Thinking about signing up for Experian IdentityWorks? You’re in the right spot — but there’s more to this service than meets the eye.

In this deep dive, we’ll walk you through what IdentityWorks actually offers — and what it doesn’t — when it comes to keeping your personal info safe from scammers, snoops, and surprise charges. From powerful credit monitoring to questionable privacy practices, there’s a lot to unpack.

If you’re eager to dive straight into what IdentityWorks actually offers, skip ahead to our breakdown of the core features — but stick with us to get the full picture and decide whether this service is truly worth your trust.

| Website | Experian.com |

| Pricing | $24.99 – $34.99/month |

| Money-back guarantee | No (but there is a 14-day cancellation period for new customers) |

| 3-bureau credit monitoring | Yes (with paid plans) |

| 24/7 customer support | No |

| Insurance | Up to $1 million |

| Best deal | N/A |

Highlights from testing Experian IdentityWorks

- Experian IdentityWorks gives you options, from a totally free plan with basic Experian credit monitoring to feature-packed premium tiers that include three-bureau credit reports, dark web monitoring, and up to $1 million in identity theft insurance.

What stood out? We liked the social media monitoring, the sleek mobile app that keeps your info just a tap away, and the family plan that covers two adults and unlimited kids — no need to buy separate subscriptions for each family member.

- But it’s not all smooth sailing. Customer service can be hit-or-miss, the premium plans are on the pricier side, and Experian’s history with data sharing might raise a few eyebrows for privacy-first users.

- Curious about what it’ll cost you? Jump to pricing and latest deals here.

Experian IdentityWorks pros and cons

Let's dive into the advantages and drawbacks of opting for IdentityWorks:

+ Pros

A 7-day trial period

Enhanced alert system

Protection plans for individual users and families

Yearly payment discounts

Comprehensive credit monitoring across the three major credit bureaus

A permanent free plan with essential features

Mobile apps for iOS and Android

Identity theft insurance with paid subscriptions

Option to include another adult and up to 10 children in the family plan

– Cons

Limited to Experian credit reports in the basic plan

Pricier than some other options on the market

Potential sharing of user data with third parties for marketing purposes

Privacy concerns due to previous data breaches

No live chat support

Experian IdentityWorks feature summary

From credit monitoring to dark web alerts, here’s what you get with IdentityWorks:

Credit monitoring across all three major bureaus – Keeps an eye on your credit reports from Experian, Equifax, and TransUnion to promptly identify any suspicious changes that could indicate fraud.

Dark web surveillance – Monitors the dark web for signs of your personal information being traded or misused.

Social media account alerts – Monitors your social media platforms for any unusual activity that could compromise your online identity.

Social Security number surveillance – Notifies you instantly if your unique Social Security number (SSN) is being misused, safeguarding your identity.

Child identity protection – The family plan option allows for up to 10 children, providing vigilant monitoring to keep your kids' identities safe.

Lost wallet assistance – Offers support in canceling and reissuing cards and accounts if your wallet goes missing, helping to reduce the impact of the loss.

Address change monitoring – Alerts you to any unauthorized address changes filed with the USPS, which could be a sign of identity fraud.

Payday and non-credit loan alerts – Detects any quick cash loan applications made in your name, preventing fraudsters from exploiting your identity.

Court records scanning – This feature checks court records to make sure no crimes are falsely reported in your name.

Sex offender registry checks – Experian monitors sex offender registries across all 50 US states, providing notifications if your identity is mistakenly linked or if a sex offender is located near you.

- Free plan and free trial – You can cancel your membership anytime during the 7-day trial without incurring any charges. There's also a free but basic plan with limited protection options.

What is Experian IdentityWorks and how it works?

Since Experian is one of the three major credit bureaus, it already has deep insight into your credit activity. With IdentityWorks, it leverages that insider knowledge to provide you with daily alerts, flag potential threats, and help you stay one step ahead of identity thieves.

The free plan gives you a basic safety net: Experian credit monitoring, dark web surveillance, and some handy fraud resolution tools. It’s a decent entry point if you just want to dip your toes into identity protection.

