Identity theft isn’t slowing down — and neither are the companies promising to stop it. The challenge? Figuring out which ones are all talk and which actually deliver.

We took a deep dive into two big names: Aura and Experian IdentityWorks. Both come packed with features, but only one stood out during our hands-on testing — and not always for the reasons you’d expect. Curious about what really sets them apart? Dive into the full feature comparison!

From fast alerts and device security to parental controls and credit monitoring, there’s a lot to unpack. Whether you’re just getting started or considering a switch, this guide will help you make a confident, informed choice — without the guesswork.

| Aura | Experian IdentityWorks | |

| Website | Aura.com | Experian.com |

| Pricing | $12 – $32/month | $24.99 – $34.99/month |

| Money-back guarantee | 60 days | 7 days |

| 3-bureau credit monitoring | Yes (across all plans) | Yes (with paid plans) |

| 24/7 customer support | Yes | No |

| Identity theft insurance | Up to $1 million (up to $5 million with family plans) | Up to $1 million |

| Best deal | 50 – 60% Off Coupon > | N/A |

Key takeaways from Aura and Experian IdentityWorks comparison

- Aura brings the whole family under one digital roof — with 24/7 support, rock-solid parental controls, and a firm “we don’t sell your data” policy. It’s a privacy-first pick that won’t empty your wallet.

- Experian IdentityWorks plays to its strengths with detailed alerts, excellent credit tracking, and even a free plan if you're just testing the waters — all backed by a household name in credit.

- Both offer up to $1 million in identity theft insurance, but when it comes to overall value? Aura wins, especially with this 68% off coupon.

How to choose the best identity theft protection: Aura vs Experian IdentityWorks

Whether you’re flying solo or guarding your whole family’s digital lives, picking the right identity protection service comes down to the fine print—and the perks. Let’s break it down:

Identity theft insurance – Both Aura and IdentityWorks come with a $1 million safety net. If identity thieves crash your party, this coverage helps clean up the mess, financially speaking.

Three-bureau credit monitoring – Identity theft can pop up anywhere, so keeping an eye on all three credit bureaus is a must. Thankfully, both Aura and IdentityWorks have plans that keep tabs on Equifax, Experian, and TransUnion. Nothing slips through the cracks.

Family plan options – Got kids glued to screens? Aura’s family plan is built for today’s digital families, with smart extras like parental controls. IdentityWorks also covers up to ten kids and two adults, but it’s a bit more “classic coverage” than “kid-smart.”

Affordable pricing and additional discounts – Aura dishes out great value, especially with its annual plan discounts (plus, keep an eye out for limited-time deals). IdentityWorks offers a variety of plans, so there’s something for most budgets — just a bit less bang for your buck.

- Money-back guarantee – Trying before buying? Aura gives you 60 days to kick the tires on an annual plan. IdentityWorks? A 7-day trial. Blink and it’s over.

By weighing these factors against your needs, you can decide if Aura or Experian IdentityWorks is the right choice for you.

Aura vs Experian IdentityWorks: Digital defense face-off

It’s Aura vs Experian IdentityWorks, with both services stepping into the spotlight to show off their strengths:

| Aura | Experian IdentityWorks | |

| Pricing (billed annually) | $12 – $32/month | $24.99 – $34.99/month |

| Family-focused plans and features | ✅ | ✅ |

| 3-bureau credit monitoring and reports | ✅ (across all plans) | ✅ (with paid plans) |

| Dark web monitoring and alerts | ✅ | ✅ |

| Identity theft insurance | Up to $1 million | Up to $1 million |

| Social media account alerts | ❌ | ✅ |

| Credit lock | ✅ | ✅ |

| Lost wallet remediation | ✅ | ✅ |

| Antivirus and VPN | ✅ | ❌ |

| Password manager | ✅ | ❌ |

| 24/7 customer support | ✅ | ❌ |

| Best deal | 60% Off Coupon > | N/A |

Time to dig into how Aura and Experian stack up when it comes to trust and credibility.

Aura vs Experian IdentityWorks: Who wins on trust?

In the world of identity theft protection, flashy features only go so far — what counts is trust. Aura and IdentityWorks both promise peace of mind, but let’s see how they measure up when it comes to earning it.

Let’s kick things off with Aura.

Aura overview

| Starting price | $12/month |

| Supported platforms | Windows, macOS, Android, and iOS |

| Identity theft insurance | $1M – $5M ($1M per adult) |

| Security and privacy extras | VPN, antivirus, password manager, and parental controls |

| Best deal | 68% off coupon > |

Aura may be a relative newcomer — it launched in 2014 — but it’s made a big splash in the identity protection world. Founded by Hari Ravichandran, Aura has quickly built a reputation for serious digital security with a user-first attitude. What makes it stand out? A crystal-clear privacy policy (no sneaky data-selling here), robust identity theft protection, and coverage that extends across your digital life.

