When you're comparing Aura vs LifeLock for identity theft protection, both services promise strong monitoring and fraud recovery. Yet one stands out by bundling antivirus, VPN, and a password manager into every plan at no extra cost, while the other locks those essentials behind add-ons and steep renewal hikes.

We put both services to the test to find out which one offers better protection without wasting your money (or your time). See exactly where they differ in credit monitoring, insurance coverage, family plans, and real-world usability. You'll get the clear facts on setup ease, alert quality, and support response times, so you can choose the option that delivers real protection without hidden fees or complications.

Want to see how their digital defenses really stack up? Skip ahead to our feature-by-feature breakdown. But don’t worry! We’ll walk you through everything step by step so you can make the right call without second-guessing. Let’s get into it!

| Aura | LifeLock | |

|---|---|---|

| Website | Aura.com | LifeLock.Norton.com |

| Pricing | $9 – $25/month (with coupon) | $7.50 – $69.99/month |

| Money-back guarantee | 60 days | 60 days |

| 3-bureau credit monitoring | Yes (across all plans) | 1 bureau (3 bureaus with premium plans) |

| 24/7 customer support | Yes | Yes |

| Identity theft insurance | Up to $1 million (up to $5 million with family plans) | Up to $3 million |

| Best Deal | 68% Off Coupon > | 52% Off Coupon > |

Key takeaways from Aura and LifeLock comparison

Aura packs a punch with antivirus, VPN, and credit monitoring from all three bureaus included in every plan — no sneaky upsells. LifeLock? You’ll need to pay extra for the same features, and watch out for that hefty renewal price hike.

- When it comes to coverage, Aura keeps things simple: $1 million in insurance across all plans, a solid security toolkit, and a 60-day money-back guarantee. LifeLock ups the insurance to $3 million — but only if you spring for their most expensive plan.

- Both companies claim to have your back, but when it comes to trustworthiness, Aura’s record is a little cleaner. LifeLock has had its fair share of BBB complaints and regulatory run-ins, which might give some users pause.

- Looking at the full picture, Aura delivers more bang for your buck, especially with this 68% off coupon. In a hurry? Skip to our final verdict to see who wins.

How to select the right identity theft protection service: Aura vs LifeLock

Before we break down what sets Aura and LifeLock apart, let’s take a quick pit stop and cover the basics of what makes a great identity theft protection service, so you know exactly what to look for.

- Monitoring: Both Aura and LifeLock scan the dark web, public records, and credit files to detect if your info is floating where it shouldn’t be. Think of it as a 24/7 security patrol for your digital identity.

- Protection tools: The best services don’t stop at detection — they help you stay secure in the first place. We’re talking antivirus software, safe browsing, spam call blocking, and even data broker removal tools to scrub your info from sketchy sites. Looking for the real protection perks? Skip to the extra security tools.

- Real-time alerts: When something shady pops up, fast alerts can make all the difference. Aura and LifeLock both ping you when they catch something suspicious, so you can take action right away.

- Fraud resolution and insurance: If the worst happens, both services offer expert help and insurance to cover eligible losses. Wondering who offers more peace of mind? Skip to the insurance comparison and find out whose coverage is more generous.

Now, let’s see how these two really compare — and which one gives you more protection for your money.

Aura vs LifeLock: Side-by-side comparison

Two big names, one tough choice. This quick comparison should make it a little easier to pick your winner:

| Aura | LifeLock | |

|---|---|---|

| Pricing | $9 – $25/month (with coupon) | $7.50 – $33.39/month |

| Family-focused plans and features | ✅ | ✅ |

| 3-bureau credit monitoring and reports | Yes (Experian, TransUnion, and Equifax) | 1-bureau (Equifax) or 3-bureau (Experian, TransUnion, and Equifax) |

| Dark web monitoring and alerts | ✅ | ✅ |

| Identity theft insurance | Up to $1 million | Up to $3 million |

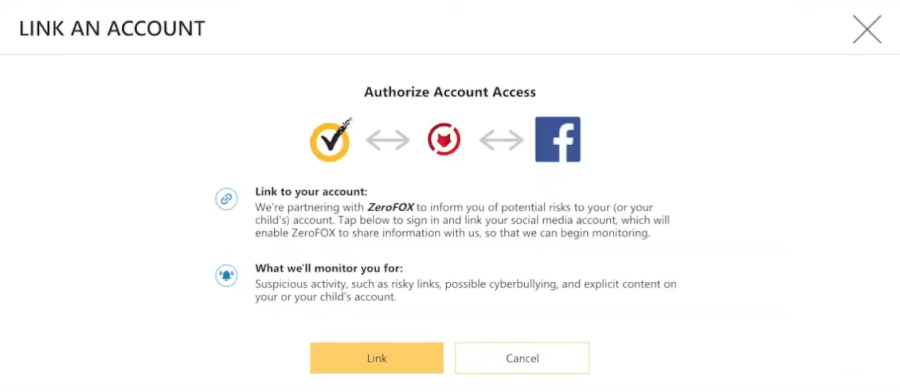

| Social media account alerts | ❌ | ✅ |

| Credit lock | ✅ | ✅ |

| Lost wallet remediation | ✅ | ✅ |

| Antivirus and VPN | ✅ | ✅ (as an add-on for an extra fee) |

| Password manager | ✅ | ❌ |

| 24/7 customer support | ✅ | ✅ |

| Best Deal | 68% Off Coupon > | 52% Off Coupon > |

Aura vs LifeLock: Who has the better track record?

Trusting a company with your most sensitive info isn’t something you do lightly. Before you pick a service, it’s worth digging into their track record, how many people rely on them, and whether they actually walk the walk when it comes to security.

So, how do Aura and LifeLock measure up? Let’s take a closer look.

