When you buy something online, is your payment data safe? Every week we read stories about breached databases, identify theft, and financial fraud that is committed because the bad guys gained access to “secure” data. In this landscape, the ability to use private and anonymous payment methods is more important than ever.

Using a private and anonymous payment method has serious advantages — both online and off. Consider this. Every month we learn about new data breaches being sold on hacker forums or simply released on the dark web for cybercriminals to use at their leisure.

The problem: You don't have control over the databases and data that you release to other companies. This data, including your payment data, can be hacked, leaked, or handed over to various government agencies without your knowledge.

The solution: You can minimize your data footprint by using private and/or anonymous payment methods.

Unfortunately, you can't count on companies, or even governments, to protect your personal information. However, if you pay for things anonymously, the bad guys won't get anything they can use against you.

In this article we will look at several private and anonymous payment methods and services. We'll also give you clear instructions on how to use these products and services in a way that gives you the most data security and control possible. But first, we need to clarify what kind of anonymity you need.

How much privacy or anonymity do you need with payments?

For the purposes of this article, there are two different kinds of anonymity, partial and full:

Partial anonymity – Payment methods and services that offer partial anonymity typically hide your identity from whoever is sending you a payment or receiving a payment from you.

Full anonymity – With this type of anonymity, no one knows who you are. A cash transaction is the classic way to get full anonymity, but today you'll learn a few more.

Partial anonymity is relatively easy to achieve, as you will see in a moment — but full anonymity is harder. That's mainly because making (and receiving) payments entails moving money from (and to) the world of fiat money. Fiat is the kind of “money” we carry in our wallets and store in banks.

Moving money around in the fiat financial system is virtually impossible without mandatory disclosure of all sorts of personal information. The US has the infamous KYC (Know Your Customer) regulations, for example.

Full anonymity is much harder to achieve than partial. Paying with cash is the time-honored method. But cash is rather impractical for many types of transactions, particularly online purchases. Fortunately, there are still a few ways to get the job done, even for online purchases. You'll see what I mean soon.

Let's start with the easy stuff: partially anonymous methods and services.

Partially anonymous methods and services

Here are several methods and services, that when used as described in this section, provide you with partial anonymity.

1. Prepaid cards (gift cards)

Prepaid cards, also known as prepaid credit cards, prepaid debit cards, and prepaid gift cards, are cards that you buy with a certain amount of money loaded onto them. You can use them like a credit card or a debit card, with a few crucial differences.

- Prepaid cards are not credit cards. With a credit card, you are borrowing money every time you use the card, then paying off your debt later. With a prepaid card, you aren't borrowing money. You are simply using the money that has already been loaded onto the card's account.

- Prepaid cards are not debit cards. A debit card is linked to your bank account and draws money from that as necessary. Prepaid cards are not linked to your bank account. They simply draw money from their own account until the prepaid amount is used up.

You can buy prepaid cards in many places, including online or from a physical store (with cash). How you buy them, and what you do with them after you have used up all the money, determines whether a prepaid card is partially anonymous, or fully anonymous. Be careful, however, as the FTC warns about some prepaid card payment scams.

If you simply want to conceal your identity from whoever you are transacting with, prepaid cards offer enormous flexibility. You can buy your prepaid cards in person at some store, or online with a credit card. It really doesn't matter, because the person you are transacting with still won't know who you are.

You may be wondering what to do with the little plastic card once you've used all the money in its account. In general, the card will go in the garbage once you use the money loaded onto it. Some prepaid cards can be reloaded anonymously with cash or perhaps with cryptocurrency. This is fine, assuming again that you don't need to provide an ID to reload your card.

If a card allows you to reload it online, the card provider will get some information about you during the process. You'll still be anonymous from the perspective of the person you are transacting with.

Note: Use a burner email!

This is probably a good time to mention that email address databases are also getting breached with shocking regularity. One potential solution is to use a temporary burner email address, which conceals and protects your regular email address, while still letting you purchase from and register on various websites.

