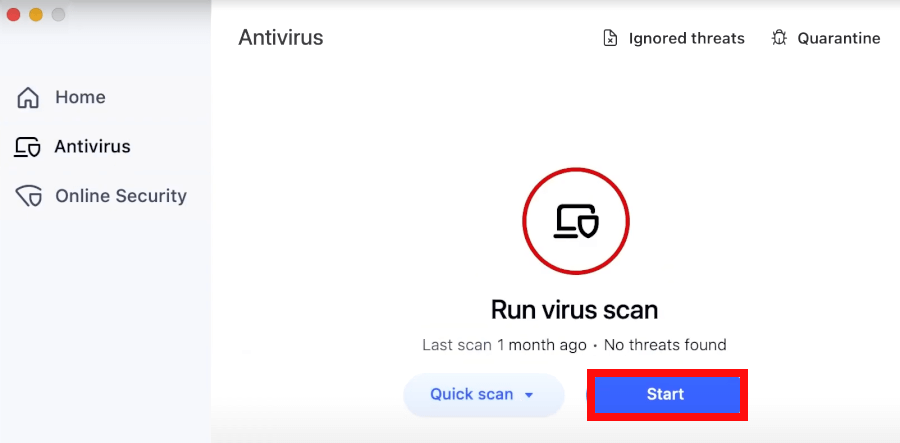

Antivirus and VPN protection

Aura includes antivirus and VPN protection in all its plans, while Identity Guard focuses more on monitoring and alerts, skipping the antivirus software. With Aura, you get a VPN that encrypts your internet browsing, making it super tough for anyone to spy on you. Their antivirus software is always on guard against malware threats.

Aura’s VPN uses AES-256 encryption, which is top-notch for keeping your internet connection secure, especially when you’re on public Wi-Fi. Even though Aura is based in the US (FVEY), its strict no-logs policy ensures your browsing habits stay private.

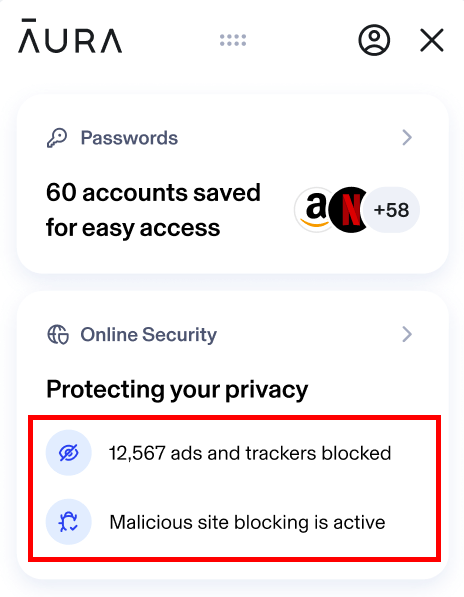

Ad and tracker blocking browser extension

Ad and tracker blocking are key to keeping your online activity private and free from annoying ads.

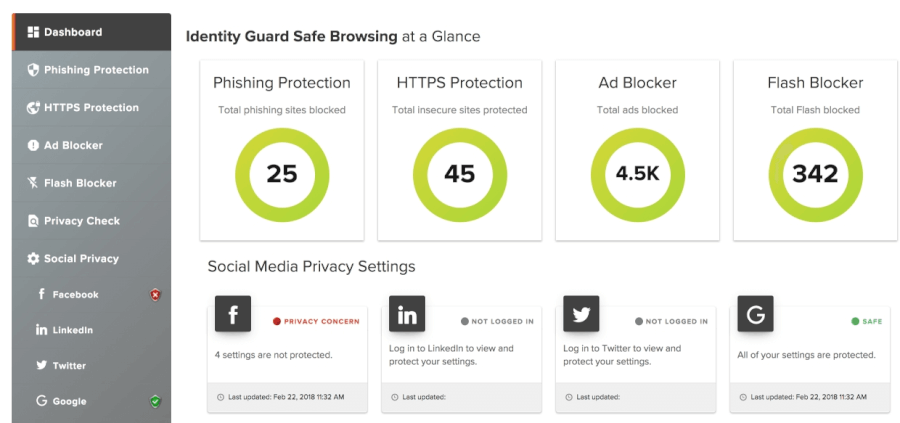

Identity Guard’s safe browsing features do a solid job of blocking ads and trackers, helping protect against invasive tracking and targeted ads.