Upgrade to “Plus” or “Premium”, and the protection levels up fast — think Social Security number alerts, lost wallet support, and even FICO score tracking. The Premium tier takes things even further, with three-bureau credit monitoring (Experian, Equifax, and TransUnion), enhanced family coverage, and up to $1 million in identity theft insurance.

Company background: Can we trust Experian IdentityWorks?

Founded in 1996 and headquartered in Dublin, Ireland, Experian has come a long way from its early days as part of Credit Data Corporation. Today, it's a global data analytics titan, keeping tabs on over a billion individuals and businesses worldwide. Known for its comprehensive credit insights on millions in the US, Experian is a key player among the “Big Three” credit-reporting agencies, along with TransUnion and Equifax.

Listed on the London Stock Exchange and part of the prestigious FTSE 100 Index, Experian has had its share of adventures and misadventures. It's faced down the FTC over credit report sign-up disclosures and paid fines for credit score hiccups. But it's also made savvy moves, like acquiring Clarity Services to deepen its data pool.

The “big three” data breach we need to talk about

When assessing Experian, a company specializing in credit reporting and identity protection, it's essential to check its security history. Unfortunately, Experian's data breaches have sparked serious security worries.

In October 2015, Experian announced a data breach that had persisted for two years, from September 2013 to September 2015, potentially compromising the personal information of up to 15 million individuals, including T-Mobile customers who had applied for credit checks.

In 2020, another breach occurred, this time affecting Experian's operations in South Africa. Initially, Experian assured that the incident had been contained, but it was later revealed that the personal information of 24 million South Africans and nearly 800,000 businesses were exposed, including financial details for 24,838 entities.

The following year, in 2021, a leak was linked to Experian's Brazilian subsidiary, Serasa Experian. Data from 220 million citizens, including deceased individuals, was sold online, encompassing names, social security numbers, income tax declaration forms, and addresses. Despite Experian's claims of no evidence indicating their systems had been compromised, the leak was traced back to Serasa Experian.

After seeing all this, we can't help but feel a shadow of doubt looming over the security of our personal information due to its history of data breaches.

Core features: A closer look at what you get with IdentityWorks

Here’s how Experian IdentityWorks helps you stay one step ahead of identity thieves.

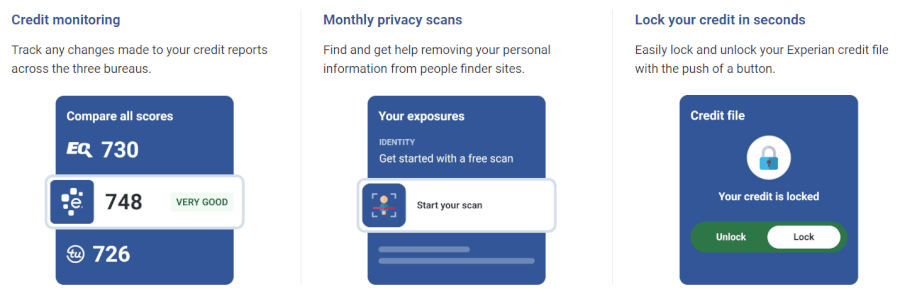

All three credit bureaus, one monitoring service

Experian IdentityWorks provides vigilant credit monitoring services, keeping a watchful eye on your credit reports from Experian, TransUnion, and Equifax. This is crucial for spotting potential identity theft early by alerting you to any unauthorized inquiries or unfamiliar accounts that may appear.

Quick Tip: Wondering what makes a good credit score? Aim for a range between 881 and 960 for a solid rating. Scores falling between 721 and 880 are considered fair or average. Steering clear of anything below the average range helps maintain a strong financial standing.

With Experian's deep expertise in credit data analysis, you can expect to receive timely updates about any unusual activities, helping to shield your financial identity from potential threats.

Dark web surveillance

Experian IdentityWorks keeps a watch over your personal details, promptly alerting you to any irregular activities that hint at identity theft. Alongside this, the service extends its protective reach into the depths of the dark web, ensuring that any unauthorized trading or misuse of your personal data doesn't slip past unnoticed.

Fraud resolution and up to $1 million ID theft insurance

If you're dealing with the challenges of identity theft, Experian IdentityWorks offers dedicated fraud resolution support to guide you through the recovery process smoothly and expertly.