Aura overview

| Starting price | $12/month ($9 with a coupon) |

| Supported platforms | Windows, macOS, Android, and iOS |

| Three-bureau credit monitoring | Yes (across all plans) |

| Identity theft insurance | $1M – $5M ($1M per adult) |

| Best deal | 68% off coupon > |

Aura kicked off in 2014, when founder Hari Ravichandran had his own credit info stolen — a harsh wake-up call that sparked a mission to make the internet a safer place. Fast forward to today, and over a million people trust Aura to help protect their digital lives.

Aura’s no stranger to the spotlight either. With nods from Inc. Magazine, Forbes, and even the Mom’s Choice Awards, it’s clear they’re doing something right. Their 4.3 TrustScore on Trustpilot (based on 850+ reviews) doesn’t hurt either — that’s a lot of happy, protected users.

After acquiring Identity Guard, Aura expanded its offerings to fit different lifestyles, with flexible plans for individuals, couples, and families. All plans come with powerful tools, including antivirus, a VPN, and a password manager, ensuring your devices and data stay secure.

And they’re still leveling up — like with the new Online Balance feature (“Family” and “Kids” plans), which helps parents keep an eye on their child’s digital well-being with insights and conversation starters.

Aura pros and cons

Let’s take a closer look at the pros and cons of choosing Aura to guard your digital life:

+ Pros

- Antivirus software across all plans

- Comprehensive identity theft protection and credit monitoring services

- Dark web monitoring

- Fraud call protection

- Up to $1 million in insurance coverage

- Plans for individuals, couples, and families

- Useful parental control app

- Password manager and VPN included

- 24/7 customer support and fraud resolution

- Transparent pricing

- 3-bureau credit monitoring included in all plans

– Cons

More expensive than some competitors

Now that we’ve explored Aura, let’s turn the spotlight on LifeLock and see how it stacks up.

LifeLock overview

| Starting price | $7.50/month |

| Supported platforms | Windows, macOS, Android, and iOS |

| Three-bureau credit monitoring | Yes (top-tier plans) |

| Identity theft insurance | Up to $3 million |

| Best deal | 52% Off Coupon > |

LifeLock has been in the identity protection game since 2005, and it’s had quite the journey — including a rebrand in 2022 when it officially became part of Gen Digital Inc. (formerly NortonLifeLock). Over the years, it’s weathered a few storms, from a $12 million FTC fine for misleading ads to a high-profile founder exit that added a dash of drama to its story.

But LifeLock didn’t just dust itself off — it leveled up. Merging with Norton 360 helped beef up its security offerings, and today, it’s still one of the most recognized names in identity theft protection.

Its 4.8 rating on Trustpilot suggests plenty of satisfied customers, but it’s not all smooth sailing. Around 9% of users gave it the lowest score, pointing to false alarms, glitchy alerts, and mixed experiences with customer support. So while LifeLock’s reputation remains solid, there are a few bumps in the road you’ll want to know about before signing up.

Curious how LifeLock handles your data behind the scenes? Jump to our deep dive on security and privacy.

LifeLock pros and cons

Now, let's delve into the strengths and weaknesses associated with choosing LifeLock for your digital identity safeguarding needs.

+ Pros

30-day free trial period

VPN included with family subscriptions

Full-service identity theft protection

Integration with Norton 360 antivirus for enhanced security

Insures up to $1 million in costs stemming from identity theft incidents

Intuitive user interface and straightforward setup process

Protection for lost wallets

- Easy-to-use mobile applications

– Cons

Monitoring from all three credit bureaus is reserved for the more premium plans

- The structure of the paid plans may be perplexing

Price increase after the first year

Steeper pricing compared to competitors

Availability and insurance coverage: Which service protects you better when things go wrong?

From lost funds to legal fees, recovery costs add up fast. Here's how Aura and LifeLock compare when it comes to insurance protection.

| Aura | LifeLock | |

| Identity theft insurance amount | $1M for each adult member, up to $2M on the “Couple” plan, and up to $5M on the “Family” plan | $1M with all plans, but only for lawyers and experts. Stolen funds and personal expenses vary from $25,000 to $1M, depending on the plan |

| Stolen funds reimbursement | Up to $1M | From $25,000 to $1M, depending on the plan |

Aura keeps things simple and generous. Every adult on a plan gets up to $1 million in identity theft insurance, no matter the tier. Couples get $2 million total, and families enjoy a whopping $5 million in total coverage — enough cushion to help recover from stolen funds, legal fees, and more.

See all Aura price plans here >

LifeLock? Also offers insurance, but the details are a bit more layered. You’ll always get $1 million for expert and legal support, but coverage for stolen funds and personal expenses starts at just $25,000 on the lower-tier plan and scales up with higher ones. So if insurance protection is a top priority, it’s worth checking the fine print.

See all LifeLock price plans here >

As for platform support and system compatibility…

Aura plays well across the board — Windows, macOS, Android, and its browser extensions work on Chrome, Firefox, and Edge. It also monitors dark web activity, public records, and new account openings to help keep your name, SSN, and address safe — not just from identity theft, but from the digital shadows where that info might surface.

LifeLock also covers all the major platforms, including iOS, and includes Norton’s Safe Web extension for Chrome, Firefox, and Edge. You’ll get solid monitoring features across the board, but not necessarily the same all-in-one digital safety net you’d get with Aura.

Core identity protection capabilities: Who wins the Aura and LifeLock face-off?

When it comes to identity monitoring, Aura and LifeLock take different routes to the same goal: keeping your personal info safe. From credit checks to dark web scans and bank account alerts, it’s worth comparing how each service handles the dirty work of spotting trouble before it hits.

Credit monitoring across the bureaus

Aura includes three-bureau credit monitoring, even on its base plan — a significant win compared to LifeLock, which reserves full coverage for its higher tiers. Keeping tabs on all three credit bureaus (Experian, Equifax, and TransUnion) is important since they don’t always show the same data, and missing one could mean missing a red flag.