Aura takes it a step further with its advanced ad and tracker-blocking technology.

We've found the Aura browser extension, compatible with Chrome, Firefox, and Edge, to be super effective in blocking digital tracking across all our devices. Just keep in mind that it relies on a browser extension, so if you want more comprehensive protection, a VPN ad-blocker might be a better choice since it covers all browsers and apps.

Secure password manager

Keeping our digital lives secure is crucial, and both Aura and Identity Guard have got us covered with their password managers.

We've found Aura’s password manager incredibly user-friendly and included in all their plans. It ensures our passwords are unique and secure, giving us peace of mind. Plus, each adult gets 1 GB of secure cloud storage in the Vault for important documents and passwords. And for the kids? Aura lets us set up profiles for them too, creating a secure online environment for everyone.

Identity Guard also offers a great password manager across its plans. It's a lifesaver for storing our passwords securely, so we don’t have to remember each one. It even gives us a heads-up if our credentials are weak or have been compromised.

While Aura’s broader security suite feels like a fortress, Identity Guard’s password manager still provides a strong line of defense against cyber threats.

Social media account monitoring and alerts

In today's digital world, where we share so much on social media, keeping an eye on our accounts is crucial. Identity Guard really steps up here with its social media account monitoring and alerts. Unlike Aura, Identity Guard offers this feature, giving you peace of mind by tracking harmful content and any suspicious activity on your accounts. If something fishy is going on, you'll get an alert right away. This proactive approach helps you stay ahead of potential issues and keep your online presence secure.

Aura vs Identity Guard: Which one’s simpler and more helpful?

When it comes to protecting your identity, ease of use and support are key. Aura stands out with round-the-clock customer support and a sleek, modern interface that's easy to navigate. Identity Guard is reliable but follows a more traditional approach, with some features only available in higher-cost plans.

Before we make a final decision, let's take a closer look at both services.

Setting up your protection

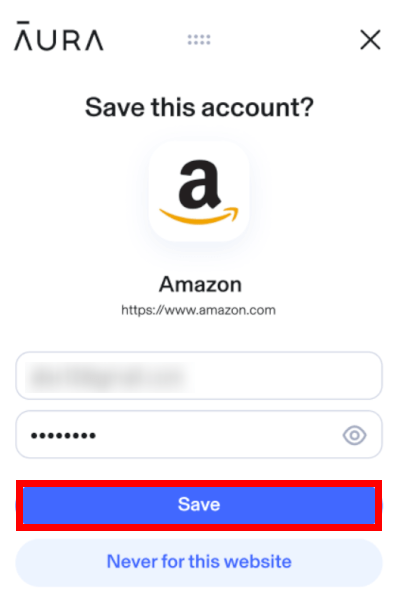

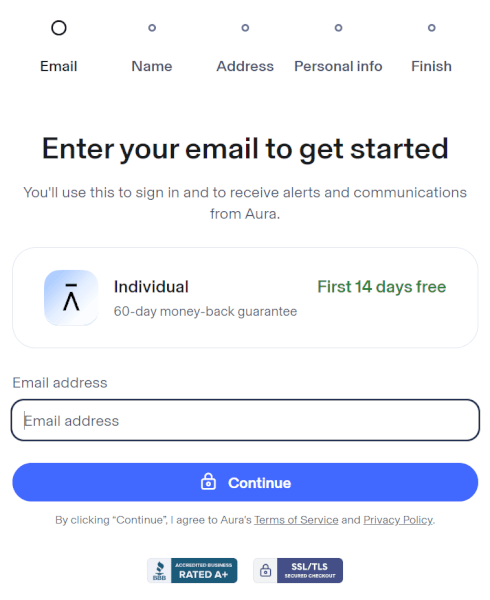

With Aura, setting up is a breeze. To sign up with Aura, head to their website, enter your name, email, phone number, and create a strong password. Once you’re in, the user interface is super intuitive. Features like VPN and antivirus are easy to access, and separate downloads for things like Safe Gaming keep everything simple. Plus, the browser extensions add an extra layer of security with password management and ad blocking.

