Your personal data fuels a massive underground market where brokers sell it freely and criminals exploit it for fraud, draining the accounts and ruining the credit of undefended victims overnight. NordProtect and Incogni, both powered by Nord Security, tackle this problem from opposite angles: one monitors threats and handles recovery, while the other scrubs your information from broker lists before trouble starts.

NordProtect delivers dark web scans, credit alerts, up to $1 million in insurance, and bundled tools like VPN protection, with its Platinum plan even including Incogni for full coverage. This 2026 comparison breaks down their features, pricing, and real strengths so you decide whether to focus on prevention, active defense, or combine both for complete peace of mind.

So… which one actually deserves your trust? We tested both to find out. If you're just here for the bottom line, feel free to jump ahead to our pricing and plan breakdown. Otherwise, let’s dig into the key differences and see which service fits your digital life best.

| NordProtect | Incogni | |

| Website | NordProtect.com | Incogni.com |

| Core features | Three-bureau credit monitoring, dark web monitoring, identity theft insurance, recovery services, cyber extortion coverage, and bundled security tools | Automatic data removal from 420+ data brokers and people search sites |

| Pricing | $4.49 – $9.99/month | $7.99 – $23.39/month |

| Money-back guarantee | 30 days | 30 days |

| 24/7 customer support | No (email and FAQs) | Yes |

| Best deal | 71% Off Coupon > | 50% Off Coupon > |

Highlights for our NordProtect and Incogni comparison

- Deciding between NordProtect and Incogni? One shields your identity with alerts, credit monitoring, and $1 million theft insurance. The other wipes your data from shady broker sites. Both keep you safe — but in very different ways.

- NordProtect is perfect if you're worried about fraud. It watches your credit, scans for threats, and has your back if things go wrong. Incogni, on the other hand, helps you disappear by automatically removing your info from data brokers.

- Want to see how they perform? Jump to our performance comparison.

- Oh — and if you want both in one package, check out Aura’s current deals. It covers everything, often for less than you'd expect.

NordProtect and Incogni at a glance: Which is better for privacy?

NordProtect is built to shield your identity from every angle — monitoring the dark web, tracking your credit, and alerting you to breaches before they turn into full-blown disasters. Plus, it comes with up to $1 million in identity theft recovery coverage.

But here’s the twist: it doesn’t stop there. NordProtect also taps into the power of Incogni, a service that scrubs your personal info from 420+ data broker sites. Incogni keeps the cleanup going with automated requests and regular scans, so your data doesn’t resurface.

NordProtect shields you from threats — Incogni scrubs your digital trail. Together, they offer a practical approach to strengthening your privacy.

NordProtect: The identity theft defense team

| Starting price | $4.49/month |

| Supported platforms | Windows, macOS, Android, and iOS |

| Three-bureau credit monitoring | ✅ (with Platinum plan) |

| Identity theft insurance | $1M |

| Best deal | 71% Off Coupon > |

From phishing scams and data breaches to someone hacking into your accounts or opening a credit card in your name, cybercriminals are always looking for ways to cash in on your personal info. That’s where NordProtect steps in. It keeps an eye on your sensitive data and alerts you the moment something suspicious shows up — like a new account you didn’t open or a breach involving your email address.

But NordProtect isn’t just here to wave a red flag. If identity theft does happen, it rolls up its sleeves and helps you recover. That means up to $1 million in coverage to deal with legal fees, lost income, and even mental health support, because identity theft can be just as stressful as it is expensive. You also get a dedicated restoration case manager to guide you through the chaos, whether you need to freeze your credit, file reports, or start repairing the damage.

On top of that, NordProtect provides credit monitoring through TransUnion, one of the major credit bureaus. Three-bureau credit monitoring is also available, but it is reserved for the Platinum plan. So if someone tries to take out a loan or apply for a new line of credit in your name, you’ll get a heads-up before things spiral. You’ll also get alerts for dark web leaks and signs of cyber extortion, which is a fancy way of saying, “Hey, someone’s threatening to release your stolen data unless you pay up.” NordProtect even includes some coverage for that, just in case.