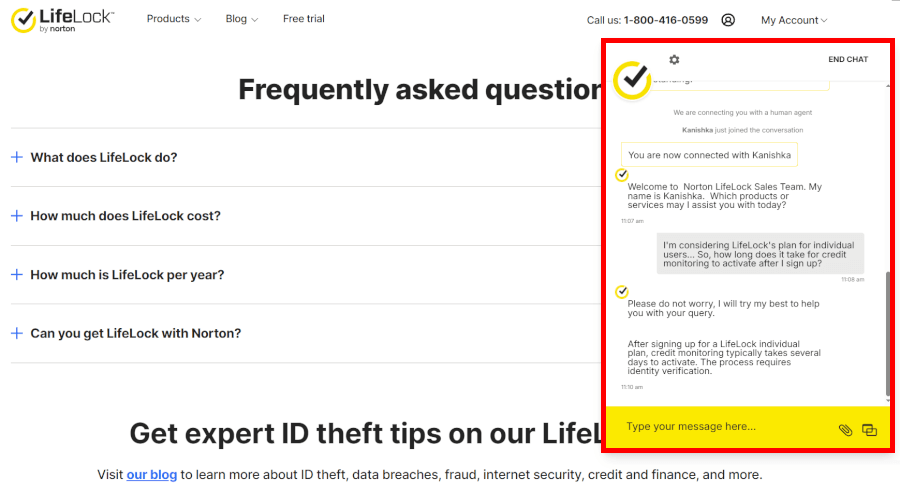

Both Aura and LifeLock alert you to new accounts or inquiries on your credit file — a common sign of fraud. But Aura gets bonus points for its direct connection to the credit bureaus, which means faster alerts and quicker action when something suspicious pops up. LifeLock’s setup, on the other hand, can take a few days to kick in.

Since speed matters in stopping identity theft early, Aura’s real-time alerts and full credit monitoring from the start make it a stronger choice here.

Dark web surveillance

The dark web might sound mysterious, but in reality, it’s where a lot of illegal activity happens — and where stolen personal data often ends up for sale. Here’s a glimpse at what goes on behind the scenes:

Your data, up for grabs: Hackers sell sensitive info like SSNs, passwords, and credit card numbers.

Underground markets: Everything from narcotics to weapons is available if you know where to look.

Hacker hangouts: It’s a breeding ground for cyber attacks and ransomware schemes.

Illegal content: From pirated content to banned material, it’s all there.

Because of all this, dark web surveillance isn’t just helpful — it’s essential. It acts like an early warning system, letting you know if your information has been compromised before bigger problems hit.

| Aura | LifeLock | |

| Where does it monitor for signs of fraud? | The dark web, data broker sites, public records, bank and investment accounts, online sites and discussion forums, payday loans, criminal and court records | The dark web, data broker registries, public records, bank and investment accounts, online sites and forums, payday loans, criminal and court records, and social media platforms |

| What can you add to your watchlist? | Your name, date of birth, address, up to 10 email addresses, 40 credit/debit card numbers, 5 phone numbers, 3 health insurance IDs, and more | Your name, date of birth, address, up to 5 email addresses, 10 credit/debit card numbers, 5 phone numbers, 5 health insurance IDs, and more |

| You'll receive alerts for any suspicious activity? | ✅ | ✅ |

Aura takes identity monitoring seriously, scanning everything from the dark web and public records to financial accounts and data broker sites. If it finds anything off, you’ll get a detailed alert and guidance on what to do next, plus free dark web scans to see if your info has already been leaked.

LifeLock covers similar ground, watching for threats like criminal record misuse, payday loan fraud, and banking irregularities. But while it does offer solid protection, it’s a bit less clear on how fast those alerts come through. With Aura’s reputation for speed, you’re more likely to catch a threat before it spirals out of control.

Protecting your bank and investment accounts

Let’s see who does a better job of guarding your bank accounts and keeping your finances fraud-free — Aura or LifeLock?

| Aura | LifeLock | |

| Account monitoring? | Yes, complete account monitoring (credit cards, checking accounts, savings accounts investment accounts 401(k)s, and any changes to banking information) with all plans | Depend on the plan: None with the “Standard” plan”, limited with the “Advantage” and complete account monitoring with the “Ultimate Plus” plan |

| High-risk transaction alerts? | ✅ | ✅ |

| Lost wallet remediation | ✅ | ✅ |

Aura doesn’t mess around when it comes to watching your money. Every plan includes monitoring for bank accounts, credit cards, 401(k)s, and investment accounts — plus alerts for anything suspicious, from weird transactions to payday loans you didn’t sign up for. It’s solid protection across the board, no upgrade required.

LifeLock, meanwhile, offers similar tools — but only if you’re willing to pay more. Their entry-level plan skips over full financial account monitoring, saving those features for their pricier Advantage and Ultimate Plus plans.

So while both services do a good job of flagging high-risk transactions and guarding your wallet, Aura makes it easier (and cheaper) to protect your finances from day one.

Additional digital defenses: Who offers better extras?

While both Aura and LifeLock shine at identity theft protection, they also throw in some great bonus tools. Think VPNs, antivirus programs, and password managers that help round out your overall digital security.

Keeping kids safe

When you're a parent, identity protection isn't just about your credit score — it's about making sure your kids are safe from digital dangers too. That’s why features like parental controls and child identity monitoring deserve a top spot on your must-have list.