For those who opt for the “Premium” or “Family” plans, there's an additional layer of reassurance in the form of identity theft insurance, which provides up to $1 million in financial reimbursement to cover the losses and expenses incurred from such incidents.

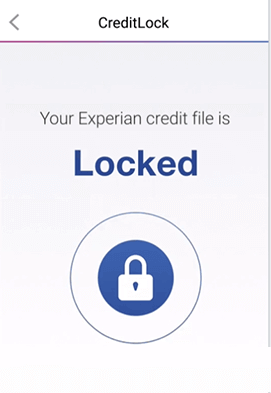

Experian CreditLock

An exclusive feature for subscribers is the Experian CreditLock. This tool gives you the easy ability to lock and unlock your Experian credit file whenever you need to, putting you in control of who can access your credit information.

We found it to be a simple yet effective way to boost our credit security, offering a strong defense against any unauthorized credit inquiries.

A few extra security perks we liked

Experian IdentityWorks isn't just about the basics. It also provides a suite of advanced security features to bolster its identity theft protection services:

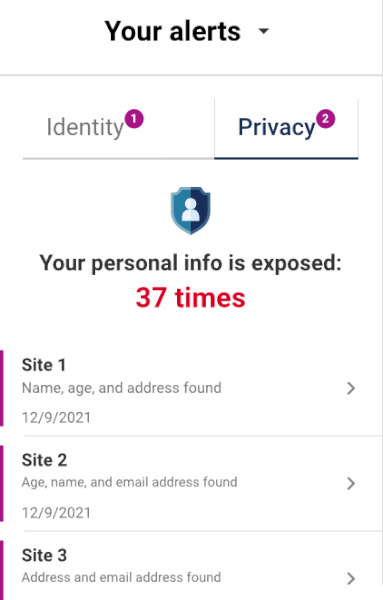

Monthly privacy scans

Monthly privacy scans are a crucial part of Experian IdentityWorks' offering. These scans search through covered people-finder databases to identify and help remove your personal information, reducing your exposure to potential identity theft and unwanted contact.

Social media monitoring

As our digital and real lives become increasingly intertwined, safeguarding our online presence is critical. IdentityWorks’ social media monitoring feature sends alerts to users when a social media post may put their identity or reputation at risk, ensuring that their online life remains private and secure.

Lost wallet protection

If your wallet goes missing, IdentityWorks steps in to ease the stress with its lost wallet assistance. They'll guide you through the process of canceling and reissuing your credit and debit cards, which is a critical step in preventing fraudulent charges and protecting your identity.

This feature should save you time and spare you the hassle typically associated with lost or stolen wallets. While the service is generally effective, the speed of assistance and the response from financial institutions can influence its efficacy.

Ease of use: How beginner-friendly is IdentityWorks?

IdentityWorks shines with its user-friendly approach. Downloading and setting up the software is pretty straightforward, although it can take some time. Once installed, you're practically all set. The system allows you to customize alerts and choose your preferred notification methods, while IdentityWorks manages the rest, ensuring a seamless experience for users.