We have an entire guide devoted to temporary disposable email address that you should check out.

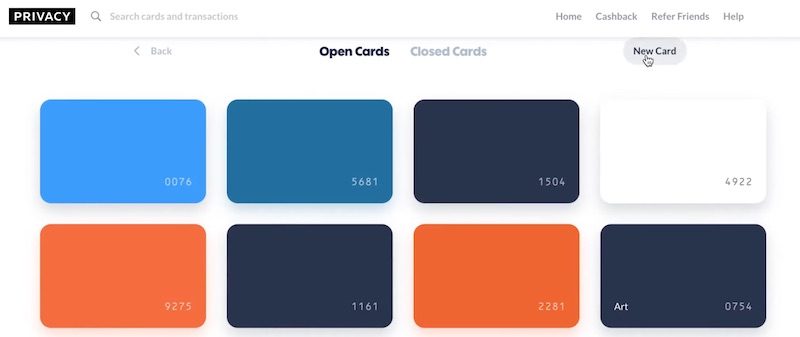

2. Virtual credit cards

Virtual credit card services, such as Privacy.com, have both pros and cons. For one, these are not anonymous payment methods because:

- The virtual card service knows your identity (and is linked to your bank account or credit card)

- Every transaction can be seen by the virtual card service

Despite these drawbacks, however, there are still advantages to virtual card services. For example, here are some benefits to privacy.com, which is a popular service in the United States:

- You can hide your identity from the merchant where you are purchasing goods or services.

- You can create burner cards that expire after a single transaction.

- You can set spending limits on cards, which prevents unauthorized payments.

- You can delete cards at any time, so they can no longer be used.

- Cards are locked to the first merchant they are used with, preventing unauthorized use by third parties.

I have been using Privacy.com for a few years and find it to be a useful service when I want more privacy with transactions or more control over how the virtual card will be used by merchants. Being able to delete cards and set limits certainly has some advantages in a world with unauthorized charges.

Note: For UK residents, there is also Curve.com.

3. PayPal payments with partial anonymity

PayPal is a widely-known online payment system. What isn't so widely known is that with a little work you can use PayPal as a partially anonymous payment system. Let's see how that works.

To set up a PayPal account you'll need to give the service your name and email address. To get money into and out of PayPal, you need to register a card or a bank account with the service. People who send payments to you or receive payments from you only see your name and email address.

If you are accepting physical goods with your PayPal transaction, there is also a way to keep your real (home) address private. Simply add another address that you want the item shipped to. This could be a PO box, a friend's address, a business address, or another location.

If you have a business, you can also create a business account. This will allow you to hide your real name with PayPal transactions, with the business name and email address appearing instead.