Identity Guard, on the other hand, offers a three-tiered system, which means you might need to spend a bit more time selecting the right plan. However, the setup process remains user-friendly. After choosing your plan, you will create a password, enter your details, and provide a payment method. We appreciated the helpful pop-ups that explain why certain information is needed, which is beneficial if you’re new to this type of service. The dashboard is clear and easy to navigate, displaying your digital security status at a glance. Since it runs as cloud-based software in your browser, no downloads are required.

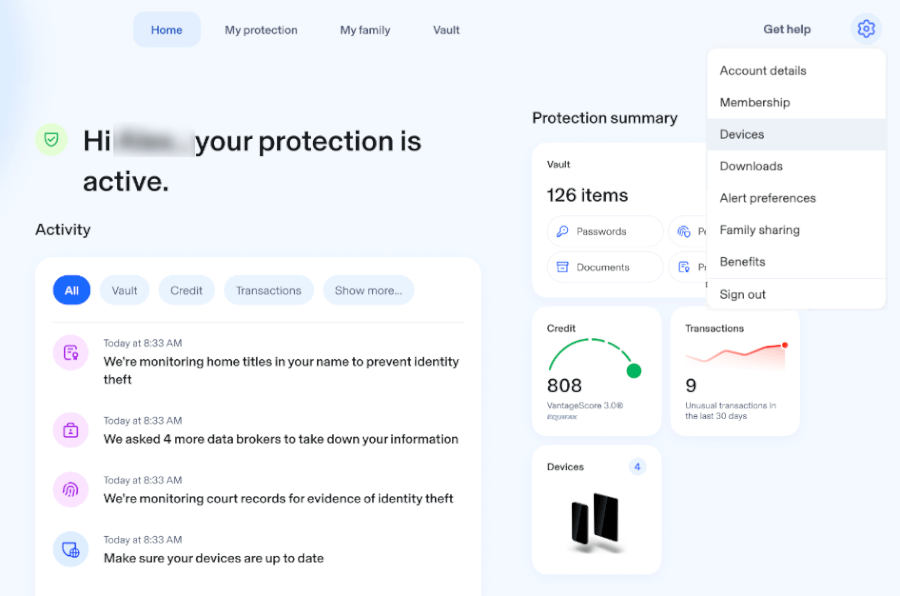

Navigating your dashboard and apps

Aura's app and dashboard are super user-friendly, even though they’re packed with features. It's easy to access identity alerts and manage settings. The desktop app pulls all the security features into one place, keeping us updated on our credit score, recent transactions, and the status of our personal information. We love that you can customize the dashboard to show what’s most important, like social media activities, financial account statuses, or the security of personal identifiers like Social Security and credit card numbers.

For mobile users, Aura’s app performs excellently on both iOS and Android platforms. Its sleek design makes managing protection on the go a breeze. It’s easy to manage your Aura account and link financial accounts for monitoring. Instant notifications keep you informed of any security issues, so you stay protected wherever you are. One thing we noticed, though, is that Aura has multiple apps for different features, which can sometimes make things a bit confusing compared to services that bundle everything into one app.

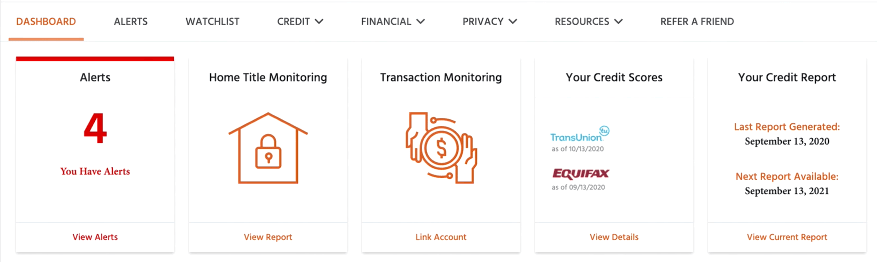

Identity Guard’s dashboard offers a more focused, streamlined experience. It gives quick access to popular tools like alerts, monthly credit score, credit reports and scores, home title monitoring, transaction monitoring, and security freeze. Everything is laid out clearly, so it’s easy to find and use the tools you need. For mobile use, Identity Guard offers apps for both Android and iOS, which are perfect for quick checks and receiving alerts. While the mobile app is handy for on-the-go monitoring, we found the desktop version essential for in-depth management.