All of this comes from Nord Security, the same team behind NordVPN, NordPass, and other tools known for locking down digital lives. So you’re not just getting some pop-up protection add-on — you’re tapping into a whole ecosystem built around keeping you safe online. Pair that with some good digital habits (strong passwords, less oversharing, and regular credit checks), and NordProtect becomes a smart, well-rounded way to stay one step ahead of identity thieves.

NordProtect pros and cons

Is NordProtect really up to the task of guarding your identity? Let’s break down the pros and cons.

+ Pros

$1M identity theft recovery

Cyber extortion coverage

24/7 dark web monitoring

Effortless to set up and use

Criminal record and malware breach alerts

3-Bureau credit monitoring

Higher tiers come with a VPN and a password manager

Accepts a range of payment methods

- Frequent deep discounts on long-term plans

30-day money-back guarantee

– Cons

Pricey premium plans

No live chat support

SSN required for credit monitoring (but that’s typical)

Is Incogni worth the privacy hype? Let’s find out.

Incogni: The data broker cleanup crew

| Starting price | $7.99/month |

| Supported platforms | Windows, macOS, Android, iOS (via browser dashboard) |

| Coverage | 420+ data brokers |

| Availability | US, Canada, the UK, the Isle of Man, Switzerland, Norway, Iceland, Liechtenstein, and all of the EU |

| Best deal | 50% Off Coupon > |

Ever wonder how spammy emails, junk mail, or creepy targeted ads seem to know a little too much about you? You can thank data brokers — those behind-the-scenes companies that collect, package, and sell your personal info without ever asking for permission. We’re talking names, addresses, browsing habits, even your favorite online stores. That’s where Incogni comes in. It’s not trying to be a jack-of-all-trades; it’s laser-focused on one job: getting your data off those shady lists.

Once you sign up, Incogni goes to work fast. It fires off opt-out requests to over 420 data brokers and people-search sites, telling them to remove your information. But it’s not a one-time deal — Incogni keeps checking back in, making sure they actually follow through. And thanks to privacy laws like GDPR and CCPA, it’s not just politely asking either. It’s flexing your legal right to be forgotten, and making sure those brokers remember it.

What really makes Incogni stand out is how smart and hands-off it is. Its system uses algorithms to figure out which data brokers are most likely to have your info based on where you live and what kind of data they collect. Then it keeps the removals rolling automatically — no constant follow-ups, no endless forms. You just set it up, and it quietly handles the mess for you.