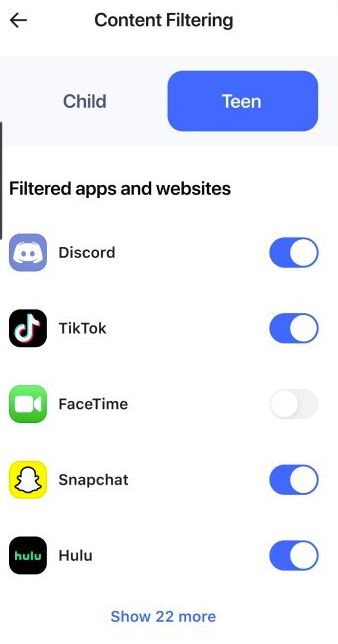

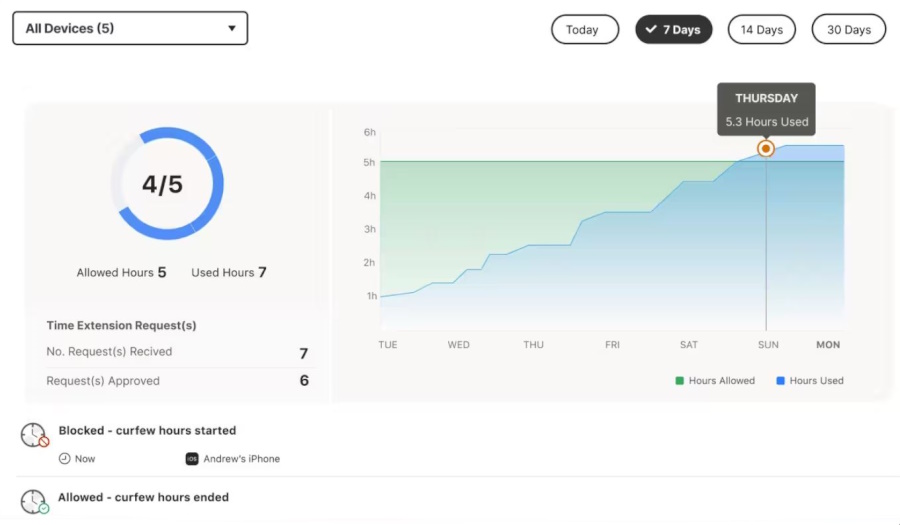

Aura steps up for families with powerful tools to help keep kids safe online. Think of its parental controls as your digital sidekick — helping you block harmful content, manage screen time, and stay in the loop with alerts about cyberbullying or online predators. All of this comes wrapped in Aura’s “Family” plan — a one-stop safety kit for your kids’ digital lives.

LifeLock comes through with strong child identity monitoring and social media alerts, keeping an eye out for fraud. But if you're hoping for full-on parental controls, like content filters or screen time tools, LifeLock leaves those to other apps.

Antivirus and VPN protection

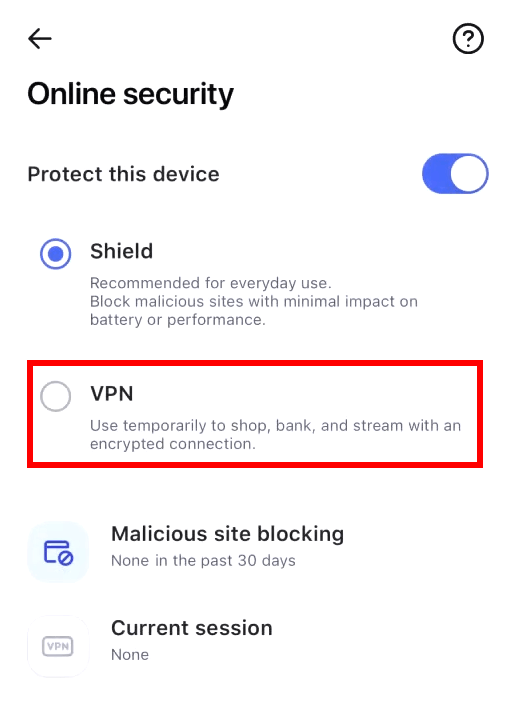

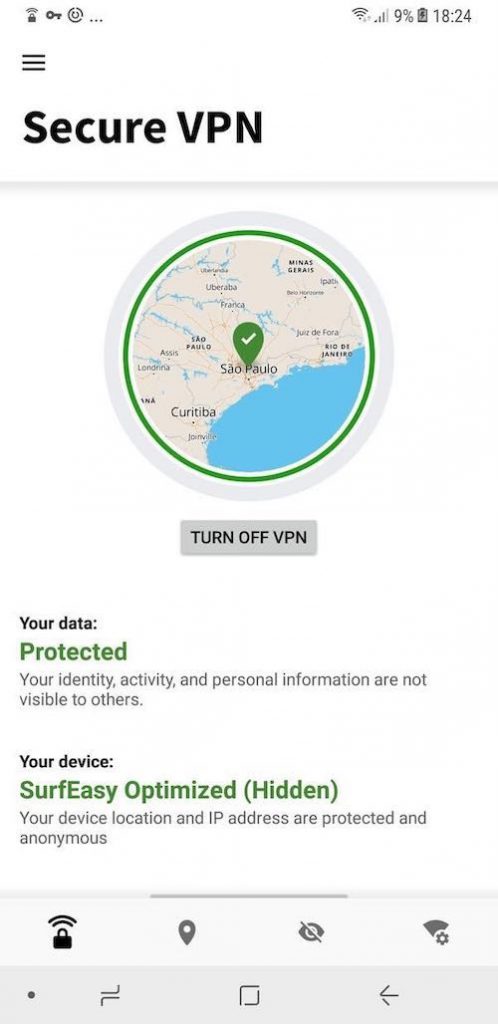

In the digital wild west, you’ll want some serious armor, and Aura delivers with built-in antivirus and VPN protection. Here’s what their secure VPN setup looks like behind the scenes.

So, Aura doesn’t make you jump through hoops for solid digital security. Antivirus and VPN protection come built into every plan, giving you peace of mind whether you’re shopping online, checking your bank account, or just browsing memes. You’re covered right out of the box.

LifeLock, meanwhile, takes a different route. It offers Norton 360’s antivirus and VPN, but only as a separate add-on. That means you can beef up your protection, but it’ll cost extra. So while LifeLock gives you options, Aura gives you everything upfront — no upsells needed.

All things considered, Aura takes the crown for antivirus and VPN protection. By including these essentials in every plan, it offers solid, built-in security without the extra price tag.