Thanks to smart acquisitions like Identity Guard, Aura has crafted flexible plans for individuals, couples, and families alike. Today, it protects over a million members around the globe.

Users seem to love it too. Aura boasts a 4.3 out of 5 TrustScore on Trustpilot, based on 800+ reviews, with a whopping 86% of them giving it five stars. Between its lightning-fast alerts, fraud support that helps, and commitment to privacy, Aura is a modern go-to for staying safe online.

Aura pros and cons

Before you hit that “subscribe” button, here’s a quick rundown of what Aura nails — and where it might fall short:

+ Pros

- Antivirus software across all plans

- Comprehensive identity theft protection and credit monitoring services

- Dark web monitoring

- Fraud call protection

- Up to $1 million in insurance coverage

- Plans for individuals, couples, and families

- Useful parental control app

- Password manager and VPN included

- 24/7 customer support and fraud resolution

- Transparent pricing

- 3-bureau credit monitoring included in all plans

– Cons

More expensive than some competitors

See the latest Aura prices and deals.

Now that Aura’s had its moment, let’s see what IdentityWorks is working with.

Experian IdentityWorks overview

| Starting price | $24.99/month |

| Supported platforms | Android, and iOS |

| Identity theft insurance | $1M |

| Security and privacy extras | Social media monitoring and lost wallet assistance |

| Best deal | N/A |

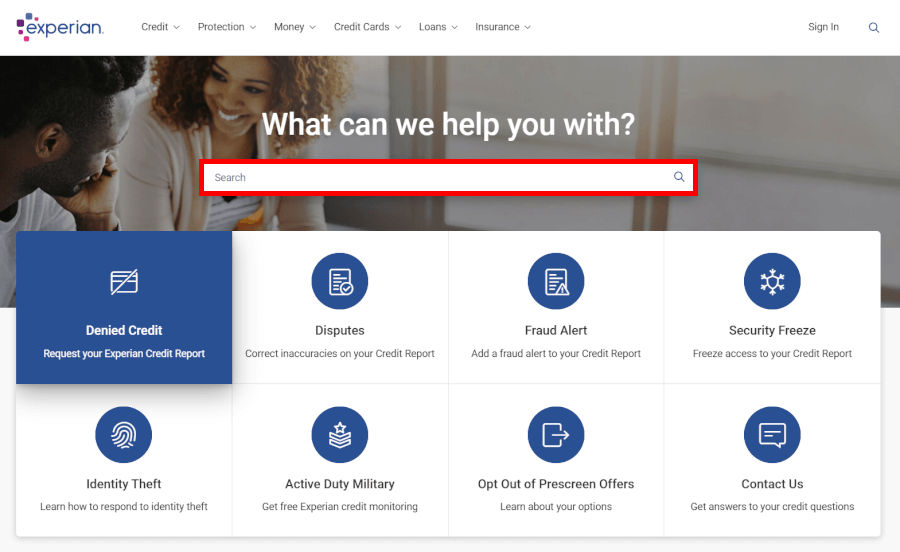

Experian IdentityWorks comes with some serious street cred—after all, it’s backed by Experian, one of the “Big Three” credit giants alongside TransUnion and Equifax. With roots going back to 1996 and headquarters in Dublin, this global heavyweight keeps tabs on the credit profiles of over a billion people and businesses. If anyone knows credit monitoring inside and out, it’s these folks.

But even big names have their bumps. While Experian brings world-class data analytics to the table, it’s also weathered a few storms — most notably a massive data breach in 2015 that impacted around 15 million people. And in 2020 and 2021, data exposures in South Africa and Brazil leaked personal and financial info of millions more. Yikes.

Still, these incidents serve as a reminder of how important it is to have a strong line of defense when it comes to your identity. That’s where IdentityWorks steps in, offering credit-savvy tools and protection features for those who want security from a trusted industry name — just with eyes wide open.