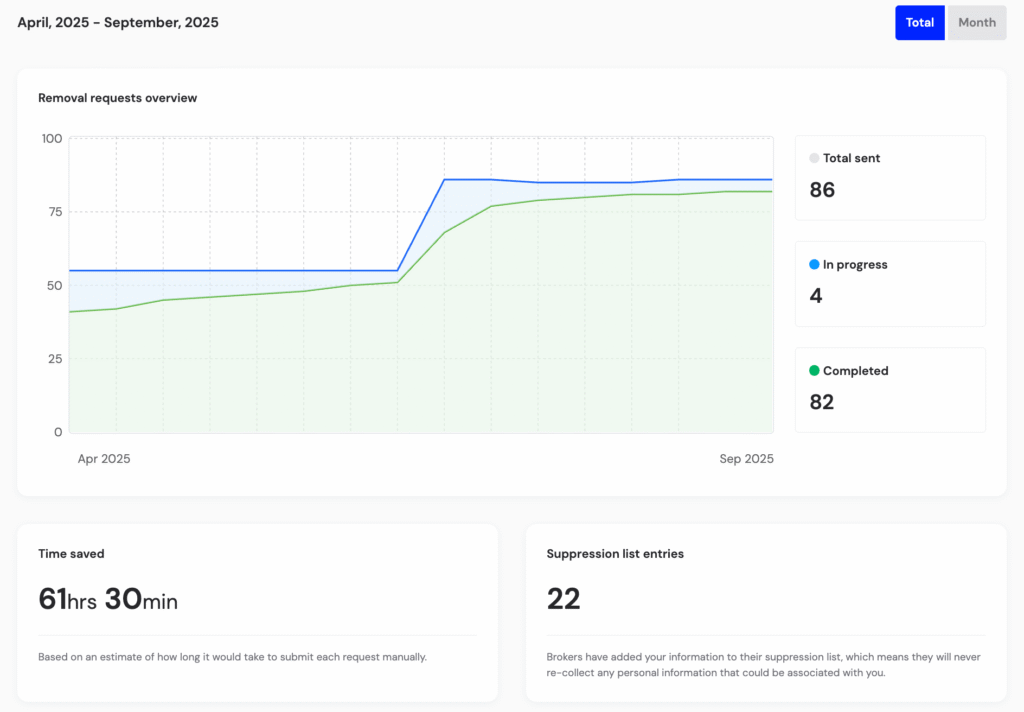

You also get a clear, easy-to-use dashboard where you can track the cleanup. You’ll see which brokers have wiped your data, which are still pending, and what’s happening in real time. It’s a stress-free way to stay in control of your privacy without needing a law degree or hours of free time. In short, Incogni makes digital privacy simple — and actually enjoyable.

Incogni pros and cons

Incogni promises to clean up your digital footprint — but does it deliver? Let’s break down the pros and cons.

Pros +

30-day money-back guarantee

- Coverage of 420 data brokers across all plans

Simple sign-up process

Detailed dashboards and user-friendly interface

Removes user data from hundreds of online databases

- Unlimited custom removals

- Free risk assessment

Fast removals with repeat requests

- Updates on data removal every 30 days

- 34 countries covered under one plan

Affordable pricing

- Marketing claims independently verified by Deloitte

- 24/7 live chat

Cons –

Lacks in-depth reports

- No free trial, only money-back option

Now that you know what each service is all about, let’s break down what they actually do — feature by feature.

Core features of NordProtect

NordProtect packs a punch when it comes to guarding your identity. From round-the-clock dark web scans to focused credit monitoring and real-time alerts, it’s built to spot trouble before it snowballs. And if things do go south, you’re backed by Nord Security’s hefty identity theft insurance — up to $1 million to help clean up the mess. It’s a solid mix of prevention and recovery, all wrapped up in one no-nonsense package.

So, what exactly do these features look like in action? Let’s break them down, one by one.

Identity theft insurance: Serious backup when things go sideways

If identity theft ever hits you where it hurts, NordProtect doesn’t just send you an alert and wish you luck — it brings serious backup. With up to $1 million in identity theft insurance, you’re covered for the big stuff: legal fees, lost wages, and even therapy if the stress gets overwhelming. This isn’t just a nice bonus — it’s real, practical support when things get messy.

| Type of coverage | Reimbursement limit |

| Identity theft recovery | Up to $1 million |

| Cyber extortion protection | Up to $50,000 |

| Cyber attack coverage | Up to $10,000 |

| Online fraud reimbursement | Up to $10,000 |

| Lost wages | Up to $5,000 |

| Mental health counseling | Up to $1,000 |

| Additional recovery costs | Up to $1,000 |

| Deductible | $100 per incident |

There is a $100 deductible, but the coverage comes through HSB Specialty Insurance, a well-established provider that knows how to handle these kinds of claims. And NordProtect doesn’t stop at standard recovery help — it also offers cyber extortion coverage. If a hacker tries to hold your data for ransom, you’ve got up to $50,000 to deal with it, plus expert guidance to handle the situation without panicking.

You also get up to $5,000 in lost wage reimbursement and no cap on legal fee coverage, which is a big deal if you ever find yourself stuck in an identity-theft nightmare. From stolen credit to fake accounts to blackmail-worthy breaches, NordProtect’s insurance gives you breathing room while you get your life back on track.