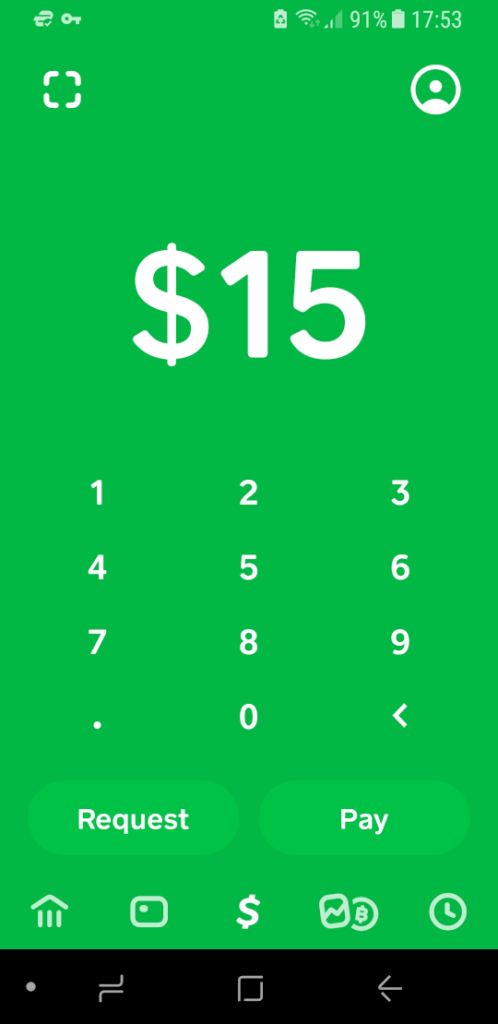

3. Cash App

Cash App is a mobile payment service that serves the United States and the UK (United Kingdom). With it, you can send and receive payments without either party knowing the identity of the other. This is possible because each user has a $Cashtag, which is a username that is sufficient for a transfer of funds.

Note: For privacy reasons, make sure that you do not use your real name as your $Cashtag!

You can send payments to someone's Name, $Cashtag, SMS (telephone text messages), or Email address. Likewise, you can request payments from someone using the same options. The app is very easy to use, as we verified in our tests.

While you can remain anonymous to those with whom you send or receive payments, Cash App will know who you are. That's because you need to connect a bank account to the app to get money into the app from the real world. There are ways to get around this, but they can be complicated and involve already having a functional anonymous payment system. And this kind of defeats the purpose of the whole thing.

Note: Cash App offers a range of services beyond simply sending and receiving payments. These include investing and buying cryptocurrencies (which could come in handy for some other anonymous transactions).

4. Cryptocurrency payments

Cryptocurrencies (cryptos for short) are one of the first things most people think of when they want to make any kind of anonymous payments. But that can be a bad mistake.

Cryptocurrencies are not inherently anonymous

As a matter of fact, for Bitcoin and most other cryptocurrencies, every single transaction is recorded in a public ledger that anyone on Earth can see. This ledger, called a blockchain, records each and every transaction. It doesn't include personal information, but it does include the addresses of each cryptocurrency wallet involved in the transaction. Conceptually, the record of a transaction on a blockchain doesn't look like this:

At 12:00:00 on 12/04/2021 Heinrich Long bought a cigar from John Doe for $10.00 US.

Instead, it might look something like this:

At 12:00:00 on 12/04/2021 someone sent 0.00001 BTC from wallet address X to wallet address Y.

There is no obvious personal information in this record. But since the blockchain records every such transaction ever made, it is possible to search these transactions for information that can be used to identify participants. For example, you could look through all transactions related to each address to find the point where someone used a credit card or a bank transfer to put money into one of the wallets involved in the transaction. Or the point where someone converted some of their cryptocurrency into dollars and deposited those dollars in the bank.

And of course, there are many types of groups that are working to de-anonymize cryptocurrency transactions to identify the parties involved.

The reality of the process is more complicated than that, but the point is that cryptocurrency transactions are not fully anonymous. But you can consider them partially anonymous, or pseudonymous. That's because digging through a blockchain trying to identify someone is a large and expensive effort.

However, the US Treasury Department wants to wants to force KYC (Know Your Customer) requirements onto cryptocurrency wallets. Whether this invasive policy will ever get enacted is unclear, but it is one more reason why you should consider crypto transactions as partially anonymous.

Note: Not all cryptocurrencies are the same in terms of privacy. Monero, for example, solves some of the privacy problems that are inherent with Bitcoin.

Cryptocurrency prepaid cards

There are also some services that can provide prepaid cards that are funded using cryptocurrency instead of, or in addition to, fiat money. These prepaid cards can be physical or virtual. The important thing for us is that they give you a card number to use for crypto transactions, instead of having to deal only with organizations that accept cryptocurrencies directly.

Using a crypto prepaid card also strengthens your privacy and anonymity a bit. After all, the universe of people who pay for stuff with cards is vastly larger than the universe of those paying with cryptos.

Fully anonymous methods and services

Here's where we get to the really good stuff. You are about to discover some ways to still make fully anonymous transactions in this world of near-total financial surveillance.

