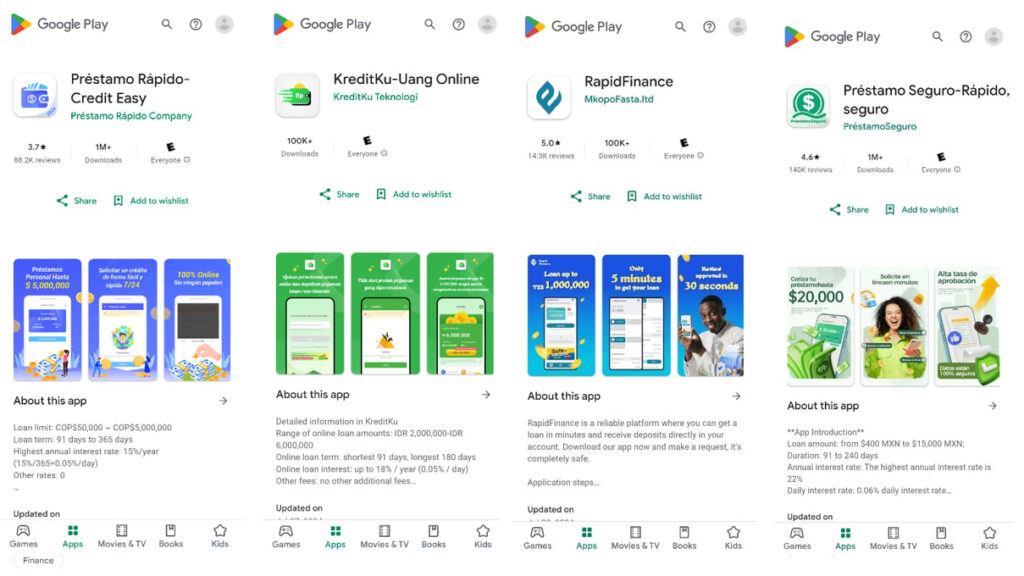

The McAfee mobile research team has uncovered a disturbing trend involving “SpyLoan” apps—predatory loan applications exploiting social engineering tactics to compromise Android users globally. These apps, found on Google Play with over 8 million combined downloads, deceive users into granting excessive permissions and providing sensitive personal data. The apps then misuse this information for harassment, extortion, and financial fraud.

SpyLoan modus operandi

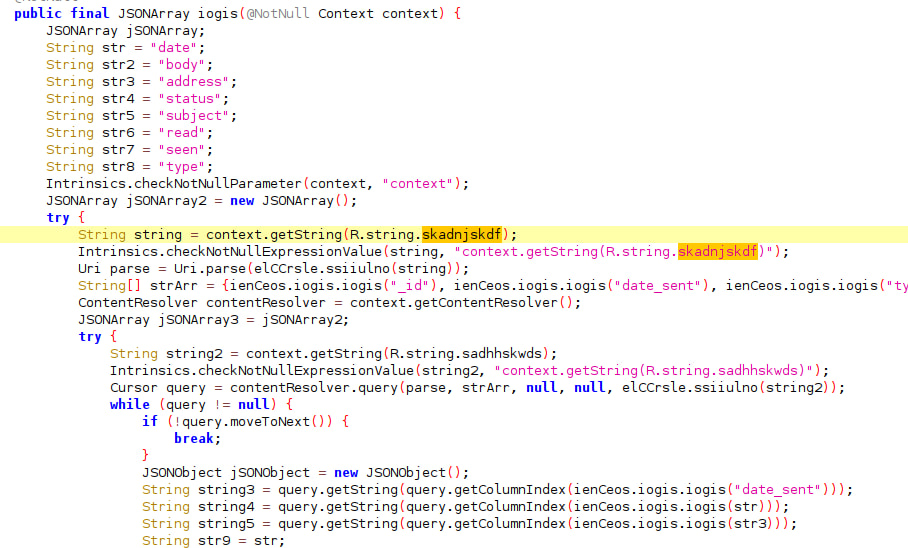

Fernando Ruiz and the McAfee team analyzed 15 SpyLoan apps targeting users in South America, Southern Asia, and Africa. These apps share common codebases and infrastructure, encrypting and transmitting stolen data to command-and-control (C2) servers. Distributed under misleading names and logos resembling legitimate financial institutions, the apps create a façade of trustworthiness.

McAfee

Key tactics of these apps include:

- Deceptive social media ads promote fast approvals and enticing loan terms.

- Countdown timers pressure users to apply.

- Access to SMS, call logs, contact lists, and even device cameras or microphones.

After installation, the apps require users to submit sensitive data, including identity documents and banking information, which is exfiltrated for nefarious purposes. In some cases, victims report harassment of their family members and even death threats from operators of these applications.

McAfee

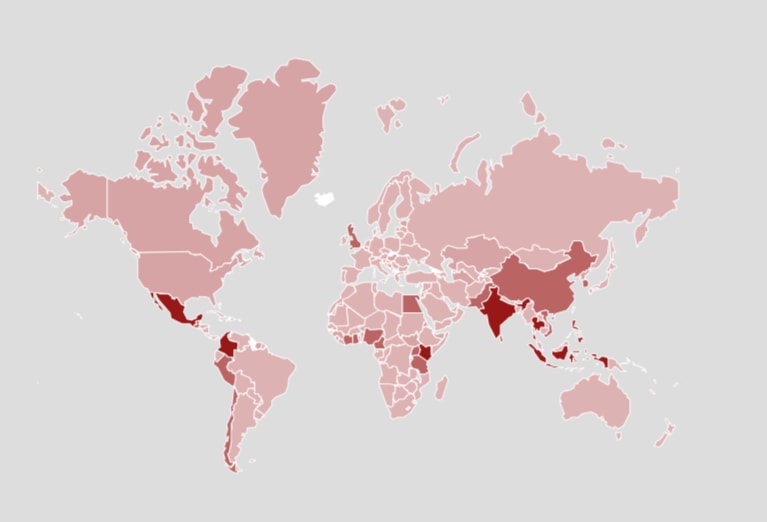

SpyLoan apps have spread worldwide, with McAfee detecting a 75% increase in their activity between Q2 and Q3 of 2024. Key affected regions include:

- Asia: India, Indonesia, Thailand, and the Philippines report rampant abuse and harassment.

- Africa: Countries like Nigeria and Kenya face financial fraud targeting underserved populations.

- Latin America: Mexico, Colombia, and Chile see significant cases, including emotional distress and reputational damage for victims.

The apps exploit local financial vulnerabilities while sharing infrastructure elements such as encryption techniques and C2 URLs, suggesting a shared framework or centralized developer.

McAfee

Law enforcement

Authorities have launched several crackdowns against SpyLoan operators:

In Peru, a raid dismantled a call center linked to extortion, involving over 300 individuals and defrauding at least 7,000 victims.

In Chile, police detained 25 individuals connected to fraudulent loan apps which scammed more than 2,000 victims.

Despite these efforts, the threat continues to evolve, with new operators filling the void left by previous takedowns.

To avoid falling victim to SpyLoan apps, users should deny unnecessary permissions requested during installation, run background checks on the developer/publisher, and ensure Google Play Protect is active on the device at all times.

Not so different from Microsoft, Meta, Google, Apple and other vendors behaviors in the industry if you think objectively