Dark web monitoring: Your lookout in the internet’s sketchy back alley

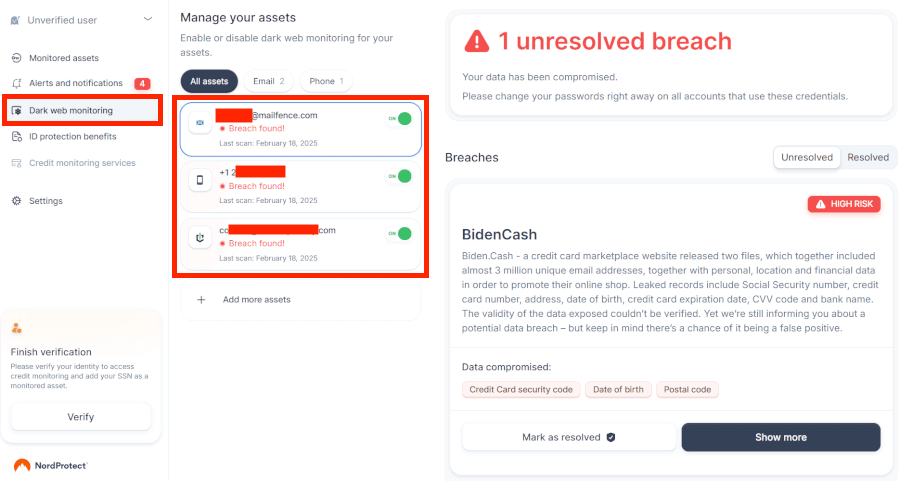

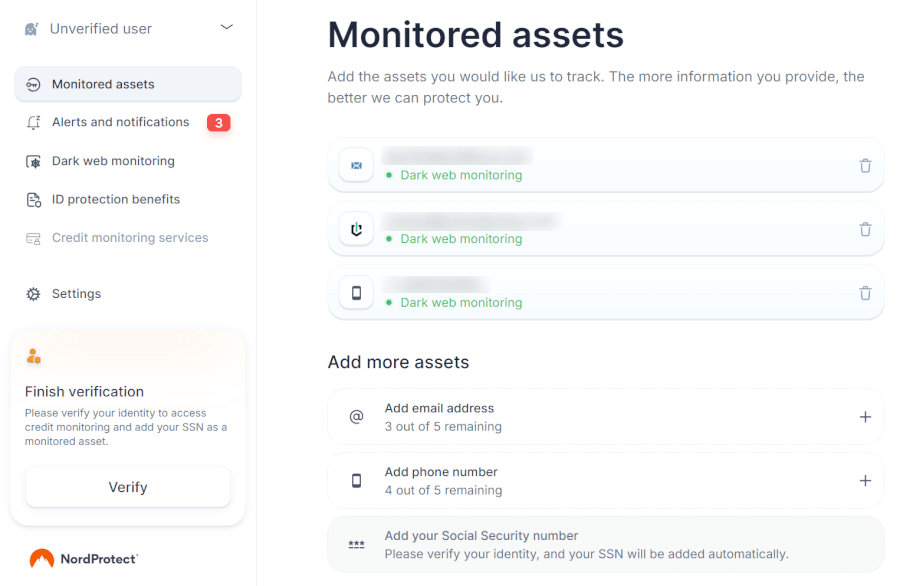

The dark web is where stolen data goes to party — and not in a good way. It’s packed with shady forums, hacker hangouts, and black-market sites where your personal info can end up on sale without you ever knowing. That’s why NordProtect’s 24/7 dark web monitoring is such a big deal. It constantly scans those digital back alleys for signs that your info — like your email, phone number, or Social Security number — has been leaked.

Once you plug in your details (you can track up to five emails and five phone numbers per adult), NordProtect goes to work quietly in the background. If anything turns up, you get an immediate alert, complete with details about what was exposed and what to do next. No vague warnings or confusing reports — just clear, useful info that helps you lock things down fast.

When we tried it out with a few test emails, NordProtect quickly flagged some old breaches and laid out a simple plan for fixing things. It didn’t just say, “Hey, you’ve been hacked” — it told us exactly what had leaked and how to respond. That kind of clarity is rare, and it seriously cuts down on the panic factor when your data’s floating around out there.

Sure, it doesn't monitor every single detail of your digital life, but it zeroes in on the most sensitive pieces of personal info. With real-time alerts for your SSN, phone, and email, you’ll know if your identity is at risk before the damage is done.