Experian IdentityWorks pros and cons

Now that we know the backstory, let’s size up the perks and pitfalls of going with Experian:

+ Pros

A 7-day trial period

Enhanced alert system

Protection plans for individual users and families

Yearly payment discounts

Comprehensive credit monitoring across the three major credit bureaus

A permanent free plan with essential features

Mobile apps for iOS and Android

Identity theft insurance with paid subscriptions

Option to include another adult and up to 10 children in the family plan

– Cons

Limited to Experian credit reports in the basic plan

Pricier than some other options on the market

Potential sharing of user data with third parties for marketing purposes

Privacy concerns due to previous data breaches

No live chat support

Availability and insurance coverage: Who offers the fuller safety net?

| Aura | Experian IdentityWorks | |

| Identity theft insurance amount | $1M for each adult member, up to $2M on the “Couple” plan, and up to $5M on the “Family” plan | Up to $1M with “Premium” and “Family” plans |

| Stolen funds reimbursement | Up to $1M | Up to $1M |

Insurance coverage can be the ultimate tie-breaker in the race to protect your identity. Luckily, both Aura and Experian IdentityWorks come in strong with up to $1 million in identity theft insurance. But Aura doesn’t just stop at “strong” — it steps it up with coverage for every adult on the plan, including everything from legal fees to lost wages and even travel expenses if identity theft throws your life off course.

First things first — where can you actually access these tools? Let’s break it down:

| Aura | Experian IdentityWorks | |

| Windows | ✅ | ❌ |

| macOS | ✅ | ❌ |

| Android | ✅ | ✅ |

| iOS | ✅ | ✅ |

Aura’s also easy to access wherever you are. It runs smoothly on MacOS (10.15 or later), Windows 10 and 11, and even slips into your favorite browser with extensions for Chrome, Firefox, and Edge. And if you're constantly on the go? The Aura mobile app is polished and powerful on both iOS and Android.

IdentityWorks, meanwhile, keeps things simple with mobile access through the Experian app, available on Android and iOS. There's just one catch — there’s no separate app for IdentityWorks, which might leave some users scratching their heads.

Core identity protection capabilities: Who gets the fundamentals right, Aura or Experian?

Aura keeps watch with instant alerts, bank account monitoring, and sharp-eyed surveillance. Meanwhile, Experian IdentityWorks leans into its credit bureau muscle with top-tier credit monitoring and dark web scans. They’re both tough, but only one might be the best fit for your digital life. Let’s break it down.

Credit monitoring capabilities

When it comes to keeping tabs on your credit, both Aura and Experian IdentityWorks pack some serious punch. Aura delivers three-bureau monitoring across all its plans — no upsells needed — and alerts you the moment something fishy pops up. Plus, if you’ve got kids, Aura throws in child credit freezes to lock down their identities before fraudsters even have a chance.

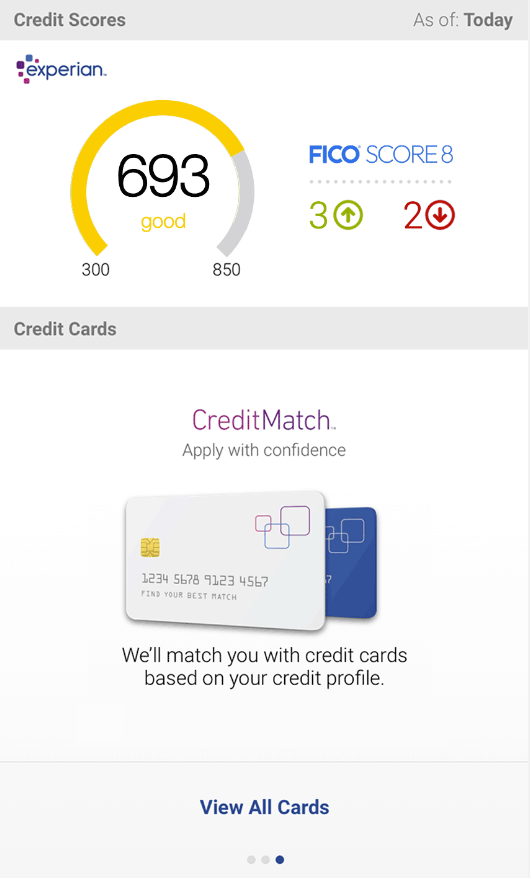

On the other hand, Experian IdentityWorks flexes its credit bureau muscle with daily credit reports, FICO scores, and its slick Experian CreditLock tool for fast, one-click credit file freezes. That said, full three-bureau monitoring only comes with the top-tier plan, and there's no credit freeze option for kids.

So, while both tools offer strong credit protection, Aura takes the win for families and anyone wanting full-spectrum coverage right out of the gate.

Dark web surveillance

The dark web is where stolen identities go to find a buyer, so keeping tabs on it is a must. Both Aura and Experian IdentityWorks do a solid job here, but their styles differ a bit.

Aura shines with powerful dark web monitoring, offering on-demand scans and lightning-fast alerts if your info, like your SSN, passwords, or even old email addresses, shows up in sketchy corners of the internet. It’s all about quick reaction time, and Aura nails it.