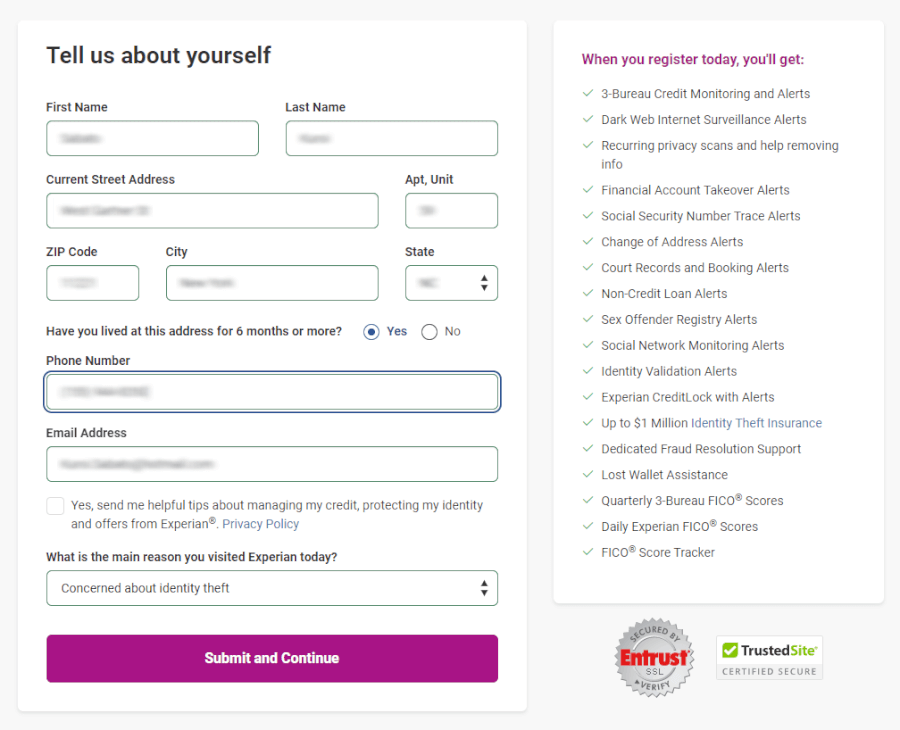

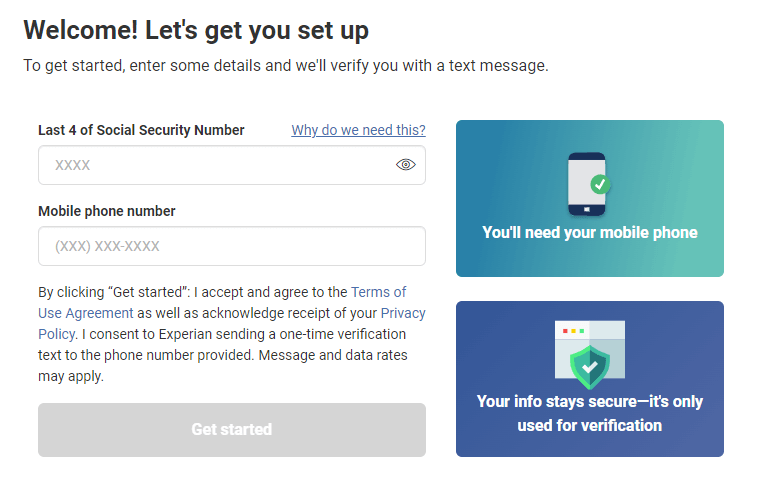

Getting started with IdentityWorks

Below is a screenshot from when I registered with IdentityWorks to test out the service.

Users are required to provide personal information such as their Social Security number, birthday, and phone number for identity verification.

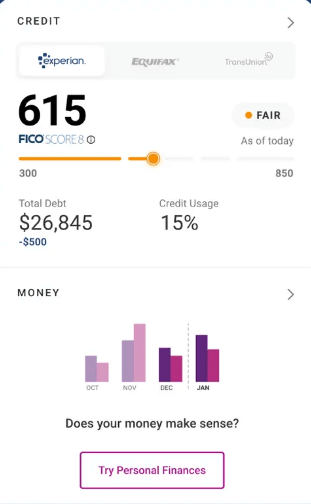

Once an account is created, users can immediately access key data points like their FICO score, percentage of credit usage, and total debt. The dashboard also provides actionable items and resources, including the ability to lock your credit file, view alerts, and perform a free child ID scan, all through the user-friendly Experian dashboard.