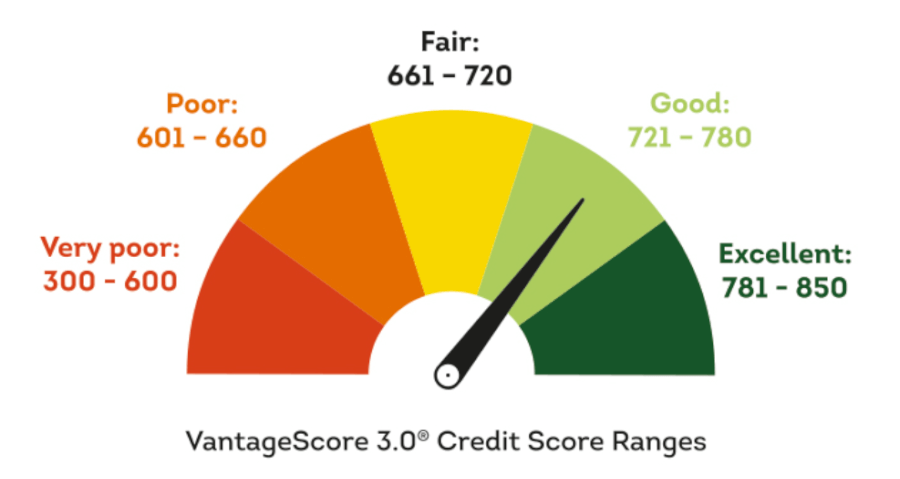

Credit monitoring: Your early-warning system for sneaky activity

When it comes to identity theft, your credit report is often the first place trouble shows up — and NordProtect doesn’t miss much. On standard tiers, it monitors your credit file through TransUnion and sends alerts the moment something suspicious appears, whether it’s an unexpected credit inquiry or a fraudulent attempt to open a loan in your name. Fast alerts mean faster damage control.

NordProtect uses VantageScore 3.0 for credit alerts, helping translate changes in your credit file into actionable notifications. You also get real-time updates when your credit score shifts in any direction, so you can track your financial health without constantly checking manually.

For users comparing NordProtect vs Incogni, it’s worth noting that these services tackle different parts of identity protection. Incogni focuses on data removal — scanning the web for your personal information and requesting its deletion from data brokers — while NordProtect leans more toward monitoring and recovery tools, including credit surveillance, VPN, and cyber attack insurance on higher tiers.

NordProtect does offer three-bureau credit monitoring, but only on the Platinum plan. That tier expands monitoring beyond TransUnion to include all three major credit bureaus, giving you a broader view of your credit activity. If full bureau coverage is a priority, Platinum is currently the only NordProtect tier that delivers it.

If you spot anything suspicious, NordProtect can also guide you through freezing your credit to limit further exposure. Meanwhile, TransUnion-only monitoring on lower tiers still provides a useful snapshot of credit movement, making sure you’re not left unaware while deciding whether a broader monitoring setup — or complementary data removal tools like Incogni — fits your needs.

Identity restoration: Real help when things go wrong

If identity theft ever hits home, NordProtect doesn’t just leave you to figure it out on your own. You’ll be assigned a dedicated identity restoration case manager — a real human who walks you through the mess, step by step. Whether you need to freeze your credit, file reports, or start reclaiming what’s yours, they’re right there with you, helping untangle the chaos.

This kind of personalized support can make a huge difference, especially when you're knee-deep in confusing paperwork and frustrating phone calls. Having someone in your corner who knows the system and can actually help? That’s a game-changer.

And NordProtect doesn’t stop at credit cleanup. It also includes criminal records monitoring, which alerts you if your name ever gets tied to something shady in a legal database. It’s a rare but serious risk — and one most people don’t think about until it’s too late. With NordProtect, you’ll know right away if your identity gets tangled up in the wrong kind of trouble.

In short, if someone tries to steal your identity, NordProtect jumps into action — not just with tools, but with real people, smart alerts, and a clear plan to get you back on track.

Now that NordProtect had its moment, let’s shine the spotlight on Incogni.

Core features of Incogni

If NordProtect is your shield, Incogni is your mop and bucket — scrubbing your personal info off the internet, one shady data broker at a time. It’s a focused, behind-the-scenes service that quietly pulls your data from places it never should’ve ended up in the first place.

With Incogni, you get a fully automated personal data removal service that targets hundreds of data brokers and people-search sites — no paperwork, no chasing down opt-out forms. Just set it up and let it do its thing. And the best part? If you’re on NordProtect’s top-tier plan, this powerful privacy tool is already included.

Let’s take a closer look at what it can do.

Automated data removal: Set it, forget it, stay private

Incogni doesn’t just ask politely — it flexes legal muscle. Armed with privacy laws like GDPR, CCPA, and PIPEDA, it demands that data brokers delete your personal information. And the best part? It does all of this automatically, without you needing to fill out endless forms or send emails into the void. Once you sign up, Incogni kicks off a wave of removal requests to over 420 data brokers, and keeps following up until your data is off their lists.