IdentityWorks takes things further by including social media in its surveillance net. That means it’s not just looking for stolen logins — it’s watching your digital reputation too. Daily scans help detect breaches, but the social media coverage gives Experian an extra edge if you’re active online.

Bottom line? Aura wins on speed and detail, while Experian scores points for casting a wider net, especially when your social life is part of your digital life.

Financial and investment account safeguards

In the fight against identity theft, your bank and investment accounts deserve top-notch security. Aura leads the charge with transaction monitoring that alerts you to unusual activity, plus extra safeguards for property title changes — a must-have for homeowners and investors alike. You can set thresholds so you’ll know if someone tries to move too much money.

Experian IdentityWorks also helps guard your financial identity, alerting you if someone tries to use your SSN to open new accounts or link fraudulent addresses. While both services offer strong protection, Aura’s deeper, more customizable financial monitoring gives it a strong edge, especially for families who want detailed oversight.

Monitoring and alerts

When it comes to staying one step ahead of identity thieves, real-time alerts and sharp-eyed monitoring are non-negotiable. Aura does an impressive job of watching over everything from your SSN to your passport and bank account details. If anything fishy happens, you’ll be the first to know — thanks to Aura’s super-fast fraud alerts that help you jump into action quickly.

Experian IdentityWorks also pulls its weight, monitoring a broad range of identity markers, including credit reports, address changes, payday loan applications, and the dark web. It’s a strong lineup, but Aura edges ahead with more detailed coverage of sensitive personal data and faster alerts, making it easier to stay in control.

Assistance after identity theft

If identity theft strikes, you’ll want backup that goes beyond just alerts, and that’s exactly what Aura delivers. They don’t just send warnings; they roll up their sleeves and help with three-way calls, paperwork, and disputes. You’ll get instant transaction monitoring across banks, credit cards, and even investment accounts, plus up to $1 million per adult in stolen fund reimbursement and recovery expenses. Talk about a solid safety net!

Experian IdentityWorks also has your back with up to $1 million in coverage and useful fraud resolution tools. The “Premium” plan helps keep tabs on your bank and credit card activity, flagging anything fishy like suspicious wire transfers.

While both services offer essential post-theft help, Aura’s all-in approach, with investment protection and a higher insurance cap for families, makes it a tough one to beat.

Additional digital defenses: Who packs more powerful extra tools?

Aura doesn’t just protect your identity — it wraps it in digital bubble wrap with a bunch of bonus tools. In contrast, Experian IdentityWorks keeps things more traditional, focusing squarely on credit and identity alerts.

So, let’s unpack the bonus features and find out which service gives you more bang for your cybersecurity buck.

Lost wallet assistance

Losing your wallet is the kind of plot twist no one wants, but Aura and IdentityWorks both offer a happy ending. Aura impressed us with how smoothly they handled our lost wallet drama. They didn’t just cancel and reissue cards — they also helped us stay ahead of any potential identity threats with a smart recovery plan.

IdentityWorks is no slouch either. Their lost wallet assistance guides you through the process, helping cancel cards and get replacements issued. Just keep in mind that the effectiveness can vary depending on how fast your bank and their support team act.

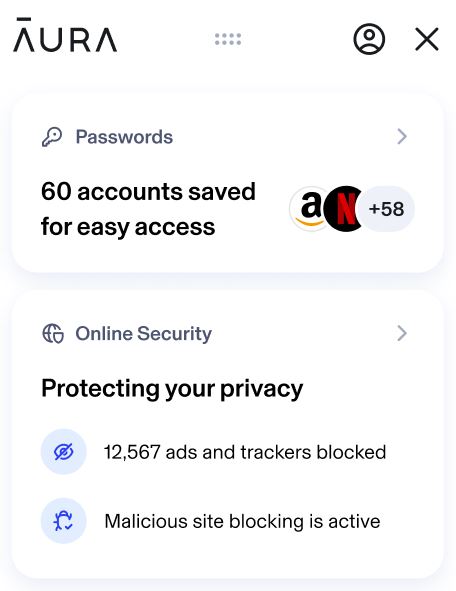

Ad-blocking browser extension

Aura’s ad-blocking extension for Chrome, Firefox, and Edge is a solid privacy booster. It blocks intrusive ads, stops creepy trackers in their tracks, and even masks your email — all while sitting quietly inside your browser. It also flags malicious websites, helping you dodge scams and phishing traps before they strike.

We did notice a few extra verification prompts, especially during Google searches. While it can momentarily slow things down, we saw it as a fair trade-off for the extra protection. If you want a privacy tool that packs a punch without getting in your way, this one’s worth a look.