Customer support and resources

When you need help, having reliable customer support is a game changer. Both Aura and Identity Guard offer solid support, but our experience with Aura really stood out due to its 24/7 availability, making it easy to get help whenever you need it. Identity Guard, while comprehensive, only offers support during specific hours and days, with no help on Sundays.

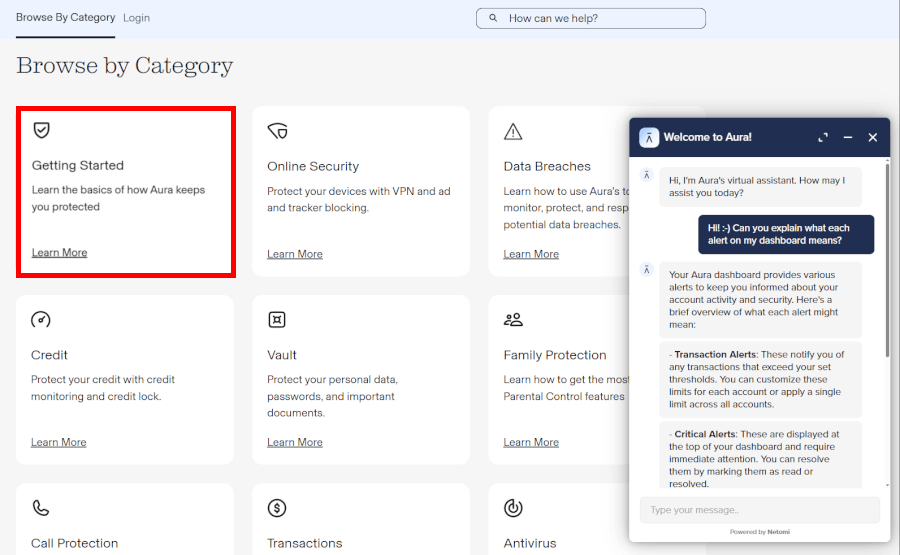

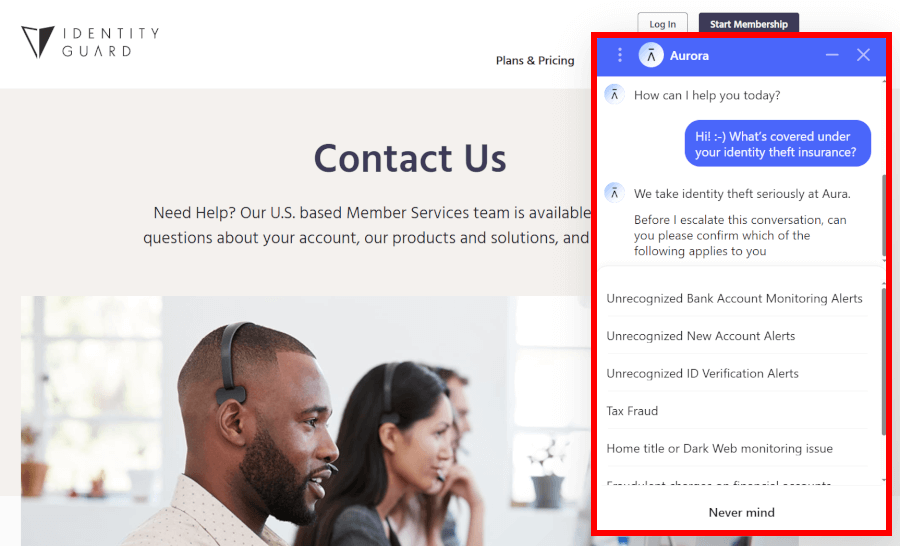

Aura’s US-based customer support is fantastic. Whenever we had an issue, we could reach out by phone, email, or live chat, and we always got quick, expert help. If identity theft happens, Aura’s dedicated fraud resolution specialists provide clear guidance and support, making the recovery process smoother. For those who prefer handling issues independently, Aura offers a comprehensive library of self-help documents and articles.