Ad and tracker blocking

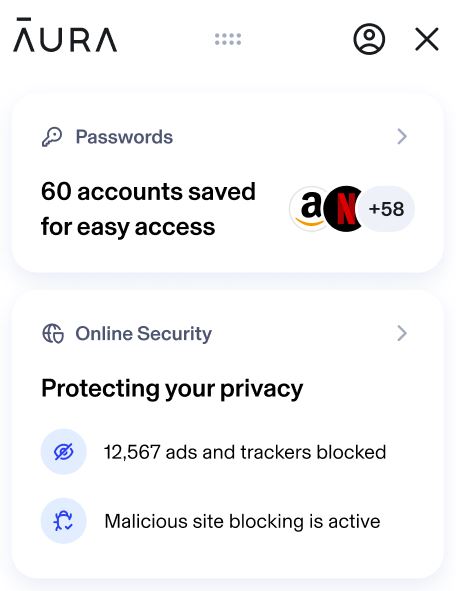

Aura’s browser extension takes care of more than just annoying ads. It blocks trackers, helps pages load faster, and even includes tools like a password manager and email masking — all designed to keep your digital footprint private.

Want an even stronger shield? Team it up with Aura’s built-in VPN for broader protection across all your devices. Just a heads-up: you might hit a few extra verification screens here and there (hello, Google), but it’s a small trade-off for keeping your personal info locked down.

Over on the LifeLock side, ad blocking isn’t a core feature. Norton’s add-on only offers ad blocking for iOS, which leaves users on other platforms in the dust. So, if you're looking for privacy features that work across the board without needing extra purchases, Aura is the clear winner.

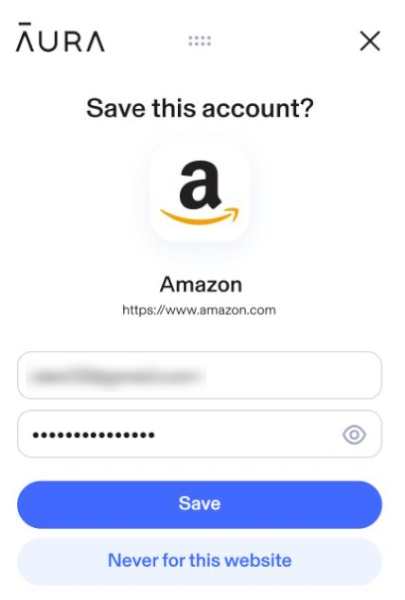

Password manager

Aura packs a solid password manager into every plan — it stores your logins, flags weak or leaked passwords, and can even update them for you on supported sites. It's a simple way to tighten security without the usual hassle.

LifeLock skips the built-in password manager, but Norton does offer one as a free add-on. The catch? It doesn’t connect with LifeLock’s other tools, so switching between apps can feel a bit disjointed.

Social media account monitoring and alerts

LifeLock takes social media safety seriously, scanning for suspicious activity like hacked posts, sketchy links, or sudden changes to your account settings. It doesn’t stop with adults either — LifeLock also keeps an eye on your kids’ profiles, flagging signs of cyberbullying or risky viral trends before they spiral out of control.

Aura, on the other hand, skips dedicated social media monitoring, but makes up for it with powerful parental controls and full-family protection. Its tools even let you manage or block access to certain social media platforms like Facebook. From shielding your info to guarding against financial fraud, Aura covers more ground — even if it doesn’t scroll through your feed.

Ease of use and support: How user-friendly are Aura and LifeLock?

Identity protection doesn’t have to be complicated. Aura and LifeLock both offer help when you need it, but which one makes managing your security a breeze? Stick around as we explore which service keeps things simple and straightforward.

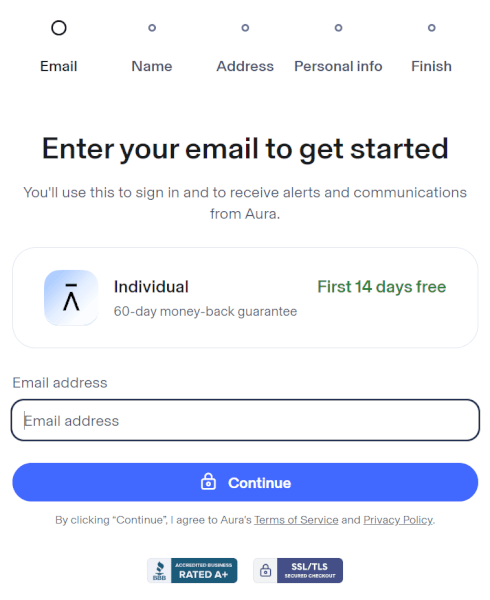

Setting up your protection

Signing up is a key first step when picking an identity theft protection service. Aura keeps it simple on its website, smoothly guiding you through choosing a plan and entering basics like your name, email, and phone number.

Aura’s user-friendly interface guides you effortlessly through registration, quickly activating security features like VPN, antivirus, and handy browser extensions with password management and ad blocking to keep you safe online.