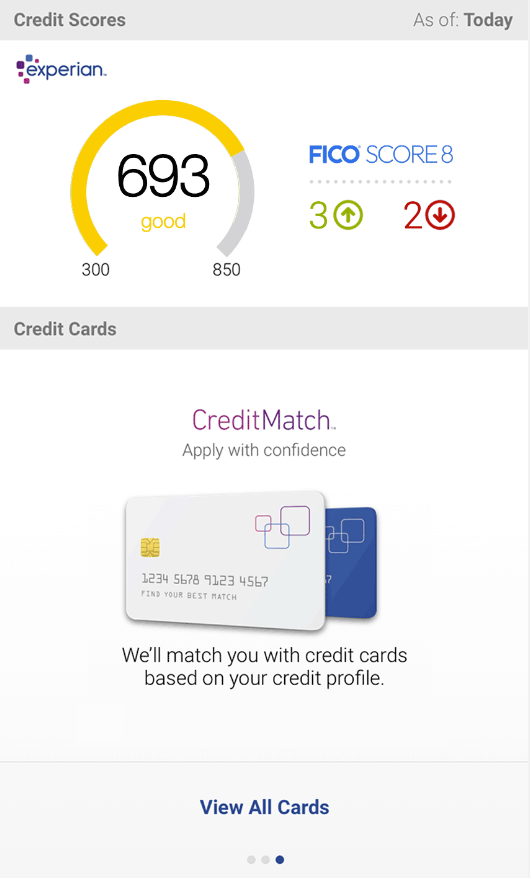

Using the IdentityWorks mobile app

Quick Tip: For easy credit and identity management on the go, download the Experian app for iPhone and Android. Simply search for “Experian” in your app store to find it, as there's no specific app for IdentityWorks.

The Experian IdentityWorks mobile app is a well-designed tool that lets you monitor your identity while on the move. Here's what the app allows you to do with ease:

Access your account for continuous monitoring of your personal information, ensuring peace of mind wherever they are.

View detailed credit reports, providing a clear picture of their financial standing.

Check their FICO scores, keeping track of any fluctuations that could indicate potential identity theft.

Receive immediate and reliable alerts about any suspicious activities, allowing for quick action to protect their identity.

After trying it out, we've found that the app's functionality and user-friendly design make it not only useful but also enjoyable to use. We think most users will feel the same.

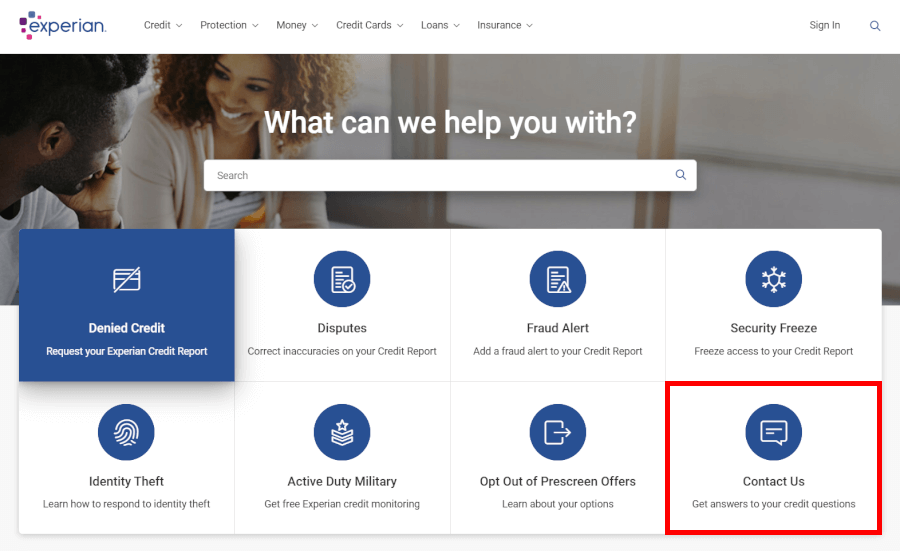

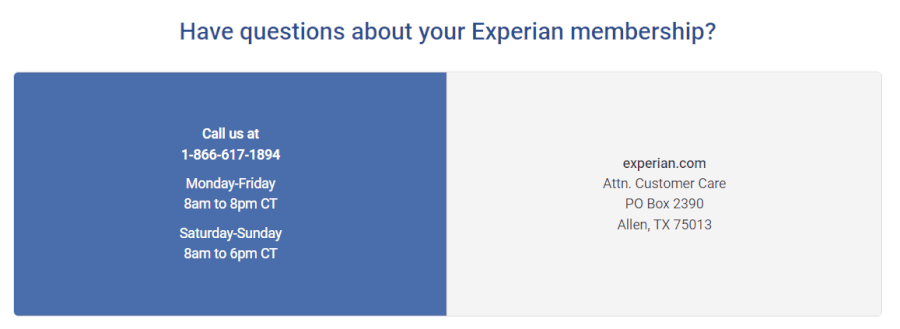

Customer support: Here's what you get with Experian

Experian does provide a toll-free customer support number, but its service falls short in several areas. The lack of 24/7 availability and real-time online chat options is a significant drawback, particularly in urgent identity theft situations where time is of the essence.