Identity Guard also delivers solid support via phone and email, and we found their representatives helpful and friendly. Their AI assistant adds a handy touch, providing quick answers to common questions anytime. You can reach real humans during normal business hours Monday through Saturday, plus weekday evenings, though they’re closed Sundays. While there’s no live chat, their phone and email teams are efficient. Plus, for emergencies, Identity Guard offers 24/7 access to a live representative, so you’re covered when it counts.

Financial health: Who offers more helpful credit reports and scores?

When it comes to keeping tabs on your financial health, both Aura and Identity Guard offer valuable tools like credit reports and scores. Aura ensures you stay in the know with monthly credit scores and annual reports from Equifax, Experian, and TransUnion, available across all their plans. This means you can easily track changes and address any issues promptly.

On the other hand, Identity Guard reserves three-bureau credit monitoring for its “Total” and “Ultra” plans. Opting for the “Ultra” plan gives you access to monthly credit scores and comprehensive alerts, while the Total plan offers essential alerts and a monthly credit score. Identity Guard also provides a risk management report, which gives you insights into your vulnerability to identity fraud, helping you stay proactive in protecting your identity.

Security and privacy: Is Aura or Identity Guard a safer choice?

When keeping your identity safe online, Aura and Identity Guard take slightly different paths while ensuring your security is their top priority. Aura stands out with its helpful parental controls and robust remediation services, providing peace of mind for families and individuals alike. On the other hand, Identity Guard shines in monitoring social media accounts, offering vigilant protection against digital threats.

Both services prioritize your security with features like two-factor authentication (2FA), adding an extra layer of defense to your accounts. Their shared commitment to privacy and data security is evident, backed by clear policies that protect your personal information from unauthorized access and misuse.

Aura's broad device compatibility and round-the-clock live chat support make managing your security straightforward and accessible. Meanwhile, Identity Guard ensures your data is securely encrypted through trusted third-party services, reinforcing its dedication to safeguarding your privacy.

When it comes to data handling, both Aura and Identity Guard are pretty transparent. They only collect the essential information needed to provide their services, making sure your data is managed with trust and care. Also, since Aura has acquired Identity Guard, their privacy policies are aligned.

Pricing and plans: Aura vs Identity Guard — Who gives you more bang for your buck?

When considering identity theft protection, both Aura and Identity Guard provide transparent pricing with options tailored to different needs.

| Aura plans | Price per month (paid monthly) | Price per month (paid yearly) |

| Individual | $15/month | $12/month ($9 with coupon) |

| Couple | $29/month | $22/month |

| Family | $50/month | $32/month |

Aura offers three well-structured plans for identity theft protection, each designed to cater to different needs:

- Individual: This plan is perfect for single users, priced at

$12 monthly($9/month with coupon) when billed annually. It encompasses $1 million in identity theft insurance, 1GB of secure cloud storage in the Vault, and comprehensive security for up to 10 devices. - Couple: Ideal for two users, this plan is available at

$22 per month($17/month with coupon) with annual billing. It includes the same $1 million insurance coverage for identity theft, doubles the cloud storage to 2GB, and extends device security coverage to 20 devices. - Family: Designed with families in mind, this plan is priced at

$37 per month($25/month with coupon) when billed annually. It significantly increases the insurance coverage to $1 million per adult, provides a generous 5GB of cloud storage space, and secures up to 50 devices.

Exclusive Aura Coupon:

Get 68% Off Aura subscription plans with the coupon below:

(Coupon is applied automatically; 60 day money-back guarantee.)