But data brokers are a stubborn bunch. Even when they’re legally required to comply, they’re not exactly racing to hit delete. That’s where Incogni’s persistence really shines. It keeps the pressure on with recurring removal requests, so even if your data pops back up or brokers drag their feet, Incogni’s on it. The result? A cleaner, leaner digital footprint — and way less exposure to shady data practices.

What makes it even better is that Incogni doesn’t stop at the usual suspects. With its unlimited custom removals feature (available on the “Unlimited” plan), you can submit links to specific sites that have your info — even if they’re not officially part of Incogni’s database. Just drop the URL into your dashboard, and Incogni will review it and go after the source. It might take a few weeks, but it’s a smart way to handle the stragglers that other services leave behind.

Behind the scenes, a smart algorithm figures out which brokers are most likely to have your data based on location, activity, and broker behavior — then sends out automated opt-out requests. Weekly updates in your dashboard keep you in the loop the whole time. So while Incogni’s working hard to clean up your digital trail, you can kick back knowing your data is being hunted down and wiped — automatically.

Ease of use: Which one’s smoother — NordProtect or Incogni?

Both services aim to keep things simple, but they take different routes. NordProtect gives you a clean, easy-to-navigate dashboard and walks you through setup via the NordAccount site — no extra apps or downloads. That said, you’ll need to verify your identity and set up multi-factor authentication, which adds a couple of extra clicks before you’re good to go.

Incogni, on the other hand, is all about hands-off privacy. You sign up, plug in your details, and it gets straight to work. No setup fuss, no manual steps — just automated data removal doing its thing in the background.

So what’s the verdict? NordProtect gives you more control, but Incogni wins on pure simplicity.

User interface and accessibility

NordProtect sticks to the Nord playbook: clean design, crisp layout, and no fluff. Everything runs through the NordAccount dashboard, so whether you’re on a computer or mobile, the experience stays consistent — no separate app required. Signing up is smooth, and even though you’ll need to verify your identity and turn on multi-factor authentication, it’s all laid out clearly. Want extra privacy? You can even pay with crypto.

Once you’re in, the dashboard rolls out a no-nonsense layout: tabs for dark web monitoring, alerts, credit checks, and more — all easy to find, easy to manage, and actually kind of satisfying to click through. It’s all about giving you control without overwhelming you with options.

Incogni, on the other hand, is laser-focused on one thing: cleaning up your data. Its browser-based dashboard works across all major platforms — Windows, macOS, Android, iOS, Linux — and it’s just as snappy on Chrome or Firefox. Setup is straightforward: enter your info, sign a quick authorization form, and let Incogni do the heavy lifting. No digging through menus or tweaking settings — it’s a total “set it and forget it” experience.

Once you’re in, you’ll see a dashboard that tracks your data removal progress in real time. You can monitor how many brokers have been contacted, how many have complied, and what’s still in progress — complete with charts, status bars, and helpful little tips.

Bottom line? NordProtect is polished and feature-packed, while Incogni wins for simplicity and focus. Both are accessible, sleek, and designed for real people, not just tech wizards.

Customer support: Who’s got your back when you need it?

When it comes to support, NordProtect does the job — but it keeps things pretty low-key. If you run into trouble or just need a hand, your only option is email support. We found responses to be prompt and professional (we heard back in a few hours), but if you’re hoping to hop on a live chat or talk to a real person on the phone… no luck there. A more robust help center or faster ways to reach support would definitely be a welcome upgrade.

That said, if you’re dealing with identity theft, NordProtect steps up in a big way. You’ll be assigned a dedicated case manager and get access to up to $1 million in recovery support — including legal fees, lost wages, and even mental health care. So while the day-to-day customer service is a little basic, the real support kicks in when it matters most.

Incogni, on the other hand, keeps things smooth and stress-free from the start. It offers 24/7 live chat, plus a helpful knowledge base that walks you through everything from data removal steps to understanding privacy laws. And if you ever want to take matters into your own hands, their opt-out guides are refreshingly easy to follow — no tech jargon, just clear, actionable tips.