1. Anonymous prepaid cards

We discussed prepaid cards earlier as partially anonymous payment methods. But with a little care, they can also be used for totally anonymous payments. That goes for prepaid gift cards, prepaid credit cards, prepaid debit cards, whatever a vendor wants to call them. Using the cards is almost the same as I described in the “partially anonymous” section. To make fully anonymous payments with prepaid cards, you need to be sure you do three things:

First, buy your prepaid cards with cash, at a supermarket, drugstore, or department store. You shouldn't be required to provide any ID when doing this, giving you full anonymity. As far as we know, there is no requirement to show ID when buying these kinds of cards, at least in the United States… yet.

If you want to be really safe, buy a small denomination card and see if the vendor demands ID, before trying to buy a handful of maxxed-out cards. For that matter, don't try to buy a handful of maxxed-out cards anywhere. That's likely to invite unwelcome questions.

Second, don't ever use your real name, email address, or phone number when paying with one of these cards. It is easy to slip up like that, and you don't want to screw things up with such a simple mistake. Again, this is where a burner email service becomes useful.

Third, don't get a card that can be recharged online. If you do that, you'll need to give them a bank account and so on. There goes your anonymity.

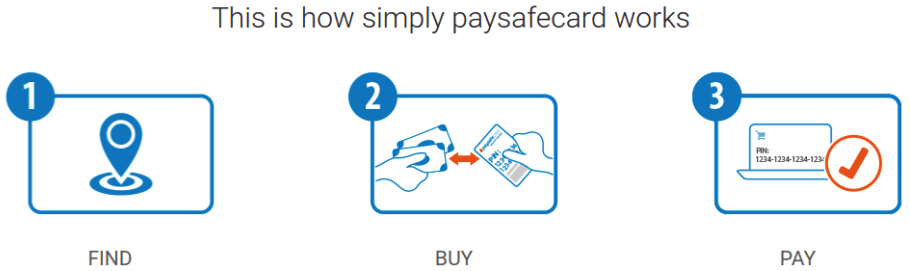

2. Paysafecard

Paysafecard cash vouchers combine some of the benefits of cash and online services. You can buy Paysafecard vouchers from vendors in many countries. If you pay with cash, this is a fully anonymous payment method, since there will be no way to associate the voucher numbers you use with any personally identifying information.

Each voucher has a 16-digit PIN printed on it. You use this PIN to make anonymous online payments. The Paysafecard website says that thousands of merchants accept Paysafecard. You can buy Paysafecards in $10, $25, $50, and $100 denominations. You can also link together up to 10 cards for larger purchases.

Again, assuming you pay for your Paysafecard voucher with cash, this is a totally anonymous way to pay. However, there are two drawbacks to using Paysafecard.

- The only types of companies that appear to accept Paysafecard are online games and licensed online gambling parlors.

- It can be hard to find a business that will sell you Paysafecards. There are a limited number of vendors, and not all countries have even one vendor.

You can check their website for purchasing options near you.

3. Cash

If you are doing transactions in the physical world, cash is about as anonymous as it gets. Hand the mysterious stranger some funny-looking pieces of paper, take the loaf of bread, secret plans, or cigars and walk away. For even more anonymity and atmosphere, do it in a darkened alleyway or other location where there are unlikely to be witnesses or surveillance cameras.

Unfortunately, cash isn't nearly as useful for long-distance transactions. You could send a pile of greenbacks by courier, or wire the money using Western Union, but either approach is a lot of work, involves risk, and can incur hefty fees. Plus there is more scope for mistakes with these approaches, like reflexively putting your own return address on the package. And if you are looking to do fully online transactions, cash is problematic.

Note: US dollars are the most common form of cash in the world, so they are good to use to avoid any tipoffs as to where you are from. Gold and silver coins could work well too, in some circumstances.

Getting virtual access to another country

What happens if you are using one of the payment apps we recommend but find yourself outside the official coverage area? For example, Cash App only supports the United States and United Kingdom (UK). Now suppose you are in Canada when the President decides to close the US borders because of some new health threat. How would you get access to your Cash App account, or create a new account to send money to your family back home?