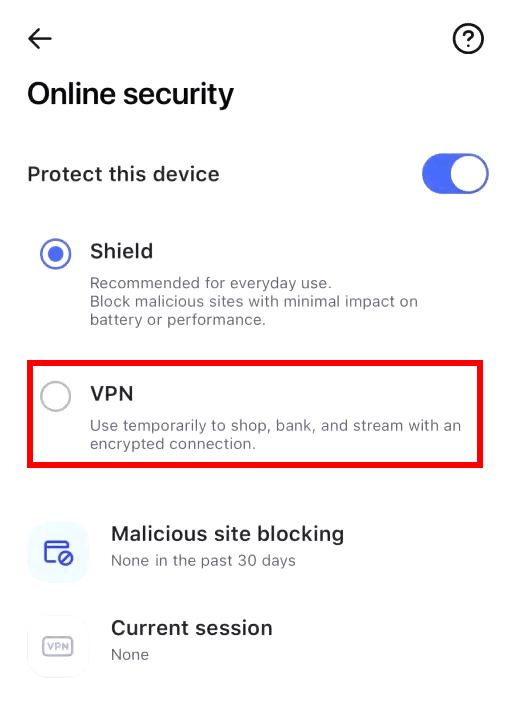

VPN protection

Aura’s VPN is your one-tap ticket to safer browsing. It uses top-tier AES-256 encryption and a no-logs policy to keep your data locked down, even when you're connected to public Wi-Fi. Whether you're working remotely or scrolling at a cafe, you’re covered.

But it’s not just about security — Aura’s VPN now comes with over 100 virtual locations, letting you switch between more than 20 US and 80 international servers. That means better access to global content, without sacrificing speed. We found it blazing-fast for everything from Netflix to online gaming. Setup is a breeze too: open the app, toggle on the VPN under “Online Security,” and enjoy private browsing across all your devices.

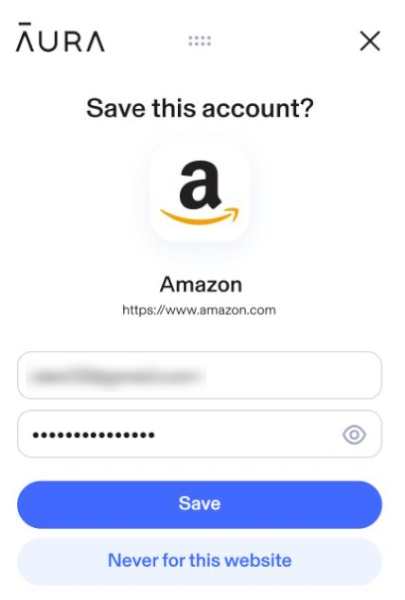

Secure password manager

We’ve really come to appreciate Aura’s password manager in day-to-day use. It quietly saves our logins as we browse and makes them easy to access later, whether we're on the mobile app or using the Chrome extension. It’s one of those tools that just works without getting in the way.

The 1 GB of secure cloud storage per adult came in handy for keeping documents safe, and we liked that you can add kids’ profiles to the vault, too. It's a thoughtful extra that makes it feel more like a family tool than another password locker.

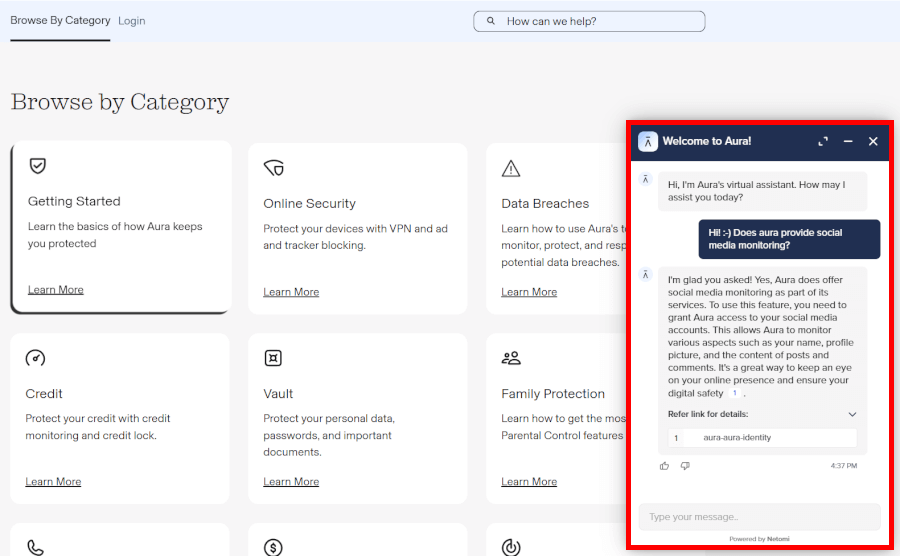

Social media monitoring

When it comes to social media monitoring, Experian IdentityWorks takes the lead by actively tracking your posts to prevent any that might harm your identity or reputation. With so much of our lives online these days, this feature is a game-changer in keeping your online presence secure. It’s like having a digital bodyguard for your social media profiles.