Customer feedback often highlights dissatisfaction with Experian's customer support, particularly the feedback on Trustpilot. Our experience with their online help center was underwhelming. The absence of direct email support or a live chat feature led to a frustrating experience. Instead, we were redirected to a generic knowledge base, which, although somewhat informative, failed to offer the immediate, personalized assistance we wanted. The support center's resources could also be more accessible to beginners, with clearer guides to navigate the service's features.

Plans and pricing: Is Experian IdentityWorks the right fit for your wallet?

Experian IdentityWorks offers three plans: “Basic“, “Premium“, and “Family“, one of which is free of charge:

| IdentityWorks plan | Price | What you get |

| Basic | Forever-free | Experian credit monitoring, FICO Score and tracker |

| Premium | $24.99/month (after 7-day trial) | 3-bureau monitoring, ID theft alerts, privacy scans |

| Family | $34.99/month (after 7-day trial) | Everything in “Premium” for 2 adults and up to 10 children |

You can see all prices and offers here >

The forever-free Basic plan offers main credit monitoring services, including access to your Experian credit report and FICO score. It provides alerts for any significant changes, helping to detect potential fraud. Subscribers also benefit from dark web surveillance and a privacy scan to uncover any exposed personal information online.

The Premium plan, at $24.99 per month, enhances the Basic offering with advanced identity theft monitoring, including monthly privacy scans to help remove personal info from people-finder sites. It provides comprehensive three-bureau credit monitoring, dark web surveillance alerts, financial account takeover, and Social Security number trace alerts.

At $34.99 per month, the Family plan includes all Premium features, plus coverage for one extra adult and up to 10 children, making it an ideal choice for family-wide identity protection.

All paid plans come with the added benefit of a 7-day trial to test the services. However, IdentityWorks tends to be pricier than many similar services.

Getting started with Experian IdentityWorks: A step-by-step guide

Getting started with IdentityWorks is straightforward. Just follow these steps:

Create your account – Provide your SSN, birthday, and phone number on the Experian IdentityWorks website for identity verification.

Verify your identity – Complete the verification process to secure your IdentityWorks account.

Explore your dashboard – Log in and view your FICO score and perform a dark web scan via the dashboard.

Choose a plan – Select from the Basic, Premium, or Family plans based on your protection needs.

Confirm and activate – Confirm your plan choice, set up your account preferences, and start using the service.

With these steps complete, you're now ready to take control of your personal identity protection with IdentityWorks.

Security spotlight: Is Experian IdentityWorks up to the job?

So, how does Experian IdentityWorks stack up when it comes to security? Let’s break it down feature by feature.

| Bank-level AES-256 encryption | ✅ |

| Real-time threat and fraud alerts | ✅ |

| Social media identity monitoring | ✅ (with “Premium” plan and up) |

| Two-factor authentication | ✅ (but only via SMS) |

| Dedicated privacy tools (VPN, password manager, and ad blocker) | ❌ |

Experian IdentityWorks uses secure sockets layer (SSL) technology to maintain encrypted communication between the user’s browser and its servers, aiming to protect personal data from unauthorized access. An automatic logout feature has been implemented to enhance security, which activates after 15-20 minutes of inactivity, thus helping to secure user accounts in case of inadvertent neglect to log out.

In terms of user authentication, IdentityWorks requires not just a password but also the last four digits of the user's SSN upon each login. This approach to security, combining a password with the last four digits of a user's Social Security number, aims to strengthen account protection.

As for privacy, IdentityWorks may not be the best fit for those who prioritize confidentiality above all else. The service's multi-factor authentication (MFA) does make your account more secure. However, it's also good to know what kind of personal information Experian collects.

Because Experian is based in the US, it follows local laws, which means some user data could potentially be shared with government agencies if required. That said, Experian is pretty open about what it collects, like your IP address, device info, and general usage data. They may also share anonymized info with third parties for advertising, but the good news is: you can opt out if that’s not your thing.

For those who prioritize privacy, we suggest being cautious with IdentityWorks due to past data breaches and how they handle user data.

Not sold on Experian IdentityWorks? Here are the best alternatives

Experian IdentityWorks gives you solid credit-focused protection, but if you're looking for more all-in-one security or hands-on support, it’s worth checking out some top alternatives.