So, who wins this round? Incogni’s got the edge on quick, accessible support, while NordProtect focuses its muscle on post-breach recovery. Different vibes — both helpful in their own way.

Pricing plans: Which one gives you more for your money?

When it comes to protecting your identity and your privacy, both NordProtect and Incogni offer solid value, but they go about it in very different ways. Let’s break down what you’re actually getting for your money.

NordProtect plans and pricing: Identity + VPN + cleanup in one

NordProtect has three main plans — “Silver“, “Gold“, and “Platinum” — all available on a monthly, yearly, or two-year basis. The longer you commit, the more you save (up to 71% off). Here’s a quick look:

| NordProtect plan | Silver | Gold | Platinum |

| Starting price | $4.49/per month | $6.49/per month | $9.99/per month |

| Three-bureau credit monitoring | ❌ (TransUnion only) | ❌ (TransUnion only) | ✅ |

| Identity theft insurance | Up to $1M for ID theft, $50K for cyber extortion, and $10K for online fraud | Up to $1M for identity theft, $50K for cyber extortion, $10K for online fraud, and $10K for cyber attacks | Up to $1M for identity theft, $50K for cyber extortion, $10K for online fraud, and $10K for cyber attacks |

| Nord Security products | ❌ | NordVPN and Threat Protection Pro | NordVPN, Threat Protection Pro, and Incogni |

No hidden fees, no confusing add-ons — just everything Nord Security has to offer in one privacy-packed bundle. You can even pay anonymously with cryptocurrency if you prefer a low-profile signup.

Incogni plans and pricing: Focused data cleanup, for one or the whole family

If you’re laser-focused on getting your personal data off shady broker sites, Incogni offers four clean-cut plans:

| Incogni plan | Monthly price | Core features | Best for |

| Standard | $7.99 – $15.98/month | Removes data from 420+ brokers, but no custom requests | Individuals wanting basic protection |

| Unlimited | $14.99/month | Everything in “Standard” and unlimited custom data removal requests | Privacy-conscious users who want full control |

| Family | $15.99 – $31.98/month | Covers up to 5 people and removes data from 420+ brokers | Families looking to protect everyone |

| Family Unlimited | $23.39/month | All “Family” features and unlimited custom removal for each member | Families who want maximum privacy tools |

All plans come with a 30-day money-back guarantee, and payment is simple — just use a card or PayPal. The annual plans offer significant savings, especially if you want long-term protection that auto-updates as new brokers are added.

So, what should you get?

If you're after full-spectrum protection — identity, privacy, security, and peace of mind — NordProtect’s “Platinum” plan is your best bet. You get:

- Secure, ultra-fast VPN (NordVPN)

- Threat Protection Pro™ for blocking malware and trackers

- Real-time identity and credit monitoring

- Incogni’s personal data removal service — fully included

On the other hand, if your main goal is to erase your data from the web and you're not worried about identity theft insurance or credit monitoring, Incogni “Unlimited” delivers excellent value on its own.

But honestly? For an all-in-one solution, “Platinum” wins. It’s like buying the whole privacy toolkit in one go — and it’s backed by Nord Security’s trusted name.

Security and privacy: Who keeps your data safer?

When it comes to guarding your personal info, both NordProtect and Incogni bring solid privacy chops to the table — but in different ways. One’s a full-blown security suite, the other a precision tool for wiping your data off the web. Let’s break it down.

NordProtect comes from the house of Nord Security, the same crew behind NordVPN, and it shows. Your data is protected with AES-256 encryption (that’s bank-grade), and their internal practices are just as locked down. We’re talking:

- Regular third-party security audits.

- Employee training for privacy best practices.

- Firewalls, anti-malware tools, and data encryption both in transit and at rest.

If you spring for the “Platinum” plan, you get the full fortress: NordVPN, Threat Protection Pro, and even Incogni for removing personal data from broker sites. It's a complete security ecosystem.

On the privacy side, NordProtect is GDPR and CCPA compliant, doesn’t sell your data, and sticks to a minimal collection policy — only gathering what’s needed to protect you.

Incogni may not have flashy firewalls or anti-virus software — because it doesn’t need them. It’s laser-focused on data privacy, not device security. What it does offer is:

- Minimal data collection (only what’s necessary to send opt-out requests).