Unfortunately, Aura doesn't include social media monitoring in its toolkit, so you’ll need to manage your social presence on your own. However, for parents, Aura's parental controls at least give insight into the time spent on social media apps, though they don’t show what exactly is going on inside those apps.

AI-powered spam call and text protection

Spam calls and scam texts can be a nightmare, but Aura’s AI-powered call assistant handles them with ease. It blocks unwanted calls, filters out scam texts, and even checks links for phishing attempts, sending any suspicious messages to your junk folder. It's a feature we found super useful.

Ease of use and support: Is Aura or Experian IdentityWorks more user-friendly?

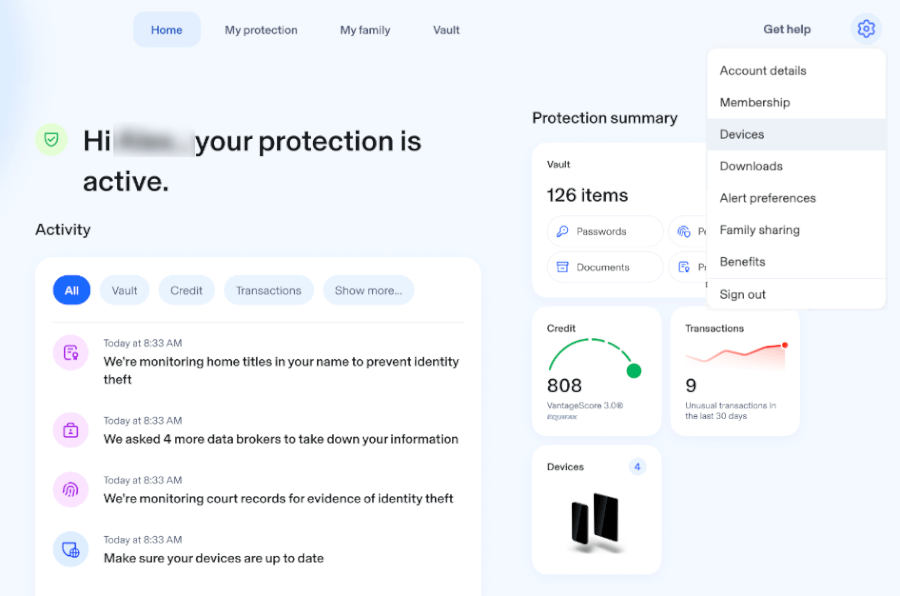

When we tried Aura, we were pleasantly surprised by how easy it was to set up. The interface is super intuitive, making it simple to manage everything, especially if you’ve got kids to protect. We appreciated how user-friendly it felt from the start!

On the flip side, IdentityWorks packs a punch with tons of features and alerts. While it’s great to have all those tools, the platform can feel a bit overwhelming.

User interface and navigation

Navigation can make or break your experience. We’ll break down how Aura and Experian IdentityWorks handle usability.

With Aura's user-friendly interface and smooth mobile app, protecting your identity has never been easier.

Signing up with Aura is a breeze, and the desktop app’s customizable dashboard keeps your focus on the essentials like finances and personal data.

With a feature-packed online platform, Experian IdentityWorks offers plenty to explore, but it might take a little navigation to get the hang of it. The app is handy for identity monitoring and alerts, but it isn’t as sleek as Aura’s. After registration, the dashboard serves up essential info, while the app ensures you’re always alerted when something’s up.

Customer support and resources

Customer service is a critical aspect of any service-oriented company, especially in the identity theft protection space where you might need immediate help.

Aura really sets the bar high when it comes to support — we gave it a spin, and here’s what stood out:

24/7 expert fraud support: We reached out at odd hours (for science), and still got through to friendly, US-based specialists with serious know-how. These pros had answers ready for everything we threw at them.

Dedicated fraud resolution team: If your identity ever gets compromised, Aura’s got a team just for that. They don’t just hand you instructions — they walk you through each step to help untangle the mess.

Multiple contact options: Whether we called +1 833-552-2123, emailed support@aura.com, or used the live chat during business hours, support was easy to reach and quick to respond.