For all I know, there may be some way to work around this with Cash App. But I want to give you a possible solution that ought to work with any of these apps and any locations. Use a highly secure VPN to make the connection.

Using a VPN with a foreign payment app

A VPN (Virtual Private Network) is a privacy-protecting service. All VPNs use sophisticated encryption and servers scattered around the world to protect the privacy of your internet activities. One of the primary ways they do this is by preventing third parties from seeing your IP address.

For our purposes, we don't need to get down into the technical details of how IP addresses are used by various online services. All we need to know is that an IP address can be used to identify you (your computer actually), and to figure out approximately where you are physically located in the real world.

When you use a VPN, it replaces your IP address and location with the IP address and location of the VPN server you are using. Going back to our example, if you used a VPN to connect to Cash App, Cash App would see the IP address of the VPN server, located in the US, for example, not your computer in Canada.

In other words, the IP address that the VPN passes to Cash App will be a US IP address. So Cash App should think that you are located in the United States and let you log in. Theoretically, you will have full access to the app, even though you are outside their service area.

People throughout the world use VPNs for unblocking websites and gaining access to different media and content. One of the most popular examples of this is using a VPN for Netflix to access different regional libraries.

A VPN's ability to make it look like you are physically located somewhere else has the potential to let you use a payment app you would otherwise not be able to. Now there are a couple of things to keep in mind about this. First off, doing this might violate the payment app's Terms of Service (ToS). As far as we know, doing this kind of thing isn't illegal anywhere, but violating an app's ToS could get your account cancelled. So be sure to check that first.

The other thing to keep in mind is that not all VPNs are capable of unblocking everything. However, a VPN that is really good at unblocking streaming content should also be good at convincing a payment app that you are physically located somewhere else. Check out our recommended best VPNs here and select one with a large server network and good streaming support.

Frequently Asked Questions

Perhaps you have a few questions about anonymous and private payments. Let's see if we can answer them…

Can I use my anonymous payment app outside the country?

This depends on the policies of the app as well as your craftiness. Some apps support multiple countries, some support one or a few. You'll have to check their Terms of Service (ToS) to see. Regardless of the app's policies, if you are smart, you'll use a VPN to trick the app into thinking you are located in a country that they do serve. We know this works because I used this exact trick to sign up for some apps while writing this article. I guess that makes me crafty too.

How do you pay anonymously?

You can pay partially anonymously or completely anonymously if you follow the instructions in the body of this article. Partially anonymous paying means that the recipient won't know anything about you except that they received the payment. While the recipient won't know your identity, the app or service will.

Fully anonymous payments are generally harder to do, but if you do make a fully anonymous payment, no one (except you) will know your identity. As you'll see when you dig into our article, making fully anonymous payments is possible, but not necessarily easy.

How can I receive money anonymously?

You can receive money partially anonymously using Cash App. But if you want to get the payment out of your Cash App account and into your hot little hands, you'll have to give up your bank account number and some other information. That means Cash App will know you received the payment, even if the person sending it doesn't know they were sending it to you.

The future of private and anonymous payments

While we try to stay positive and optimistic here at CyberInsider, the future is not looking great.

In this brave new world in which we live, there have been increasing calls to undermine financial privacy. This includes abolishing cash payments and switching to a digital currency system that is directly linked to your identity.

Of course, there will always be excuses thrown around for abolishing privacy with financial transactions. These include fighting terrorism, tax evasion, and other crimes. But ultimately, when you lose privacy, you also lose a degree of freedom. And when all payments are digital and linked to your identity, you can easily be locked out of the system.

Cryptocurrencies are also coming under the spotlight. Many governments around the world are working harder to regulate and tax cryptocurrencies. The US Treasury Department is now proposing KYC (Know Your Customer) laws for cryptocurrency exchanges to identify users. In India, there have even been proposals for an outright cryptocurrency ban.

How this will all play out is anyone's guess. But in the meantime, you would be smart to take more control over your financial data and private information by using the services and techniques in this guide.

Leave a Reply