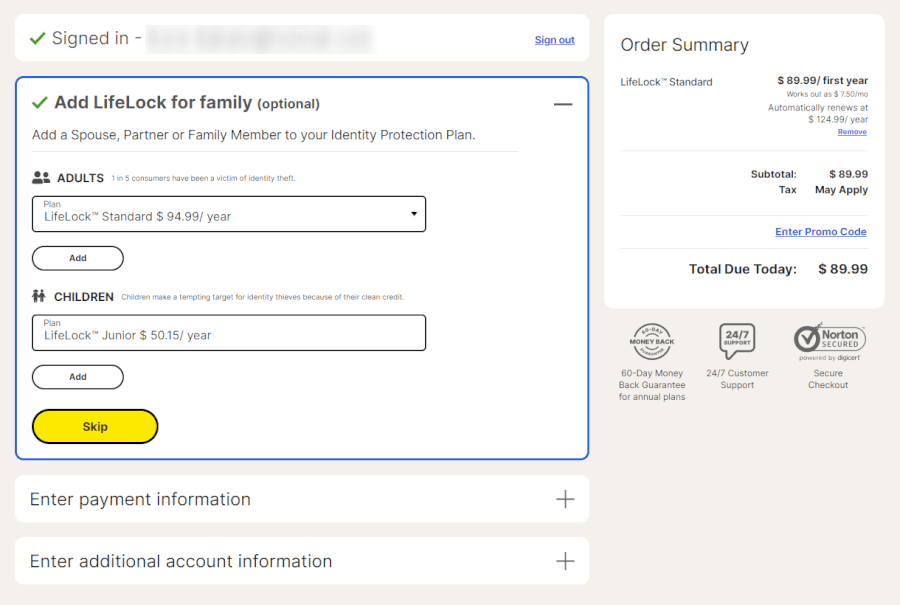

Signing up for LifeLock takes a bit more time, requiring thorough personal and financial details to tailor protection just for you. Once billing info is in, you land on the LifeLock dashboard — your hub for managing settings and keeping tabs on alerts about your identity.

Aura scores high praise for its clean, user-friendly interface that works smoothly across Windows, Mac, iOS, and Android. LifeLock covers the same platforms but tends to feel a bit clunkier, with users noting it takes a bit more clicking and digging to find what you need compared to Aura’s slicker experience.

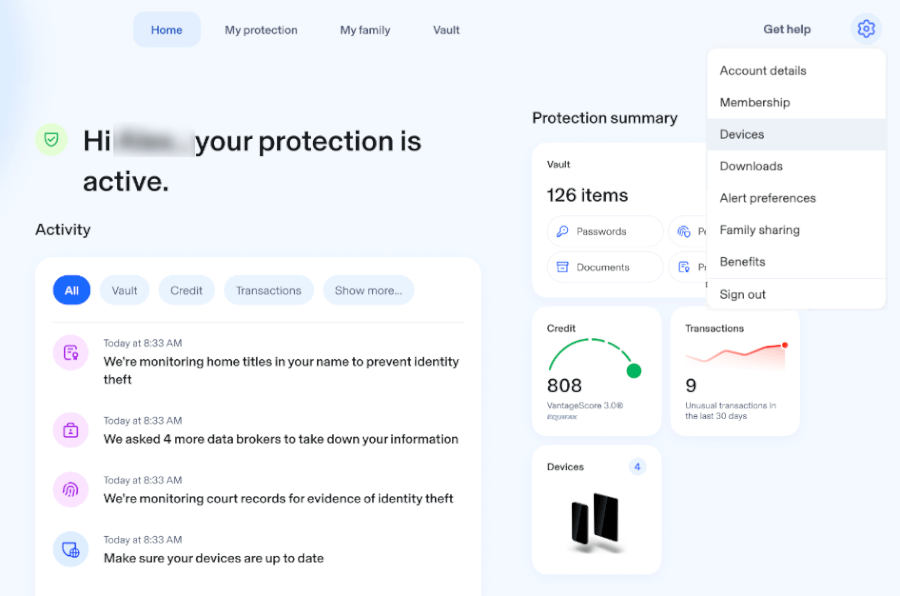

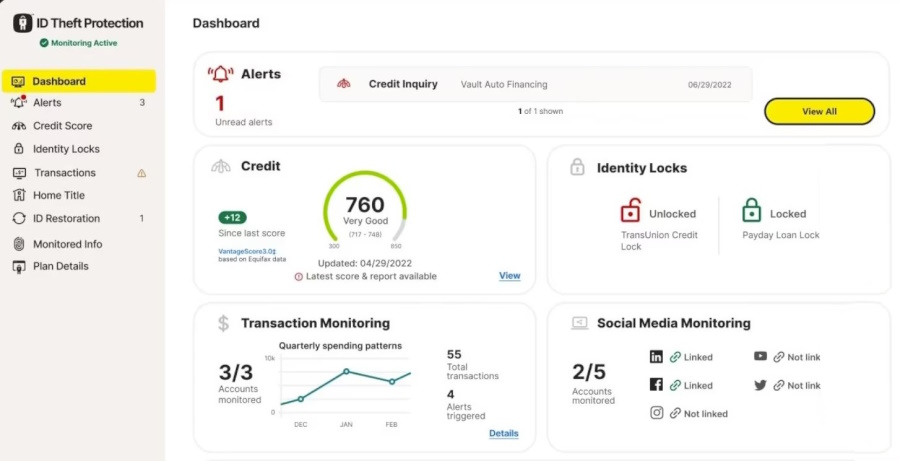

Navigating your dashboard and apps

Aura’s app keeps things simple and smart. Whether you’re on iPhone, Android, or desktop, you get a clean dashboard that lets you track your finances, manage alerts, and stay on top of your digital security — all in one place.

LifeLock’s dashboard is clean and easy to navigate, but don’t expect instant access to everything — credit monitoring can take a few days to kick in after sign-up, so there’s a bit of a waiting game before you get the full scoop. Their mobile apps are slick and user-friendly, but having two different apps might leave you scratching your head at first, wondering which one you need to download.

Aura’s clean, easy-to-use interface makes managing your identity protection a breeze — giving LifeLock a run for its money in user-friendliness.

Customer support and resources

When things go wrong, who do you call? In the world of identity theft protection, solid customer support can be a real lifesaver — and both Aura and LifeLock are on call 24/7/365 to lend a hand.