If safeguarding your children is your main concern, Aura’s “Kids” plan is an excellent choice. It offers parental controls powered by Circle, ensuring safe browsing and time management across all devices for an unlimited number of children.

Each plan includes $1 million identity theft insurance and 24/7 support, backed by a 60-day money-back guarantee.

At the same time, Identity Guard offers several tiers:

- Value: At $6.67 per month, this plan includes basic identity theft protection, including dark web surveillance and high-risk transaction alerts.

- Total: Priced at 11.99 per month, this plan offers comprehensive protection, including credit monitoring, dark web surveillance, high-risk transaction alerts, and social media account monitoring.

- Ultra: At $17.99 per month, this top-tier plan provides the most extensive coverage. It includes all features from the “Total” plan, plus enhanced fraud resolution services and regular credit score updates.

For those seeking family-focused protection, Identity Guard offers plans ranging from $6.67 to $39.99 per month, covering up to five adults and an unlimited number of children. These family plans ensure comprehensive coverage for your entire household.

Aura or Identity Guard: Which identity protection service wins?

Choosing the right identity protection service means finding one that aligns with your specific needs. Aura stands out with its robust security tools, quick fraud alerts, and clear insurance policies, making it ideal for families. Its modern interface is user-friendly, and the option for a risk-free trial adds peace of mind.

On the other hand, Identity Guard offers reliable protection and essential services tailored to different needs. While it lacks a free trial, its tiered plans provide flexibility and strong security measures.

In summary:

Trustworthiness: Aura

Availability and insurance: Aura

Core identity protection: Aura

Additional digital defenses: Aura

Ease of use and support: Aura

Financial health reports: Aura

Security and Privacy: Aura

Plans and pricing: Aura

Aura takes the lead in this comparison, thanks to its extensive features and commitment to customer satisfaction. While Identity Guard provides specialized services with a solid reputation, Aura's robust protection suite and competitive pricing make it the clear winner.

Three situations where you might prefer to go with Identity Guard

Here’s a fast breakdown to point you toward the better fit:

| Your Top Priority | Recommended Service | Why? |

|---|---|---|

| Tiered plans with precise feature control | Identity Guard | Lets you pay only for the monitoring depth you want |

| Advanced alerts & social media monitoring | Identity Guard | Stronger AI insights and neighborhood watch features |

| Lowest possible entry price | Identity Guard | Value plan delivers core identity monitoring cheaper |

Identity Guard if you prefer customizable tiers and potentially lower costs. Start with the plan that matches your main concern, and you’ll get solid coverage without overpaying.

Identity theft protection comparisons on CyberInsider:

- Aura vs LifeLock

- Aura vs Experian IdentityWorks

- IDShield vs Aura

- Aura vs McAfee

- Aura vs NordProtect

- LifeLock vs IDShield

- Aura vs Incogni

- Aura vs IdentityIQ

- Aura vs IDShield

- Identity Guard vs LifeLock

- Identity Guard vs NordProtect

- LifeLock vs Experian Identity Works

Identity Guard vs Aura FAQ

Are Aura and Identity Guard the same?

No, Aura and Identity Guard are not the same but they share a strong connection due to Aura's acquisition of Identity Guard. Aura stands out with its superior features and functionality, offering a comprehensive suite of digital security tools, including antivirus, VPN, and parental controls. Meanwhile, Identity Guard is known for its more budget-friendly options, making it accessible for users looking to save money.

What are the main differences between Aura and Identity Guard?

The main differences between Aura and Identity Guard lie in their additional features and approach to identity protection. Aura offers a more holistic security suite, including antivirus software, VPN, and parental controls, making it ideal for families. Identity Guard focuses on specialized identity monitoring tools and social media oversight.

Additionally, Aura includes consistent credit monitoring across all plans, whereas Identity Guard reserves some features for higher-tier plans.

Which service is better for families, Aura or Identity Guard?

Aura is generally considered better for families due to its comprehensive suite of digital security tools. It includes antivirus protection, VPN, parental controls, and generous insurance coverage of up to $5 million for families. These features ensure robust protection for all family members, making Aura a more attractive choice for households seeking all-encompassing security.

Leave a Reply