Here’s how they stack up:

| Starting price | Best for | Standout features | |

| Aura | $9/month (with coupon) | All-in-one family protection | VPN, antivirus, password manager, up to $5M theft insurance |

| IDShield | $14.95/month | Hands-on recovery help | Licensed private investigators, strong legal support, family plans |

| Experian IdentityWorks | $24.99 (there is a free tier) | Credit tracking and Experian integration | 3-bureau credit monitoring, social media alerts, privacy scan tools |

Aura is your best bet if you want premium features like scam blocking, device protection, and identity monitoring across the board — all in one package. IDShield is a standout for anyone who wants expert recovery help, with licensed investigators just a phone call away.

Meanwhile, Experian IdentityWorks offers a good set of tools if your main concern is credit reports, especially from Experian itself. But its higher pricing and data-sharing concerns might leave privacy-focused users looking elsewhere.

Wrap-up: Experian IdentityWorks — Yay or nay?

Experian IdentityWorks comes loaded with features like three-bureau credit monitoring, identity theft insurance, and even social media tracking — so on paper, it's a solid package. But before you rush to sign up, there are a few trade-offs to consider.

For starters, Experian has a history of data breaches and may share certain user data for advertising. That’s not ideal if privacy is your top concern. Plus, customer support is phone-only — no live chat — so getting help quickly might take a little patience.

So, is it worth it? If you're already tied into Experian’s ecosystem and want strong credit monitoring tools, IdentityWorks could be a decent fit. But if you’re looking for better privacy practices, faster support, and all-around digital security tools (like VPNs), you might want to check out Aura or Identity Guard instead. They’re strong alternatives with more bang for your buck.

Other identity theft protection reviews on CyberInsider:

- Aura Review

- IDShield Review

- LifeLock Review

- NordProtect Review

- McAfee Review

- IdentityIQ Review

- Identity Guard Review

Experian IdentityWorks FAQ

What does Experian IdentityWorks do?

Experian IdentityWorks draws upon the extensive credit monitoring knowledge of its parent company, Experian, to keep you informed of any changes to your credit reports. With its premium plans, you'll receive alerts from all three major credit bureaus, giving you a well-rounded view of your credit health.

But there's more to IdentityWorks than just credit monitoring. It also watches over public records, the dark web, and social media channels for any signs that your identity might be at risk.

Should you ever find yourself dealing with identity theft, IdentityWorks is there to help. Their team of fraud resolution specialists will guide you through sorting out the aftermath, including any legal issues. And with up to $1 million in insurance coverage for financial losses related to identity theft, you'll have extra peace of mind.

Does Experian IdentityWorks come with a money-back guarantee?

While Experian IdentityWorks doesn't offer a money-back guarantee, it does feature a 7-day free trial for its premium services. This trial period allows you to fully experience the service and determine if it aligns with your needs without any initial financial commitment. Should you decide it's not the right fit, simply cancel within those seven days to avoid any charges.

How secure is Experian IdentityWorks?

Experian IdentityWorks takes several steps to safeguard user data, employing SSL technology for secure communications and an automatic logout feature to prevent unauthorized access. Users also have the option to enhance their account security with additional authentication measures, such as security questions or PINs.

Also, logging in requires not just a password but also the last four digits of the user's Social Security number, adding an extra layer of protection for personal information. However, given Experian's history of data breaches and its handling and potential sharing of user data, privacy-focused individuals should hesitate to use their services.

Experian should be ashamed of itself! I received an alert from Experian Identity Works. I had trouble signing in using what I had written down as my username and password. It took a while before I got it straight that Experian.com and ExperianIdidworks.com are not the same thing. There are different sign-in usernames and passwords required. The “Help” on both sites is pathetic. The people answering the phones for either site were no help, because neither of them seem to know anything about the other one or that they are even connected in any way (but they are linked, right?). I spent quite a bit of time answering the ID Works “Help” person’s questions demanding my personal data (including my full SSN), all for nothing, because after all that, the “Help” person couldn’t help me. He gave me more numbers to call, which were dead ends. The Identity Works site has no space for comments or questions – only a PO Box address! Pitiful! I have heard so many times that “we should run government like a business”. Really?!