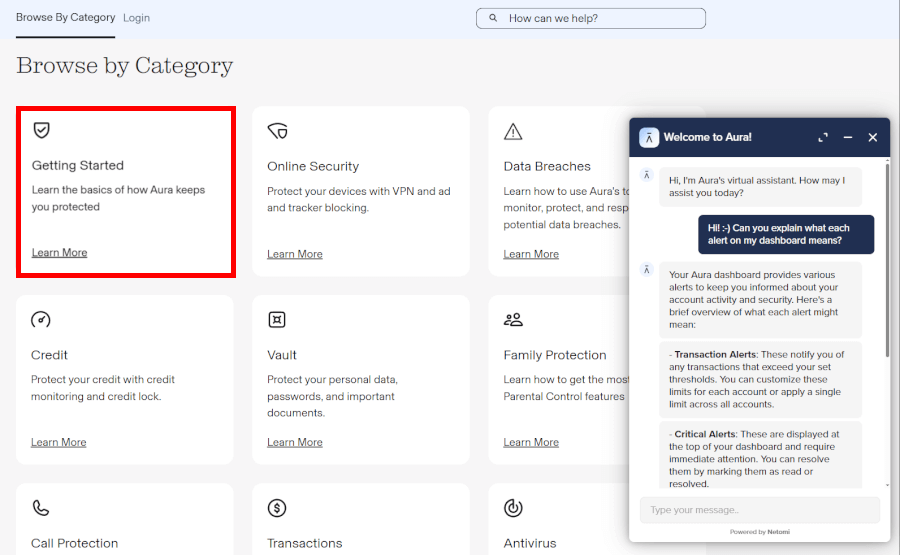

Aura stands out with its all-US-based support team that’s available every hour of every day — even on holidays (because hackers don’t take time off). Whether you prefer calling, emailing, or chatting live, Aura makes it easy to reach someone who actually knows what they’re talking about. We especially liked their AI assistant, which handled basic questions surprisingly well, fast, friendly, and right on the money.

And if you ever do fall victim to identity theft, Aura goes beyond just sympathy and sends in the pros. Each customer gets a dedicated case manager, often with years of experience in fraud resolution, to walk them through every step of recovering their identity. It’s personalized, patient, and — based on our experience — pretty reassuring during a stressful time.

Aura also caters to the DIY crowd with a helpful support center packed full of how-to guides and articles. Whether you're curious about how something works or trying to fix a minor issue, there's plenty of info to dig through without having to wait on hold.

LifeLock also promises 24/7 support, though the experience is a bit more of a mixed bag. While their case managers are also US-based and ready to help you through an identity theft crisis, their general support team is largely overseas. They’re available around the clock, but we noticed that many reps seemed more versed in Norton’s antivirus tools than LifeLock’s identity protection features. This can make troubleshooting more complex issues a little frustrating.

One perk for those on LifeLock’s Ultimate Plus plan is “priority support,” which bumps you up in the queue — handy if you don’t love waiting. However, you won’t find direct email support or a dedicated customer portal. And while there is a blog and an FAQ section, it’s not quite as comprehensive as Aura’s resource library.

Financial health: Who gives you the better view?

Keeping tabs on your credit is a big deal — and both Aura and LifeLock bring useful tools to the table, though how much you get depends on the plan.

Aura keeps it simple but solid, offering three-bureau credit monitoring on every plan. You’ll get monthly credit score updates and one annual credit report to check in on your financial standing. It’s great for staying in the loop, but Aura doesn’t go the extra mile with tools like credit score simulators or budgeting calculators — so you’ll have to do the math yourself.

LifeLock, especially if you go for the “Ultimate Plus” plan, turns things up a notch with daily credit score updates and monthly credit reports from all three bureaus. You also get the power to lock and unlock your TransUnion credit file, which can be a lifesaver when applying for loans or stopping fraud in its tracks. Just keep in mind: the cheaper plans only monitor one bureau and may skip the full reports, meaning less visibility and more DIY work for complete protection.

Security and privacy: Is Aura or LifeLock a safer choice?

When it comes to keeping your personal info under lock and key, both Aura and LifeLock are in the spotlight, but they've taken different paths to safeguard your data.

Let’s start with a quick head-to-head:

| Security features | Aura | LifeLock |

| Bank-level AES-256 encryption | ✅ | ✅ |

| Real-time threat and fraud alerts | ✅ | ✅ |

| Two-factor authentication | ✅ | ✅ |

| Dedicated privacy tools (VPN, ad block) | ✅ | ❌ (separate Norton bundle) |

Aura uses military-grade AES-256 encryption — the gold standard for digital security — to guard your personal info. It’s the same level of protection trusted by banks and government agencies. Combine that with Aura’s high-profile partnerships (including Walmart and Bank of America), and you get the sense they’re doing something right.

Plus, Aura includes extras like a secure VPN, ad blocker, safe browsing tools, and even password management — all built right in.

LifeLock covers the basics but has a few dents in its armor. It’s been fined twice by the FTC — once in 2010, and again in 2019 — for failing to protect user data and misrepresenting its services. While it has taken steps to improve, the past still casts a shadow.

Also, LifeLock does use strong encryption, and its top-tier plan comes bundled with Norton’s antivirus and VPN tools. But unlike Aura, those features aren’t fully integrated and can feel like an afterthought. You’ll need to toggle between apps and dashboards, which isn’t exactly seamless.

Plans and pricing: Does Aura or LifeLock offer greater value for money?

When it comes to protecting your identity, the features matter — but so does the price tag. Aura and LifeLock both offer a range of plans, but how much value do you actually get for your money?

| Aura plans | Individual | Couple | Family |

|---|---|---|---|

| 1-month | $12.00/month | $20.00/month | $30.00/month |

| 1-year | $9.00/month | $17.00/month | $25.00/month |

Deal: Get 68% discount on Aura's yearly plans >

| Aura plans | Price per month (paid monthly) | Price per month (paid yearly) |

| Individual | $12/month | $9/month |

| Couple | $20/month | $17/month |

| Family | $30/month | $25/month |

Aura keeps pricing simple, all-inclusive, and refreshingly free of hidden fees. The “Individual” plan covers one adult with $1 million in identity theft insurance, 1GB of secure cloud storage, and protection for up to 10 devices — all for $12/month (or just $9/month with a discount).