Comprehensive help center: For those of us who like to poke around on our own first, Aura’s help center is full of genuinely useful guides and how-tos. We found answers fast, without the fluff.

All in all, Aura made us feel like there was always someone ready to help, whether we needed quick answers or full-on support during a crisis.

On the other hand, Experian IdentityWorks has received mixed feedback about its customer service. The absence of 24/7 availability and real-time online chat options is a notable downside, particularly in urgent situations where time is of the essence. Some users have encountered difficulties when trying to connect with a live representative for assistance.

Here's a breakdown of the support options offered by IdentityWorks:

Phone support: You can call 877-890-9332 during business hours, but reaching an actual human can sometimes feel like a waiting game. A few of us had to try more than once just to get someone live.

Online help center: It's there, but don’t expect in-depth walkthroughs. We found it a bit too generic—fine for basics, but not much help when you're in the weeds.

No live chat: This one stung. We missed the convenience of a quick chat window for fast answers. It's 2026 — this should be standard.

No direct email support: There’s no clear email option to contact support, which makes getting help feel more like jumping through hoops than it should.

No 24/7 customer support: If your identity gets hit at 9 PM on a Saturday (like it did for one of us once), you’ll have to wait until Monday. Not ideal when time really matters.

Tiresome retention tactics: A couple of us tested what it’s like to cancel — and let’s just say, the process felt more like negotiating with a clingy ex. Lots of pushback and long calls.

Bottom line? While IdentityWorks has some solid tools, its support experience lags behind, especially when you need quick help or something more personal.

Financial health: Who offers more helpful credit reports and scores?

When it comes to keeping your credit in check, both Aura and IdentityWorks deliver. IdentityWorks throws in quarterly reports and daily credit scores if you're on the “Family” plan — great for folks who like frequent updates and love the FICO model.

Aura takes a more laid-back but still solid approach, offering credit reports and VantageScore tracking. It's not every single day, but in our experience, it’s more than enough to stay on top of your financial health without feeling overwhelmed.

One thing IdentityWorks does well? It flexes its credit bureau muscles with extras like credit file locks and personal info removal from certain websites. So, if your main concern is credit — and lots of it — you might find IdentityWorks worth the extra clicks. But if you want a clean, all-in-one dashboard without the clutter, Aura holds its own just fine.

Security and privacy: Is Aura or Experian IdentityWorks a safer choice?

Aura talks the privacy talk, with bank-level encryption and big-name partners like Walmart and Bank of America backing it up. It does share some data with third parties, but exactly how isn’t crystal clear. Still, in our tests, Aura gave us plenty of reasons to feel secure.

Experian IdentityWorks also takes safety seriously, using SSL encryption and auto logouts to keep your info locked down. You’ll even need the last four digits of your SSN to log in — pretty solid.

That said, Experian’s history of data breaches makes us raise an eyebrow. If privacy is high on your list, you might lean toward a provider with a cleaner track record.

Plans and pricing: Aura or Experian IdentityWorks, who offers more for less?

When it comes to choosing an identity theft protection service, price can be a deal-breaker — or a total win. It’s all about striking the right balance between what you pay and what you get.

| Aura plans | Individual | Couple | Family |

|---|---|---|---|

| 1-month | $12.00/month | $20.00/month | $30.00/month |

| 1-year | $9.00/month | $17.00/month | $25.00/month |

Deal: Get 68% discount on Aura's yearly plans >

Aura offers three well-structured plans, each tailored to meet different user needs:

- Individual: Perfect for solo users, this plan costs $12 per month (or $9/month with this coupon), billed annually. You get $1 million in identity theft insurance, 1GB of secure cloud storage, and protection for up to 10 devices.

- Couple: Ideal for two adults under one digital roof, this plan runs $22 per month (or $17/month with this coupon), billed annually. It includes 2GB of cloud storage, insurance coverage for both users, and secures up to 20 devices.

- Family: Built for busy households, this plan costs $37 per month (or $25/month with this coupon), billed annually. It offers $1 million in coverage per adult, 5GB of storage, and device protection for up to 50 devices.

For families who just want kid-safe browsing and screen time controls, there’s also the “Kids” plan at $10/month (billed annually). It covers an unlimited number of children, but heads up, it doesn’t include full identity theft protection.

Exclusive Aura Coupon:

Get 68% Off Aura subscription plans with the coupon below:

(Coupon is applied automatically; 60 day money-back guarantee.)

Every Aura plan includes $1 million in identity theft insurance per person, so everyone’s covered. You’ll also get 24/7 access to their US-based support team, which we found super responsive.

