In early July 2025, Abacus Market, the largest Bitcoin-enabled Western darknet marketplace, abruptly went offline, triggering widespread suspicion of an exit scam.

According to blockchain intelligence firm TRM Labs, all of Abacus’s infrastructure, including its clearnet mirror, became inaccessible, suggesting either a deliberate shutdown by its operators or a covert law enforcement seizure.

The first red flags emerged in late June, when Abacus users began reporting withdrawal delays, a typical prelude to an exit scam. In response, the platform’s administrator, known online as “Vito,” addressed concerns on the darknet forum Dread, attributing the disruptions to a sudden influx of users from Archetyp Market (which had been seized by law enforcement on June 16) and a persistent DDoS attack. Despite these claims, confidence among the darknet community eroded quickly. TRM Labs noted a dramatic drop in platform activity: daily deposits plunged from $230,000 across 1,400 transactions in early June to just $13,000 and 100 deposits by early July.

TRM Labs

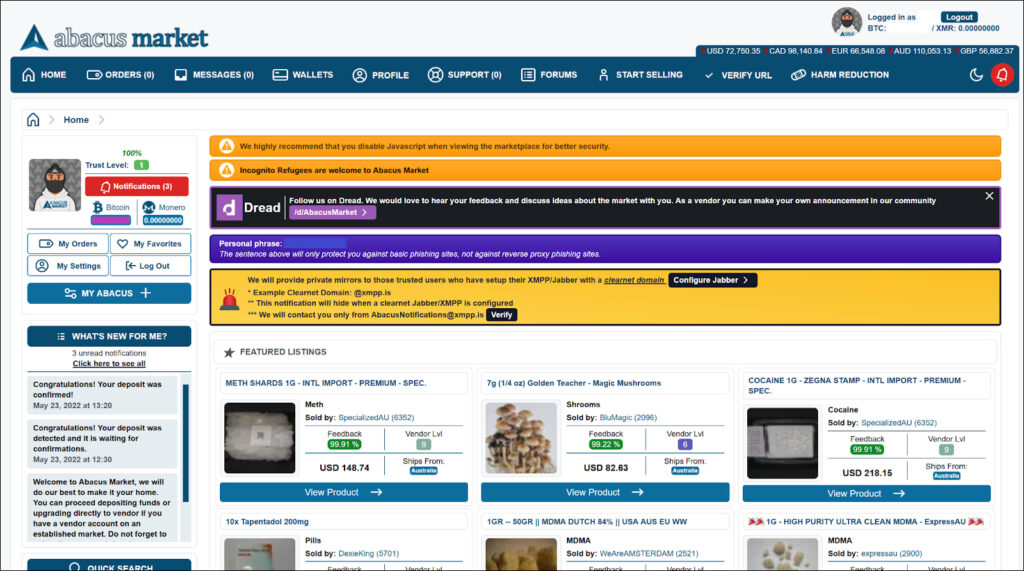

Abacus Market originally launched in September 2021 under the name Alphabet Market before rebranding just two months later. While the platform served a global audience, it carved out a stronghold in Australia, tailoring marketing to local users and appointing a dedicated moderator for the region. The marketplace offered a wide array of illicit goods, ranging from stimulants and dissociatives to opioids, prescription medication, and cannabis-related products. It supported both Bitcoin and Monero, and operated with a central deposit wallet architecture combined with multisignature capabilities, setting it apart from competitors like ASAP Market, DrugHub, and Incognito Market.

TRM Labs

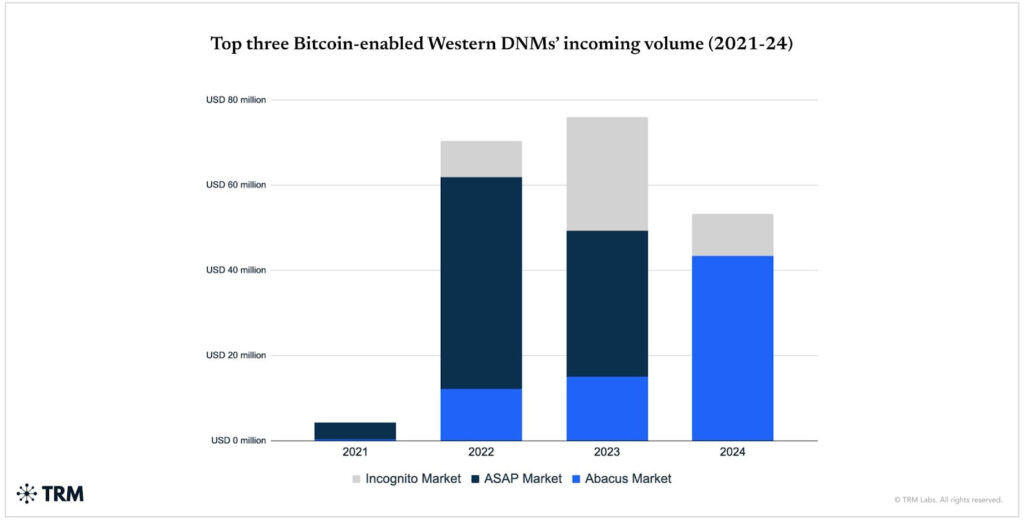

The platform’s prominence grew significantly following the closure of rival marketplaces. After ASAP Market voluntarily shut down in July 2023 and Incognito Market was seized in March 2024, Abacus’s market share soared, surpassing 70% by late 2024. TRM Labs estimates that Abacus facilitated nearly $100 million in Bitcoin transactions, though actual volume is likely much higher due to the widespread use of Monero, which accounted for as much as three-quarters of total sales. This places Abacus’s total transaction volume between $300 million and $400 million.

TRM Labs

TRM’s analysts suggest that Abacus’s rapid growth may have led directly to its downfall. In June 2025, following Archetyp’s takedown, Abacus experienced its highest monthly sales, $6.3 million, drawing significant attention and possibly making it a top target for law enforcement. Faced with increasing scrutiny and a surge in new users, its operators may have opted to shut down operations and escape with user funds rather than risk exposure or arrest. This behavior aligns with previous cases, such as Evolution Market’s exit scam or Agora and WhiteHouseMarket’s voluntary closures, none of which have resulted in public arrests.

Despite speculation, TRM notes that no official seizure banner has appeared on the site, and Dread’s administrator “Hugbunter,” who had close ties to Abacus staff, publicly dismissed the possibility of a takedown. However, law enforcement agencies have increasingly favored covert disruptions over public announcements. Cases like Nemesis Market and Monopoly Market involved marketplaces vanishing without explanation, only for related arrests to occur months later, suggesting an evolving strategy focused on intelligence gathering and vendor disruption rather than immediate platform takedowns.

With Abacus gone, its absence has sent shockwaves through the already shrinking Western darknet ecosystem. As major marketplaces disappear, TRM Labs reports a shift toward vendor-operated storefronts and encrypted communication platforms like Telegram. Remaining platforms such as DrugHub, MGM Grand, and TorZon Market, now face increased user demand but also intensified law enforcement attention. Most new marketplaces, including 3DogsMarket and Drugula Market, are low-effort clones plagued by poor security and short life spans, further illustrating the instability of the current DNM landscape.

To defend against this growing volatility, users and vendors are increasingly turning to privacy-centric tools. Nearly half of darknet markets launched in 2024 supported only Monero, up from just over a third in 2023. While the total number of darknet marketplaces fell by 42% in the past year, cryptocurrency-enabled drug sales still grew 19% year-over-year, reaching $2.4 billion, highlighting both consolidation and sophistication among the remaining actors.

Leave a Reply