The “Couple” plan covers two adults, bumps cloud storage up to 2GB, and secures up to 20 devices for $20/month (or $17/month with a discount).

The “Family” plan is the best deal if you’re protecting the whole household. For $30/month ($25/month with a discount), you get $1 million in insurance per adult, 5GB of storage, coverage for up to 50 devices, and extra features like child identity protection and parental controls.

And the best part? No upsells, no add-ons — Aura gives you the full package right out of the gate.

We’ve seen what Aura offers (and it’s a lot), so now it’s time to dive into LifeLock’s pricing and see how it compares.

| LifeLock plans | Price per month (paid monthly) | Price per month (paid yearly) |

| Standard | $11.50/month | $7.50/month |

| Advantage | $23.39/month | $14.99/month |

| Ultimate Plus | $34.99/month | $19.99/month |

LifeLock takes a more complicated path when it comes to pricing. You’ve got three main plans — Standard, Advantage, and Ultimate Plus — each with a discounted first-year rate. But here’s the catch: when renewal time rolls around, prices can jump by as much as 45%.

They do match Aura’s 60-day money-back guarantee on annual plans, which is great. But if you want Norton’s device security and VPN (something Aura includes by default), you’ll need to pay extra.

For context: LifeLock’s Ultimate Plus starts at $239.88/year for individuals, but that jumps to $339.99/year when it renews — and that’s without the full Norton 360 suite baked in.

See all LifeLock prices here >

Aura vs LifeLock video comparison

The rising threat of identity theft: Key statistics for 2026

Identity theft continues to surge this year, making reliable protection more essential than ever. Here are the most recent figures that show why monitoring services like Aura or LifeLock deserve serious consideration.

- The FTC received 1,157,317 identity theft reports in just the first nine months of 2025—already surpassing the full-year total for 2024.

- Credit card fraud leads as the most common type, with 503,450 cases reported in that same period, a 54% jump year-over-year.

- Data breaches reached a record 3,322 incidents in 2025, up 5% from 2024 and exposing millions to potential fraud.

- Consumers reported losing $12.5 billion to fraud in 2024, with over 1.1 million identity theft cases that year alone, the trends point to even higher numbers ahead.

These numbers highlight the real danger: one breach or stolen detail can quickly spiral into major headaches. Strong monitoring, alerts, and recovery support give you the best defense, and bundling extras like antivirus helps cover modern threats without added costs. If you're ready to stay ahead of the risks, compare the plans and pick the one that fits your needs.

Conclusion: Which identity theft protection service is best?

When it comes down to choosing between Aura and LifeLock, here’s how they stack up across the board:

Trustworthiness: Aura

Availability and insurance: Tie

Core identity protection capabilities: Aura

Additional digital defenses: Aura

Ease of use and support: Aura

Financial health reports: Tie

Security and privacy: Aura

Plans and pricing: Aura

In the end, both Aura and LifeLock put up a good fight — but Aura pulls ahead where it really counts. With stronger credit monitoring across the board, built-in security tools, and a smoother experience from sign-up to support, Aura gives you more without the hidden costs. If you're looking for a smarter, simpler way to stay protected, Aura is the clear winner.

Exclusive Aura Coupon:

Get 68% Off Aura subscription plans with the coupon below:

(Coupon is applied automatically; 60 day money-back guarantee.)

Not sure about Aura? Try it out — and if it’s not your thing, there’s a 60-day money-back promise. Then give LifeLock a try.

Identity theft protection reviews on CyberInsider:

- Aura vs Experian IdentityWorks

- Aura vs IDShield

- Aura vs McAfee

- Aura vs NordProtect

- LifeLock vs IDShield

- Aura vs Incogni

- Aura vs IdentityIQ

- Aura vs IDShield

- Identity Guard vs Aura

- Identity Guard vs LifeLock

- Identity Guard vs NordProtect

- LifeLock vs Experian Identity Works

Aura vs LifeLock FAQ

Which is better, Aura or LifeLock?

Both Aura and LifeLock offer solid identity protection, but Aura pulls ahead in the key areas that matter the most — like better credit monitoring on every plan, handy security tools bundled in, and a smoother, more user-friendly experience. If you want straightforward protection without surprises or upsells, Aura’s the one to beat.

What’s the difference between Aura and LifeLock?

Aura is all about simplicity, with easy-to-understand plans that cover your identity, credit, and online security in one neat package. LifeLock, on the other hand, can be a bit more complex with tiered plans and extra fees if you want Norton antivirus or VPN services. Plus, Aura’s support is US-based and super responsive, while LifeLock’s has some quirks and overseas reps. Bottom line: Aura aims to keep it simple and reliable.

Are there hidden fees with Aura or LifeLock?

Good news — Aura keeps things transparent. No sneaky upsells or surprise add-ons; what you see is what you get. LifeLock’s pricing can get a little tricky, especially after the first year, with some plans hiking prices and charging extra if you want Norton antivirus or VPN. So, if you hate hidden fees, Aura might be your best bet.

Do Aura and LifeLock include a VPN or antivirus?

Aura’s got your back with a solid VPN included across all plans, plus extra security tools like malware protection and a secure vault. LifeLock offers antivirus and VPN too, but those come as add-ons and usually cost extra. If you want all-in-one protection without hunting for extras, Aura’s package is simpler and more wallet-friendly.

Which service provides better credit monitoring: Aura or LifeLock?

Both keep an eye on your credit, but Aura includes full three-bureau credit monitoring on every plan — no matter which one you pick. LifeLock’s top-tier plan offers daily credit score updates and the ability to lock your TransUnion credit file, but lower-tier plans only cover one bureau and don’t always include free reports. For all-around credit watchfulness, Aura gives you more bang for your buck.

LifeLock used to be the top contender for identity theft services. But Aura has taken the lead. It offers a more comprehensive service, better features, and is a much better value than LifeLock, especially when you look at the coverage that each service provides.