- Strong encryption to protect your info during every request.

- Full compliance with privacy laws like GDPR, CCPA, and others.

Plus, since it’s now part of the Nord Security family (thanks to the NordVPN + Surfshark merger), you know it’s backed by a company that knows how to do privacy right.

NordProtect vs Incogni: Which privacy tool is right for you?

Picking the right privacy tool isn’t always simple. It comes down to what kind of protection you’re after. Are you more about locking down your identity and finances? Or do you just want to scrub your personal data off the web and chill?

Go with NordProtect if…

You’re looking for serious identity protection with a side of financial backup. NordProtect doesn’t just monitor the dark web — it goes full-on bodyguard mode. With up to $1M in identity theft insurance, cyber extortion coverage, and alerts for shady activity, it’s perfect if you:

- Shop online a lot.

- Want peace of mind around your credit and personal data.

- Like the idea of a secure VPN and malware protection bundled in.

- Want human help if identity theft ever happens.

Choose Incogni if…

You’re tired of your name showing up in creepy corners of the internet. Incogni is your “set it and forget it” data scrubber, sending out automated opt-out requests to over 420 data brokers — and chasing them down until your info disappears.

It’s perfect if you:

- Don’t want to spend time hunting data brokers manually.

- Value privacy over features.

- Just want your personal info off the grid.

- Already have a VPN or antivirus and want to add data cleanup.

If you want total identity protection plus handy extras like VPN and dark web monitoring, NordProtect “Platinum” is a fantastic all-in-one solution.

But if you just want to vanish quietly from data broker lists without the extras, Incogni is a sleek, affordable way to take back your digital privacy.

Still can’t decide? Honestly, NordProtect “Platinum” gives you the best of both worlds — full-on identity security plus Incogni’s privacy cleanup tools. It’s a win-win if you want to cover all bases.

The smartest privacy strategy: Layered protection with active defense

You cut identity risks most effectively by addressing them at multiple stages rather than relying on one tool alone. Incogni prevents future damage by removing your data from broker sites upfront, starving many scams of the information they need. NordProtect detects problems early through constant monitoring and steps in with insurance-backed recovery if fraud occurs.

These services complement each other perfectly because they target different parts of the threat cycle. That's necessary since no single tool covers everything. Data removal reduces exposure but can't catch leaks already out there, while monitoring alerts you to issues but doesn't stop initial spreads.

Opting for both closes those gaps. The easiest way to achieve this layered approach is through NordProtect Platinum, which integrates Incogni directly into its premium plan alongside VPN and malware tools. You gain full prevention and defense without juggling multiple services, making it the most complete option for long-term privacy in 2026.

NordProtect vs Incogni FAQ

What’s the difference between NordProtect and Incogni?

NordProtect is an all-in-one identity protection service that keeps an eye on things like your credit, the dark web, and any suspicious activity. It even includes insurance to help you recover if something goes wrong, like identity theft or online fraud.

Incogni, meanwhile, is focused purely on data broker removal. It works behind the scenes to get your personal information off the internet by sending official opt-out requests to the companies that collect and sell it.

Does NordProtect include Incogni’s data removal service?

Yes — but only if you sign up for the “Platinum” plan. That’s the top-tier package that includes everything NordProtect offers, plus Incogni’s automated data cleanup service. If you want both identity protection and extra privacy, this is the plan to go for.

Does Incogni remove data from all data brokers?

It removes data from 420+ brokers (and the list keeps growing). While no service can guarantee 100% coverage, Incogni targets a huge portion of the industry and keeps sending follow-ups until brokers take action. Thanks to privacy laws like GDPR and CCPA, most brokers comply — even if they take their time.

Is Incogni enough if I already use a VPN or antivirus?

A VPN hides your online activity, and antivirus software protects your device — but neither removes your personal data from broker sites. Incogni fills that gap by actively getting your data taken down from those sites. It’s a solid privacy upgrade that works well alongside a VPN or antivirus.

Does NordProtect protect against cyber extortion and online fraud?

Yes, and that’s one of its biggest strengths. NordProtect includes financial protection for things like cyber extortion (up to $50,000) and online fraud (up to $10,000). So if someone tries to scam you or demand a ransom, you’ve got support and backup ready to go.

Leave a Reply