And if you’re on the fence? Aura offers a 60-day money-back guarantee on annual plans, so you’ve got time to test the waters without feeling locked in.

Let's now take a closer look at IdentityWorks.

| IdentityWorks plan | Price |

| Basic | Forever-free |

| Premium | $24.99/month (after 7-day trial) |

| Family | $34.99/month (after 7-day trial) |

So, Experian IdentityWorks serves up three plans:

Basic: Free! You’ll get an Experian credit report, FICO score, dark web scanning, and privacy scans for your peace of mind.

Premium: For $24.99/month, it adds more coverage with three-bureau credit monitoring, monthly privacy scans, and enhanced identity theft monitoring.

Family: At $34.99/month, this one expands on Premium with coverage for an extra adult and up to 10 children. Perfect for families looking to protect more than one identity.

All paid plans come with a 7-day trial, but just a heads up — IdentityWorks’ pricing might seem a bit steeper than other options out there.

Conclusion: Is Aura or Experian IdentityWorks best?

After diving deep into the features of Aura and IdentityWorks, here's how they measure up across various categories:

Trustworthiness: Aura

Availability and insurance coverage: Aura

Core identity protection capabilities: Aura

Additional digital defenses: Aura

Ease of use: Aura

Support: Aura

Financial health reports: Experian IdentityWorks

- Security and privacy: Aura

Plans and pricing: Aura

In the end, Aura takes the crown as the ultimate all-in-one solution, especially for families. With its killer combo of features and incredible value, Aura is a game-changer. From strong privacy protections to top-tier identity theft insurance, plus extras like antivirus, VPN, and a password manager — it’s the full package.

While both services have their perks, Aura’s broad range of protections makes it the clear winner, especially for those who want the most bang for their buck.

Ready to test it out? Snag this coupon for the best deal!

Exclusive Aura Coupon:

Get 68% Off Aura subscription plans with the coupon below:

(Coupon is applied automatically; 60 day money-back guarantee.)

Identity theft protection comparisons on CyberInsider:

- Aura vs LifeLock

- IDShield vs Aura

- Aura vs McAfee

- Aura vs NordProtect

- Aura vs Incogni

- Aura vs IdentityIQ

- Aura vs IDShield

- Identity Guard vs Aura

- Identity Guard vs LifeLock

- Identity Guard vs NordProtect

- LifeLock vs IDShield

- LifeLock vs Experian Identity Works

Aura vs Experian IdentityWorks FAQ

Which is better, Aura or Experian IdentityWorks?

Aura takes the lead as the better all-around pick, especially if you’re after rock-solid identity protection, a bunch of helpful digital tools, and features the whole family can use.

Sure, Experian IdentityWorks deserves credit (pun intended) for its daily FICO score updates and solid credit monitoring, but Aura sweeps the rest. From always-on support to built-in perks like antivirus, VPN, and a password manager, it’s an all-in-one safety net that’s also super user-friendly and refreshingly clear about its pricing.

Can I try Aura or IdentityWorks for free?

You can try both, but Experian IdentityWorks has a forever-free “Basic” plan, while Aura gives you a generous 60-day money-back guarantee on annual plans. IdentityWorks also offers a 7-day trial for its paid tiers, which is handy for a quick test drive.

Aura doesn’t do traditional trials, but with two full months to try it out — and get your money back if it’s not the right fit — you’ve got plenty of room to explore without feeling locked in.

Does Aura offer better value for families than IdentityWorks?

Yes, Aura definitely offers more value for families with its flexible coverage, more device protection, and extra parental controls. Aura’s family plan covers up to five adults and unlimited kids, with identity theft insurance for each adult.

Plus, it throws in helpful extras like screen time limits and safe browsing tools to keep kids protected. On the other hand, IdentityWorks only covers two adults and up to 10 kids, with fewer digital safety features for the whole family.

Does Aura monitor all three credit bureaus like Experian?

Yes, Aura includes three-bureau credit monitoring in all plans, just like Experian does in its “Premium” and “Family” tiers. Even though Experian is a credit bureau itself, Aura keeps pace by offering credit monitoring across Experian, Equifax, and TransUnion. So, no matter which service you choose, you won’t miss out on any crucial alerts!

Can I use Aura or IdentityWorks internationally?

Both services primarily operate in the US, but some of Aura’s features, like the VPN and password manager, can still work abroad. Identity monitoring and credit checks rely on US databases, so they won’t be as effective internationally.

However, Aura’s digital tools — like antivirus, VPN, and password vault — can still offer solid protection while you're traveling or living abroad, even though they’re mainly designed with US users in mind.

Leave a Reply