Google is expanding Android's in-call scam protection system to users in the United States, aiming to curb the rising trend of financial scams exploiting phone calls and screen sharing.

Initially piloted in the UK earlier this year, the system now includes US-based fintech platforms such as Cash App and major institutions like JPMorgan Chase.

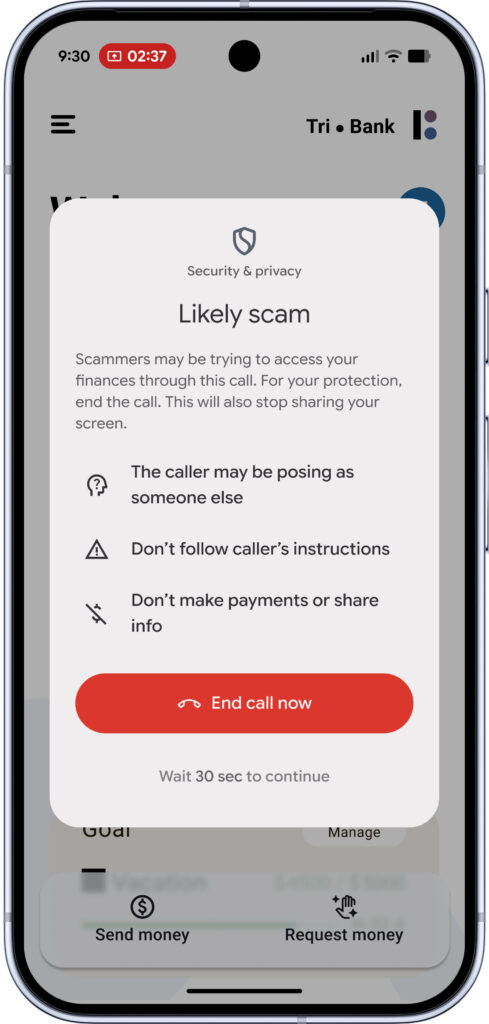

The in-call scam detection feature, first announced in May 2025, activates when a user opens a participating financial app while screen sharing and engaged in a call with an unknown number. In such scenarios, Android displays an alert warning that the call is potentially part of a scam and urges the user to end the call immediately. To prevent impulsive continuation, the system enforces a 30-second pause before allowing the user to proceed.

This form of behavioral intervention is designed to interrupt the psychological manipulation tactics that scammers often employ, such as inducing panic or creating false urgency, to convince victims to share banking credentials or authorize fraudulent transactions. By breaking that momentum, the feature gives users a critical moment to reconsider their actions.

Android's anti-scam initiative is informed by ongoing research. A Google-commissioned YouGov survey conducted between July and August 2025 found that Android users were 58% more likely than iOS users to report receiving no scam texts in the previous week, suggesting the platform's multilayered protections are already reducing exposure to common scam vectors.

After successful pilots in the UK and newly launched programs in Brazil and India, the expansion to US financial apps marks the most significant scale-up to date. Beyond traditional banks, the pilot now includes peer-to-peer payment apps, acknowledging the popularity and risk profile of these platforms among users transferring funds to individuals.

The feature is available on Android 11 and newer devices and reflects Google's growing reliance on AI to detect real-time fraud indicators. The alert system is not based on content analysis of calls but rather behavioral signals such as app usage, screen sharing, and caller status, used to identify potentially risky situations.

To mitigate the risk of phone-based scams, users are advised to:

- Never trust unsolicited callers claiming to represent banks or payment services.

- Avoid screen sharing while discussing finances on the phone.

- Use apps from trusted sources and keep devices updated to access security features like this one.

- End any call that triggers scam warnings or seems suspicious.

As Google gathers data from these expanded pilots, further improvements and broader availability are expected.

Leave a Reply