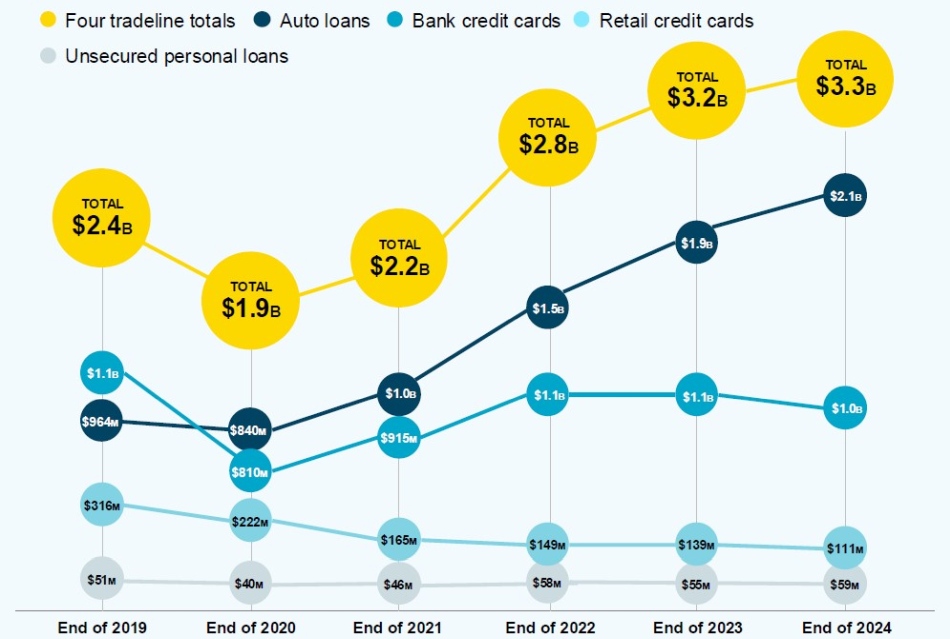

Criminals using sophisticated fake identities cost US lenders over $3.3 billion in 2024, exposing a major vulnerability in traditional verification systems that leaves financial institutions at risk.

TransUnion’s analysis shows that public data signals such as voter registration, vehicle ownership, and familial ties can play a critical role in spotting fraud. While not definitive proof of authenticity, the absence of such “living characteristics” often points to synthetic identities. For instance, lacking relatives or motor vehicle records can make an identity up to seven times more likely to be fraudulent.

Synthetic identities are built from a mix of real and fake details, often combining stolen Social Security numbers with fabricated names and contact information. These identities are engineered to mimic legitimate consumer behavior, making them particularly difficult to detect. Interestingly, every synthetic profile analyzed by TransUnion shared one universal trait: no record of open bankruptcies.

TransUnion

To address this threat, TransUnion has rolled out its Synthetic Fraud Model, which applies advanced analytics to uncover suspicious patterns before fraudsters can exploit them. By incorporating public data signals into its assessments, the model helps lenders distinguish between genuine and synthetic applicants with greater accuracy.

”While the presence of living characteristics such as vehicle ownership, voter registration or familial connections is not a definitive solution to detecting synthetic identities, it represents an important piece of the broader identity puzzle,” said Steve Yin, Senior Vice President and Global Head of Fraud at TransUnion. “These attributes alone cannot confirm authenticity, but when combined with credit header data, they offer valuable context that contributes to forming a clear picture of identity.”

TransUnion argues that better detection tools not only reduce financial risk but also improve efficiency by minimizing manual reviews and lowering friction for legitimate customers. As fraudsters refine their tactics, the company says lenders must use every available data point to defend against the growing wave of synthetic identity attacks.

Leave a Reply